Australia Laminated Flooring Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2026-2034

Australia Laminated Flooring Market Summary:

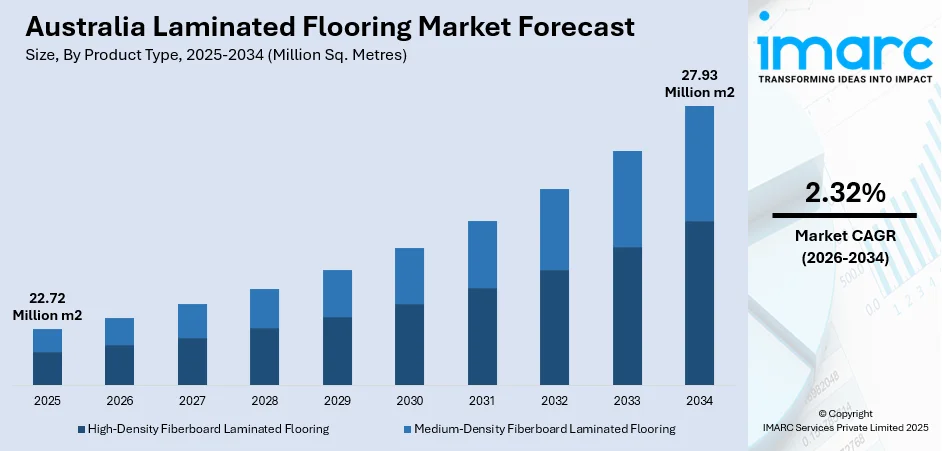

The Australia laminated flooring market size reached 22.72 Million Sq. Metres in 2025 and is projected to reach 27.93 Million Sq. Metres by 2034, growing at a compound annual growth rate of 2.32% from 2026-2034.

The market is witnessing steady growth as consumers and developers prioritize cost effective, durable, and visually appealing flooring solutions. Rising residential renovations, expanding commercial construction, and increasing preference for easy to maintain materials are supporting demand. Improved moisture resistant technologies and wider design options are attracting both budget conscious buyers and premium customers, strengthening the market’s overall adoption across urban and regional areas.

Key Takeaways and Insights:

- By Product Type: High-density fiberboard laminated flooring dominates the market with a share of 60% in 2025, driven by its durability, stability, and suitability for high traffic areas.

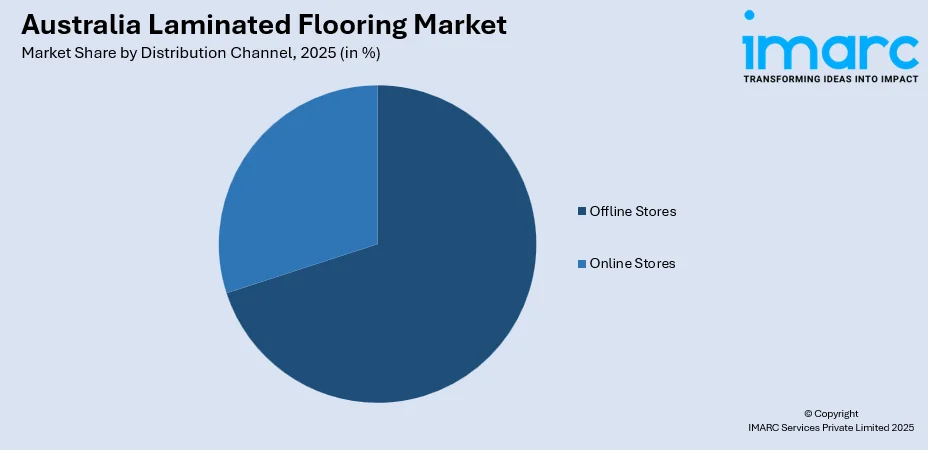

- By Distribution Channel: Offline stores leads the market with a share of 70% in 2025, supported by consumer preference for in person product evaluation and installation guidance.

- By End User: Residential represents the largest segment with a market share of 65% in 2025, due to rising home renovations and growing adoption of affordable flooring solutions.

- Key Players: The competitive landscape is moderately consolidated, with companies focusing on design variety, durability enhancements, and stronger retail distribution. Firms offering moisture resistant technologies and competitive pricing continue to gain traction in both residential and commercial segments.

