Australia K-12 Education Market Report by Application (Elementary School (K-5), Middle School (6-8), High School (9-12)), Institution (Public, Private), Delivery Mode (Online, Offline), and Region 2025-2033

Australia K-12 Education Market Overview:

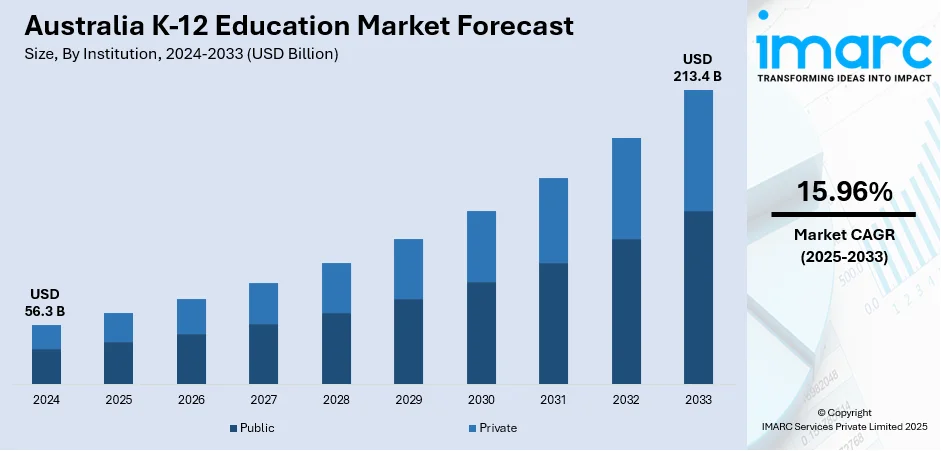

The Australia K-12 education market size reached USD 56.3 Billion in 2024. Looking forward, the market is expected to reach USD 213.4 Billion by 2033, exhibiting a growth rate (CAGR) of 15.96% during 2025-2033. The market is primarily driven by increased government funding, rising student enrollment driven by population growth, and enhanced investment in educational infrastructure and resources to accommodate diverse and expanding student needs across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 56.3 Billion |

|

Market Forecast in 2033

|

USD 213.4 Billion |

| Market Growth Rate 2025-2033 | 15.96% |

Key Trends of Australia K-12 Education Market:

Supportive Government Funding

The Australian government's commitment to enhancing K-12 education through increased funding has been pivotal in supporting the sector's growth. As per the Australian government, Department of Education, educational institutions like schools in Australia are witnessing unprecedented levels of government support, with funding reaching $25.3 Billion in 2022 and a total of $318.9 Billion from 2018 to 2029. Moreover, a boost of $62.4 Million is allocated to enhance student educational achievements through the National School Reform Fund and the Non-Government Reform Support Fund. Besides, an extension of a grants program with $17.3 Million dedicated to helping boarding providers improve support for Aboriginal and Torres Strait Islander students, aiming to enhance their educational experiences. Furthermore, the introduction of the Commonwealth Regional Scholarship Program, with $10.9 Million allocated to help up to 200 families from low-SES backgrounds afford boarding school fees, is influencing the market growth. This financial investment has been instrumental in several areas and facilitates significant improvements in educational infrastructure, ensuring schools are well-equipped and conducive to learning. Hence, this comprehensive financial support enhances the quality of education and makes Australian schools more attractive and competitive in the global education market.

To get more information of this market, Request Sample

Rising Enrollment Numbers

The growth in student numbers in Australia's K-12 education system is a direct reflection of broader demographic trends, particularly population growth fueled by immigration. According to the Australian Bureau of Statistics, Australia witnessed enrollment figures reach 4,086,998 students across 9,629 schools in 2023. Additionally, the average ratio of students to teaching staff in all schools stood at 13.1 to one. Moreover, in Australia, the student population in schools grew to 4,086,998, marking a 1.1% surge or an increase of 44,486 students from the previous year, 2022. Most of these students, accounting for 64.0%, attended government schools, while 19.7% were enrolled in Catholic schools, and 16.3% in independent schools. This demographic expansion necessitates a proportional increase in educational facilities, resources, and staffing, which in turn drives the expansion of the education sector. Moreover, schools are compelled to scale up their operations, from enlarging physical infrastructures like classrooms and laboratories to enhancing digital infrastructures to support e-learning platforms. Furthermore, the rising enrollment underscores the demand for more comprehensive educational services and amplifies the need for specialized educational programs to cater to a diverse student population. As Australia continues to attract immigrants, the diversity in student backgrounds necessitates educational adaptations that can offer tailored, inclusive educational experiences, thus further shaping the growth of the K-12 education market in the country.

