Australia Juicer Market Size, Share, Trends and Forecast by Product, Technology, Distribution Channel, and Region, 2025-2033

Australia Juicer Market Overview:

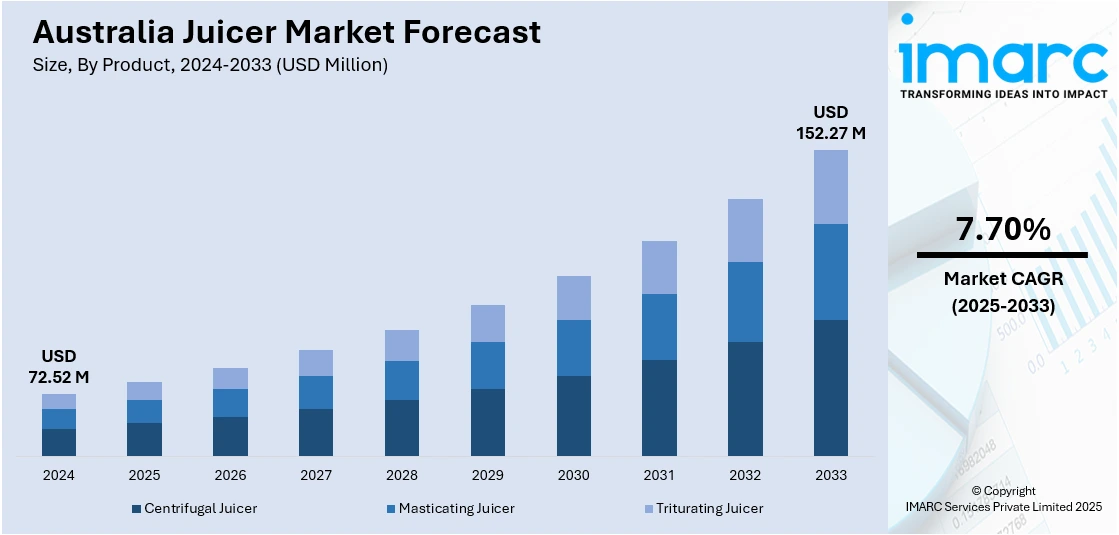

The Australia juicer market size reached USD 72.52 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 152.27 Million by 2033, exhibiting a growth rate (CAGR) of 7.70% during 2025-2033. The market is witnessing growth as a result of heightening health consciousness and the trend for homemade juice. People are favoring electric and masticating juicers more due to improved nutrition and convenience. Innovative technology for juicers, such as quieter modes and pulp control, is drawing modern families. Sales via online and specialty retail channels are also improving access and product diversity. These together are notably increasing the Australia juicer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 72.52 Million |

| Market Forecast in 2033 | USD 152.27 Million |

| Market Growth Rate 2025-2033 | 7.70% |

Australia Juicer Market Trends:

Increased Health Awareness Drives Demand for Juicers

The increased focus on healthy living throughout Australia has contributed immensely to the demand for juicers, especially in urban markets. Due to a growing consciousness about diet-borne diseases and the advantage of nutritious drinks, families are turning more and more towards introducing fresh juices into their daily lives. Juicers are becoming a standard kitchen gadget, supported by consumer interest in home-prepared, additive-free drinks. Government-sponsored public health initiatives supporting fruit and vegetable consumption further fuel the trend. The power of digital wellness blogs—particularly those from fitness and nutrition bloggers—has also fueled general interest in detox beverages, cold-press juices, and smoothies. The trend is not limited to urban centers only, as rural markets are also exhibiting an increase in health-focused kitchen shopping. As a result, Australia juicer market growth is seeing steady momentum, with health awareness becoming a key driver across demographics. The convergence of lifestyle change, fitness culture and nutritional transparency continues to shape the trajectory of the market.

To get more information on this market, Request Sample

Technological Innovation Enhances Consumer Experience

Technological advancement has become a pivotal trend in the Australian juicer market, with modern appliances offering convenience, efficiency, and improved nutrient retention. As per the reports, in April 2025, Hurom's E50ST Slow Juicer received the Red Dot Design Award, which further fueled Australian demand for high-end, design-driven juicers that balance innovation, performance, and health-oriented functionality. Moreover, customers now look for quieter, easier-to-clean products with features like multiple speed controls and pulp separation mechanisms. The masticating and triturating juicer market is particularly significant, with these products addressing users who require maximum juice output and better vitamin retention. These trends reflect key Australia juicer market trends, highlighting consumer demands for reliability over the long term and greater performance. In addition, smart kitchen integration like touchscreen and automated cleaning systems is being valued by technology-savvy consumers. Environmentally aware consumers also prefer products that are constructed using BPA-free and recyclable materials. Since these technologies meet both the functional as well as environmental demands, they are crucial for business growth. Consumer preference is gradually moving from generic models to technology-driven products, which demonstrates an advanced demand profile within Australia's changing domestic appliance market.

