Australia Kitchen Fittings Market Size, Share, Trends and Forecast by Product Type, Material, Distribution Channel, End User, and Region, 2025-2033

Australia Kitchen Fittings Market Overview:

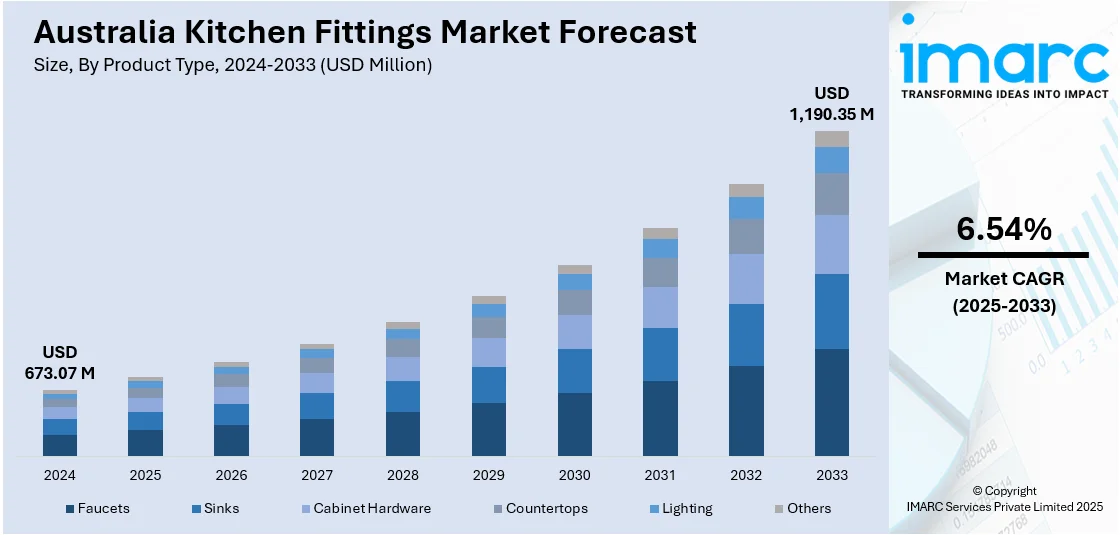

The Australia kitchen fittings market size reached USD 673.07 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,190.35 Million by 2033, exhibiting a growth rate (CAGR) of 6.54% during 2025-2033. The market is experiencing steady growth driven by the increasing demand for modern, stylish, and functional kitchen solutions. Rising home renovations and growing focus on high-quality, durable fittings are also propelling the market. Consumers increasingly seeking energy-efficient and sustainable products, and growing preference for premium designs is leading both local and international brands to expand, thereby contributing to the Australia kitchen fittings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 673.07 Million |

| Market Forecast in 2033 | USD 1,190.35 Million |

| Market Growth Rate 2025-2033 | 6.54% |

Australia Kitchen Fittings Market Trends:

Increasing Demand for Smart Kitchen Fittings

In Australia there is an increasing demand for smart kitchen fittings due to consumers' desire for greater convenience, hygiene, and energy efficiency in the kitchen. Touchless faucets which are not subject to physical touch are increasingly in demand because of their capacity to reduce germ spread and save water. Demand for sensor-operated appliances including automatic soap dispensers and smart dishwashers is also on the rise providing greater functionality and convenience. These intelligent features not just enhance convenience but also help in sustainability by reducing water and energy usage. As the trend of the smart home picks up these kitchen fixtures are becoming a necessary component of contemporary kitchens showing a greater interest in home automation. This change is adding to the overall increase in the Australia kitchen fittings market.

To get more information on this market, Request Sample

Rising Focus on Sustainable Materials

There is growing focus on sustainability within the Australia kitchen fittings market, with both consumers and manufacturers increasingly looking towards sustainable materials. Kitchen fittings, including faucets, sinks, and countertops, are now being fabricated using sustainable materials such as recycled metals, bamboo, and low-emission composites. Eco-friendly coatings and finishes that minimize environmental impact are also becoming the norm. Water-conserving technologies like flow-restricting faucets and intelligent dishwashers are becoming increasingly popular, enabling homes to consume less water while using similar amounts of energy. This trend towards sustainability is part of an overall move by consumers towards more environmentally friendly living as Australians grow more aware of their ecological footprint. As demand for eco-conscious solutions rises, these trends are fueling the Australia kitchen fittings market growth, as both homeowners and designers opt for more sustainable choices in kitchen renovations.

