Australia Intravenous Solution Market Size, Share, Trends and Forecast by Type, Nutrients, and Region, 2026-2034

Australia Intravenous Solution Market Summary:

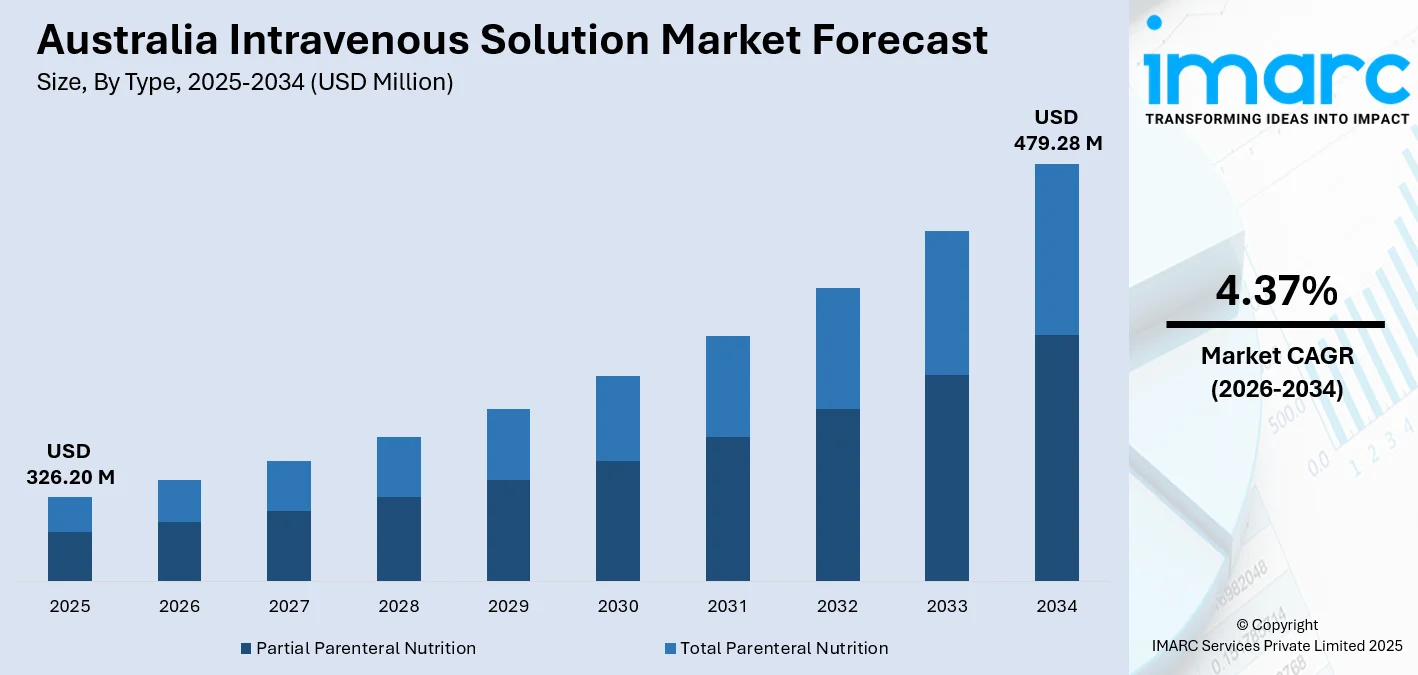

The Australia intravenous solution market size was valued at USD 326.20 Million in 2025 and is projected to reach USD 479.28 Million by 2034, growing at a compound annual growth rate of 4.37% from 2026-2034.

The Australia intravenous solution market is experiencing steady expansion, driven by an aging population requiring enhanced medical care, rising prevalence of chronic diseases demanding continuous fluid management, and increasing surgical procedures across public and private healthcare facilities. The market benefits from a well-established healthcare infrastructure operating under Medicare's universal coverage, which ensures broad patient access to essential IV therapies. Growing adoption of specialized parenteral nutrition formulations and integration of advanced infusion technologies further strengthen market dynamics, positioning IV solutions as fundamental components of critical care delivery across Australian healthcare settings.

Key Takeaways and Insights:

- By Type: Total parenteral nutrition dominated the market with 64% revenue share in 2025, attributed to its essential function in providing complete nutritional support to patients with impaired or non-functional gastrointestinal systems, particularly in surgical ICUs and oncology settings where comprehensive intravenous nutrition is critical for patient care and recovery.

