Australia Lightweight Building Materials Market Size, Share, Trends and Forecast by Type of Material, Density, Application, End User, and Region, 2025-2033

Australia Lightweight Building Materials Market Overview:

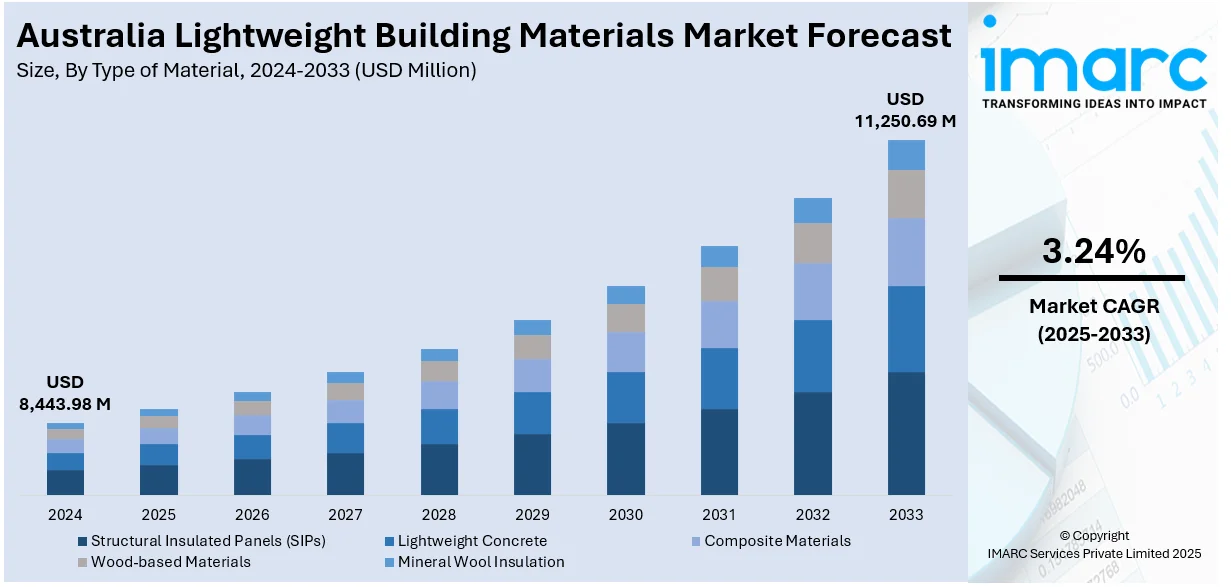

The Australia lightweight building materials market size reached USD 8,443.98 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 11,250.69 Million by 2033, exhibiting a growth rate (CAGR) of 3.24% during 2025-2033. The market is driven by tightening environmental regulations and rising demand for sustainable construction, prompting builders to adopt eco-friendly materials. Accelerated by government policies, such as NCC updates and green certifications, manufacturers are innovating with low-emission composites to meet energy efficiency targets. Additionally, the housing shortage and cost advantages of prefabrication are increasing demand for lightweight modular solutions, further augmenting the Australia lightweight building materials market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8,443.98 Million |

| Market Forecast in 2033 | USD 11,250.69 Million |

| Market Growth Rate 2025-2033 | 3.24% |

Australia Lightweight Building Materials Market Trends:

Increasing Demand for Sustainable and Eco-Friendly Lightweight Materials

The market is experiencing an increase in demand for sustainable and eco-friendly solutions, driven by stricter environmental regulations and growing consumer awareness. Builders and developers are increasingly opting for materials such as recycled steel, cross-laminated timber (CLT), and fiber-reinforced polymers, which offer reduced carbon footprints compared to traditional concrete and steel. Government initiatives, such as the National Construction Code (NCC) updates promoting energy efficiency, are further accelerating this shift. Additionally, green building certifications, including Green Star and NABERS, are encouraging the adoption of lightweight, recyclable materials that enhance thermal performance and reduce construction waste. During the 2023/24 year, Australia's Green Building Council certified over 1,000 projects, taking the total area of Green Star-certified space to 64 million square meters, with 46% of central business district offices now sustainability certified. The adoption of government-led Net Zero policies and an increase in industry submissions have accelerated the adoption of sustainable building practices. With 3.4 million daily shoppers passing through Green Star-rated shopping malls and almost a million residents of certified communities, sustainable design is revolutionizing Australia's building materials industry. Manufacturers are responding by innovating with bio-based composites and low-emission production processes. As sustainability becomes a key priority in construction, the market for eco-conscious lightweight materials is expected to grow significantly, particularly in residential and commercial projects aiming for net-zero energy goals.

To get more information on this market, Request Sample

Rising Adoption of Prefabricated and Modular Construction Techniques

The increasing use of prefabricated and modular construction methods, which rely heavily on lightweight, high-strength materials, is supporting the Australia lightweight building materials market growth. Prefabrication reduces construction time, labor costs, and on-site waste, making it an attractive option for urban housing and infrastructure projects. Lightweight materials such as structural insulated panels (SIPs), aluminum composites, and engineered timber are gaining popularity due to their ease of transport and assembly in off-site manufacturing. The housing shortage in major cities such as Sydney and Melbourne is further driving demand for rapid, cost-effective construction solutions. Australia faces a substantial shortage of housing; the current rate of building, around 43,000 per quarter, is far below the 57,000 needed to meet Labor's target of 1.2 million homes over five years and related forecasts for demand. This deficit in building, due to labor and material shortages as well as cumbersome approval procedures, has a direct impact on the light building materials sector, as decreased projects translate into decreased demand for efficient and innovative building products. They are necessary to address these systemic issues, including a 30-year stagnation in construction productivity, in order to increase housing supply. Additionally, advancements in material technology, including fire-resistant and weatherproof lightweight composites, are enhancing the durability and safety of prefabricated structures. As the construction industry embraces efficiency and scalability, the integration of lightweight materials in modular building systems is expected to expand, supported by government incentives for innovative construction practices.

