Australia Lactic Acid Market Size, Share, Trends and Forecast by Raw Material, Form, Application, and Region, 2025-2033

Australia Lactic Acid Market Overview:

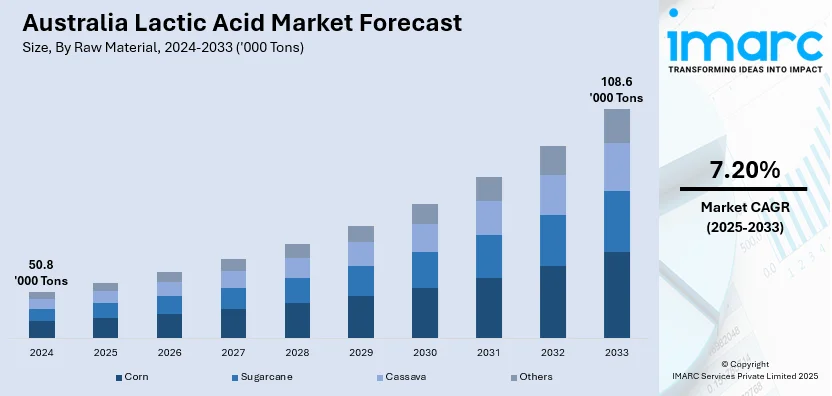

The Australia lactic acid market size reached 50.8 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 108.6 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market is expanding steadily, supported by rising demand for bio-based materials, advancements in sustainable packaging, and broader applications in food preservation and personal care formulations. Regulatory support and consumer preferences are further reinforcing market development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 50.8 Thousand Tons |

| Market Forecast in 2033 | 108.6 Thousand Tons |

| Market Growth Rate 2025-2033 | 7.20% |

Australia Lactic Acid Market Trends:

Sustained Demand for Biopolymer Applications

The increasing emphasis on sustainability across industrial and consumer segments has positioned lactic acid as a key ingredient in the transition toward biodegradable materials. In Australia, the growing demand for polylactic acid (PLA), a derivative of lactic acid, is being driven by regulatory initiatives targeting single-use plastics and rising environmental consciousness among manufacturers and consumers alike. The food processing and packaging industries are actively integrating PLA-based solutions to align with circular economy goals and corporate sustainability benchmarks. Simultaneously, the Australian market is witnessing steady usage of lactic acid in food-grade applications, where it functions as a preservative, pH regulator, and flavor enhancer. This trend is aligned with a broader shift toward clean-label ingredients. In a related global development, Emirates Biotech’s collaboration with Sulzer to establish the world’s largest PLA production facility demonstrates the scale at which lactic acid is gaining prominence. While the plant is situated outside Australia, the implications for supply chain advancements and technology diffusion are relevant for domestic stakeholders aiming to enhance processing capabilities and reduce environmental impact.

To get more information on this market, Request Sample

Natural Ingredient Focus in Formulations

In Australia’s personal care and pharmaceutical sectors, the preference for naturally derived ingredients is significantly influencing the adoption of lactic acid. With a well-documented safety profile and efficacy in skin-renewal applications, lactic acid is increasingly incorporated into high-end skincare products, including exfoliants, moisturizers, and anti-aging formulations. The compound’s mild nature and compatibility with sensitive skin types contribute to its growing utilization in dermatologically approved and wellness-oriented product lines. Additionally, the pharmaceutical sector is exploring lactic acid in the development of biodegradable polymers for controlled drug release systems and implantable devices. These innovations are supported by a regulatory environment that favors biocompatible and environmentally safe materials. A notable international development that reflects the strategic importance of lactic acid is the upcoming PLA facility by Emirates Biotech, which will leverage Sulzer’s licensed technology. Though located in the UAE, this project exemplifies the global momentum toward bio-based chemistry, indirectly encouraging Australian enterprises to explore scalable production methods and invest in R&D for expanded lactic acid applications.

Australia Lactic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on raw material, form, and application.

Raw Material Insights:

- Corn

- Sugarcane

- Cassava

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes corn, sugarcane, cassava, and others.

Form Insights:

- Liquid

- Solid

The report has provided a detailed breakup and analysis of the market based on the form. This includes liquid and solid.

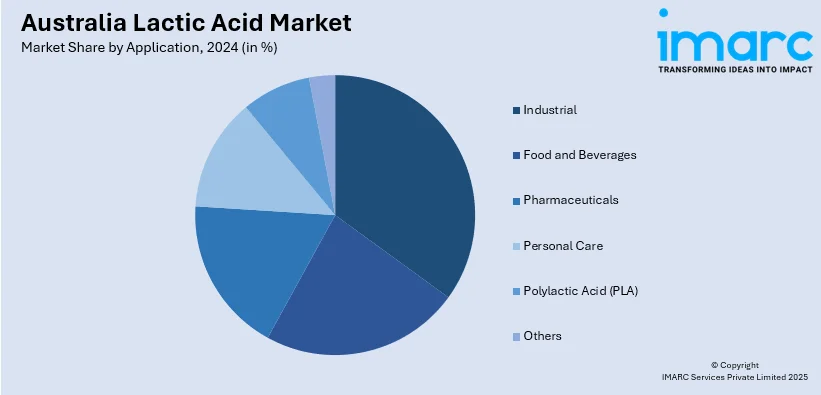

Application Insights:

- Industrial

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Polylactic Acid (PLA)

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes Industrial, food and beverages, pharmaceuticals, personal care, polylactic acid (PLA), and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Lactic Acid Market News:

- April 2025: Researchers at DTU and Novonesis highlighted how lactic acid bacteria enhanced flavour and nutrition in plant-based dairy products. This advanced fermentation approach boosted demand for food-grade lactic acid in Australia, reinforcing its role in developing sustainable, high-quality dairy alternatives across the industry.

- January 2025: Mondeal Pty Ltd launched the PDLLA-based injectable Lenisna (Juvelook) in Australia, marking a key development in lactic acid-derived aesthetic solutions. This introduction expanded PDLLA applications, boosting demand in the cosmetic sector and advancing the market for collagen-stimulating biocompatible materials.

Australia Lactic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Corn, Sugarcane, Cassava, Others |

| Forms Covered | Liquid, Solid |

| Applications Covered | Industrial, Food and Beverages, Pharmaceuticals, Personal Care, Polylactic Acid (PLA), Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia lactic acid market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia lactic acid market on the basis of raw material?

- What is the breakup of the Australia lactic acid market on the basis of form?

- What is the breakup of the Australia lactic acid market on the basis of application?

- What are the various stages in the value chain of the Australia lactic acid market?

- What are the key driving factors and challenges in the Australia lactic acid market?

- What is the structure of the Australia lactic acid market and who are the key players?

- What is the degree of competition in the Australia lactic acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia lactic acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia lactic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia Lactic Acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)