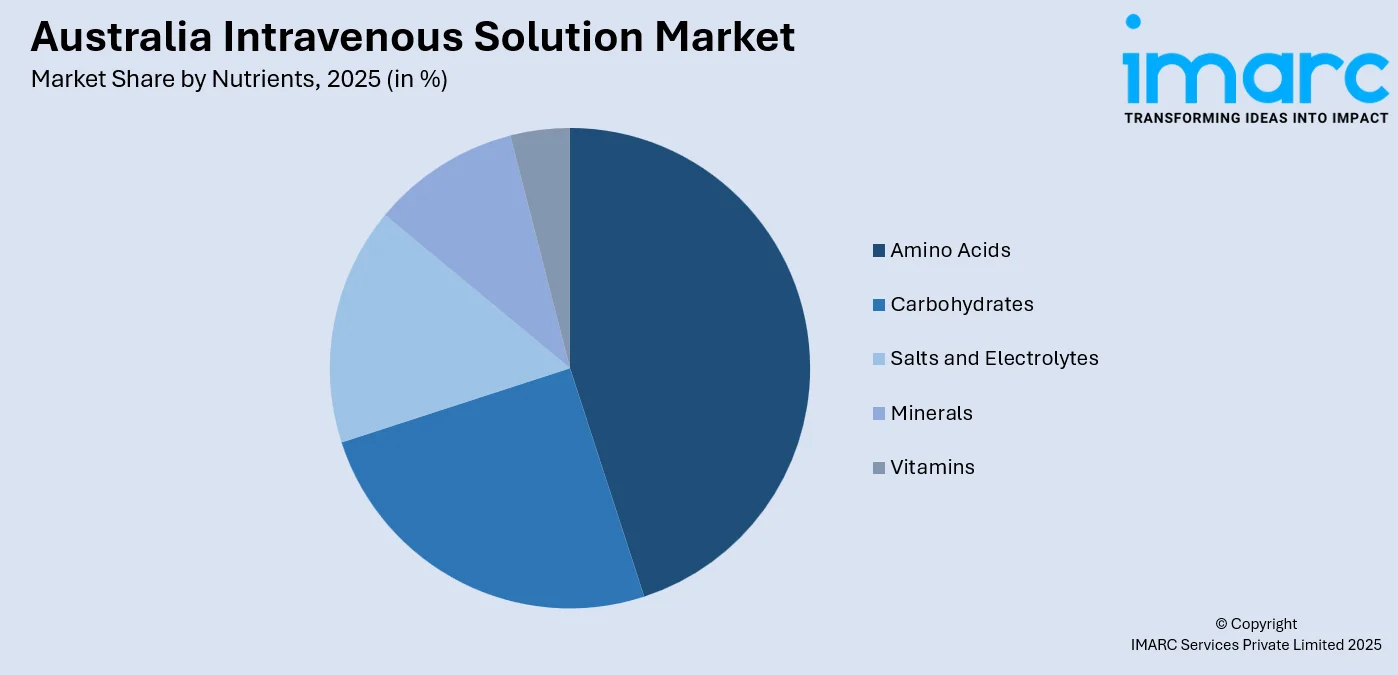

- By Nutrient: Amino acids lead the market with a share of 45% in 2025, driven by their vital role in supporting protein synthesis, maintaining muscle mass, and providing metabolic assistance to critically ill patients who experience severe muscle depletion and require targeted nutritional support during prolonged hospitalisation.

- By Region: Australia Capital Territory & New South Wales represent the largest segment with a market share of 30% in 2025, attributed to the concentration of major tertiary hospitals, specialized medical centers, and the presence of Australia's sole onshore IV fluid manufacturing facility in Western Sydney.

- Key Players: The Australia intravenous solution market demonstrates moderate competitive intensity, characterized by the presence of multinational healthcare corporations alongside specialized nutritional therapy providers. The market structure reflects a combination of local manufacturing capabilities and import dependencies, with established suppliers maintaining strong relationships with public and private healthcare institutions across the country.

