Australia Laundry Detergent Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Application, and Region, 2025-2033

Australia Laundry Detergent Market Overview:

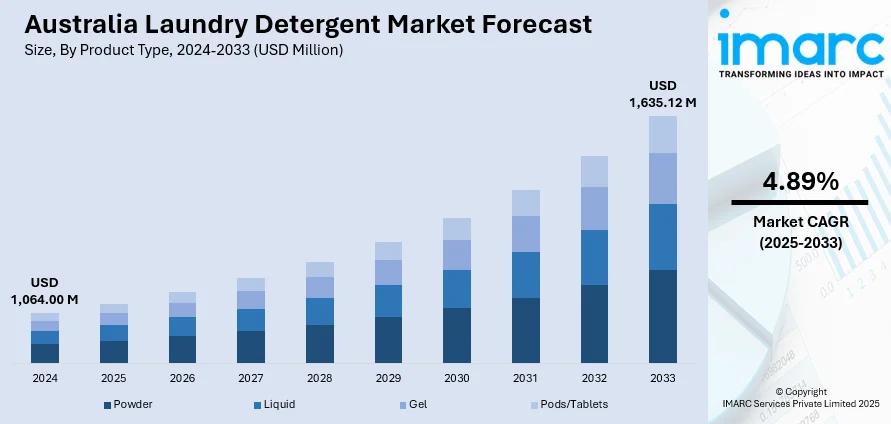

The Australia laundry detergent market size reached USD 1,064.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,635.12 Million by 2033, exhibiting a growth rate (CAGR) of 4.89% during 2025-2033. The market is driven by elevating demand for eco-friendly products, rapid urbanization leading to compact living and convenience-based purchasing, growing awareness of hygiene and skin sensitivity, and the expansion of e-commerce platforms that enable wider access to innovative detergent formats tailored to modern consumer lifestyles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,064.00 Million |

| Market Forecast in 2033 | USD 1,635.12 Million |

| Market Growth Rate 2025-2033 | 4.89% |

Australia Laundry Detergent Market Trends:

Rising Consumer Demand for Eco-Friendly and Sustainable Products

One of the key drivers of the Australia laundry detergent market is the rising consumer preference for sustainable and green products. Consumers in Australia are becoming extensively aware of environmental issues, especially those related to climate change, plastic pollution, and water pollution. Consequently, there is a strong trend in consumer behavior towards purchasing products that cause less environmental damage. This trend is especially pronounced in the laundry detergent category, where consumers are actively looking for biodegradable, phosphate-free, and plant-based detergents. A few Australian brands have taken advantage of this trend by using recycled or compostable packaging, refill points, and waterless forms like detergent sheets or concentrates. The availability of natural components, such as eucalyptus oil and tea tree extract, not only resonates with environmentally conscious consumers but also responds to sensitive skin individuals. In addition to this, active regulatory support, including the promotion of sustainable labeling and waste reduction goals, is acting as another significant growth-inducing factor.

To get more information of this market, Request Sample

Growth of Urban Living

The structural transition towards urban residence and the emergence of smaller households are also bolstering the market growth. Australia has witnessed significant urbanization over the past two decades, with an upsurge in the number of people living in urban hubs, such as Sydney, Melbourne, and Brisbane. Urban lifestyles are dominated by reduced dwelling sizes, multi-person accommodations, and time-sensitive lifestyles, which have a significant impact on household product usage patterns—such as laundry detergent. This geographic and demographic change has generated greater demand for small, convenient-to-store detergent products such as pods, liquid sachets, and concentrated formats. Single-use formats appeal especially to young professionals and students who value convenience, efficiency, and low mess. Many apartment buildings also have limited laundry facilities or communal washing machines, generating interest in rapid-dissolving, low-foam detergents that perform well in cold washes and high-efficiency machines. Additionally, the growth of single-person households has redefined consumption volumes. Manufacturers are meeting this by way of smaller package sizes, subscription programs, and formulations that are suited for episodic but intense utilization.

Australia Laundry Detergent Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and application.

Product Type Insights:

- Powder

- Liquid

- Gel

- Pods/Tablets

The report has provided a detailed breakup and analysis of the market based on the product type. This includes powder, liquid, gel, and pods/tablets.

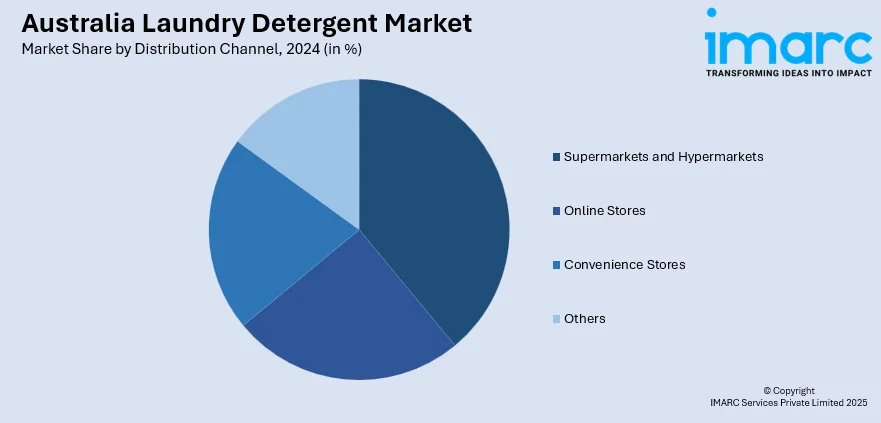

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Online Stores

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, online stores, convenience stores, and others.

Application Insights:

- Industrial

- Household

The report has provided a detailed breakup and analysis of the market based on the application. This includes industrial and household.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Laundry Detergent Market News:

- September 2024: Australian brand MNML launched a laundry capsule infused with proprietary fragrance technology aimed at enhancing sleep quality. This product combines cleaning efficiency with wellness benefits, catering to consumers seeking multifunctional household items.

- May 2023: Unilever Australia invested AUD 9.5 million to upgrade its North Rocks facility in Western Sydney. This included the installation of advanced processing and packaging machinery, enhancing production capabilities for brands like Omo and Surf.

Australia Laundry Detergent Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Powder, Liquid, Gel, Pods/Tablets |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Online Stores, Convenience Stores, Others |

| Applications Covered | Industrial, Household |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia laundry detergent market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia laundry detergent market on the basis of product type?

- What is the breakup of the Australia laundry detergent market on the basis of distribution channel?

- What is the breakup of the Australia laundry detergent market on the basis of application?

- What are the various stages in the value chain of the Australia laundry detergent market?

- What are the key driving factors and challenges in the Australia laundry detergent?

- What is the structure of the Australia laundry detergent market and who are the key players?

- What is the degree of competition in the Australia laundry detergent market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia laundry detergent market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia laundry detergent market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia laundry detergent industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)