Australia Laboratory Automation Market Size, Share, Trends and Forecast by Type, Equipment and Software Type, End User, and Region, 2025-2033

Australia Laboratory Automation Market Overview:

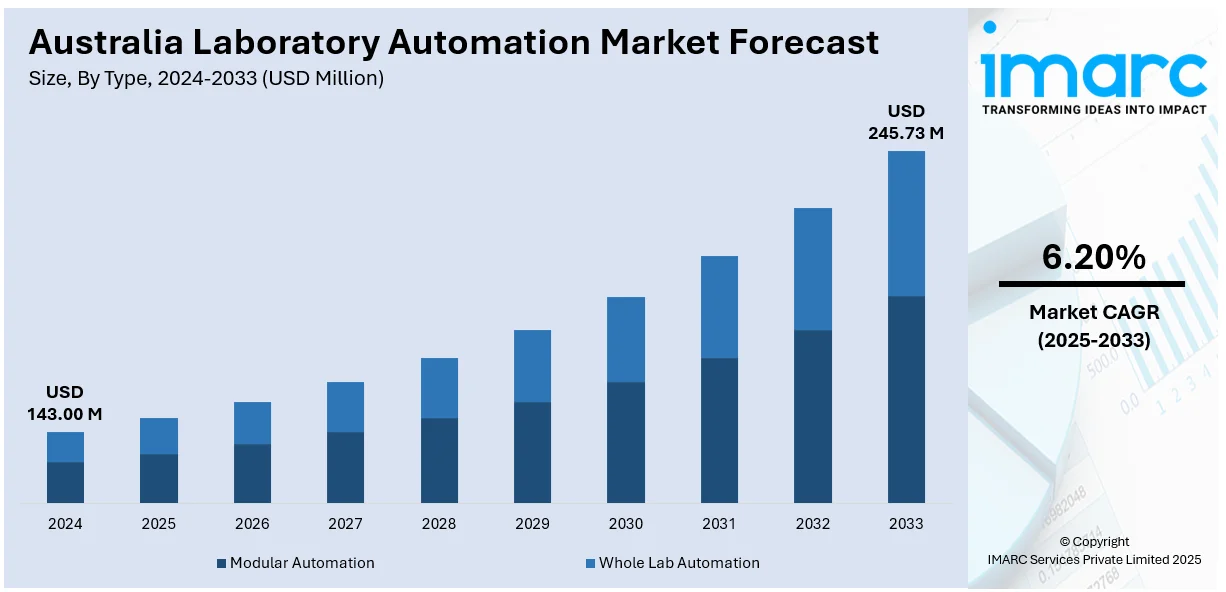

The Australia laboratory automation market size reached USD 143.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 245.73 Million by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is driven by the growing demand for high-throughput testing, rising healthcare needs, and AI-driven diagnostic advances. The pressure for efficiency, less human error prospects, and quicker turnaround times in research and clinical environments further accelerates the use of automated systems across various scientific and medical applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 143.00 Million |

| Market Forecast in 2033 | USD 245.73 Million |

| Market Growth Rate 2025-2033 | 6.20% |

Australia Laboratory Automation Market Trends:

Integration of AI and Cloud Technologies

The Australia laboratory automation market share is witnessing a revolutionary shift toward integration of artificial intelligence (AI) and cloud computing technologies. AI facilitates laboratories to automate time-consuming data analysis activities, with higher accuracy and faster turnaround times for research results. Machine learning algorithms are able to forecast experimental results, streamline workflows, and discover patterns in massive datasets, hence streamlining decision-making processes. Cloud-based Laboratory Information Management Systems (LIMS) complement further by enabling scalable and flexible data storage solutions. Real-time sharing and collaboration of data among researchers are enabled, irrespective of their location, as a result of these systems, thus enhancing the speed of scientific discovery. Hence, the synergy between cloud technology and AI is enhancing laboratory processes, while also encouraging innovation in research methods across a variety of scientific disciplines.

To get more information on this market, Request Sample

Expansion Across Diverse Applications

The Australia laboratory automation market growth is fueled by various applications, such as clinical diagnostics, drug discovery, and genomics research. In clinical diagnostics, automation systems are improving the speed and accuracy of laboratory testing, resulting in quicker patient diagnosis and better healthcare outcomes. Automated systems in drug discovery are hastening the pace at which drugs that can act as potential therapeutics are identified, which is shortening the time and financial resources it traditionally requires to develop new drugs for the marketplace. Automation technology is also transforming the field of genomics with the high-throughput sequencing and data analysis enabled, driving advancements in personalized medicine. This extensive use of automation technologies in varied applications reflects the flexibility and utility of laboratory automation in meeting the changing requirements of the scientific community in Australia.

Competitive Environment and Market Forces

The Australia laboratory automation market outlook is influenced by both established multinational players and newer local players. Major global companies are increasing their presence in the Australian market through acquisition, partnership strategies, and the launch of innovative automation solutions adapted to local conditions. At the same time, Australian medium-sized companies and startups are propelling market growth through the development of niche automation technologies. This on-going interaction between worldwide and local stakeholders is creating a competitive space that promotes innovation and refining of laboratory automation products. In addition, the industry is subject to pressures from parameters like regulatory norms, availability of funds for research projects, and need for customized healthcare solutions, all of which determine the strategic actions of players and influence the industry's overall growth trajectory.

Australia Laboratory Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, equipment and software type, and end user.

Type Insights:

- Modular Automation

- Whole Lab Automation

The report has provided a detailed breakup and analysis of the market based on the type. This includes modular automation and whole lab automation.

