Australia Laminates Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Australia Laminates Market Overview:

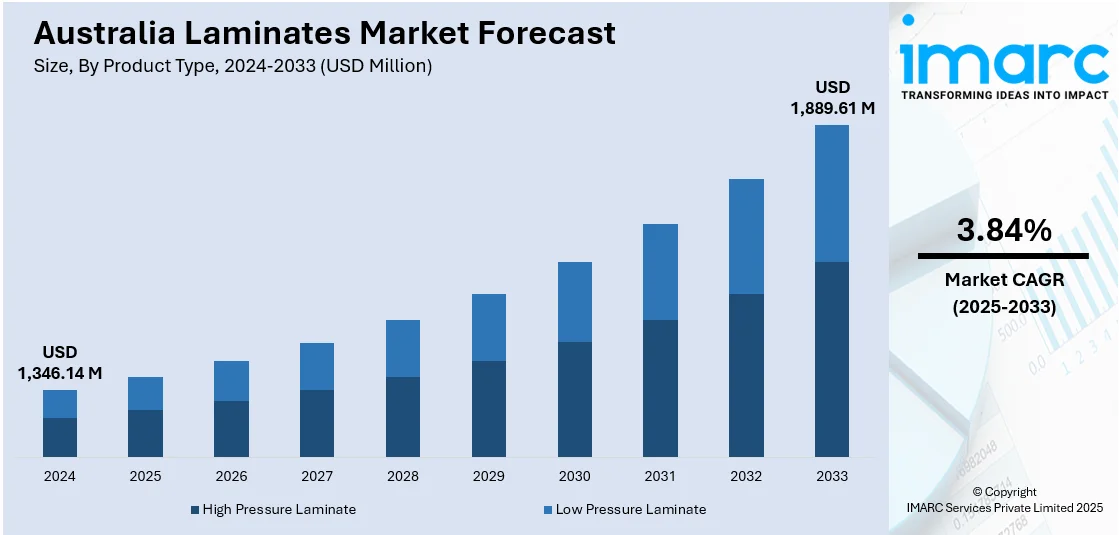

The Australia laminates market size reached USD 1,346.14 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,889.61 Million by 2033, exhibiting a growth rate (CAGR) of 3.84% during 2025-2033. The sector is fueled by increasing demand for sustainable and green materials, which mirrors consumers' increasingly elevated environmental awareness. The use of advanced technologies like high-pressure laminates and digital printing provides superior durability and design options and appeals to residential and commercial consumers. Furthermore, rising home remodeling and interior design activities enhance Australia laminates market share, as laminates provide cost-effective, fashionable, and low-maintenance alternatives for furniture, cabinetry, and wall coverings, appealing to many applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,346.14 Million |

| Market Forecast in 2033 | USD 1,889.61 Million |

| Market Growth Rate 2025-2033 | 3.84% |

Australia Laminates Market Trends:

Sustainability and Eco-Friendly Materials

In Australia, a heightened sensitivity about the environment is impacting the laminates market to a great extent, with the demand for sustainable and environmentally friendly products increasing. Consumers and companies alike are increasingly moving towards laminates produced from recycled materials or sustainably harvested resources, which is prompting producers to change their manufacturing processes. This change corresponds with the country's initiatives to promote green building and less harmful environmental outcomes. Sustainability-certified laminates are becoming increasingly popular as they ensure customers of sustainable sourcing and production. The market is changing by creating products that balance both environmental and visual standards, combining style with sustainability. These changes are not transient—it represents a shift in regulatory requirements that align with long-term consumer values. With sustainability now a key driver of purchasing, it is transforming product development, marketing, and material sourcing strategies in the Australian laminates industry, fueling long-term Australia laminates market growth and differentiation.

To get more information on this market, Request Sample

Rise in Home Renovation and Interior Design

The booming home renovation and interior design activities are a primary growth driver for the market. Australians spent more than $3 billion on home alteration and additions in the September quarter of 2023, which is up 4.2% from the previous quarter and 3% higher year-on-year. This increasing home upgrade investment indicates a strong consumer demand for improving living spaces. Laminates are gaining popularity for their cost-effectiveness, flexibility, and capacity to mimic high-end materials such as wood, marble, and metal without the expense or maintenance. They are popularly applied in kitchen cabinetries, furniture, and wall panels for decoration because of their strength and appeal. With an increasing number of homeowners looking for fashionable yet functional design solutions, laminates provide the perfect option. This trend is driving consistent demand in urban and suburban areas, solidifying laminates as a staple in contemporary home remodels.

