Australia Kitchenware Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, End User, and Region, 2026-2034

Australia Kitchenware Market Overview:

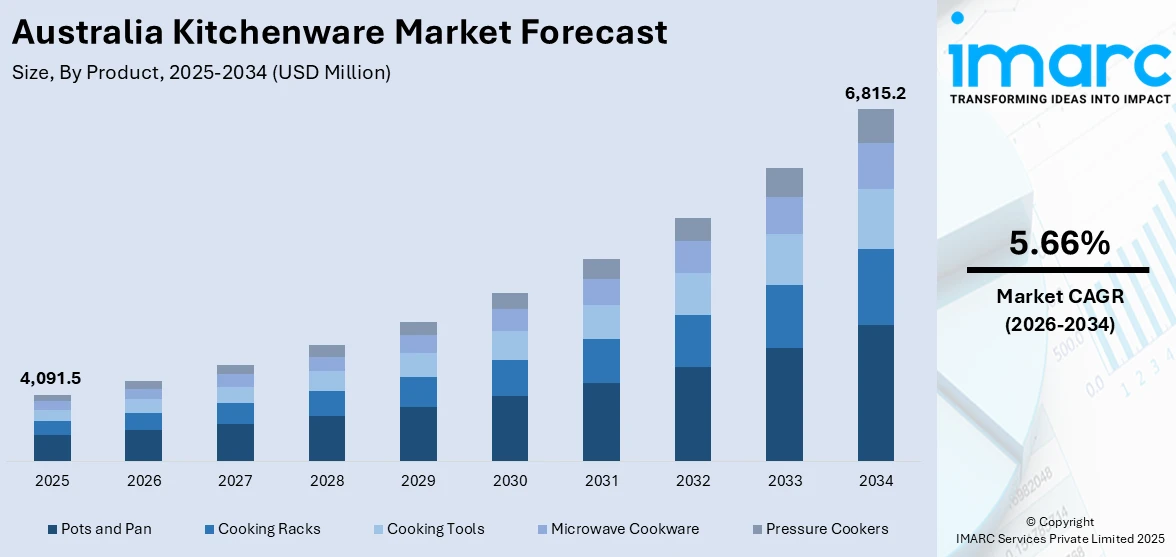

The Australia kitchenware market size reached USD 4,091.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 6,815.2 Million by 2034, exhibiting a growth rate (CAGR) of 5.66% during 2026-2034. The market is being driven by increasing health-consciousness, as consumers prefer products that enable healthier cooking such as non-toxic cookware and air fryers. There is also technological development, whereby smart, networked kitchen appliances that are convenient and precise in nature continue to become more popular. There is also mounting environmental awareness driving demand for sustainable, eco-friendly materials and reusable products. Together, these drivers drive innovation and Australia kitchenware market share, as consumers look for functional, fashionable, and sustainable kitchenware solutions that fit today's lifestyles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4,091.5 Million |

| Market Forecast in 2034 | USD 6,815.2 Million |

| Market Growth Rate 2026-2034 | 5.66% |

Key Trends of Australia Kitchenware Market:

Rise of Health and Wellness Cooking

Growing wellness and health awareness is transforming the Australia kitchenware market growth as more people are choosing to dine at home for greater ingredient control, nutritional quality, and hygiene. This trend drives demand for specialized tools such as air fryers, blenders, steamers, and non-toxic cookware that enable healthier cooking methods. Australians are increasingly favoring ecologically friendly, BPA-free, and non-stick materials, echoing both health concerns and environmental considerations. Kitchen appliances that support portion control and meal prep are becoming more popular as individuals embrace mindful eating. This trend that is guided by health is not only boosting sales but also propelling product innovation and premiumization. Consequently, brands are launching functional yet fashionable kitchenware that resonates with wellness-conscious consumers. The movement is also inspiring long-term lifestyle modification, placing kitchenware not merely as an instrument but as a central element of healthier, more aware living in contemporary Australian households.

