Australia Limestone Market Size, Share, Trends and Forecast by Type, Size, End Use Industry, and Region, 2025-2033

Australia Limestone Market Overview:

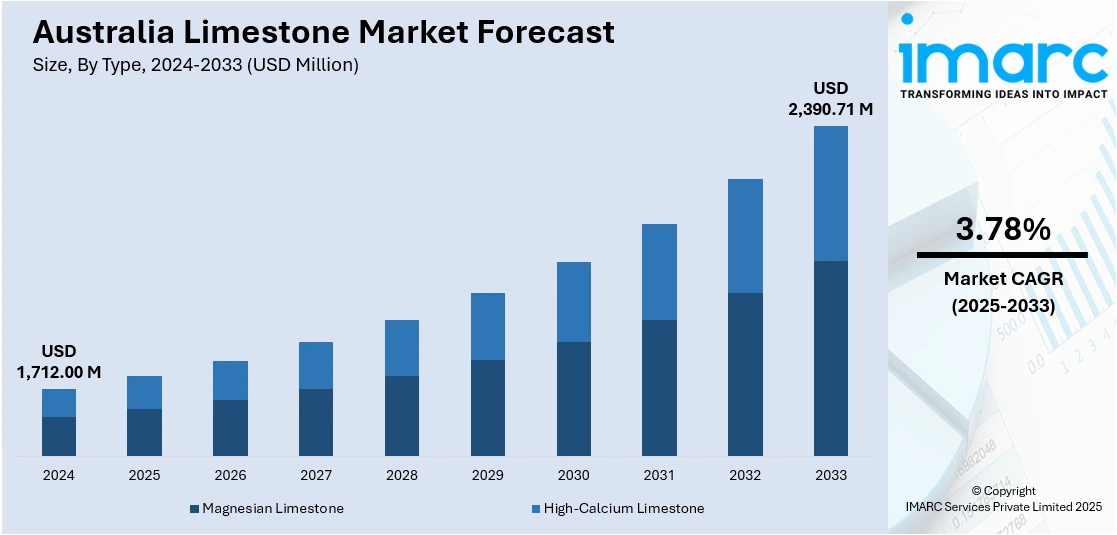

The Australia limestone market size reached USD 1,712.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,390.71 Million by 2033, exhibiting a growth rate (CAGR) of 3.78% during 2025-2033. The market is driven by strong construction activities tied to national infrastructure programs and urban expansion in major cities. Steel manufacturing demand, particularly from domestic producers adopting transitional technologies, ensures steady industrial consumption, thereby fueling the market. Environmental remediation initiatives and soil enhancement in agriculture are expanding limestone’s use in sustainability-focused applications, further augmenting the Australia limestone market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,712.00 Million |

| Market Forecast in 2033 | USD 2,390.71 Million |

| Market Growth Rate 2025-2033 | 3.78% |

Australia Limestone Market Trends:

Infrastructure Expansion and Demand from the Construction Sector

Australia’s limestone market is fundamentally supported by the material’s vital role in the construction industry, particularly in cement production, road base applications, and aggregate use. A recent study at the 4th International Conference on Transportation Infrastructure showed that Limestone Calcined Clay Cement (LC3) could cut CO2 emissions in Australia by up to 38%, replacing 50% of cement clinker without performance loss. This supports Australia's net-zero target by 2050 and a carbon emissions trading scheme for cement. Major government-funded infrastructure initiatives, such as the Inland Rail, Western Sydney Airport, and North East Link, are intensifying demand for limestone in concrete and structural foundations. Additionally, urban expansion in Melbourne, Brisbane, and Sydney is leading to a surge in residential and commercial building activity, where limestone is preferred for its durability and availability. The material’s thermal efficiency, sound insulation, and aesthetic versatility also make it a popular choice for architectural cladding and landscaping in new housing developments. Importantly, local sourcing of limestone helps lower transport costs and ensures timely supply in fast-paced construction schedules. Furthermore, Australia’s Building Code encourages energy-efficient materials, reinforcing limestone’s usage in sustainable building frameworks. The confluence of these demand streams from public and private sectors is keeping limestone quarries highly active across New South Wales, Victoria, and Western Australia. As infrastructure and real estate investments intensify and environmental guidelines favor long-life, low-impact materials, the outlook remains promising for Australia limestone market growth driven by construction-centered consumption.

