Australia Lentil Market Size, Share, Trends and Forecast by End Use and Region, 2025-2033

Australia Lentil Market Overview:

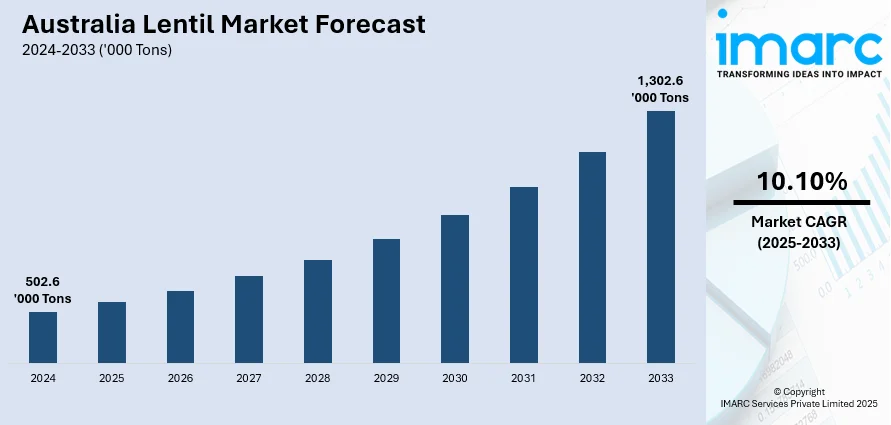

The Australia lentil market size reached 502.6 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 1,302.6 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 10.10% during 2025-2033. The market is driven by the growing shift towards vegetarian, vegan, or flexitarian eating habits among the masses, rising focus on agricultural research, especially in plant breeding, and trade agreements with major international partners of Australia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 502.6 Thousand Tons |

| Market Forecast in 2033 | 1,302.6 Thousand Tons |

| Market Growth Rate 2025-2033 | 10.10% |

Australia Lentil Market Trends:

Rising Demand for Plant-Based Protein

The growing shift towards plant-based eating habits is driving the demand for lentils substantially, making Australia a major supplier. As per the Food Frontier consumer survey, in 2024, approximately 5% individuals in the country adhered to a vegan diet, portraying a 2% increase from 2023. As more consumers turn to vegetarian, vegan, or flexitarian eating, lentils are becoming a favorite high-protein substitute because of their nutritional density, price competitiveness, and versatility. This is not limited to consumers interested in health but is also fueled by environmental issues. Lentil cultivation has a smaller carbon footprint than animal protein, and this attracts environmentally conscious consumers. Australia gains from its quality reputation for pulses and robust export infrastructure. Large markets depend on Australian lentils to fill their domestic deficiencies. With the plant-based trend gaining traction, the market in Australia is experiencing robust growth, subsequently encouraging local production and investment in lentil farming.

To get more information on this market, Request Sample

Advancements in Breeding for Climate Resilience

Australia's exceptional climate uncertainty brings challenges as well as possibilities for lentil cultivation. Current advances in agricultural science, especially plant breeding, have enhanced lentil crops in terms of resistance and flexibility enormously. Agricultural research, especially in plant breeding are focusing on improving the resilience and adaptability of lentil crops. These new crops also resist prevalent disease and pests, lessening the reliance on chemicals and decreasing costs of production. The Bureau of Meteorology declared 2024 as the driest year recorded in certain regions of South Australia. With climate change altering weather conditions and rainfall distribution, having resilient crops is now more crucial in ensuring long-term sustainability. With this scientific advance, farmers can consistently produce yields, remain profitable, and help support a more secure national supply. The flexibility of these new lentil varieties is one of the dominant aspects in contributing to the ongoing growth and diversification of the Australian lentil sector.

Strategic Trade Agreements Enhancing Export Access

Trade agreements with major international partners of Australia is contributing to the market growth. These agreements eliminate or lower trade barriers, enabling lentils to access the global market more competitively. Countries that heavily depend on lentil imports to serve the local market, are becoming open to the sale of Australian product through eased tariffs and import quotas. This enhanced market access provides stable demand for Australian lentils and gives producers confidence to increase production. In addition, such agreements usually entail technical assistance, efficient customs clearance, and regular communication among trading partners, which ensure long-term relationships. In December 2024, Australia exported 780,917 tons of chickpeas and 239,900t of lentils, as per the information provided by the Australian Bureau of Statistics. By its strategic geographic location and consistent quality, Australia is continuing to augment its position as a leading exporter of pulses and employs these frameworks of trade in establishing its strength in high-demand markets.

Australia Lentil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on end use.

End Use Insights:

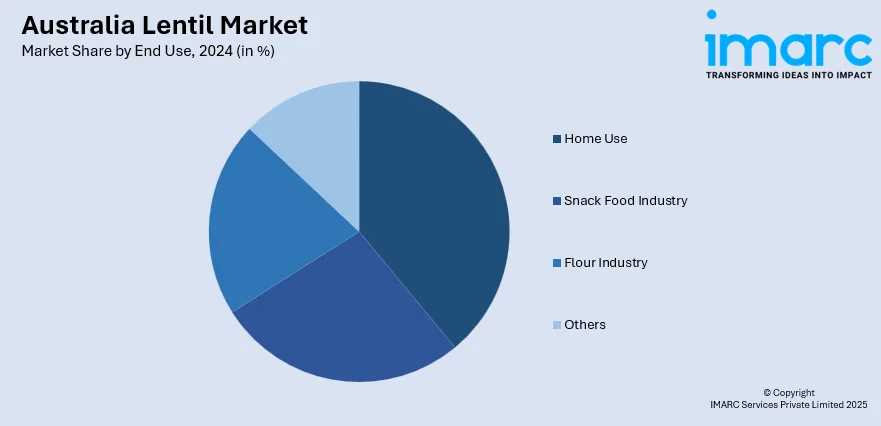

- Home Use

- Snack Food Industry

- Flour Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes home use, snack food industry, flour industry, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Lentil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Home Use, Snack Food Industry, Flour Industry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia lentil market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia lentil market on the basis of end use?

- What is the breakup of the Australia lentil market on the basis of region?

- What are the various stages in the value chain of the Australia lentil market?

- What are the key driving factors and challenges in the Australia lentil market?

- What is the structure of the Australia lentil market and who are the key players?

- What is the degree of competition in the Australia lentil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia lentil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia lentil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia lentil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)