Australia Juvenile Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Age Group, and Region, 2025-2033

Australia Juvenile Products Market Overview:

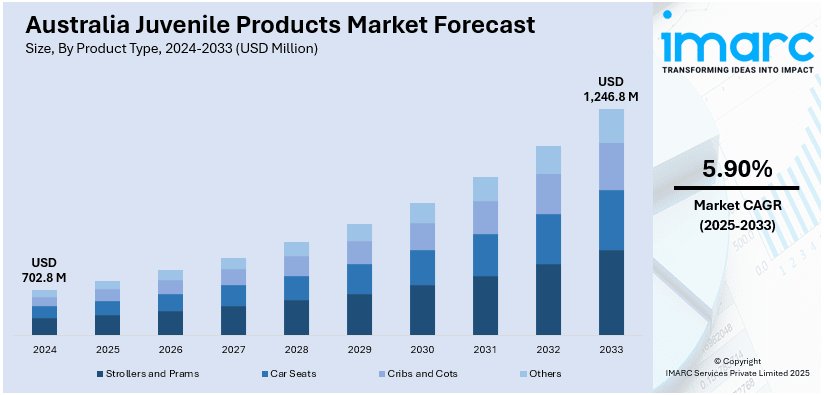

The Australia juvenile products market size reached USD 702.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,246.8 Million by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. The rising disposable incomes, increasing demand for eco-friendly and safe products, technological advancements in baby gear and smart toys, and the rapid growth of e-commerce are some of the major factors fueling the Australia juvenile products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 702.8 Million |

| Market Forecast in 2033 | USD 1,246.8 Million |

| Market Growth Rate 2025-2033 | 5.90% |

Australia Juvenile Products Market Trends:

Rising Disposable Incomes

With an increase in disposable income among Australian households, parents are more willing to invest in premium juvenile products that ensure safety, comfort, and long-term value. Higher income levels support the purchase of branded strollers, ergonomic car seats, smart baby monitors, and organic apparel, creating a positive impact on the Australia juvenile products market outlook. Parents are also more likely to prioritize quality over price, especially for items that directly impact their children’s health and well-being. This shift in purchasing behavior drives demand for innovative, high-end juvenile products, creating opportunities for manufacturers and retailers to offer diverse, premium product lines tailored to modern parenting needs. For instance, in January 2024, Australian infant goat milk formula company Nuchev announced the release of its inaugural bovine product for older children and adults, as it plans to roll out a range of products designed to improve digestion and immunity in the coming year. The company claims its motivation for expanding into bovine originates from the increasing demand for products aimed at immunity and digestion identified through comprehensive consumer research conducted in Australia and China.

To get more information on this market, Request Sample

Expansion of E-commerce and Digital Retail Channels

E-commerce has significantly transformed the juvenile products market in Australia by providing easy access to a wide range of baby and child-related items. Online platforms allow parents to compare prices, read reviews, and shop from the comfort of their homes—especially important for busy or new parents. The COVID-19 pandemic further accelerated digital adoption, making online retail the preferred shopping method for many families. E-commerce has also opened doors for global brands to enter the Australian market, increasing product diversity. Features like subscription services, virtual consultations, and fast delivery enhance customer experience, fueling sustained Australia juvenile products market growth. For instance, in August 2023, Baby Bunting, the leading specialty retailer for maternity and baby products in Australia, unveiled its new online Marketplace – providing Australians access to thousands of additional products for babies and children from numerous trusted retail partners. Baby Bunting Marketplace enables customers to explore a wider selection of products from external vendors and buy those items through the Baby Bunting website.

Australia Juvenile Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and age group.

Product Type Insights:

- Strollers and Prams

- Car Seats

- Cribs and Cots

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes strollers and prams, car seats, cribs and cots, and others.

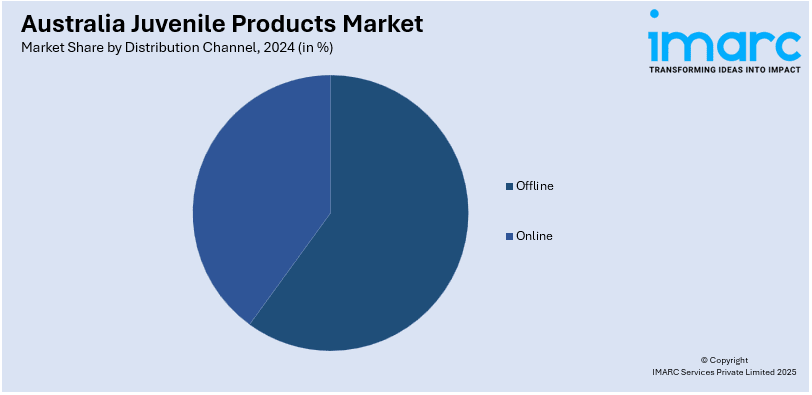

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Age Group Insights:

- 0-1 Year

- 2-4 Years

- 5-7 Years

- >8 Years

A detailed breakup and analysis of the market based on age group have also been provided in the report. This includes 0-1year, 2-4 years, 5-7 years, and >8 years.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Juvenile Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Strollers and Prams, Car Seats, Cribs and Cots, Others |

| Distribution Channels Covered | Online, Offline |

| Age Groups Covered | 0-1 Year, 2-4 Year, 5-7 Year, >8 Year |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia juvenile products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia juvenile products market on the basis of product type?

- What is the breakup of the Australia juvenile products market on the basis of distribution channel?

- What is the breakup of the Australia juvenile products market on the basis of age group?

- What is the breakup of the Australia juvenile products market on the basis of region?

- What are the various stages in the value chain of the Australia juvenile products market?

- What are the key driving factors and challenges in the Australia juvenile products market?

- What is the structure of the Australia juvenile products market and who are the key players?

- What is the degree of competition in the Australia juvenile products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia juvenile products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia juvenile products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia juvenile products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)