Growth Drivers of Australia K-12 Education Market:

Digital Transformation in Classrooms

Australian schools are undergoing a major digital transformation, with rapid integration of advanced technologies reshaping traditional learning environments. E-learning platforms, AI, interactive devices like smart boards, and virtual simulations are the tools that are rapidly spreading into classroom use to enhance a student-centered environment. The innovations allow the creation of personalized learning experiences where content is tailored to personal progress, leading to better understanding and retention. Real-time analytics also helps teachers to keep up with the progress and adjust the style of teaching accordingly. Besides knowledge, technology promotes group work and problem-solving, which will prepare students to work in modern places. The transition to technology-based classrooms can better accommodate needs and abilities, and also place the Australian K-12 education system at the forefront of adopting future-centered learning practices.

Growing Focus on STEM Education

The increasing emphasis on science, technology, engineering, and mathematics (STEM) subjects has become a cornerstone of growth within Australia’s K-12 education sector. Driven by global demand for future-ready skills, schools are actively embedding STEM into curricula to equip students for evolving workforce requirements. Practical learning opportunities, robotics programs, coding classes, and laboratory-based projects are becoming integral in nurturing innovation and problem-solving abilities. This focus also aligns with Australia’s long-term economic priorities, fostering a generation prepared to contribute to high-tech industries and scientific advancements. By inspiring curiosity and analytical thinking, STEM education not only boosts student engagement but also strengthens pathways to higher education and career opportunities. Its rising importance underscores a strategic shift toward aligning education with future global competitiveness, which is further fueling the Australia K-12 education market share.

Increasing Private Sector Participation

The growing role of private institutions and education service providers is significantly shaping the Australian K-12 education market. Private schools are investing heavily in modern infrastructure, advanced teaching models, and internationally recognized curricula to attract families seeking quality education. Their ability to offer innovative programs, smaller class sizes, and enhanced extracurricular opportunities sets them apart from many public schools. Additionally, collaborations with technology providers and international institutions are expanding the range of learning experiences available to students. The presence of private sector initiatives also fosters healthy competition, driving overall improvements in teaching quality and resource availability. This expanding participation not only diversifies educational choices for parents but also accelerates the development of Australia’s education ecosystem by setting higher benchmarks.

Opportunities of Australia K-12 Education Market:

Expansion of Online Learning Models

The growing adoption of online and hybrid learning models is creating significant opportunities within Australia’s K-12 education market. Schools are increasingly turning to digital platforms to expand accessibility, enabling students to learn beyond the traditional classroom environment. This shift supports diverse learning needs, offering flexibility for students in remote areas, those requiring personalized learning pathways, and families seeking alternative education formats. Online learning also provides opportunities to integrate multimedia tools, interactive assessments, and self-paced modules, enhancing student engagement. Furthermore, schools can utilize data-driven insights from these platforms to better understand student progress and tailor instructional strategies. As digital literacy becomes a core skill, the integration of online models positions institutions to remain competitive and innovative in a technology-driven education landscape.

International Student Attraction

Australia’s strong global reputation for delivering high-quality education presents a valuable opportunity for K-12 institutions to attract international students. Private schools and specialized programs are well-positioned to appeal to families seeking globally recognized curricula and enriched learning experiences. Exchange programs, international partnerships, and bilingual offerings further enhance the appeal of Australian schools to overseas students. This trend not only generates additional revenue streams for institutions but also enriches the learning environment by promoting cultural diversity and global perspectives among students. With growing demand for international education options, K-12 schools can leverage Australia’s brand strength to establish long-term networks and create inclusive environments that prepare students for success in an interconnected and multicultural world.

