Australia Lighting Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Australia Lighting Market Overview:

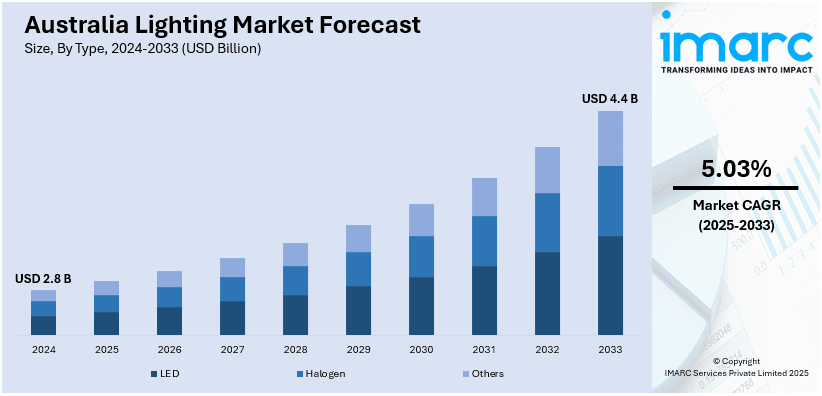

The Australia lighting market size reached USD 2.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.03% during 2025-2033. The market is driven by the heightened efforts towards reducing greenhouse gas emissions and improving energy efficiency, ongoing construction developments in Australia, especially in urban and suburban areas, and rising number of people spending money on Internet of Things (IoT)-based lighting solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.4 Billion |

| Market Growth Rate 2025-2033 | 5.03% |

Australia Lighting Market Trends:

Government Energy Efficiency Policies and Building Standards

Australia's attempts towards decreasing greenhouse gas emissions and enhancing energy efficiency are positively influencing the market. The federal and state governments are imposing stringent energy efficiency standards for buildings, including compulsory compliance with the National Construction Code (NCC). The NCC mandates lighting power density limits and promotes the adoption of high-efficiency lighting systems, especially in commercial and residential buildings. Moreover, initiatives like the Energy Efficiency Opportunities (EEO) Program and Minimum Energy Performance Standards (MEPS) are driving the shift away from conventional lighting technologies such as incandescent and halogen bulbs towards light emitting diode (LED) lighting. Incentives and rebates for energy-efficient upgrades are also driving this transition. The IMARC Group predicts that the Australia LED lighting market size is expected to reach USD 3,777.2 Million by 2033.

To get more information on this market, Request Sample

Growing Construction and Infrastructure Development

The ongoing construction developments in Australia, especially in urban and suburban areas, is impelling the growth of the market. The growth in both residential and non-residential construction activity, including high-end infrastructure projects like transport terminals, commercial centers, and public buildings, is driving the demand for advanced lighting solutions. Smart lighting technologies, architectural illumination, and energy-efficient LED luminaires are being used more and more in new projects to achieve both functional and aesthetic objectives. This growth is especially robust in urban areas where urban migration and population growth are encouraging new commercial and residential developments. In addition, government investment in infrastructure through initiatives such as the "Infrastructure Investment Program" and public-private partnerships add to the increased demand for intelligent and sustainable lighting systems. According to the 2024 Infrastructure Market Capacity Report by Infrastructure Australia, the country’s $213 billion five-year Major Public Infrastructure Pipeline, showed almost a quarter of the country’s total $1.08 trillion of construction activity was growing across energy and social infrastructure projects.

Technological Advancements in Smart and Connected Lighting

The adoption of smart light technologies is offering a favorable market outlook. Customers and companies are increasingly spending money on Internet of Things (IoT)-based lighting solutions providing remote operation, automation, and integration with smart building management or smart home systems. The solutions come with advantages like energy efficiency, increased user comfort, and increased security, which find applications everywhere, from homes, offices, and industries. New technologies like light fidelity (Li-Fi), adaptive light, occupancy sensor, and daylight harvesting are making their way ahead. Businesses also design lighting controls that integrate well with voice systems catering to technology-hungry customers. Furthermore, how artificial intelligence (AI) and machine learning (ML) can work together to realize predictive maintenance and intuitive lighting behavior is propelling new innovation. These innovations are encouraging key market players to present lighting solutions that offer convenience, efficiency, and eco-friendliness. In 2024, HSS launched its exclusive range of professional luminaires and control solutions at the new Adelaide Marriott Hotel.

Australia Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- LED

- Halogen

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes LED, halogen, and others.

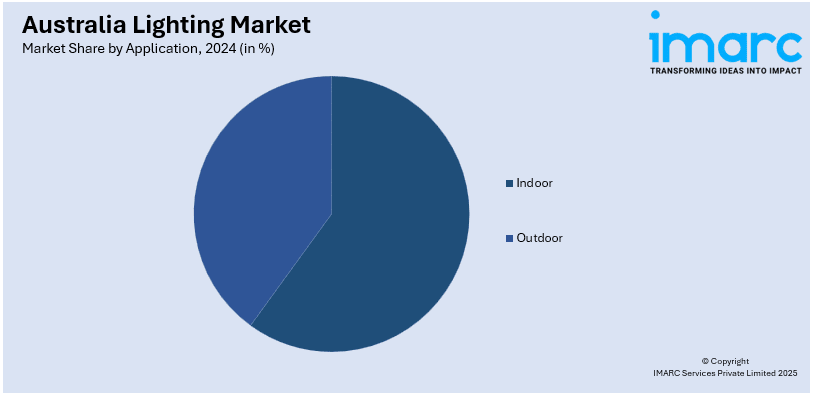

Application Insights:

- Indoor

- Outdoor

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes indoor and outdoor.

End User Insights:

- Residential

- Commercial

- Industrial

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, industrial, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | LED, Halogen, Others |

| Applications Covered | Indoor, Outdoor |

| End Users Covered | Residential, Commercial, Industrial, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia lighting market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia lighting market on the basis of type?

- What is the breakup of the Australia lighting market on the basis of application?

- What is the breakup of the Australia lighting market on the basis of end user?

- What is the breakup of the Australia lighting market on the basis of region?

- What are the various stages in the value chain of the Australia lighting market?

- What are the key driving factors and challenges in the Australia lighting market?

- What is the structure of the Australia lighting market and who are the key players?

- What is the degree of competition in the Australia lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia lighting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)