Australia Iron Ore Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Australia Iron Ore Market Size and Share:

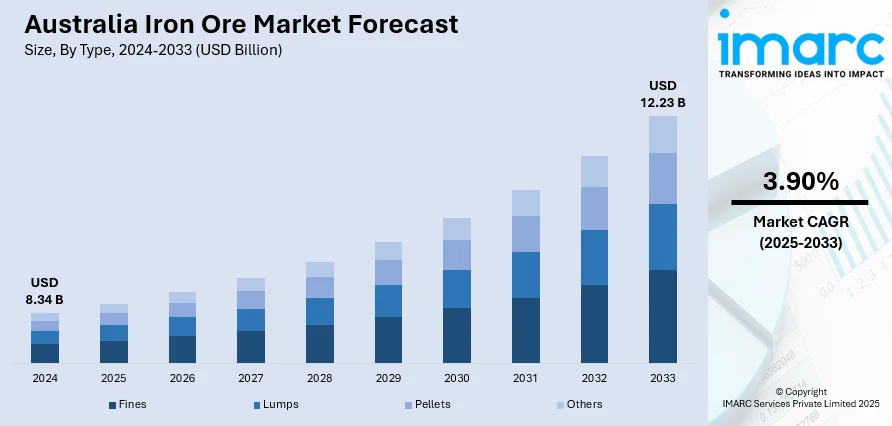

The Australia iron ore market size reached USD 8.34 Billion in 2024. Looking forward, the market is projected to reach USD 12.23 Billion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The increasing global demand for low-carbon steel and sustainable production methods drives the market. At the same time, investments in green technologies and low-carbon iron projects continue to strengthen Australia iron ore market share, thereby positioning the country as a key player in the green metals sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.34 Billion |

| Market Forecast in 2033 | USD 12.23 Billion |

| Market Growth Rate 2025-2033 | 3.90% |

Key Trends of Australia Iron Ore Market:

Shift Toward Low-Carbon Steel Production

Australia's iron ore sector is facing a critical change as global demand shifts more toward low-carbon steel production. Further, pressure for change is being driven considerably by the global call for sustainability and efforts to curb industrial carbon emissions. As countries and industries strive to achieve their decarbonization goals, demand for cleaner materials, such as low-carbon steel, has increased. To counteract this, the Australian government introduced the USD 1 Billion Green Iron Investment Fund in February of 2025. This will feature a USD 500 Million commitment toward converting Whyalla steelworks, and it is central to bolstering Australia's global green metals sector standing. The nation is helping the world decarbonize and gaining the long-term demand for its iron ore by backing technologies that minimize carbon emissions in steelmaking. Meanwhile, government encouragement of low-carbon steelmaking shows Australia's strategic interest in aligning its mining sector with sustainability. This strategy allows the nation to be able to address the increasing demand for cleaner products while establishing it as a leader in low-carbon steel production, further impelling Australia iron ore market growth.

To get more information on this market, Request Sample

Increasing Investment in Green Metals

The Australian market is experiencing a surge in investments focused on green metals, signaling a broader global trend toward sustainable industry practices. Furthermore, this shift is driven by the increasing recognition of the need to meet global carbon reduction commitments and environmental standards. As the demand for cleaner materials intensifies, governments and industries are directing more capital toward projects that support low-carbon alternatives. A key development in this direction was the Albanese Government's unveiling of a USD 3 Billion green metals strategy in May 2025, which included the establishment of a USD 1 Billion Green Iron Investment Fund. This fund aims to support the development of low-carbon iron projects, positioning Australia as a global leader in the green metals sector. At the same time, the initiative strengthens the market for Australian iron ore by aligning it with the global shift toward sustainable industries by investing in technologies that reduce the carbon intensity of iron production. The green metals strategy, including substantial funding for innovative projects, reinforces Australia's commitment to both economic growth and environmental sustainability. This investment is expected to generate long-term demand for Australian iron ore, ensuring the country's competitive advantage in the global market as industries increasingly prioritize sustainable solutions.

Sustained Export Demand

Asia remains a crucial factor driving the Australia iron ore market demand primarily due to its growing steel production requirements. The major economies of China, India, and South Korea have a high dependence on Australian iron ore to fuel their manufacturing sector, construction industry, and infrastructure. China is the biggest importer that continuously demands high-quality ore for steel used in buildings, transport, and industrial equipment. The development of India's infrastructure and South Korea's industry also support long-term demand. Australia's geographical location near these markets and its track record of consistent high-grade ore solidifies its position as a major exporter. This stable regional demand is imperative for the continuing growth and stability of the Australian iron ore industry supporting long-term export and revenue increases.

