Australia LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2025-2033

Australia LED Lights Market Overview:

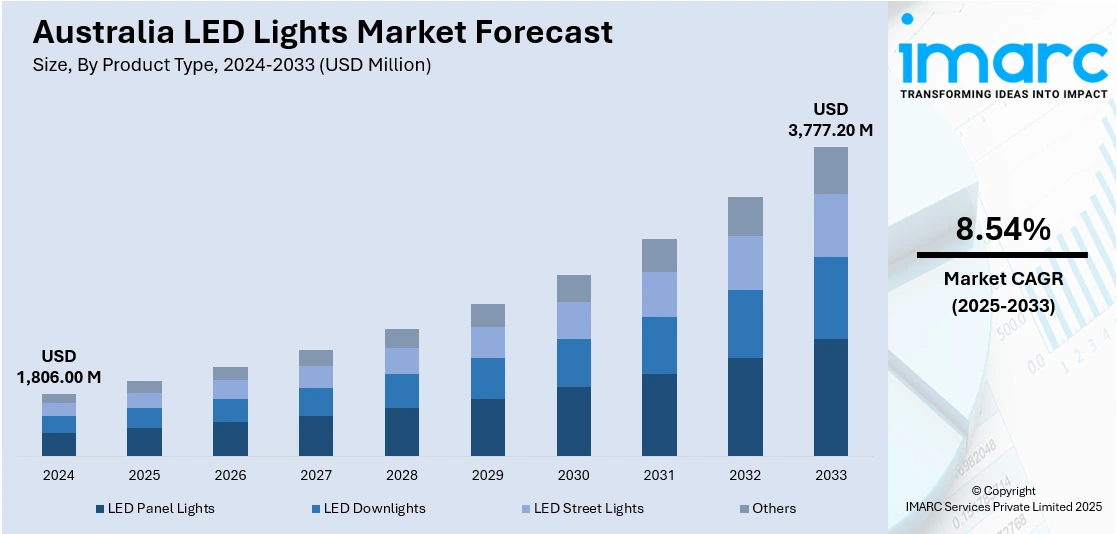

The Australia LED lights market size reached USD 1,806.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,777.20 Million by 2033, exhibiting a growth rate (CAGR) of 8.54% during 2025-2033. Government regulations promoting energy efficiency, the shift toward sustainable lighting solutions, and increasing adoption of smart LED technologies in residential, commercial, and industrial sectors are among the key factors driving the expansion of the LED lights market in Australia, alongside technological advancements and incentives supporting energy-efficient upgrades across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,806.00 Million |

| Market Forecast in 2033 | USD 3,777.20 Million |

| Market Growth Rate 2025-2033 | 8.54% |

Australia LED Lights Market Trends:

Government Regulations and Energy Efficiency Policies

One of the strongest drivers of the expansion of the Australian LED lights market is the strict regulatory environment encouraging energy efficiency. In recent years, Australian state and federal governments have implemented a series of mandates to cut greenhouse gas emissions, reduce electricity usage, and eliminate inefficient lighting technologies. Some of these initiatives are the Minimum Energy Performance Standards (MEPS) and the initiative to phase out halogen and incandescent bulbs, opening the way for mass adoption of LEDs. LEDs are regarded as a pillar of Australia's wider sustainability agenda. Public infrastructure projects and government agencies have widely embraced LED technology as part of their energy management efforts. Moreover, incentive schemes such as rebates and grants for energy-efficient upgrades in residential and commercial sectors have rendered LED lighting more affordable. Utility companies have also collaborated with state governments to introduce schemes that subsidize the installation of LEDs, particularly in lower-income or high-usage households.

To get more information on this market, Request Sample

Advancements in Smart Lighting and IoT Integration

Another key driver of the LED lights market in Australia is the fast pace of innovation and uptake of smart lighting technologies based on the Internet of Things (IoT). This trend is driven by consumer demand for convenience, automation, and greater control over lighting systems in residential and commercial settings. Smart LED lighting solutions provide a suite of features including dimming, color shifting, motion detection, and scheduling and are all remote-controlled through smartphone apps or voice control through speakers like Google Assistant or Amazon Alexa. These technologies appeal to modern consumers and business owners who prioritize energy efficiency over aesthetics and functionality. Integration with wider smart home systems and building management systems also increases appeal, with centralized control of lighting, HVAC, and security systems. In commercial environments, particularly in office buildings and retail environments, smart LEDs facilitate data capture on occupancy patterns, allowing space utilization analytics and predictive maintenance. The spread of 5G and greater internet penetration throughout Australia also underpins the development of connected lighting solutions.