To get more information on this market Request Sample

Technological Integration and Smart Kitchenware

The integration of technology in kitchenware is transforming the Australia market, with smart appliances like app-controlled slow cookers, smart ovens, and voice-activated tools becoming increasingly popular. These innovations offer greater convenience, precision, and connectivity, aligning with the modern consumer’s desire for efficiency and seamless integration into smart home ecosystems. As of 2023, around 7.6 million Australian households had at least one smart device, such as connected fridges or smart speakers, highlighting widespread adoption. Consumers are drawn to features like automated settings, remote monitoring, and energy efficiency, which not only enhance the cooking experience but also support sustainable living. This growing demand is driving manufacturers to develop Internet of Things (IoT)-enabled kitchen tools that blend technology with sleek, modern design. With rising expectations for smarter, more efficient kitchens, brands investing in tech-driven kitchenware gain a strong competitive edge in an evolving and highly responsive Australian market.

Sustainable and Eco-Friendly Products

Sustainability is a core driver shaping consumer preferences in Australia’s kitchenware market. Increasing environmental awareness is influencing buyers to opt for eco-friendly products made from bamboo, recycled metals, and biodegradable plastics. Consumers are prioritizing durability, recyclability, and reducing single-use items and waste. This trend is further supported by data showing that 32% of urban Australians prefer products with eco-friendly packaging, while 34% favor those made through sustainable sourcing. Brands are actively responding with environmentally conscious packaging, reusable kitchen tools, and certified sustainable offerings. These initiatives not only meet rising consumer expectations but also reflect a wider movement toward responsible consumption. As a result, companies are being encouraged to adopt transparent, green practices, enhancing brand trust and loyalty. In the long term, this shift supports market growth and positions sustainability as a competitive advantage in the evolving Australian kitchenware landscape.

Growth Factors of Australia Kitchenware Market:

Changing Lifestyle and Culinary Interest

Evolving consumer lifestyles and a growing interest in culinary activities are significantly driving the Australia kitchenware market. More households are embracing cooking and baking not only as a necessity but also as a hobby, a form of self-expression, and a way to experiment with global cuisines at home. This has fueled the demand for a wide variety of kitchenware products, ranging from basic cookware and utensils to advanced specialty tools designed for precision cooking. The influence of food culture, cooking shows, and social media trends further motivates consumers to invest in better equipment. As more people explore home cooking as part of a healthier, creative lifestyle, the appetite for innovative and functional kitchenware products continues to expand rapidly.

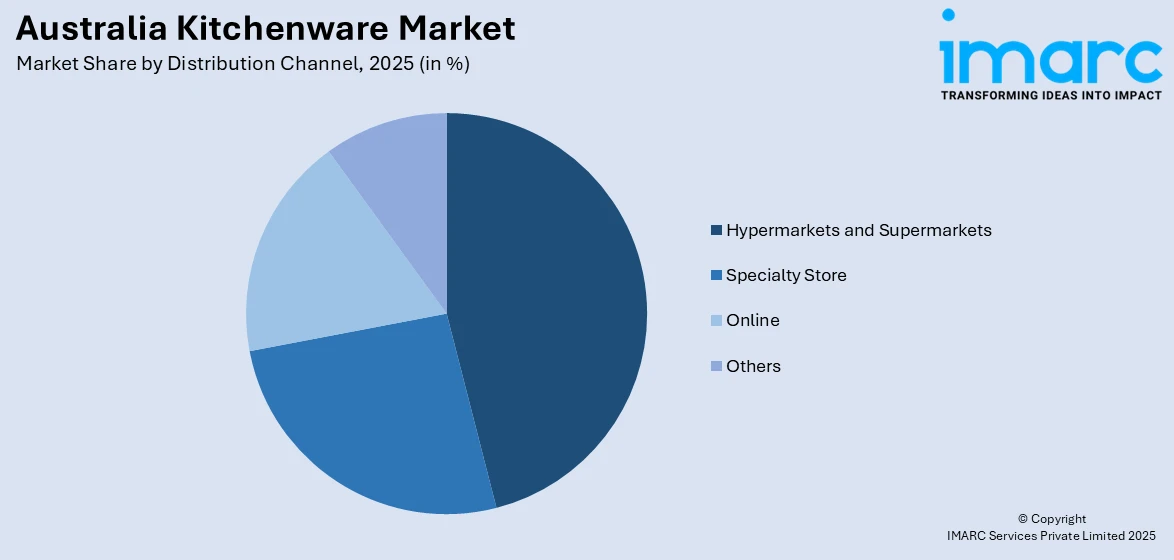

Expansion of Organized Retail and E-commerce

The expansion of organized retail and e-commerce is a major growth factor for the Australian kitchenware market, making products more accessible and diverse. Supermarkets, specialty stores, and department stores still offer extensive product visibility, while online shopping introduces further convenience in the form of doorstep delivery and simple price comparisons. Online retail has especially fueled market expansion by providing unique product lines, customer reviews, and personalization opportunities that assist with decision-making. Urban and rural consumers both enjoy this enhanced availability, closing the gap between local and global product lines. Promotional offers, sales during seasonal periods, and bundled packages additionally motivate buying. As retail networks both on and offline continue to develop further, they establish greater brand presence, increased opportunities for selling, and wider consumer participation in the market.

