Australia Insulin Pumps Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Australia Insulin Pumps Market Overview:

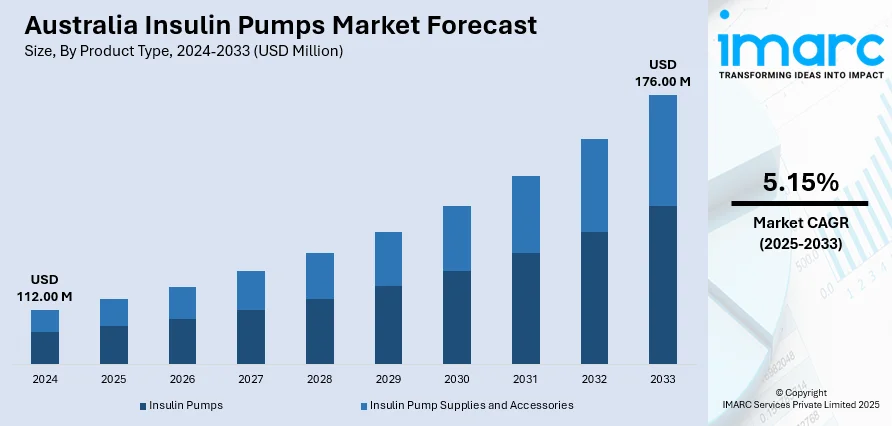

The Australia insulin pumps market size reached USD 112.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 176.00 Million by 2033, exhibiting a growth rate (CAGR) of 5.15% during 2025-2033. The rising diabetes prevalence, continuous technological innovations, supportive government reimbursement schemes, and the growing patient awareness towards improved glycemic control and quality-of-life benefits are the key factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 112.00 Million |

| Market Forecast in 2033 | USD 176.00 Million |

| Market Growth Rate 2025-2033 | 5.15% |

Australia Insulin Pumps Market Trends:

Integration of Continuous Glucose Monitoring and Closed-Loop Systems

Australia’s shift from standalone insulin delivery toward integrated continuous glucose monitoring (CGM) and closed-loop automated insulin delivery systems is transforming diabetes care by enabling real-time glucose tracking, predictive dosing, and improved glycemic control. These hybrid-closed-loop pumps leverage AI algorithms to adjust basal insulin rates continuously, reducing hypoglycemia risk and increasing ‘time in range’ without manual intervention. As patients and clinicians recognize these clinical benefits, such as a 0.5% reduction in HbA₁c levels and up to a 10% increase in time-in-range, the demand for advanced pumps is surging. This trend is reflected in the broader digital diabetes management market, which reached USD 312 million in 2024 and is projected to grow at a 17.45% CAGR through 2033, underscoring how CGM-pump convergence drives patient uptake and manufacturer research and development (R&D) investment, thereby creating a positive outlook for market expansion.

To get more information on this market, Request Sample

Expanding Reimbursement and Subsidy Programs

Affordability remains a critical lever for insulin-pump adoption in Australia, where out-of-pocket costs can exceed AUD 5,000 annually. In response, Diabetes Australia has successfully lobbied for expanded government subsidies, proposing an AUD 200 million fund to subsidize CGMs and pumps for up to 400,000 people with type 1 and high-risk type 2 diabetes. This reform would lower barriers for hard-hit populations, including indigenous communities and young adults, and is supported by modelling showing CGM use can cut lifetime complication costs by over AUD 14,000 per person while reducing renal and ocular complications. By de-risking costs for patients and providers, these reimbursement enhancements are catalyzing broader market penetration of both basic and advanced insulin-delivery devices.

Australia Insulin Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Insulin Pumps

- Tethered Pumps

- Disposable/Patch Insulin Pumps

- Insulin Pump Supplies and Accessories

- Infusion Set Insertion Devices

- Insulin Reservoirs/Cartridges

The report has provided a detailed breakup and analysis of the market based on the product type. This includes insulin pumps (tethered pumps and disposable/patch insulin pumps) and insulin pump supplies and accessories (infusion set insertion devices and insulin reservoirs/cartridges).

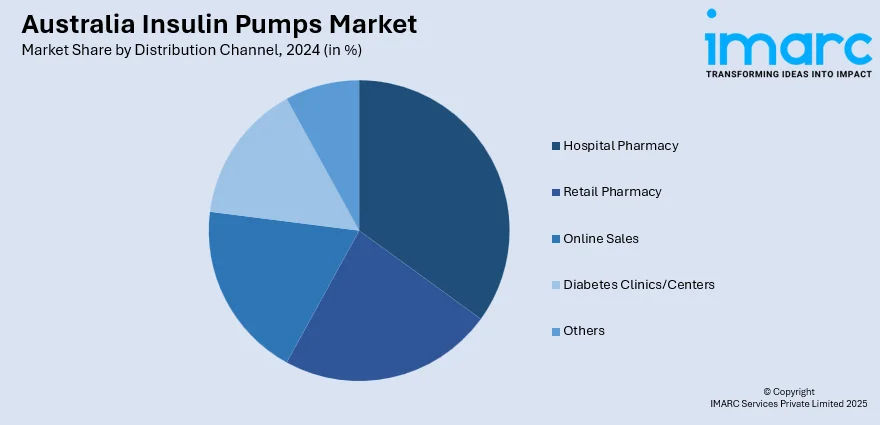

Distribution Channel Insights:

- Hospital Pharmacy

- Retail Pharmacy

- Online Sales

- Diabetes Clinics/Centers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacy, retail pharmacy, online sales, diabetes clinics/centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Insulin Pumps Market News:

- March 2025: Insulet Corporation announced the commercial availability of its Omnipod 5 Automated Insulin Delivery (AID) System in Australia. This tubeless, waterproof insulin pump integrates with Dexcom G6 and G7 continuous glucose monitors (CGMs), with plans to add compatibility with Abbott’s FreeStyle Libre 2 Plus. The Omnipod 5 system offers automated insulin delivery, adjusting doses based on real-time glucose readings, thereby simplifying diabetes management for users.

- February 2025: The Australian government announced that, from March 2025, the Dexcom G7 continuous glucose monitoring system would be subsidized through Australia’s NDSS for eligible people with type 1 diabetes, bringing down out-of-pocket costs. With 10-day wear, 30-minute warm-up, predictive alerts, and insulin pump compatibility, it supports better glucose management and seamless integration with automated insulin delivery.

Australia Insulin Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Hospital Pharmacy, Retail Pharmacy, Online Sales, Diabetes Clinics/Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia insulin pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia insulin pumps market on the basis of product type?

- What is the breakup of the Australia insulin pumps market on the basis of distribution channel?

- What is the breakup of the Australia insulin pumps market on the basis of region?

- What are the various stages in the value chain of the Australia insulin pumps market?

- What are the key driving factors and challenges in the Australia insulin pumps market?

- What is the structure of the Australia insulin pumps market and who are the key players?

- What is the degree of competition in the Australia insulin pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia insulin pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia insulin pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia insulin pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)