Collaboration with EdTech Firms

Strategic collaboration between schools and EdTech companies offers a powerful avenue for the Australia K-12 education market growth. Partnerships can introduce innovative solutions such as AI-powered learning platforms, gamified content, and immersive virtual classrooms that enhance both teaching and learning experiences. By leveraging EdTech expertise, schools can integrate adaptive learning systems that provide personalized pathways, real-time performance tracking, and interactive resources. These collaborations also reduce the burden on educators by streamlining administrative tasks and offering professional development tools. Moreover, aligning with EdTech firms allows institutions to stay ahead of technological trends while ensuring students acquire future-ready skills. Such partnerships open doors for scalable innovation, enabling schools to remain competitive and better prepared for the evolving demands of modern education.

Government Support for Australia K-12 Education Market:

Curriculum Reforms and Modernization

Australia’s K-12 education market benefits significantly from government-driven curriculum reforms designed to keep learning relevant to global demands. Policies emphasize strengthening STEM education, improving digital literacy, and embedding critical 21st-century skills such as problem-solving, creativity, and collaboration. The focus is on preparing students not only for higher education but also for a rapidly changing job market shaped by technology and innovation. By ensuring alignment with international benchmarks, these reforms enhance global competitiveness and encourage students to pursue diverse academic and professional pathways. This modernization of curricula also integrates cultural inclusivity, sustainability, and cross-disciplinary learning, creating a holistic educational approach that reflects the needs of both society and industry while fostering long-term growth in the education sector.

Infrastructure Development Initiatives

Strong infrastructure development remains a cornerstone of Australia’s efforts to strengthen its Australia K-12 education market demand. Investments are being channelled into building modern classrooms equipped with advanced teaching technologies, including smart boards, high-speed internet, and interactive digital platforms. Additionally, dedicated digital laboratories, science facilities, and upgraded libraries are being established to meet the evolving demands of students in an increasingly knowledge-driven environment. These infrastructure upgrades also aim to create safe, inclusive, and adaptable spaces that encourage collaborative and experiential learning. By bridging gaps in access to resources across urban and rural areas, such initiatives ensure equitable educational opportunities for all students. Ultimately, the modernization of physical and digital infrastructure supports academic excellence while also future-proofing schools against changing pedagogical and technological trends.

Teacher Training and Development Programs

Teacher quality plays a pivotal role in shaping student success, and the Australian government has prioritized robust training and development programs within the K-12 education sector. Continuous professional development schemes aim to upskill teachers in areas such as digital pedagogy, STEM integration, inclusive education, and innovative classroom practices. These initiatives not only enhance subject expertise but also build teachers’ ability to adapt to new learning technologies and diverse student needs. By fostering a culture of lifelong learning among educators, such programs ensure teaching methods remain current and effective. Government-supported certifications, workshops, and mentorship opportunities further strengthen professional growth. This focus on capacity building improves overall student engagement, learning outcomes, and institutional reputation, making teacher development a cornerstone of education policy.

Challenges of Australia K-12 Education Market:

Teacher Shortages and Retention

One of the pressing challenges in Australia’s K-12 education market is the shortage of qualified teachers across key subject areas, particularly in mathematics, science, and technology. Retention issues compound this shortage, as many educators face burnout, heavy workloads, and limited career advancement opportunities. High turnover rates disrupt classroom stability and hinder the consistent delivery of quality education. Schools in remote or underserved regions are especially affected, struggling to attract skilled professionals due to geographic and resource constraints. The lack of experienced teachers not only reduces instructional effectiveness but also impacts student outcomes and engagement. Addressing this challenge requires targeted recruitment strategies, better incentives, and stronger support systems to improve long-term retention within the teaching workforce.

Rising Operational Costs

Rising operational costs present a significant obstacle for schools within the Australian K-12 education sector. Institutions are under constant pressure to invest in modern infrastructure, advanced digital technologies, and curriculum innovations to keep pace with evolving educational standards. While these improvements are essential, they often create financial strain, particularly for schools in regional areas with limited funding resources. According to the Australia K-12 education market analysis, increasing energy costs, facility maintenance, and technology upgrades add to the burden, forcing administrators to make difficult choices between affordability and quality. Smaller schools and independent institutions are especially vulnerable, as they rely heavily on tuition fees and community contributions. Without sustainable funding strategies or cost-sharing mechanisms, managing operational expenses while ensuring consistent educational standards remains a persistent challenge.