Premiumization and Aesthetic Appeal

Premiumization and rising consumer preference for stylish, high-quality kitchenware are boosting the Australia kitchenware market demand. Buyers are increasingly drawn to products that combine durability with aesthetic appeal, reflecting their lifestyle and personality within the kitchen space. Multifunctional designs, innovative finishes, and modern materials have elevated kitchenware from purely functional items to lifestyle products. Social media and design-focused marketing have also amplified this trend, encouraging consumers to showcase their kitchen spaces and tools as part of aspirational living. Premium products are often viewed as long-term investments, valued for their quality and ability to enhance cooking experiences. This shift toward higher-end, aesthetically pleasing kitchenware allows brands to tap into a growing market segment that prioritizes both performance and style.

Opportunities of Australia Kitchenware Market:

Customization and Personalization

Customization and personalization are emerging as strong opportunities in the Australian kitchenware market, driven by consumers’ desire for products that reflect their lifestyle and individuality. Shoppers are increasingly attracted to items such as engraved utensils, color-customized cookware, or modular storage solutions that can be adapted to specific kitchen layouts. Personalized products are not only functional but also enhance the aesthetic appeal of homes, making them popular as gifts and for self-use. This trend is particularly appealing to younger demographics, who value uniqueness and self-expression in everyday items. By offering tailored designs, limited-edition collections, and interactive online customization tools, kitchenware brands can strengthen consumer loyalty, increase perceived value, and create a premium edge in an otherwise highly competitive market.

Growth in Urban Households and Apartments

The steady rise of urban households and compact apartments across Australia is generating new opportunities for the kitchenware industry. With smaller kitchens becoming more common, consumers are actively seeking compact, multifunctional, and space-saving solutions to maximize efficiency. Products such as stackable cookware, foldable utensils, and modular storage systems are increasingly in demand to address space constraints. According to the Australia kitchenware market analysis, this shift reflects modern lifestyle changes, where urban professionals and younger families prioritize convenience without sacrificing quality or design. Kitchenware brands catering to this demand with sleek, functional, and innovative products can appeal to a large and growing urban customer base. As housing trends continue toward smaller living spaces, the need for space-efficient kitchenware will remain a critical growth avenue for manufacturers and retailers.

Tourism and Hospitality Sector Demand

The tourism and hospitality sector in Australia provides significant opportunities for the kitchenware market. Hotels, restaurants, cafes, and catering businesses require durable, professional-grade kitchenware that can withstand intensive use while maintaining high performance and safety standards. With Australia’s reputation as a popular travel destination and a thriving food culture, demand for commercial kitchenware continues to grow steadily. Businesses in the hospitality sector increasingly prioritize modern, aesthetically pleasing designs that align with dining experiences and customer expectations. This creates consistent opportunities for B2B sales and long-term supply contracts. Manufacturers that deliver innovative, reliable, and cost-effective solutions tailored to professional environments can strengthen their presence in this sector, ensuring steady revenue streams alongside traditional consumer-driven demand in the domestic market.

Challenges of Australia Kitchenware Market:

High Market Competition

The Australia kitchenware market faces intense competition due to the presence of international brands, established local manufacturers, and private label players offered by major retailers. Global brands often compete on innovation, durability, and design, while local producers appeal through affordability, cultural alignment, and accessibility. Private labels add another layer of competition by delivering cost-effective alternatives that attract price-sensitive consumers. This crowded landscape pressures companies to differentiate through continuous product innovation, branding, and marketing strategies. Maintaining customer loyalty becomes increasingly challenging as consumers are open to experimenting with new products and brands. To stand out, kitchenware businesses must focus on balancing affordability with quality, offering unique designs, and adopting effective promotional campaigns that resonate with diverse consumer groups.