Online Shopping and Niche Specialty Stores Fuel Distribution

Distribution for Australian juicers has seen significant change, headed by rising online shopping and niche specialty store trends. Today, online channels present a vast selection of juicer models, where consumers can compare specs, read reviews, and enjoy competitive prices at home. This channel is especially interesting to young shoppers and those living in remote locations with limited access to brick-and-mortar stores. At the same time, specialty kitchen appliance retailers remain strong through offering customized advice, in-store demonstrations, and upscale product lines. These retailers frequently appeal to more discerning customers searching for high-end or special juicing technology. Furthermore, the spread of promotional campaigns and subscription services on e-commerce sites has driven repeat buying and brand engagement. The combination of online convenience and customized offline experiences provides broad market reach. Collectively, these modes of distribution are transforming the purchasing habits of consumers, playing a dominant role in making juicers more accessible and penetrating deeper into Australia's rich marketplace.

Australia Juicer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, technology, and distribution channel.

Product Insights:

- Centrifugal Juicer

- Masticating Juicer

- Triturating Juicer

The report has provided a detailed breakup and analysis of the market based on the product. This includes centrifugal juicer, masticating juicer, and triturating juicer.

Technology Insights:

- Electric

- Manual

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes electric and manual.

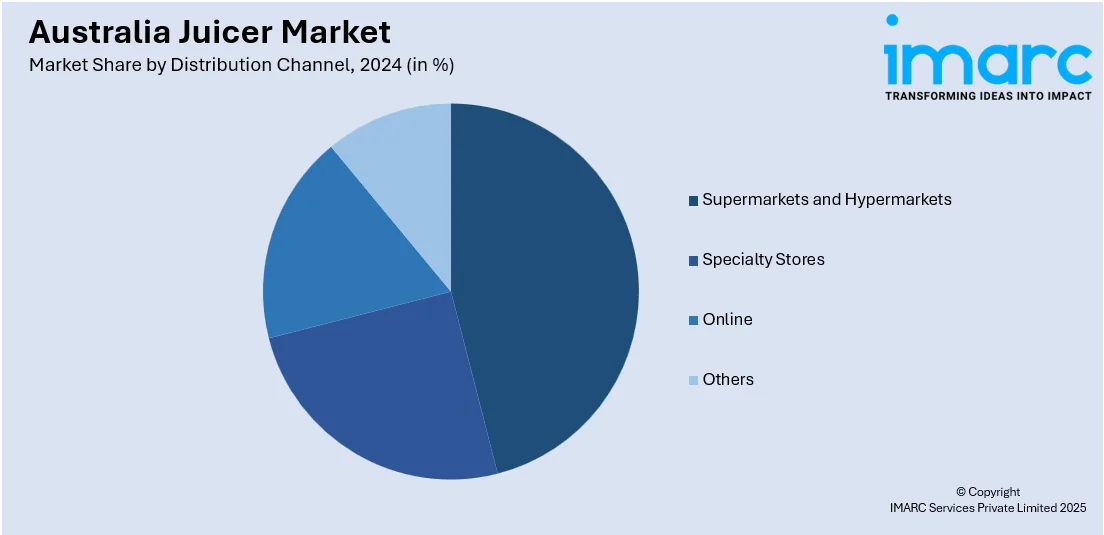

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Juicer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Centrifugal Juicer, Masticating Juicer, Triturating Juicer |

| Technologies Covered | Electric, Manual |

| Distribution Channel Covered | Supermarkets and Hypermarkets, Specialty Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia juicer market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia juicer market on the basis of product?

- What is the breakup of the Australia juicer market on the basis of technology?

- What is the breakup of the Australia juicer market on the basis of distribution channel?

- What is the breakup of the Australia juicer market on the basis of region?

- What are the various stages in the value chain of the Australia juicer market?

- What are the key driving factors and challenges in the Australia juicer?

- What is the structure of the Australia juicer market and who are the key players?

- What is the degree of competition in the Australia juicer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia juicer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia juicer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia juicer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)