To get more information on this market, Request Sample

Steel Manufacturing and Metallurgical Applications

Limestone plays a critical role as a fluxing agent in Australia’s steel industry, where it is used to remove impurities such as silica and alumina during the smelting process. With domestic steel manufacturing facilities in Whyalla, Port Kembla, and Newcastle continuing to modernize and expand, the need for consistent, high-purity limestone is increasing. As BlueScope Steel, Liberty Steel, and other manufacturers invest in decarbonization technologies, such as hydrogen-based direct reduced iron (DRI), limestone remains necessary for existing blast furnace operations and transitional technologies. This metallurgical demand is further supported by Australia's strategic emphasis on building sovereign capabilities in defense, transport, and renewables infrastructure, all of which require significant quantities of domestically produced steel. Limestone used in fluxing and desulfurization processes must meet strict compositional standards, prompting steady output from quarries aligned with metallurgical specifications. Additionally, international steelmakers have sourced Australian limestone for consistency and compliance, particularly in markets such as Southeast Asia. In 2023, Australia exported limestone flux and other calcareous materials valued at USD 273,500, totaling 602,820 kg. The primary export destinations included Papua New Guinea, New Caledonia, French Polynesia, Singapore, and Saudi Arabia. Conversely, Australia imported limestone flux and other calcareous materials worth USD 13,050,300, with Japan being the largest supplier, accounting for 77% of imports. As Australia continues to prioritize industrial productivity and low-emission steel pathways over the next decade, limestone consumption across the metallurgical chain is expected to remain robust and aligned with national supply chain strategies.

Australia Limestone Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, size, and end use industry.

Type Insights:

- Magnesian Limestone

- High-Calcium Limestone

The report has provided a detailed breakup and analysis of the market based on the type. This includes magnesian limestone and high-calcium limestone.

Size Insights:

- Crushed Limestone

- Calcined Limestone (PCC)

- Ground Limestone (GCC)

The report has provided a detailed breakup and analysis of the market based on the size. This includes crushed limestone, calcined limestone (PCC), and ground limestone (GCC).

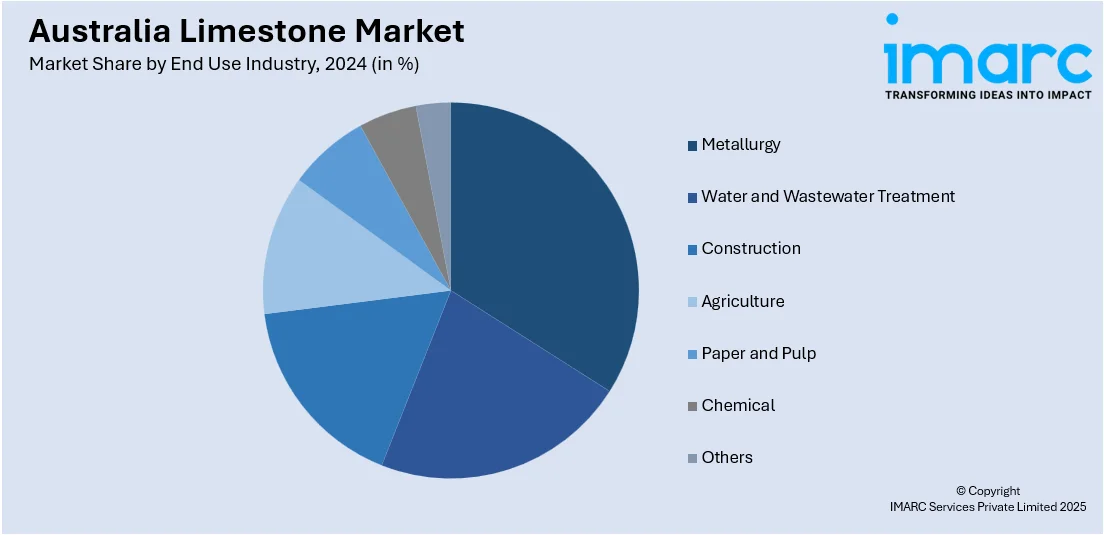

End Use Industry Insights:

- Metallurgy

- Water and Wastewater Treatment

- Construction

- Agriculture

- Paper and Pulp

- Chemical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes metallurgy, water and wastewater treatment, construction, agriculture, paper and pulp, chemical, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Limestone Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Magnesian Limestone, High Calcium Limestone |

| Sizes Covered | Crushed Limestone, Calcined Limestone (PCC), Ground Limestone (GCC) |

| End Use Industries Covered | Metallurgy, Water and Wastewater Treatment, Construction, Agriculture, Paper and Pulp, Chemical, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia limestone market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia limestone market on the basis of type?

- What is the breakup of the Australia limestone market on the basis of size?

- What is the breakup of the Australia limestone market on the basis of end use industry?

- What is the breakup of the Australia limestone market on the basis of region?

- What are the various stages in the value chain of the Australia limestone market?

- What are the key driving factors and challenges in the Australia limestone market?

- What is the structure of the Australia limestone market and who are the key players?

- What is the degree of competition in the Australia limestone market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia limestone market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia limestone market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia limestone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)