Australia Lightweight Building Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of material, density, application, and end user.

Type of Material Insights:

- Structural Insulated Panels (SIPs)

- Lightweight Concrete

- Composite Materials

- Wood-based Materials

- Mineral Wool Insulation

The report has provided a detailed breakup and analysis of the market based on the type of material. This includes structural insulated panels (SIPs), lightweight concrete, composite materials, wood-based materials, and mineral wool insulation.

Density Insights:

- Low Density

- Medium Density

- High Density

- Ultra Lightweight

A detailed breakup and analysis of the market based on the density have also been provided in the report. This includes low density, medium density, high density, and ultra lightweight.

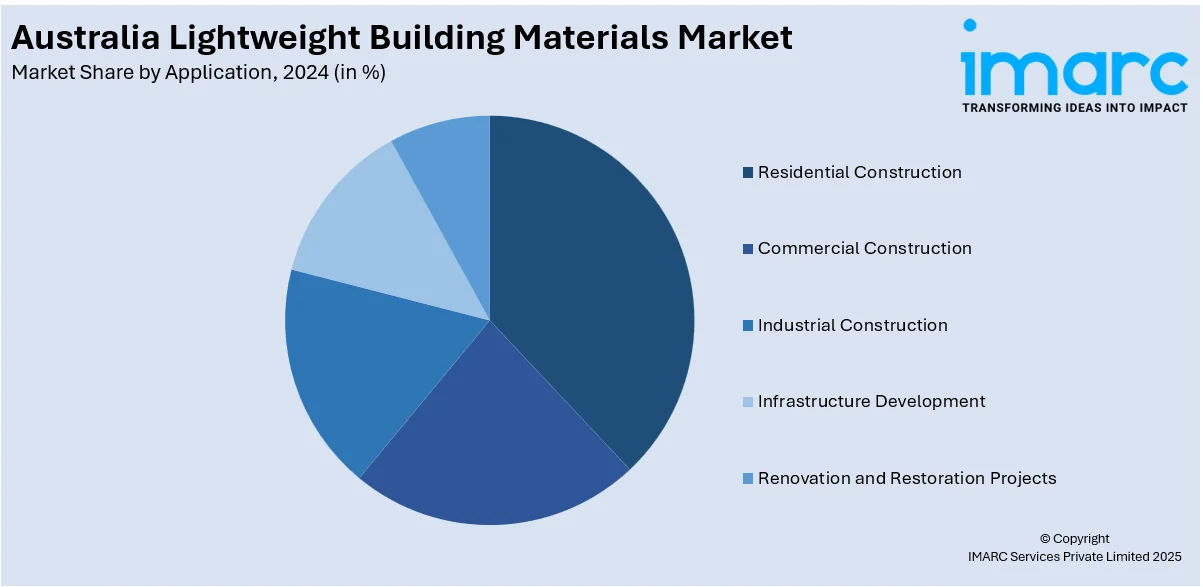

Application Insights:

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure Development

- Renovation and Restoration Projects

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential construction, commercial construction, industrial construction, infrastructure development, and renovation and restoration projects.

End User Insights:

- Contractors

- Construction Companies

- Architects and Designers

- Homeowners

- Real Estate Developers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes contractors, construction companies, architects and designers, homeowners, and real estate developers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Lightweight Building Materials Market News:

- August 15, 2024: Kingspan launched its new K-Roc™ wall and ceiling panels, made in Australia, that enhance local supply efficiency and offer superior fire-rated, non-combustible insulation products that comply with NCC requirements. The K-Roc product line consists of six launch products based on mineral wool cores that provide superior thermal and acoustic insulation performance, thus being ideal for Australian buildings that face extreme climate and soundproofing demands. These panels are suitable for many uses, such as in clean rooms, in homes, and in schools, enabling easier construction and maintaining lasting durability.

Australia Lightweight Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Material Covered | Structural Insulated Panels (SIPs), Lightweight Concrete, Composite Materials, Wood-based Materials, Mineral Wool Insulation |

| Densities Covered | Low Density, Medium Density, High Density, Ultra Lightweight |

| Applications Covered | Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Development, Renovation and Restoration Projects |

| End Users Covered | Contractors, Construction Companies, Architects and Designers, Homeowners, Real Estate Developers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia lightweight building materials market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia lightweight building materials market on the basis of type of material?

- What is the breakup of the Australia lightweight building materials market on the basis of density?

- What is the breakup of the Australia lightweight building materials market on the basis of type of application?

- What is the breakup of the Australia lightweight building materials market on the basis of end user?

- What is the breakup of the Australia lightweight building materials market on the basis of region?

- What are the various stages in the value chain of the Australia lightweight building materials market?

- What are the key driving factors and challenges in the Australia lightweight building materials market?

- What is the structure of the Australia lightweight building materials market and who are the key players?

- What is the degree of competition in the Australia lightweight building materials market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia lightweight building materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia lightweight building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia lightweight building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)