Australia Interactive Kiosk Market Size, Share, Trends and Forecast by Component, Type, Mounting Type, Panel Size, Location, Industry Vertical, and Region, 2025-2033

Australia Interactive Kiosk Market Overview:

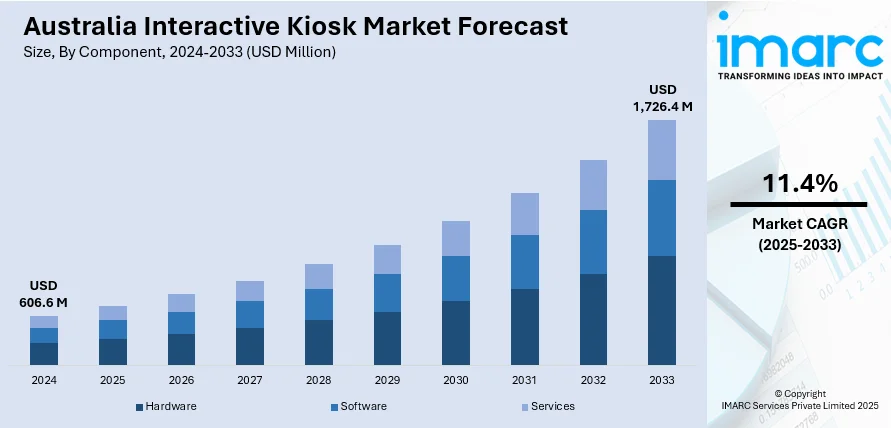

The Australia interactive kiosk market size reached USD 606.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,726.4 Million by 2033, exhibiting a growth rate (CAGR) of 11.4% during 2025-2033. The market is experiencing steady growth due to several government Initiatives for digital transformation and increasing product adoption across sectors such as retail, transportation, and healthcare. Moreover, the rising demand for self-service solutions, continuous innovations in hardware and software that enhance kiosk functionality and user experience, and cost savings and operational efficiency are some other key factors increasing Australia interactive kiosk market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 606.6 Million |

| Market Forecast in 2033 | USD 1,726.4 Million |

| Market Growth Rate 2025-2033 | 11.4% |

Australia Interactive Kiosk Market Trends:

Integration with AI and IoT Driving Smart Kiosk Transformation

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is transforming the interactive kiosk industry, giving companies effective tools to increase customer interaction. AI allows kiosks to learn and adjust from customer behavior, providing customized experiences, for example, product suggestions or customized information. AI in retail can identify customer interests and suggest products based on past patterns, enhancing the shopping experience. Internet connectivity enables kiosks to communicate with other hardware, making business more efficient and enabling real-time data. For instance, in January 2024, Mashgin announced the launch of 20 AI-powered self-checkout kiosks at Adelaide Oval, Australia, marking its first deployment outside North America. The technology streamlines food and drink sales for up to 70,000 fans, averaging checkout times under 14 seconds. This is particularly beneficial in sectors like transportation and healthcare, where kiosks can provide live updates, such as flight statuses or patient information. The market outlook reflects the growing demand for these advanced, smart kiosks as businesses seek more innovative ways to engage users and improve operational efficiency. The increasing adoption of these smart kiosks is expected to drive substantial growth across various sectors, from retail to public services, as businesses continue to prioritize automation and enhanced customer experiences. With continuous advancements in AI and IoT, the role of kiosks will expand, becoming even more integral to industries looking for dynamic, real-time solutions.

To get more information on this market, Request Sample

Increased Adoption Across Various Sectors

The interactive kiosk market in Australia is witnessing a significant rise in adoption across various sectors, driven by the need for efficient and user-friendly service solutions. This trend is expected to continue as industries increasingly prioritize automation and customer self-service, driving the Australia interactive kiosk market growth. Retail outlets are using kiosks for streamlined checkouts, product searches, and customer engagement. For instance, in November 2023, Kmart Australia is trialling a self-serve 'click and collect' kiosk at its Eastland store, utilizing warehouse robotics to enhance customer experience. General Manager Ben Smith stated the initiative aims to streamline shopping and improve efficiency, alongside the launch of a 'select and collect' service for bulky items. In healthcare, kiosks aid patient check-ins, information retrieval, and scheduling, decreasing wait times and administrative tasks. Transportation hubs deploy kiosks for ticketing, real-time updates, and wayfinding to enhance transit experiences. Educational institutions have incorporated kiosks for navigating campus and student support services, facilitating accessibility and communication. This increasing usage of interactive kiosks in both public and private sectors signifies a wider movement toward digital transformation. As innovation in kiosk technology continues such as touchless interfaces and AI-powered services the demand is set to rise, supporting sustained market growth.