To get more information on this market, Request Sample

The Australia laminated flooring market is experiencing steady expansion as consumers increasingly seek durable, cost effective, and visually appealing flooring alternatives for homes and commercial spaces. Rising renovation activities, especially within residential properties, are strengthening demand, supported by growing interest in modern interior aesthetics and easy to maintain surfaces. The market also benefits from improved product innovations, including moisture resistant cores and enhanced locking systems that extend usability in kitchens, living areas, and light commercial settings. Strong retail networks, including specialty flooring stores and home improvement centers, continue to drive visibility and product accessibility. As urban development accelerates and consumer spending on home upgrades increases, laminated flooring is expected to maintain its position as a preferred choice in Australia’s expanding construction and remodeling landscape. In October 2025, the Albanese Government announced its plans to invest over USD 7 Million in urban precincts in Melbourne, including USD 4.4 Million for the Greenline Project along the Yarra River and USD 2.6 Million for the Pioneering Urban Innovation project in Hume. These initiatives aim to enhance public spaces and foster sustainable community development.

Australia Laminated Flooring Market Trends:

Rising Preference for Modern Aesthetic Designs

Australian consumers are gravitating toward laminated flooring that replicates natural wood with greater realism, including textured grains, matte finishes, and contemporary colour tones. This trend reflects a desire for stylish yet cost effective interiors. As homeowners prioritize visual appeal during renovations, premium laminate designs are gaining traction for their ability to elevate home aesthetics without the high expense or maintenance requirements of traditional hardwood flooring. Rising urbanisation, marked by the growth of compact apartments and modern housing developments, is further boosting demand for versatile, durable flooring solutions that deliver both practicality and contemporary style. As of November 2025, Australia's population is 27,080,855, with an estimated mid-year figure of 26,974,026, with 86.51% residing in urban areas, totaling approximately 23.3 million individuals.

Growing Adoption of Water Resistant and Durable Laminates

Demand for high performance laminates is rising as households seek flooring that withstands daily wear, moisture exposure, and heavy foot traffic. Water resistant and scratch resistant variants are becoming popular in kitchens, living rooms, and commercial spaces. These durable options offer long lasting value, easier upkeep, and improved resilience, making them a practical choice for modern lifestyles and boosting overall adoption across diverse applications.

Expansion of DIY Installation and Click Lock Systems

DIY friendly laminate flooring is becoming a major trend as more homeowners prefer budget conscious, self managed renovation projects. Click lock systems simplify installation, eliminate the need for adhesives, and reduce labour costs. This convenience appeals to first time renovators and frequent home improvers, enabling faster upgrades with minimal tools. As a result, DIY oriented products are expanding their share in the residential flooring market.

Market Outlook 2026-2034:

Australia’s laminated flooring market is expected to maintain steady growth, supported by rising home renovation activity, expanding urban housing developments, and increasing consumer preference for affordable yet visually appealing flooring solutions. The market reached 22.72 Million Sq. Metres in 2025 and is projected to reach 27.93 Million Sq. Metres by 2034, growing at a compound annual growth rate of 2.32% from 2026-2034.

Australia Laminated Flooring Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

High-Density Fiberboard Laminated Flooring |

60% |

|

Distribution Channel |

Offline Stores |

70% |

|

End User |

Residential |

65% |

Product Type Insights:

- High-Density Fiberboard Laminated Flooring

- Medium-Density Fiberboard Laminated Flooring

The high-density fiberboard laminated flooring dominates with a market share of 60% of the total Australia laminated flooring market in 2025.

High-density fiberboard laminated flooring dominates due to its superior durability, moisture resistance, and suitability for Australia’s diverse climate conditions. In 2025, Australia's spring weather has been tumultuous, swinging from hot to cold, with Melbourne experiencing its coldest November in 80 years. The Bureau of Meteorology attributes this volatility to the clash of warm and cool air, with severe thunderstorms expected across eastern Australia. Weather systems are moving rapidly, increasing unpredictability. Its stability under fluctuating temperatures makes it a preferred choice for both new constructions and renovations. This segment’s ability to balance strength, affordability, and aesthetic versatility continues to strengthen its market position.

