Australia Investment Banking Market Report by Service Type (Mergers and Acquisitions (M&A) Advisory, Equity Capital Markets (ECM), Debt Capital Markets (DCM), Corporate Finance Advisory, and Others), End User (Large Corporations, Small and Medium Enterprises (SMEs), Institutional Investors, Government and Public Sector Entities, and Others) and Region 2026-2034

Australia Investment Banking Market Size and Share:

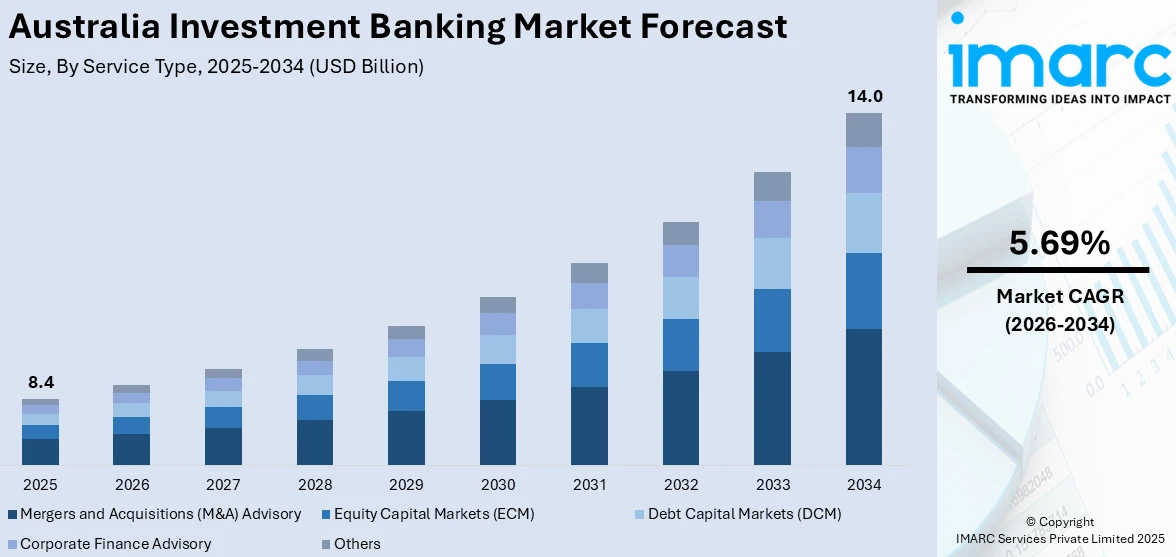

The Australia investment banking market size reached USD 8.4 Billion in 2025. The market is projected to reach USD 14.0 Billion by 2034, exhibiting a growth rate (CAGR) of 5.69% during 2026-2034. The market is experiencing steady growth driven by the rising demand for innovative financial solutions and risk assessment services, robust mergers and acquisitions among key players, considerable rise in investments in the technology sector, and the increasing need for funding for infrastructure and green energy projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 8.4 Billion |

|

Market Forecast in 2034

|

USD 14.0 Billion |

| Market Growth Rate 2026-2034 | 5.69% |

Key Trends in Australia Investment Banking Market:

Expanding mergers and acquisitions (M&A) activities

The investment banking industry in Australia is experiencing significant growth driven by an increasing level of M&A transactions. This can be attributed to businesses exploring strategic opportunities that could enhance their market shares and operational efficiencies in globally competitive environments. Therefore, the demand for investment banks is increasing as they play a crucial role in advising, due diligence, and transaction structuring to get the best deal for the stakeholders. Along with this, the trend is further supported by a stable regulatory environment that encourages foreign investments, hence making Australia a preferred region to execute cross-border transactions. Investment banks are seizing this opportunity by bulking up their mergers and acquisitions departments and adding high-tech tools to streamline procedures and enhance deal execution.

To get more information on this market Request Sample

Growth in technology sector investments

The fast-growing technology sector in Australia is majorly driving the market. Technology startups and established companies raise funds for innovation, expansion, and competitive positioning with the help of investment banks. This involves initial public offerings, private placements, and venture capital funding. Investment banks position themselves to meet the needs of the technology sector through special teams focused on technology markets, offering financial instruments custom-fit for technologies, and performing other strategic advisory services in the increasingly complex landscape of tech investments. This focus feeds the growth in the technology industry and diversifies the revenue streams for the banks through a variety of value-added services.

Infrastructure and green energy projects

Infrastructure and renewable energy projects are among the major drivers of investment banking market in Australia. The Australian government is implementing sustainable development measures and initiatives for green infrastructure expansion which is resulting in an unprecedented inflow of different projects involving huge funding and financial structuring. Here, investment banks are placed at the forefront, facilitating large-scale project financings in renewable energy plants and national infrastructure upgrades. These are often implemented by highly developed financial structures and strategies of risk management, which is particularly well done by investment banks. By offering innovative financial solutions and risk assessment services, investment banks have become essential in bringing ambitious projects from plans into real-life action that drives further growth in the sector.

Drivers of Australia Investment Banking Market:

Strong Economic Growth

Sustained economic growth is positively escalating the Australia investment banking market demand. As the economy grows companies are more likely to conduct mergers and acquisitions (M&A) activities which demand professional advisory services to steer through sophisticated deals. Likewise, companies that need to raise capital to expand, innovate, or pursue new opportunities increasingly look to investment banks to assist in equity offerings, debt issuance, and other financing arrangements. The general economic expansion also enhances the demand for strategic financial counsel, risk mitigation, and investment strategies to achieve maximum returns. With businesses flourishing in an expanding economy investment banks play a crucial role in driving expansion, providing advice, and arranging transactions that are consistent with both market dynamics and corporate goals.