Australia Interactive Kiosk Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, type, mounting type, panel size, location, and industry vertical.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Type Insights:

- Bank Kiosks

- Self-Service Kiosks

- Vending Kiosks

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes bank kiosks, self-service kiosks, vending kiosks, and others.

Mounting Type Insights:

- Floor Standing

- Wall Mount

- Others

A detailed breakup and analysis of the market based on the mounting type have also been provided in the report. This includes floor standing, wall mount, and others.

Panel Size Insights:

- 17”-32”

- Above 32”

A detailed breakup and analysis of the market based on the panel size have also been provided in the report. This includes 17”-32” and Above 32”.

Location Insights:

- Indoor

- Outdoor

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes indoor and outdoor.

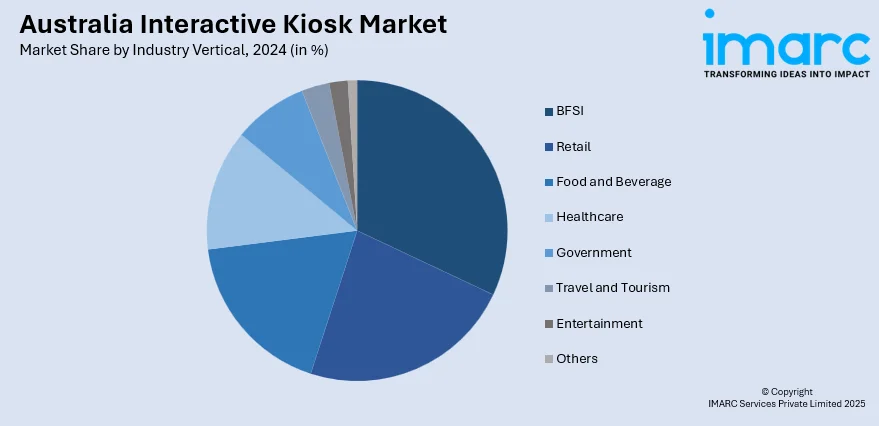

Industry Vertical Insights:

- BFSI

- Retail

- Food and Beverage

- Healthcare

- Government

- Travel and Tourism

- Entertainment

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, retail, food and beverage, healthcare, government, travel and tourism, entertainment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Interactive Kiosk Market News:

- In March 2025, Fiserv announced the launch of Clover, a smart point-of-sale system in Australia designed for small-to-medium businesses. The all-in-one platform features four models, including the self-ordering Clover Kiosk, to streamline operations in the retail and hospitality sectors, enhance customer experiences, and drive growth for local businesses.

- In September 2024, Square announced the launch of Square Kiosk, a self-serve ordering system designed for counter-service venues in Australia facing staffing challenges. The solution integrates software and hardware, reducing queues and freeing up staff.

Australia Interactive Kiosk Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Types Covered | Bank Kiosks, Self-Service Kiosks, Vending Kiosks, Others |

| Mounting Types Covered | Floor Standing, Wall Mount, Others |

| Panel Sizes Covered | 17”-32”, Above 32” |

| Locations Covered | Indoor, Outdoor |

| Industry Verticals Covered | BFSI, Retail, Food and Beverage, Healthcare, Government, Travel and Tourism, Entertainment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia interactive kiosk market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia interactive kiosk market on the basis of component?

- What is the breakup of the Australia interactive kiosk market on the basis of type?

- What is the breakup of the Australia interactive kiosk market on the basis of mounting type?

- What is the breakup of the Australia interactive kiosk market on the basis of panel size?

- What is the breakup of the Australia interactive kiosk market on the basis of location?

- What is the breakup of the Australia interactive kiosk market on the basis of industry vertical?

- What is the breakup of the Australia interactive kiosk market on the basis of region?

- What are the various stages in the value chain of the Australia interactive kiosk market?

- What are the key driving factors and challenges in the Australia interactive kiosk?

- What is the structure of the Australia interactive kiosk market and who are the key players?

- What is the degree of competition in the Australia interactive kiosk market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia interactive kiosk market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia interactive kiosk market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia interactive kiosk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)