Rising Raw Material and Production Costs

Rising raw material and production costs are a significant challenge for kitchenware manufacturers in Australia. Fluctuating prices of essential materials such as stainless steel, aluminum, ceramics, and plastics directly affect production expenses, while increasing labor and transportation costs further strain profitability. In addition, growing demand for sustainable packaging and eco-friendly materials adds to expenses, forcing brands to rethink sourcing and manufacturing strategies. For larger multinational players, scale advantages may ease the burden, but smaller and mid-sized companies face tighter margins. Passing these costs on to consumers risks reducing competitiveness, especially in price-sensitive segments. To remain viable, kitchenware manufacturers must explore cost optimization strategies, invest in efficient production methods, and strengthen supply chain resilience without compromising on product quality.

Shifting Consumer Price Sensitivity

Shifting consumer price sensitivity presents an ongoing challenge in the Australian kitchenware market. While there is rising demand for premium, high-quality, and stylish products, a considerable segment of consumers remains focused on affordability. This dual demand creates a gap where mid-range and luxury kitchenware brands often struggle to balance pricing with perceived value. Economic pressures, such as inflation and fluctuating household budgets, amplify consumer caution when spending on non-essential items like cookware and utensils. Consequently, even innovative or premium products must justify their price through durability, design, or multifunctionality. Brands that cannot effectively communicate value risk losing market share to low-cost alternatives and private labels. Navigating this sensitivity requires strategic pricing, promotions, and clear messaging about long-term benefits.

Australia Kitchenware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, material, distribution channel, and end user.

Product Insights:

- Pots and Pan

- Cooking Racks

- Cooking Tools

- Microwave Cookware

- Pressure Cookers

The report has provided a detailed breakup and analysis of the market based on the product. This includes pots and pan, cooking racks, cooking tools, microwave cookware, and pressure cookers.

Material Insights:

- Stainless Steel

- Aluminum

- Glass

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes stainless steel, aluminum, glass, and others.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets and Supermarkets

- Specialty Store

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hypermarkets and supermarkets, specialty store, online, and others.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Breville Pty Limited

- Kleenmaid Appliances

- Meyer Cookware Australia Pty Ltd.

- Mistral Appliances

- RACO Australia

- Sunbeam Australia

- Tefal Australia

- Westinghouse Appliances Australia

- Williams-Sonoma Inc

Australia Kitchenware Market News:

- In March 2025, Perth agency Block launched Side by Side, a content platform for Kitchen Warehouse’s Wolstead cookware brand. The first episode features chef Cameron Cansdell testing Wolstead’s Steeltek Ultra range against his professional cookware by cooking his signature dish twice. Designed for passionate home cooks, the platform highlights Wolstead’s quality and value, reinforcing the brand’s promise that great cooking starts with great cookware—without a premium price.

- In June 2024, Spotlight launched The Culinary Co by Manu, an exclusive kitchenware range designed in collaboration with celebrity chef Manu Feildel. Inspired by Manu’s French heritage, the collection features cookware, utensils, dinnerware, and napery, all crafted to inspire creativity and joy in the kitchen. The range includes cast iron pots and pans, chopping boards, knife blocks, cutlery, roasting dishes, and stylish dinner sets, available in stores from June 26, 2024.

Australia Kitchenware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Pots and Pan, Cooking Racks, Cooking Tools, Microwave Cookware, Pressure Cookers |

| Materials Covered | Stainless Steel, Aluminum, Glass, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Specialty Store, Online, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Breville Pty Limited, Kleenmaid Appliances, Meyer Cookware Australia Pty Ltd., Mistral Appliances, RACO Australia, Sunbeam Australia, Tefal Australia, Westinghouse Appliances Australia, Williams-Sonoma Inc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia kitchenware market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia kitchenware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia kitchenware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kitchenware market in Australia was valued at USD 4,091.5 Million in 2025.

The Australia kitchenware market is projected to exhibit a CAGR of 5.66% during 2026-2034.

The Australia kitchenware market is projected to reach a value of USD 6,815.2 Million by 2034.

The major trends of the Australia kitchenware market include the growing demand for premium and multifunctional products, and increasing influence of modern lifestyle trends. Online retail expansion, coupled with consumer preference for innovative, stylish, and space-saving designs, continues to shape purchasing decisions across households.

The growth in the Australia kitchenware market is fueled by rising consumer interest in home cooking, increasing demand for durable and innovative products, and growing preference for eco-friendly materials. Expanding online retail and lifestyle-driven purchases further enhance market opportunities, supporting steady industry expansion across diverse consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)