Australia LED Lights Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, application, import and domestic manufacturing, and region.

Product Type Insights:

- LED Panel Lights

- LED Downlights

- LED Street Lights

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes LED panel lights, LED downlights, LED street lights, and others.

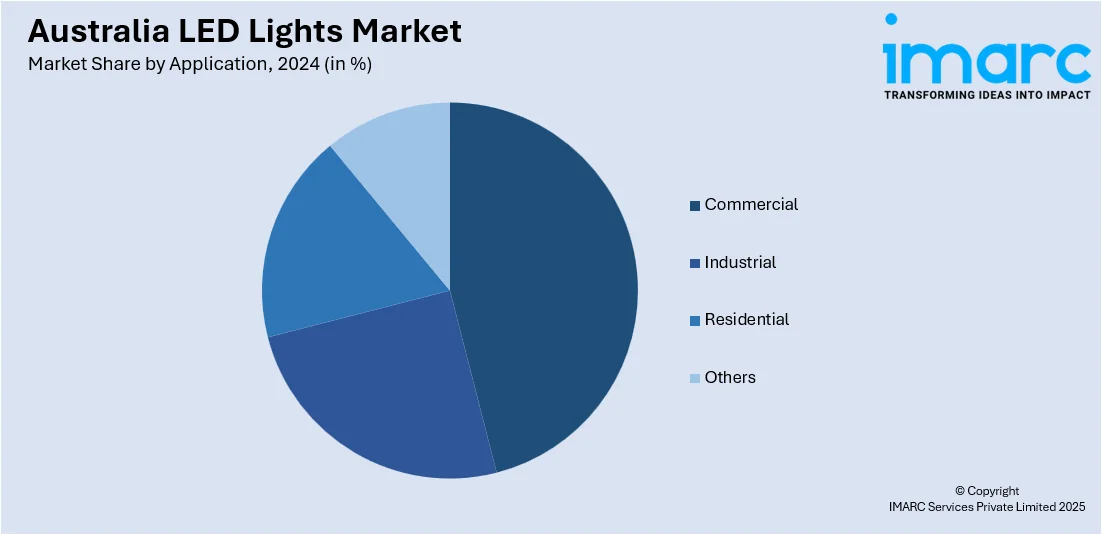

Application Insights:

- Commercial

- Industrial

- Residential

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, industrial, residential, and others.

Import and Domestic Manufacturing Insights:

- Import

- Domestic Manufacturing

The report has provided a detailed breakup and analysis of the market based on the import and domestic manufacturing. This includes import and domestic manufacturing.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia LED Lights Market News:

- November 2024: The Sydney Opera House upgraded its Concert Hall lighting by replacing old incandescent bulbs with advanced LED technology, enhancing performance versatility and energy efficiency. This initiative reduces maintenance costs and electricity usage, aligning with sustainability goals and setting a precedent for other venues.

- July 2024: The Porsche Carrera Cup Australia illuminated its vehicles with color-changing LED lights during the Sydney SuperNight event at Sydney Motorsport Park. This initiative showcased the integration of LED technology in motorsport, enhancing visibility and aesthetics. The event highlighted the growing application of LED lighting in various sectors, including automotive and event management.

Australia LED Lights Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | LED Panel Lights, LED Downlights, LED Street Lights, Others |

| Applications Covered | Commercial, Industrial, Residential, Others |

| Import and Domestic Manufacturing Covered | Import, Domestic Manufacturing |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia LED lights market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia LED lights market on the basis of product type?

- What is the breakup of the Australia LED lights market on the basis of application?

- What is the breakup of the Australia LED lights market on the basis of import and domestic manufacturing?

- What is the breakup of the Australia LED lights market on the basis of region?

- What are the various stages in the value chain of the Australia LED lights market?

- What are the key driving factors and challenges in the Australia LED lights market?

- What is the structure of the Australia LED lights market and who are the key players?

- What is the degree of competition in the Australia LED lights market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia LED lights market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia LED lights market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia LED lights industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)