Growth and Demand

The investment banking sector in Australia is facing strong growth fueled by the growth of the economy and growing corporate activity. Mergers and acquisitions are among the main drivers with deals across sectors like technology, infrastructure, and energy fueling demand for advisory and financing solutions. The growth of private equity and venture capital investments especially in start-ups also fuels the demand for specialized advisory. As companies raise capital from IPOs, bond issues, and other financial products the need for capital-raising facilities grows. High-net-worth individuals and institutional investors also seek customized wealth management services further adding to demand for investment banking services that can accommodate specific investment strategies and objectives.

Government Support

The Australian government plays a vital role in supporting the investment banking market through a stable and transparent regulatory environment that encourages investor confidence and fosters growth. Financial regulations are designed to protect both investors and financial institutions which strengthens the overall market. Additionally, government incentives for innovation and technology integration in the financial sector provide a favorable backdrop for investment banking helping firms expand their capabilities. Policies aimed at maintaining market stability ensure smooth operations especially in capital-intensive areas like M&A and IPOs. Infrastructure investment projects also create opportunities for investment banking services in financing and advisory roles while support for export-driven companies fosters cross-border investments and capital raising activities. According to Australia investment banking market analysis, the government’s proactive role in maintaining a stable regulatory environment and supporting innovation has been crucial in fostering growth within the sector.

Australia Investment Banking Market News:

- April 21, 2024: Goldman Sachs is considering an application for a local banking license to extend a broader suite of lending products to ultra-high net-worth clients in Australia. The Wall Street investment banking giant's local private wealth team numbers some 13 advisers in Sydney and Melbourne.

Australia Investment Banking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service type, and end user.

Service Type Insights:

- Mergers and Acquisitions (M&A) Advisory

- Equity Capital Markets (ECM)

- Debt Capital Markets (DCM)

- Corporate Finance Advisory

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes mergers and acquisitions (M&A) advisory, equity capital markets (ECM), debt capital markets (DCM), corporate finance advisory, and others.

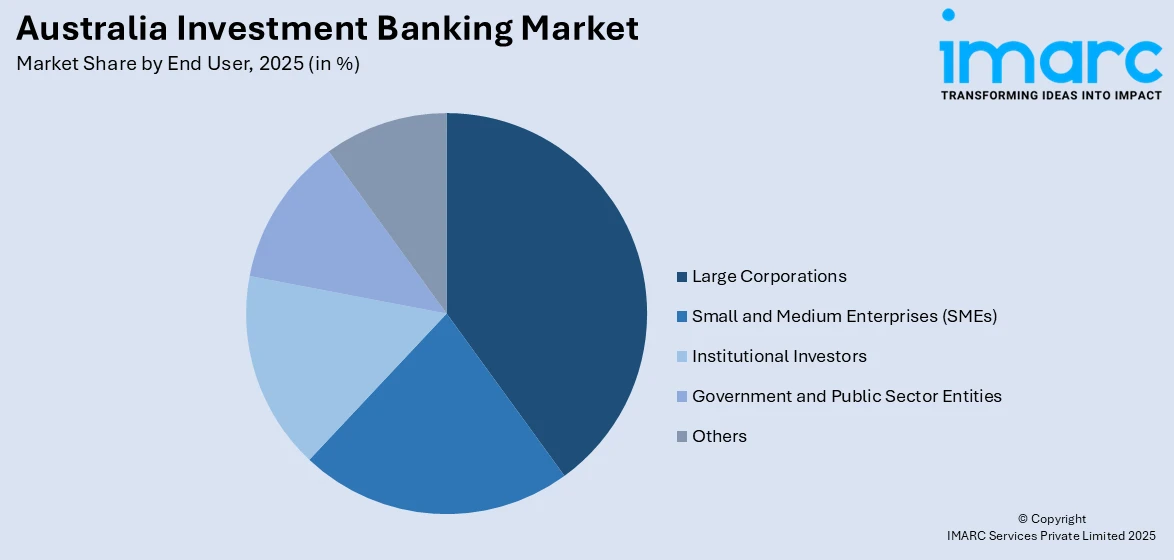

End User Insights:

Access the comprehensive market breakdown Request Sample

- Large Corporations

- Small and Medium Enterprises (SMEs)

- Institutional Investors

- Government and Public Sector Entities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes large corporations, small and medium enterprises (SMEs), institutional investors, government and public sector entities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Investment Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Mergers and Acquisitions (M&A) Advisory, Equity Capital Markets (ECM), Debt Capital Markets (DCM), Corporate Finance Advisory, Others |

| End Users Covered | Large Corporations, Small and Medium Enterprises (SMEs), Institutional Investors, Government and Public Sector Entities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia investment banking market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia investment banking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia investment banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The investment banking market in the Australia was valued at USD 8.4 Billion in 2025.

The Australia investment banking market is expected to reach a value of USD 14.0 Billion by 2034.

The Australia investment banking market is projected to exhibit a compound annual growth rate (CAGR) of 5.69% during 2026-2034.

Key growth drivers include a strong economy and rising corporate activity boosting demand for investment banking services. Increased M&A transactions along with growth in private equity and venture capital are key contributors. Government support through financial stability, infrastructure projects, and innovation incentives also fuels market expansion.

The Australian investment banking market is witnessing increasing M&A activity particularly in the tech and infrastructure sectors. There’s a growing focus on capital raising especially through IPOs and bond issuances. Wealth management services are also on the rise with a strong demand from high-net-worth individuals and institutional investors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)