The segment also benefits from manufacturers offering advanced surface technologies such as scratch-resistant coatings and embossed-in-register finishes. These enhancements make HDF laminate an attractive alternative to hardwood in high-traffic household areas. A practical example is its widespread use in rental apartments in Melbourne, where property managers prioritize materials that maintain appearance over multiple tenant cycles. As demand for durable flooring options grows, HDF remains the dominant category.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Offline Stores

- Online Stores

The offline stores leads with a share of 70% of the total Australia laminated flooring market in 2025.

Offline stores lead the market as consumers prefer physically evaluating textures, finishes, and installation quality before purchasing. Flooring showrooms and home improvement retailers offer on-site guidance, enabling buyers to compare options and receive tailored recommendations for their space. For example, large home improvement chains in Brisbane often feature full-room mockups, helping customers visualize laminate performance in real settings. This hands-on assessment strengthens consumer confidence in purchase decisions.

The dominance of offline stores is further supported by professional installation services commonly offered at these outlets. Many homeowners opt for bundled supply-and-install packages to ensure proper fitting and long-term durability. A real-world example is the growing number of suburban renovation stores in Perth providing same-day measurement and installation scheduling. Such value-added services encourage higher footfall and customer loyalty, reinforcing offline retail as the preferred distribution channel.

End User Insights:

- Residential

- Commercial

The residential leads with a share of 65% of the total Australia laminated flooring market in 2025.

The residential segment leads the market as homeowners increasingly prioritize stylish, low-maintenance, and affordable flooring solutions. Laminated flooring appeals to families seeking durable surfaces that can withstand daily wear while offering modern aesthetic options. For instance, newly built housing estates in Queensland commonly feature laminate floors in living areas due to their practicality and wide style choices. In November 2025, Queensland’s Crisafulli Government announced its plans to launch a USD 5.6 Billion initiative to construct 53,500 social and affordable homes by 2044, addressing urbanization challenges. With over 5,600 homes already in progress, the plan aims to accelerate housing supply from the previous average of 509 homes annually to 2,000 by the term's end.

In addition, residential buyers appreciate laminate’s quick installation and compatibility with various interior themes, from coastal to contemporary designs. Developers of compact apartments in major cities like Sydney frequently select laminate to balance visual appeal with budget efficiency, especially for rental-focused projects. The segment’s strong adoption is further supported by growing urban housing density and the need for cost-effective flooring materials that enhance overall property value.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory and New South Wales show strong demand for laminated flooring supported by dense urban housing, steady construction, and high renovation activity. Modern apartments and suburban homes increasingly prefer laminate for its durability, aesthetic variety, and affordability, strengthening its regional presence.

Victoria and Tasmania experience growing adoption driven by rising home improvement spending and a shift toward modern interior designs. Laminated flooring suits the cooler climate and appeals to homeowners seeking stylish, low-maintenance options. Expanding suburban developments further accelerate market demand.

Queensland’s market is supported by rapid population growth, active housing development, and preference for moisture-resistant flooring suited to warm, humid conditions. Family homes, rentals, and new residential communities in Brisbane and coastal cities continue to favor laminated solutions.

Northern Territory and South Australia demonstrate steady uptake as laminated flooring offers an affordable, climate-resilient alternative to traditional timber. Residential upgrades, renovation activities, and government-supported housing programs contribute to stable demand in both urban and remote locations.

Western Australia maintains consistent demand fueled by construction activity in Perth and surrounding areas. Homeowners value laminate for its long lifespan, attractive finishes, and cost efficiency, making it a popular choice for open-plan homes and renovation-driven upgrades.

Market Dynamics:

Growth Drivers:

Why is the Australia Laminated Flooring Market Growing?

Rising Preference for Sustainable Flooring Choices

Growing environmental consciousness among Australian consumers is encouraging the adoption of laminated flooring made from responsibly sourced wood fibers and low-emission materials. Buyers increasingly favour products with recyclable components, reduced VOC emissions, and eco-certifications that align with green building standards. This shift supports manufacturers who prioritise sustainable sourcing and energy-efficient production processes. As sustainability becomes a mainstream purchasing criterion, laminate flooring stands out as an attractive option that delivers both environmental benefits and long-term performance advantages. In October 2025, Australia's government introduced a new environmental protection bill aimed at enhancing nature conservation while simplifying project approvals. Expected to generate A$6.9 Billion annually, the legislation seeks to cut approval times, address housing shortages, and facilitate renewable energy developments.