To get more information on this market Request Sample

The Australia intravenous solution market continues to evolve as healthcare providers increasingly recognize the importance of specialized fluid therapies in patient care outcomes. Market growth is supported by ongoing government initiatives to strengthen domestic manufacturing capabilities and secure sovereign supply of critical medical resources. The expansion of home infusion services represents an emerging opportunity, enabling patients with chronic conditions to receive IV therapies in comfortable home settings while reducing pressure on hospital infrastructure. Healthcare facilities are progressively adopting smart infusion systems featuring automated monitoring and precision dosing capabilities to enhance patient safety and clinical efficiency. For instance, in March 2025, the Albanese Labor Government invested in expanding Australia’s domestic IV (intravenous) fluid manufacturing, a critical medical supply used in surgeries, hospital care, and other healthcare applications.

Australia Intravenous Solution Market Trends:

Growing Adoption of Customized Formulations

The Australian intravenous solution market is experiencing a notable transition toward tailored formulations that cater to specific patient needs. Healthcare providers are increasingly choosing customized blends incorporating electrolytes, vitamins, and nutrients designed for various medical conditions rather than relying exclusively on conventional saline or glucose solutions. These specialized solutions are particularly beneficial for patients with chronic illnesses, those recovering from surgery, or individuals with distinct nutritional deficiencies. Advancements in compounding technologies and stringent clinical guidelines prioritizing personalized care continue to bolster this trend, with hospitals and home-care providers embracing more patient-centric therapies to achieve enhanced treatment outcomes.

Integration of Smart Infusion Technologies

Technological innovation in IV delivery systems is reshaping the Australian market landscape. Smart IV pumps featuring automated infusion capabilities and sophisticated sensors have significantly improved intravenous fluid delivery precision and safety. These devices enable healthcare practitioners to monitor and manage exact dosages, flow rates, and infusion timing while reducing human error risks. The development of compact and patient-friendly IV systems has contributed to growing availability of home care and outpatient treatment services. For instance, in July 2025, Veriphi introduced its laser-based IV drug verification system at St Vincent's Hospital Melbourne, marking a global first in sterile oncology compounding and enabling real-time, non-invasive drug validation to reduce errors.

Expansion of Home Infusion Services

The shift toward home-based IV therapies represents a significant market trend in Australia, driven by patient preference for comfortable treatment environments and healthcare system efforts to reduce hospital occupancy. The Australia home infusion therapy market size reached USD 1.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2034, exhibiting a growth rate (CAGR) of 6.58% during 2026-2034. Home parenteral nutrition services are expanding as a life-saving therapy for patients with intestinal failure, supported by multidisciplinary care teams including nurses, physicians, and dietitians. This trend is particularly relevant for elderly patients who are more vulnerable to hospital-acquired infections and benefit from receiving care in familiar settings. Healthcare providers are tailoring infusion services to meet the unique needs of geriatric patients, supported by skilled nursing and remote monitoring capabilities.

Market Outlook 2026-2034:

The Australia intravenous solution market outlook remains favorable, supported by structural healthcare investments and demographic factors that ensure sustained demand growth. Government commitments to strengthen sovereign manufacturing capabilities demonstrate strategic prioritization of supply chain resilience for critical medical products. The aging population trajectory, with projections indicating nearly a quarter of Australians will be aged 65 and over by the mid-2060s, provides a stable foundation for market expansion as elderly patients require enhanced hydration, nutritional support, and medication delivery services. Continued technological advancement in infusion systems and growing acceptance of home-based care models will further diversify market opportunities. The market generated a revenue of USD 326.20 Million in 2025 and is projected to reach a revenue of USD 479.28 Million by 2034, growing at a compound annual growth rate of 4.37% from 2026-2034.

Australia Intravenous Solution Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Total Parenteral Nutrition | 64% |

| Nutrient | Amino Acids | 45% |

| Region | Australia Capital Territory & New South Wales | 30% |

Type Insights:

- Partial Parenteral Nutrition

- Total Parenteral Nutrition

Total parenteral nutrition dominates with a market share of 64% of the total Australia intravenous solution market in 2025.

Total parenteral nutrition lead the leading position in the Australian market owing to its critical role in delivering complete nutritional support to patients unable to utilize their gastrointestinal tract. TPN solutions are more highly concentrated than peripheral parenteral nutrition alternatives and are used predominantly in surgical intensive care units where patients require comprehensive intravenous nutritional therapies. The segment's dominance is propelled by the rising incidence of chronic diseases and an increasing number of hospitalizations requiring advanced nutritional interventions, establishing TPN as a cornerstone of patient care in Australia's evolving healthcare landscape.