Advancements in Laminate Technology

Technological advancement is a key driver of the transformation of the laminates market in Australia. With innovations like high-pressure laminates (HPL), the industry has created products that are long-lasting, durable, and also impact-resistant, with applications in high-usage places like homes and offices. Meanwhile, digital embossing and printing technologies have transformed design possibilities, enabling producers to create laminates replicating natural textures such as wood, stone, and metal with remarkable realism. This has broadened the visual value of laminates, providing consumers with more options for customization to meet contemporary design styles. The synergy of aesthetics and functionality has increased laminates' versatility and appeal for use in furniture, cabinetry, and interior decor. With consumer demands for quality and design increasing steadily, technology continues to play a key role in ensuring market competitiveness and fulfilling varied functional and aesthetic needs in Australia's built environments, aligning with the evolving Australia laminates market trends.

Australia Laminates Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- High Pressure Laminate

- Low Pressure Laminate

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high pressure laminate and low-pressure laminate.

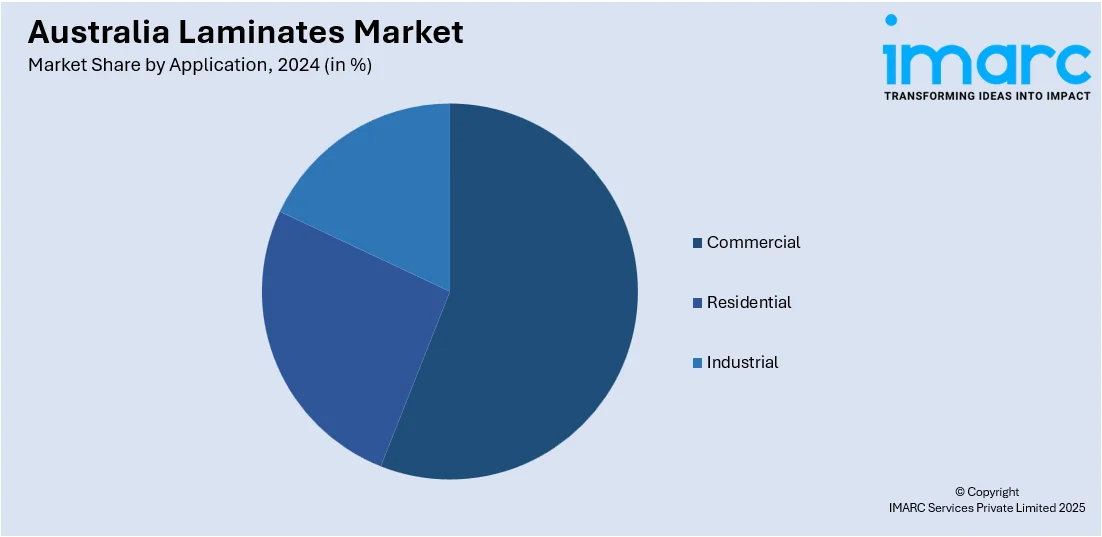

Application Insights:

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, residential, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also detailed profiles of all major companies have been provided.

Australia Laminates Market News:

- In June 2024, Big River Group has acquired Brisbane-based Specialised Laminators (SLQ) to strengthen its Panels division. SLQ, known for high-quality decorative and functional panel products, will expand Big River’s national product offerings. The acquisition enhances supply chain efficiency and innovation in panel solutions. SLQ’s leadership will continue under Big River, combining expertise to support growth and meet diverse construction needs in Australia’s building products market.

- In May 2024, Laminex appointed Sacha Leagh-Murray as its new General Manager, strengthening its position in the Australian laminates market. With six years at the company, she transformed Laminex into a design-focused brand, leading key launches like the 2019 Colour Collection and 2021 Surround wall panels. Her leadership aims to expand product categories and attract a new generation of customers, marking a fresh chapter for the 90-year-old Australian laminates brand.

Australia Laminates Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High Pressure Laminate, Low-Pressure Laminate |

| Applications Covered | Commercial, Residencial, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia laminates market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia laminates market on the basis of product type?

- What is the breakup of the Australia laminates market on the basis of application?

- What is the breakup of the Australia laminates market on the basis of region?

- What are the various stages in the value chain of the Australia laminates market?

- What are the key driving factors and challenges in the Australia laminates market?

- What is the structure of the Australia laminates market and who are the key players?

- What is the degree of competition in the Australia laminates market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia laminates market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia laminates market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia laminates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)