Equipment and Software Type Insights:

- Automated Clinical Laboratory Systems

- Workstations

- LIMS (Laboratory Information Management Systems)

- Sample Transport Systems

- Specimen Handling Systems

- Storage Retrieval Systems

- Automated Drug Discovery Laboratory Systems

- Plate Readers

- Automated Liquid Handling Systems

- LIMS (Laboratory Information Management Systems)

- Robotic Systems

- Storage Retrieval Systems

- Dissolution Testing Systems

The report has provided a detailed breakup and analysis of the market based on the equipment and software type. This includes automated clinical laboratory systems [workstations, LIMS (laboratory information management systems), sample transport systems, specimen handling systems, storage retrieval systems] and automated drug discovery laboratory systems [plate readers, automated liquid handling systems, LIMS (laboratory information management systems), robotic systems, storage retrieval systems, dissolution testing systems].

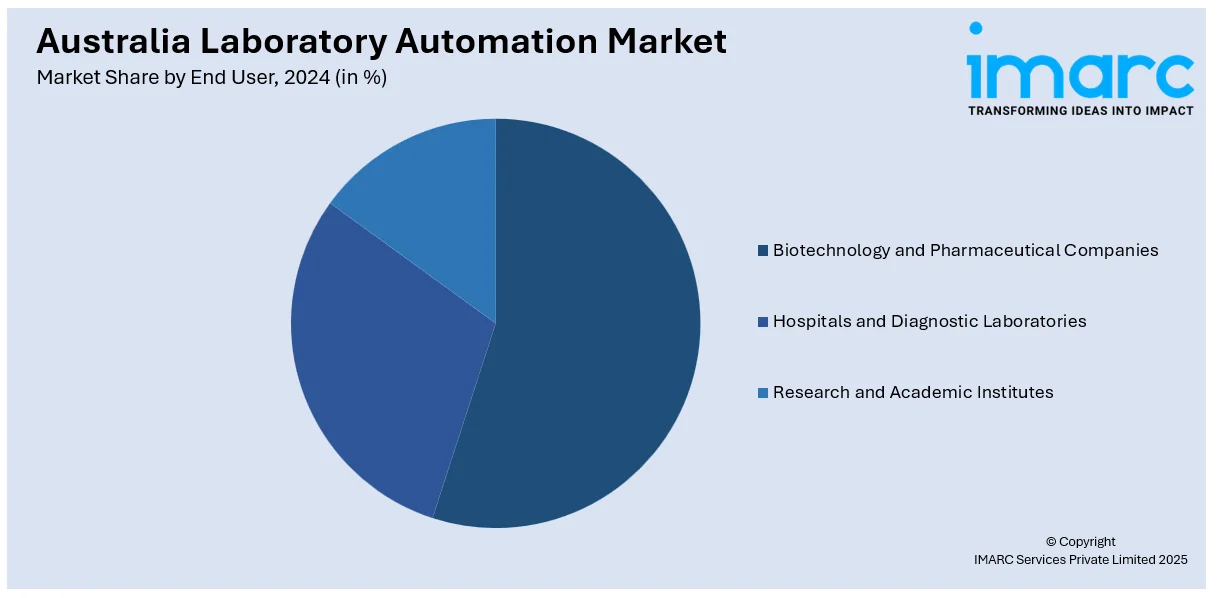

End User Insights:

- Biotechnology and Pharmaceutical Companies

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

The report has provided a detailed breakup and analysis of the market based on the end user. This includes biotechnology and pharmaceutical companies, hospitals and diagnostic laboratories, and research and academic institutes.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Laboratory Automation Market News:

- In February 2025, Abacus dx, a prominent distributor of in-vitro diagnostic and scientific solutions, revealed its new alliance with Inpeco, a worldwide frontrunner in clinical laboratory automation. This partnership represents an important advancement in improving the traceability, efficiency, and precision of diagnostic testing throughout Australia and New Zealand. Abacus dx will deliver and offer regional service and assistance for Inpeco’s cutting-edge Total Testing Process solutions, which encompass their pre-analytical ProTube sample collection system, advanced FlexLab X Total Laboratory Automation (TLA) system, and the upcoming FlexPath automation systems for Anatomical Pathology. These systems are tailored solutions aimed at optimizing laboratory processes, minimizing human mistakes, and enhancing overall patient results.

- In July 2024, Brooks Automation, a global leader in the development, manufacturing, and distribution of robotic automation in labs, announced that it has been officially approved as a supplier for Lifeblood (Australian Red Cross Lifeblood), the internationally renowned organization dedicated to the supply of blood and blood products. This accomplishment highlights the dedication of Brooks toward providing high-quality, dependable, and cutting-edge solutions for blood banks and labs across the globe. Their PathFinder™ systems are intended to provide laboratory personnel with enhanced oversight of sample handling and can be utilized in discreet, high-value areas to optimize productivity.

Australia Laboratory Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Modular Automation, Whole Lab Automation |

| Equipment and Software Types Covered |

|

| End Users Covered | Biotechnology and Pharmaceutical Companies, Hospitals and Diagnostic Laboratories, Research and Academic Institutes |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia laboratory automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia laboratory automation market on the basis of type?

- What is the breakup of the Australia laboratory automation market on the basis of equipment and software type?

- What is the breakup of the Australia laboratory automation market on the basis of end user?

- What is the breakup of the Australia laboratory automation market on the basis of region?

- What are the various stages in the value chain of the Australia laboratory automation market?

- What are the key driving factors and challenges in the Australia laboratory automation market?

- What is the structure of the Australia laboratory automation market and who are the key players?

- What is the degree of competition in the Australia laboratory automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia laboratory automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia laboratory automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia laboratory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)