Australia Leisure Travel Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Expenditure Type, Sales Channel, and Region, 2025-2033

Australia Leisure Travel Market Overview:

The Australia leisure travel market size reached USD 26.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.90 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The market is driven by rising domestic tourism, owing to government-led promotional campaigns, surging international arrivals seeking nature and luxury experiences, enhanced airline connectivity, and the rising demand for unique and immersive travel experiences across both metropolitan and regional destinations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.10 Billion |

| Market Forecast in 2033 | USD 48.90 Billion |

| Market Growth Rate 2025-2033 | 6.50% |

Australia Leisure Travel Market Trends:

Rising Domestic Tourism and Government-Led Regional Revitalization

Among the key drivers in Australia's domestic leisure travel market is higher rates of domestic tourism itself, driven largely by specific government programs focused on regional revitalization. During the past few years, especially after the COVID-19 pandemic, Australians have extensively expressed a desire to see more of what their own country has to offer. This trend has been supported by government incentives and policies, such as tourism grants, travel vouchers, regional town infrastructure development, and advertising campaigns like "Holiday Here This Year" by Tourism Australia. These have not only led to rising domestic travel but also assisted in spreading travel demand away from traditional destinations like Sydney and Melbourne. In addition to this, regional governments have made significant investments in improving regional attractions' accessibility and attractiveness—from upgrading road connectivity and building eco-tourism parks to organizing local festivals and improving hospitality services.

.webp)

To get more information on this market, Request Sample

Surge in High-Income International Visitors Seeking Luxury and Experience-Based Travel

Another strong market driver is the boom in high-income foreign visitors from the Asia-Pacific, Europe, and North America, who are attracted to luxury, nature-oriented, and experience-based tourism. These tourists are less price-conscious and are motivated mainly by unusual, high-end experiences, such as exclusive wildlife safaris, Great Barrier Reef diving expeditions, luxury train travel like The Ghan, and five-star eco-lodges in Tasmania or the Whitsundays. The image of Australia as a clean, safe, and exotic long-haul destination has become more attractive in the post-pandemic world. International travelers tend to be ready to invest heavily in immersive experiences, wellness retreats, indigenous culture tours, and eco-friendly travel options. The Australian tourism sector has also strategically targeted this segment by providing carefully designed itineraries, multilingual tour guides, and special access to distant or culturally relevant areas. Luxury hospitality companies, high-end restaurants, and custom adventure firms have all seen a significant surge in demand, led by wealthy millennials and retirees.

Australia Leisure Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on traveler type, age group, expenditure type, and sales channel.

Traveler Type Insights:

- Solo

- Group

The report has provided a detailed breakup and analysis of the market based on the traveler type. This includes solo and group.

Age Group Insights:

- Baby Boomers

- Generation X

- Millennial

- Generation Z

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes baby boomers, generation X, millennial, and generation Z.

Expenditure Type Insights:

- Lodging

- Transportation

- Food and Beverages

- Events and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the expenditure type. This includes lodging, transportation, food and beverages, events and entertainment, and others.

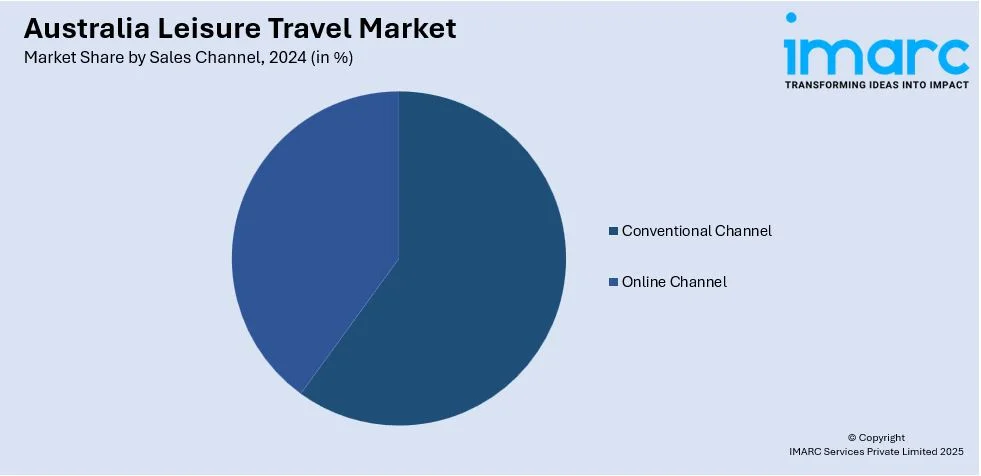

Sales Channel Insights:

- Conventional Channel

- Online Channel

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes conventional channel and online channel.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Leisure Travel Market News:

- February 2025: Delta Air Lines expanded its Australian network by launching thrice-weekly nonstop flights from Los Angeles to Brisbane, enhancing leisure travel between the US and Queensland. Additionally, Delta announced a new Los Angeles–Melbourne route starting December 2025, operated with Airbus A350-900 aircraft.

- November 2024: Air India and Tourism Australia signed a three-year marketing agreement to increase Indian tourism to Australia by collaborating on promotional activities. By facilitating easier access and raising awareness, this initiative is expected to drive progress in the Australian leisure travel market.

- May 2024: Qantas increased its Bengaluru-Sydney flights from five per week to daily between mid-December 2024 and late March 2025, adding over 12,000 seats during the peak holiday season. This expansion enhanced connectivity between India and Australia, facilitating tourism and business travel.

Australia Leisure Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Baby Boomers, Generation X, Millennial, Generation Z |

| Expenditure Types Covered | Lodging, Transportation, Food and Beverages, Events and Entertainment, Others |

| Sales Channels Covered | Conventional Channel, Online Channel |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia leisure travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia leisure travel market on the basis of traveler type?

- What is the breakup of the Australia leisure travel market on the basis of age group?

- What is the breakup of the Australia leisure travel market on the basis of expenditure type?

- What is the breakup of the Australia leisure travel market on the basis of sales channel?

- What are the various stages in the value chain of the Australia leisure travel market?

- What are the key driving factors and challenges in the Australia leisure travel market?

- What is the structure of the Australia leisure travel market and who are the key players?

- What is the degree of competition in the Australia leisure travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia leisure travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia leisure travel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia leisure travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)