Growth Drivers of Australia Iron Ore Market:

Rich Natural Reserves Driving Long-Term Supply Stability

Australia’s vast and high-grade iron ore reserves form a fundamental strength of its mining sector. These abundant deposits guarantee long-term supply reliability giving the nation a competitive advantage in the global market. Key mining areas like the Pilbara region in Western Australia are recognized for their iron ore with high iron content increasingly favored by steelmakers for its efficiency and lower emissions during processing. The trustworthy nature of Australian supply has established it as a preferred source among major importers especially in Asia. Continuous exploration and development initiatives ensure the resource base's ongoing expansion enabling Australia to satisfy future demand and maintain its leadership in the global iron ore trade for many years ahead.

Advanced Mining Technologies Enhancing Operational Efficiency

According to Australia iron ore market analysis, the integration of advanced mining technologies has remarkably enhanced operational performance throughout the sector. Automation, artificial intelligence, and data analysis are widely applied to streamline processes, enhance the utilization of resources, and minimize environmental effects. Autonomous trucks, drones, and remote-controlled equipment are now commonplace in many mining operations leading to enhanced safety and lower labor costs. AI-driven data insights assist companies in tracking ore quality, projecting maintenance requirements, and enhancing yield while reducing waste. These innovations increase productivity and support sustainability targets keeping Australia's iron ore sector competitive in the global marketplace and capable of meeting future demand and regulatory pressures.

Strong Infrastructure Backbone Supporting Export Efficiency

Australia’s well-established infrastructure is vital to the success of its iron ore sector. Comprehensive networks of railways, roads, and top-tier ports facilitate the efficient transport of ore from isolated mining areas to export terminals. This logistical efficiency reduces delays ensuring prompt delivery to international customers particularly in high-demand regions like China, Japan, and South Korea. Significant investments in infrastructure maintenance and expansion have further bolstered the nation’s capability to scale operations during peak global demand periods. The reliability of this supply chain infrastructure enhances export performance and lowers operational costs making Australia's iron ore more competitive in the global marketplace.

Australia Iron Ore Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Fines

- Lumps

- Pellets

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fines, lumps, pellets, and others.

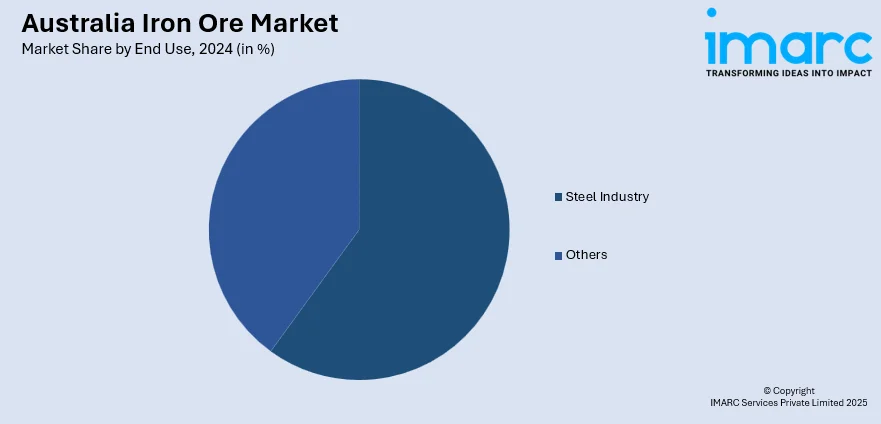

End Use Insights:

- Steel Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes steel industry and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Iron Ore Market News:

- June 2025: Rio Tinto and Baowu officially opened the Western Range iron ore mine in the Pilbara. This USD 2 Billion project, capable of producing 25 Million tonnes annually, strengthened Australia’s iron ore market, ensuring long-term stability for the Paraburdoo hub and boosting national economic growth.

- April 2025: Fortescue Metals Group proposed the 644 MW Turner River solar hub to power its iron ore mining operations near Port Hedland. This renewable energy initiative is set to support Fortescue’s goal of eliminating fossil fuels by 2030, strengthening the Australian iron ore market.

Australia Iron Ore Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fines, Lumps, Pellets, Others |

| End Uses Covered | Steel Industry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia iron ore market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia iron ore market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia iron ore industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The iron ore market in Australia was valued at USD 8.34 Billion in 2024.

The Australia iron ore market is projected to exhibit a compound annual growth rate (CAGR) of 3.90% during 2025-2033.

The Australia iron ore market is expected to reach a value of USD 12.23 Billion by 2033.

The Australia iron ore market is witnessing trends such as increased automation in mining operations, a shift toward high-grade ore production, and growing sustainability practices. Efforts to diversify export markets and adopt digital monitoring systems are also shaping the industry's long-term direction.

Key growth drivers include rising global steel demand, abundant high-quality ore reserves, and robust trade ties with Asia. Investments in mining infrastructure, supportive government policies, and advancements in extraction technologies further strengthen Australia's position as a leading global iron ore supplier.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)