Healthcare facilities across Australia are increasingly recognizing the importance of TPN in managing patients with non-functional gastrointestinal systems, severe malnutrition, and complex surgical recovery needs. The therapy involves delivering a nutritionally adequate hypertonic solution consisting of glucose, amino acids, electrolytes, vitamins, and minerals directly into the bloodstream through central venous access. According to clinical guidelines, critically ill patients require higher protein provision, with recommendations suggesting amino acid intake of approximately 1.2 to 1.5 grams per kilogram daily to support muscle preservation and metabolic function during extended ICU stays.

Nutrients Insights:

Access the comprehensive market breakdown Request Sample

- Carbohydrates

- Salts and Electrolytes

- Minerals

- Vitamins

- Amino Acids

Amino acids leads with a share of 45% of the total Australia intravenous solution market in 2025.

Amino acids represent the dominant nutrient segment in the Australian intravenous solution market, driven by their critical role in parenteral nutrition for patients unable to meet protein requirements through oral or enteral intake. The segment's leadership is supported by rising demand in clinical nutrition, especially among surgical, critical care, and malnourished patients requiring specialized metabolic support. Critically ill patients experience significant muscle loss during ICU admission, with protein synthesis rates substantially blunted compared to healthy individuals, making amino acid supplementation essential for recovery.

Clinical research supports guideline recommendations for higher amino acid provision in ICU patients, with studies demonstrating improvements in muscle thickness, reduced fatigue, and better nitrogen balance when patients receive adequate amino acid intake. The segment benefits from increasing adoption of customized amino acid formulations to improve metabolic support and recovery outcomes. Branched-chain amino acids and leucine are particularly expected to enhance muscle protein synthesis and reduce protein breakdown in critically ill patients, with healthcare providers tailoring formulations to individual patient needs based on clinical presentation and nutritional assessment.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represent the largest share with 30% of the total Australia intravenous solution market in 2025.

The intravenous (IV) solution market in the ACT is driven by a high concentration of public and private healthcare facilities, including hospitals, specialty clinics, and research centers, which create consistent demand for critical fluids. Growing adoption of patient-centric care and tailored IV formulations supports market expansion, as healthcare providers increasingly prioritize customized nutrient, electrolyte, and vitamin blends for surgical recovery, chronic illness management, and outpatient therapies. Regulatory support and strong healthcare infrastructure further ensure stable supply and adoption of advanced IV solutions.

In New South Wales, market growth is propelled by the state’s large and diverse population, combined with a robust network of tertiary hospitals and home healthcare services. Technological advancements in IV delivery systems, such as smart pumps and automated infusion monitoring, enhance treatment precision and patient safety, fostering adoption across hospitals and outpatient settings. Expanding home infusion services, coupled with increasing clinical emphasis on personalized therapies, also contribute to demand, while healthcare investments and supply chain improvements ensure reliable access to essential intravenous solutions.

Market Dynamics:

Growth Drivers:

Why is the Australia Intravenous Solution Market Growing?

Rising Prevalence of Chronic Diseases

The increasing burden of chronic diseases represents a significant driver for the Australian intravenous solution market. Patients affected by conditions including diabetes, cancer, cardiovascular disease, and kidney disorders typically require consistent hydration, electrolyte management, and nutritional support provided through intravenous therapy. According to the Australian Institute of Health and Welfare’s 2024 Burden of Disease Study, five primary disease categories, cancer, mental health disorders, musculoskeletal conditions, cardiovascular diseases, and neurological disorders, collectively contributed to roughly 64% of Australia’s overall disease burden. IV solutions are essential for administering medications during chemotherapy and addressing complications associated with chronic diseases, with healthcare facilities enhancing their use of specialized formulations to improve patient outcomes.

Growing Surgical Procedures

Australia is experiencing an increase in surgical procedures, driven by the prevalence of lifestyle-related illnesses, accidental injuries, and ongoing advancements in medical technologies. Post-surgical recovery frequently necessitates IV solutions for rehydration, pain relief, and nutritional support, establishing them as crucial components within hospital care protocols. Emergency surgeries and trauma cases require rapid patient stabilization, intensifying demand for effective IV therapies. With ongoing medical innovations, more intricate and minimally invasive procedures are being implemented across healthcare facilities, all relying on IV administration for successful patient management. The expanding elderly population contributes additional surgical volume as age-related conditions requiring intervention become more prevalent across Australia's healthcare system.

