Australia Interventional Cardiology Devices Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

Australia Interventional Cardiology Devices Market Overview:

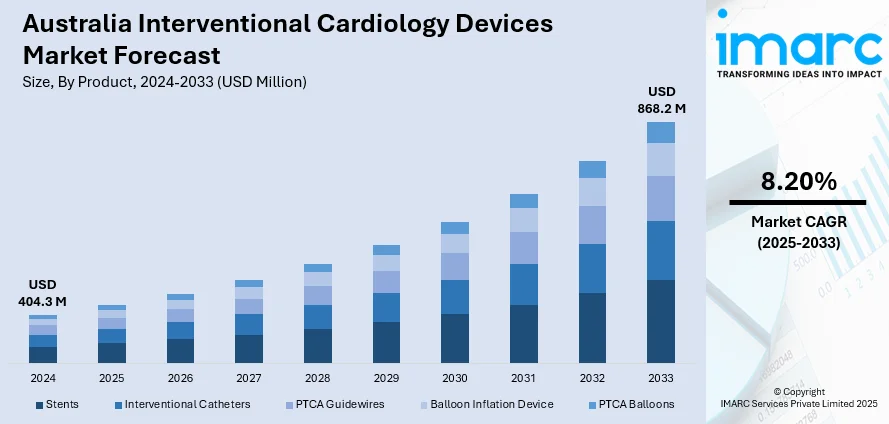

The Australia interventional cardiology devices market size reached USD 404.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 868.2 Million by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. The market is expanding due to a growing elderly population, rising cardiac disease incidence, and increased use of minimally invasive techniques. Australia interventional cardiology devices market share is rising steadily as hospitals adopt advanced technologies and treatment methods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 404.3 Million |

| Market Forecast in 2033 | USD 868.2 Million |

| Market Growth Rate 2025-2033 | 8.20% |

Australia Interventional Cardiology Devices Market Trends:

Shift Toward AI-Enhanced Monitoring

Australia's interventional cardiology market is seeing strong growth supported by advancements in AI-based cardiac monitoring technologies. Hospitals and clinics are increasingly adopting systems that combine traditional monitoring with artificial intelligence to improve accuracy in arrhythmia detection and reduce clinician workload. The focus is on the efficient identification of high-risk cardiac conditions with fewer false alerts, which allows better prioritization of patient care. Devices that offer real-time analytics and integrate smoothly into existing digital infrastructure are being prioritized across both public and private health sectors. Additionally, there is growing emphasis on technologies that support early detection of atrial fibrillation and other abnormalities. In May 2024, Medtronic upgraded its Reveal LINQ insertable cardiac monitors in Australia with AI-based algorithms under the AccuRhythm platform. These updates significantly reduced false alerts for AFib and pause episodes, improving diagnostic speed and clinical efficiency. Such developments are driving hospitals to invest in smarter cardiac care tools, aligning with national goals of advancing precision medicine and optimizing healthcare resource use, further driving Australia interventional cardiology market growth.

To get more information on this market, Request Sample

Rising Demand for Drug-Eluting Stents

The preference for minimally invasive treatments has increased the use of advanced interventional tools like drug-eluting stents (DES) across Australia. These stents are now a standard in treating coronary artery disease, offering faster recovery and fewer complications than traditional procedures. Physicians are choosing devices that provide superior drug delivery and vessel healing, which leads to improved long-term outcomes. The aging demographic and rising lifestyle-related cardiovascular issues have pushed public and private healthcare facilities to prioritize DES-based procedures. Moreover, clinical evidence supporting the effectiveness of newer-generation DES is influencing procurement decisions. In September 2024, India-based SMT received regulatory approval from Australia's TGA for its Supraflex Cruz DES, known for high flexibility and optimized sirolimus release. This has enhanced competition in the market and increased access to globally recognized cardiovascular devices. As more international players enter the Australian market with regulatory clearance, hospitals benefit from wider product choices, helping them deliver targeted therapies with better patient satisfaction.

Australia Interventional Cardiology Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product and end user.

Product Insights:

- Stents

- Drug Eluting Stents

- Bare Metal Stents

- Bio-Absorbable Stents

- Interventional Catheters

- IVUS Catheters

- Guiding Catheters

- Angiography Catheters

- PTCA Guidewires

- Balloon Inflation Device

- PTCA Balloons

- Cutting Balloons

- Scoring Balloons

- Drug Eluting Balloons

- Normal Balloons

The report has provided a detailed breakup and analysis of the market based on the product. This includes stents (drug eluting stents, bare metal stents, and bio-absorbable stents), interventional catheters ( IVUS catheters, guiding catheters, and angiography catheters), PTCA guidewires, balloon inflation device, and PTCA balloons (cutting balloons, scoring balloons, drug eluting balloons, and normal balloons).

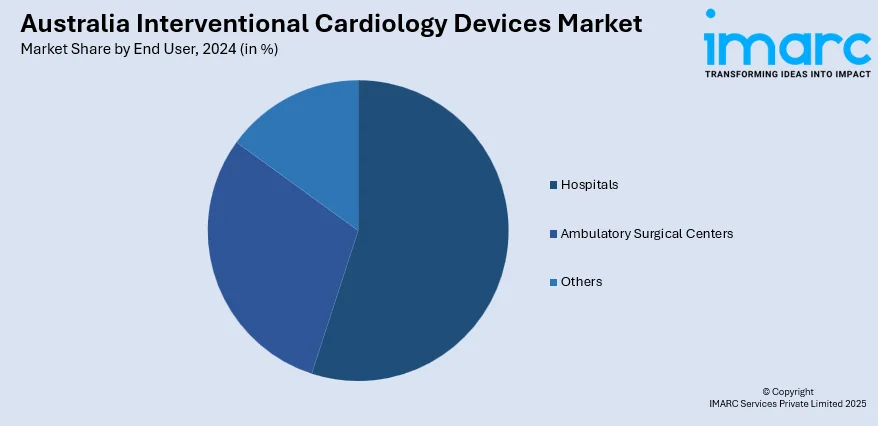

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, ambulatory surgical centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Interventional Cardiology Devices Market News:

- September 2024: SMT’s Supraflex Cruz drug-eluting stent received TGA approval in Australia, enhancing treatment options for coronary artery disease. This regulatory milestone strengthened the interventional cardiology devices market by introducing a clinically proven, flexible stent, supporting advanced patient care and driving market expansion.

- May 2024: Medtronic enhanced its Reveal LINQ cardiac monitors with AI-powered AccuRhythm algorithms in Australia, reducing false alerts for AFib and pause episodes. This upgrade improved diagnostic accuracy and clinical efficiency, strengthening Australia’s interventional cardiology devices market with advanced, AI-driven monitoring solutions.

Australia Interventional Cardiology Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia interventional cardiology devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia interventional cardiology devices market on the basis of product?

- What is the breakup of the Australia interventional cardiology devices market on the basis of end user?

- What is the breakup of the Australia interventional cardiology devices market on the basis of region?

- What are the various stages in the value chain of the Australia interventional cardiology devices market?

- What are the key driving factors and challenges in the Australia interventional cardiology devices?

- What is the structure of the Australia interventional cardiology devices market and who are the key players?

- What is the degree of competition in the Australia interventional cardiology devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia interventional cardiology devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia interventional cardiology devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia interventional cardiology devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)