Growth in Modular and Customizable Kitchen Solutions

In Australia, there is an accelerating need for modular and adaptable kitchen solutions, fueled by homeowners' need to customize their living areas. Modular kitchen fittings, which comprise prefabricated units with quick re-arrangement or expansion capabilities, offer adaptability and functionality to suit different kitchen sizes and designs. Uniquely customizable aspects, including shelves that can be altered, bespoke cabinetry, and storage that can be customized to fit requirements, enable individuals to design a kitchen tailored exactly to their requirements and personal taste. It is especially favored by homeowners who are remodeling their homes, as it provides the ability to customize extensively without paying the premium for entirely bespoke schemes. As online platforms provide simple-to-use design software, homeowners are able to design their dream kitchen in the comfort of their own home, further supporting the market's growth.

Australia Kitchen Fittings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material, distribution channel, and end user.

Product Type Insights:

- Faucets

- Sinks

- Cabinet Hardware

- Countertops

- Lighting

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes faucets, sinks, cabinet hardware, countertops, lighting, and others.

Material Insights:

- Stainless Steel

- Brass

- Ceramic

- Glass

- Wood

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes stainless steel, brass, ceramic, glass, wood, and others.

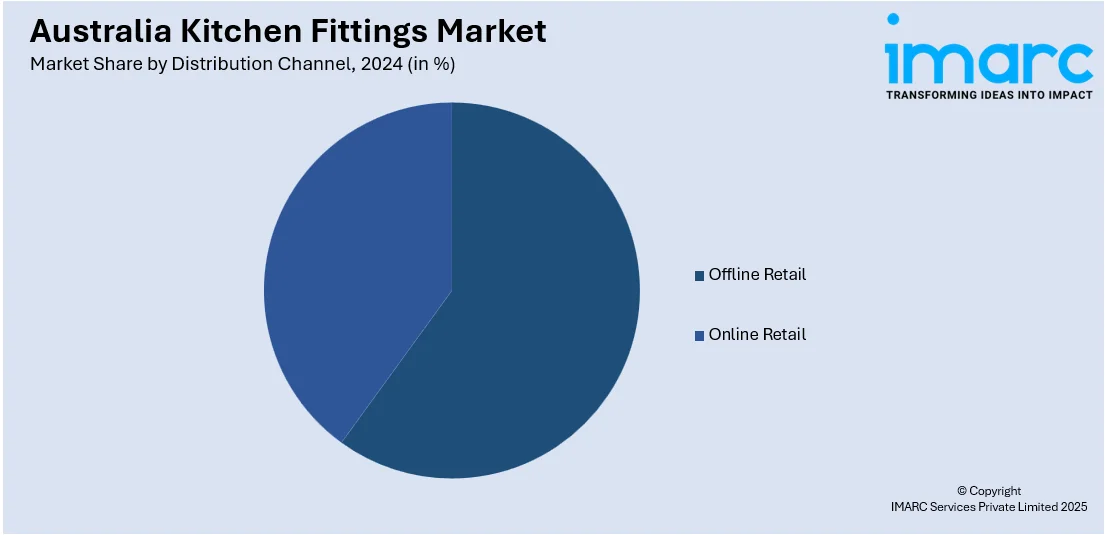

Distribution Channel Insights:

- Offline Retail

- Online Retail

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline retail and online retail.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Kitchen Fittings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Faucets, Sinks, Cabinet Hardware, Countertops, Lighting, Others |

| Materials Covered | Stainless Steel, Brass, Ceramic, Glass, Wood, Others |

| Distribution Channels Covered | Offline Retail, Online Retail |

| End Users Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia kitchen fittings market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia kitchen fittings market on the basis of product type?

- What is the breakup of the Australia kitchen fittings market on the basis of material?

- What is the breakup of the Australia kitchen fittings market on the basis of distribution channel?

- What is the breakup of the Australia kitchen fittings market on the basis of end user?

- What is the breakup of the Australia kitchen fittings market on the basis of region?

- What are the various stages in the value chain of the Australia kitchen fittings market?

- What are the key driving factors and challenges in the Australia kitchen fittings market?

- What is the structure of the Australia kitchen fittings market and who are the key players?

- What is the degree of competition in the Australia kitchen fittings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia kitchen fittings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia kitchen fittings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia kitchen fittings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)