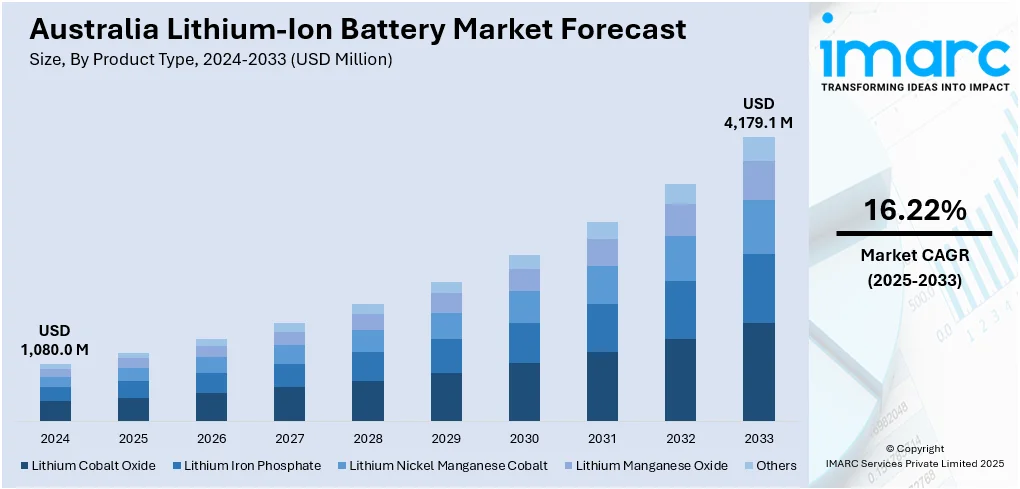

Australia Lithium-Ion Battery Market Report by Product Type (Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, and Others), Power Capacity (0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh), Application (Consumer Electronics, Electric Vehicles, Energy Storage, and Others), and Region 2025-2033

Market Overview:

Australia lithium-ion battery market size reached USD 1,080.0 Million in 2024. Looking forward, the market is expected to reach USD 4,179.1 Million by 2033, exhibiting a growth rate (CAGR) of 16.22% during 2025-2033. The growing consumer preferences towards compact and portable devices are propelling the need for efficient storage and power backup solutions, which is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,080.0 Million |

| Market Forecast in 2033 | USD 4,179.1 Million |

| Market Growth Rate 2025-2033 | 16.22% |

A lithium-ion battery represents an advanced and rechargeable power source employing lithium ions in its electrochemistry. It consists of organic electrolytes, graphite anodes, and cathodes made of lithium cobalt oxide or lithium manganese oxide. Recognized for its elevated energy density, it is extensively employed in various portable consumer electronics like smartphones, laptops, tablets, digital cameras, music players, power tools, etc. In contrast to traditional lithium batteries, lithium-ion counterparts can undergo complete discharge and recharge cycles without experiencing degradation. Consequently, they find widespread applications across various industries, including electronics, automotive, military, aerospace, etc.

To get more information on this market, Request Sample

Key Trends of Australia Lithium-Ion Battery Market:

Shift Toward Renewable Integration and Grid‑Scale Storage

In Australia, among the leading trends for lithium‑ion batteries is their increasing application toward renewable energy integration, particularly grid‑scale storage. With the nation ramping up its use of solar and wind power—both utility‑scale projects and rooftop solar installations—lithium‑ion batteries are playing a critical role in leveling out variability, storing excess generation, and handling peak evening demand. Initiatives such as big battery installs in states like South Australia and New South Wales are stabilizing electricity supply and offering ancillary services like frequency control. There is also keen interest in combining batteries with off-grid or hybrid power systems for remote mines, where electricity cost and reliability are significant issues. Local mining companies are fitting battery systems with solar/wind to reduce diesel consumption, mitigate carbon emissions, and enhance resilience. Since most parts of Australia receive strong sunshine, uptake of PV-battery combinations in residential areas is also resulting in demand dynamics for lower scale lithium-ion battery solutions.