Equity in Access

Ensuring equitable access to quality education remains a critical challenge in Australia’s K-12 market. Students in rural, remote, and low-income communities often face limited opportunities due to inadequate infrastructure, fewer qualified teachers, and restricted access to digital learning tools. This disparity widens the educational gap, making it harder for disadvantaged students to achieve outcomes comparable to their urban peers. Barriers such as long travel distances, unreliable internet connectivity, and lack of extracurricular resources further exacerbate inequality. Additionally, cultural and linguistic diversity within the student population requires specialized approaches that are not always available in underfunded schools. Bridging this gap calls for targeted policies, improved resource allocation, and inclusive practices to create equal learning opportunities for every student across the country.

Australia K-12 Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application, institution, and delivery mode.

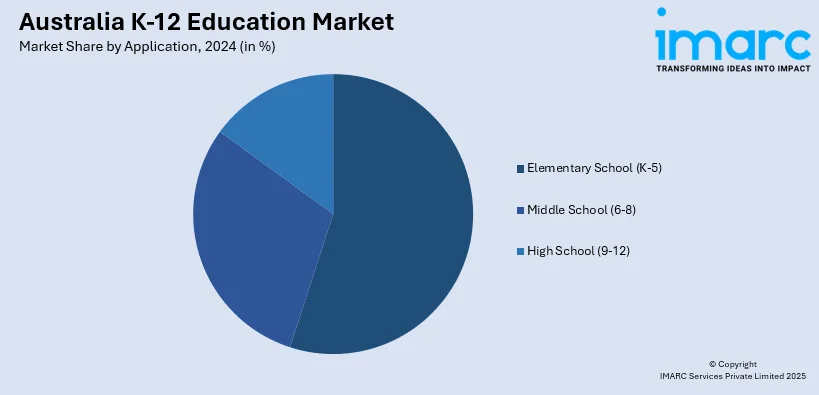

Application Insights:

- Elementary School (K-5)

- Middle School (6-8)

- High School (9-12)

The report has provided a detailed breakup and analysis of the market based on the application. This includes elementary school (k-5), middle school (6-8), and high school (9-12).

Institution Insights:

- Public

- Private

A detailed breakup and analysis of the market based on the institution have also been provided in the report. This includes public and private.

Delivery Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the delivery mode. This includes online and offline.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia K-12 Education Market News:

- On 5 October 2023, education ministers ratified the Australian Framework for Generative Artificial Intelligence (AI) in schools, which offers guidelines for comprehending, utilizing, and managing generative AI within Australia's school-based education system. This framework aims to promote the responsible and ethical application of generative AI technologies in a manner that benefits students, educational institutions, and the broader community. It provides support for various stakeholders involved in school education, including school leaders, teachers, support personnel, service providers, parents, guardians, students, and policymakers.

- In March 2024, Woodside Energy is set to expand its educational support in the Pilbara with a $7 Million investment over five years, aimed at enhancing educational outcomes and opportunities for students. This expansion, part of the Karratha and Roebourne Education Initiative, builds upon the successful efforts already in place and will now include seven primary schools in addition to continuing support for Karratha Senior High School and Roebourne District High School, Australia.

Australia K-12 Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Elementary School (K-5), Middle School (6-8), High School (9-12) |

| Institutions Covered | Public, Private |

| Delivery Modes Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia K-12 education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia K-12 education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia K-12 education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The K-12 education market in Australia was valued at USD 56.3 Billion in 2024.

The Australia K-12 education market is projected to exhibit a CAGR of 15.96% during 2025-2033.

The Australia K-12 education market is projected to reach a value of USD 213.4 Billion by 2033.

Key trends in the Australia K-12 education market include rapid digital adoption with e-learning and AI tools, a stronger focus on STEM-based curricula, growing demand for personalized and inclusive learning, rising private sector involvement, and expanding international collaborations that enrich academic standards and diversify student learning experiences nationwide.

The growth of Australia’s K-12 education market is driven by digital transformation in classrooms, rising emphasis on STEM subjects, and expanding private sector participation. These factors enhance learning quality, foster innovation, and create diverse educational pathways aligned with future workforce and global competitiveness needs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)