Expanding Geriatric Population

The increasing number of elderly individuals in Australia is boosting demand for intravenous solutions as older adults typically face greater risks of dehydration, malnutrition, and chronic conditions requiring ongoing medical support. Hospitalization rates among Australians aged 65 and over are more than four times higher than those of their younger counterparts, with geriatric patients often needing long-term care where IV therapy is essential for maintaining hydration, electrolyte balance, and nutritional well-being. Population projections indicate that by 2056, almost 25% of Australia’s population will be aged 65 and older, with life expectancy continuing to rise steadily. Healthcare providers are concentrating on specialized IV formulations to tackle age-related deficiencies and enhance recovery prospects for this growing demographic segment.

Market Restraints:

What Challenges the Australia Intravenous Solution Market is Facing?

Supply Chain Vulnerabilities and Shortages

The Australian intravenous solution market faces significant challenges from periodic shortages and supply chain disruptions that can hinder the availability of essential medical products. In 2024, multiple IV fluid products experienced shortages from all three Australian suppliers due to global supply limitations, unexpected demand increases, and manufacturing issues. These constraints particularly affected saline and Hartmann's solution products, requiring regulatory intervention to approve overseas-registered alternatives under emergency measures.

Risk of Infections and Contamination

Improper handling and administration of IV fluids increase the risk of bloodstream infections and contamination, representing ongoing safety concerns for healthcare providers. Stringent sterile manufacturing requirements, routine quality checks, and adherence to international healthcare standards are essential for preventing contamination and maintaining patient safety. These regulatory compliance requirements add complexity and cost to production and distribution processes.

High Costs of Specialty Solutions

Advanced parenteral nutrition and specialized electrolyte solutions command premium pricing that can limit adoption in resource-constrained healthcare settings. Total parenteral nutrition requires specialized management, materials, and clinical expertise, driving substantial expenses, particularly in hospital environments with facility fees and professional charges. Home-based TPN, while reducing some costs, still requires significant financial resources for supplies, equipment, and nursing support services.

Competitive Landscape:

The Australia intravenous solution market is characterized by a consolidated competitive landscape, with established multinational healthcare companies operating alongside specialized nutritional therapy providers. Domestic manufacturing supports the production of large volumes of intravenous and irrigation fluids, ensuring a reliable local supply. Regulatory frameworks facilitate flexible import policies to manage supply challenges and maintain market stability. Competition within the sector is driven by factors such as product quality, consistency of supply, advancements in delivery technologies, and the provision of comprehensive support services to healthcare providers across both public and private settings, reinforcing overall market resilience and efficiency.

Recent Developments:

- March 2025: Baxter Healthcare and the Australian Government announced an AUD 40 million investment to expand onshore manufacturing of intravenous fluids at Baxter's facility in Western Sydney. The funding will enhance local manufacturing capacity and contribute to establishing a stronger, more dependable supply of IV fluids within Australia, enhancing Australia's sovereign supply of critical medical resources and creating additional advanced manufacturing jobs in the region.

- August 2024: The Australian government secured 22 million additional IV fluid bags addressing a critical shortage, ensuring a stable supply of essential medical fluids. This strategic move mitigates the impact of global supply constraints and supports the healthcare system's capacity to manage patient care effectively. A National IV Fluid Response Group was formed to collaboratively address supply issues across Australia.

Australia Intravenous Solution Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Partial Parenteral Nutrition, Total Parenteral Nutrition |

| Nutrients Covered | Carbohydrates, Salts and Electrolytes, Minerals, Vitamins, Amino Acids |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia intravenous solution market size was valued at USD 326.20 Million in 2025.

The Australia intravenous solution market is expected to grow at a compound annual growth rate of 4.37% from 2026-2034 to reach USD 479.28 Million by 2034.

Total parenteral nutrition dominated the market with a 64% share in 2025, driven by its critical role in delivering complete nutritional support to patients with non-functional gastrointestinal tracts, particularly in surgical intensive care units.

Key factors driving the Australia intravenous solution market include rising prevalence of chronic diseases requiring ongoing fluid management, growing surgical procedures across healthcare facilities, expanding geriatric population with elevated hospitalization rates, and government investments in domestic manufacturing capabilities.

Major challenges include supply chain vulnerabilities and periodic product shortages, risk of infections and contamination requiring stringent quality controls, high costs of specialty parenteral nutrition solutions, and dependence on imported products due to limited domestic manufacturing capacity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)