Rising Home Renovation Activity

Australia’s expanding renovation culture, driven by ageing housing stock and evolving lifestyle preferences, is significantly supporting laminated flooring uptake. In November 2025, Australia launched the National Housing Modernisation Scheme to upgrade aging social housing, enhancing energy efficiency and comfort. The initiative aims to reduce residents' power costs and support environmental goals by renovating thousands of outdated homes with modern technologies like solar panels and efficient heating systems. Homeowners are looking for solutions that enhance aesthetics while offering durability, quick installation, and minimal disruption. Laminate flooring fits these expectations with modern designs, scratch resistance, and compatibility with various interior styles. The trend toward open-plan layouts and contemporary finishes further boosts demand. As renovation spending grows across urban and suburban regions, laminate flooring remains a preferred choice for cost-efficient yet stylish upgrades.

Shift Toward Cost-Effective Interior Materials

Price-sensitive consumers are increasingly selecting laminated flooring as an economical alternative to solid timber or engineered hardwood. With advances in surface printing and texturing, laminate now closely replicates natural wood while remaining far more affordable. Its low maintenance requirements and long service life enhance value for budget-conscious homeowners and developers. Builders also prefer laminate for large-scale residential projects where material efficiency is essential. This combination of cost savings, aesthetic versatility, and practicality continues to reinforce the market’s shift toward laminate-based interior solutions.

Market Restraints:

What Challenges the Australia Laminated Flooring Market is Facing?

Competition from Alternative Flooring Materials

Laminate flooring is increasingly challenged by luxury vinyl tiles, engineered wood, and hybrid flooring, which offer superior moisture resistance, enhanced durability, and broader design flexibility. These substitutes appeal to consumers seeking long-lasting performance with minimal upkeep. As a result, laminate products struggle to maintain market momentum, especially in regions prioritizing resilience and premium interior finishes.

Maintenance Perception and Quality Variations

Variability in laminate quality across manufacturers has created concerns about wear resistance, color fading, and product lifespan. The influx of low-grade imports further weakens consumer confidence, prompting buyers to consider more reliable alternatives. This inconsistent performance perception discourages repeat purchases and positions laminate as a less dependable option compared with premium or technologically advanced flooring materials.

Installation and Subfloor Preparation Challenges

Laminated flooring requires a well-prepared, level subfloor to ensure stability and prevent issues such as noise, uneven surfaces, or plank shifting. When installation is poorly executed, especially in DIY settings, overall performance declines and customer dissatisfaction increases. These installation-related challenges can negatively influence market perception and reduce long-term adoption across residential and commercial applications.

Competitive Landscape:

Australia’s laminated flooring market features a competitive landscape shaped by a mix of global brands and domestic suppliers focusing on quality, design diversity, and cost efficiency. Companies are increasingly prioritizing sustainable sourcing, advanced printing technologies, and abrasion-resistant surfaces to differentiate their offerings. Competitive momentum is also driven by strong distributor networks, partnerships with builders, and expanding retail presence across hardware chains. As consumer demand shifts toward premium textures and realistic wood replicas, manufacturers are investing in innovation to enhance durability and appeal. Price competition remains significant, encouraging players to balance performance, affordability, and value-added features to secure market share.

Australia Laminated Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Sq. Metres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High-Density Fiberboard Laminated Flooring, Medium-Density Fiberboard Laminated Flooring |

| Distribution Channels Covered | Offline Stores, Online Stores |

| End Users Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia laminated flooring market size reached 22.72 Million Sq. Metres in 2025.

The Australia laminated flooring market is expected to grow at a compound annual growth rate of 2.32% from 2026-2034 to reach 27.93 Million Sq. Metres by 2034.

High-density fiberboard laminated flooring held the largest share, driven by its superior durability, stability, and suitability for Australia’s varied climate conditions. Its balance of strength, affordability, and design versatility strengthens its dominance in both residential and commercial applications.

Key factors driving the Australia laminated flooring market include rising home renovation activity, growing preference for cost efficient interior solutions, and increasing demand for sustainable, visually appealing flooring materials. Improved installation technologies and broader retail availability also support wider adoption across urban and regional markets.

Major challenges include strong competition from luxury vinyl tiles and hybrid flooring, inconsistent product quality from low grade imports, and installation issues related to subfloor preparation. These factors can affect long term performance, consumer trust, and overall market momentum.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)