National Battery Strategy & Value Chain Localization

Another movement is Australia's growing concentration on developing a domestic value chain for lithium‑ion batteries instead of simply exporting raw lithium or spodumene. The federal government has launched a National Battery Strategy, as well as incentives and funding to promote local processing, refining, and battery component manufacturing. There is a movement toward sophisticated battery material manufacturing, and mining. The push is driven by an appreciation that while Australia is located over some of the globe's largest lithium deposits, the downstream value—refining, production of anode and cathode material, even assembly of cells—is extremely profitable and keeps more economic gain at home. International battery technology companies are being approached for potential partnerships, and investment in battery processing plants is being enticed by some state governments with tax credits or grants. In addition, tough environmental and sustainability requirements are influencing the design of new battery‑material and cell‑manufacturing facilities, with a focus on minimizing carbon footprints in mining and refining, renewable power sources, and ensuring sound sourcing of all key materials.

Chemistries, Regulation and Safety Focus

Another important trend in Australia is in the development of battery chemistry trends—with lithium-ion variants such as Lithium Iron Phosphate (LFP) being considered for their safety, stability, and cost profile benefits. Although higher energy-density chemistries are applied in most EVs and high-performance applications, regulators, customers and players in the industry are increasingly focused on safety, thermal runaway, and lifespan. These issues are driving adoption of safer battery chemistries, stricter testing and certification standards, and closer controls on battery imports and sales. For instance, certain states have added regulations to prohibit or penalize the sale of below‑standard lithium‑ion batteries in e‑mobility products such as e‑bikes and scooters following incidents of battery fires. Moreover, as battery systems proliferate in renewable storage or household backup roles, authorities are putting in place rules around installation safety, battery recycling responsibilities, and handling of end‑of‑life batteries. This mix of chemistry innovation plus regulatory tightening is pushing manufacturers and suppliers to raise quality, invest in better battery management systems, and design for safer operation across Australia.

Growth Drivers of Australia Lithium-Ion Battery Market:

Rich Mineral Resources and Downstream Value Capture

Australia's richness in the critical battery mineral resources like lithium, nickel, and cobalt is one of the key drivers for its lithium-ion battery industry. Operations like those of Western Australia (e.g. Greenbushes) and recently established ones in Northern Territory (e.g. Finniss) yield high-grade spodumene as well as other feedstocks. These mineral endowments provide Australia a head start over others in raw materials supply. Apart from mining, there is increasing momentum toward the capture of more downstream value. Rather than shipping raw minerals, more investment is being made in local processing, by converting to lithium hydroxide or battery-grade materials, and component production. This is facilitated by government plans to advance the critical minerals industry, with objectives of constructing refining, processing, and battery cell assembly domestically. The potential for movement along the value chain assists in structuring additional jobs, enhancing economic benefits, lowering dependencies on exports, and positioning Australia higher on the world battery supply chain.

Renewable Energy Integration and Grid Storage Requirements

According to the Australia lithium-ion battery market analysis, the shift toward renewable energy is a significant growth impetus for the industry. As big solar and wind farms become more common in states, the variability of RE sources necessitates solid backup and smoothing operations. More and more lithium-ion battery storage facilities are being utilized to stabilize the grid, offer frequency control, and divert excess energy to times of high demand. Initiatives such as the Victorian Big Battery and others in South Australia are good examples of how big‑scale battery energy storage systems (BESS) are being put into operation to help state grids, improving reliability and decreasing the use of fossil‑fuel generation during peak loads. Off‑grid and hybrid systems are also increasing in remote and mining areas, where operations are expensive and challenging to power. Here, lithium-ion batteries, complemented with solar or wind, curb diesel use, lower emissions, and enhance energy security. Growing mandates for utilities to add storage also underpin demand for lithium-ion batteries in Australia.

Policy Support, ESG Pressures and Innovation

Policy, regulatory incentives, and growing investor/employer pressure on environmental, social, and governance (ESG) factors are significant growth drivers of the Australia lithium-ion battery market share. The region’s federal and state governments are introducing critical minerals strategies, providing grants, tax relief, and expedited approvals for battery‑related projects such as processing, manufacturing, energy storage, and grid integration. These initiatives are assisting in lowering capital investment barriers for battery factories, R&D, and clean supply chain traceability. Moreover, expectations for sustainability by international customers like automakers, renewable energy companies, and energy utilities, are compelling Australian projects to adopt greener mining methodologies, responsible sourcing of material, and improved recycling of end-of-life batteries. Innovation is also being encouraged through pilot plants for next-generation cathode powders, hybrid battery chemistries (such as LFP or LMFP), demonstration plants for enhanced battery management systems, and producers expanding local capacity of manufacturing. Together, these programs foster a conducive environment promoting both local battery demand and the export of more value-added battery componentry or completed battery cells.

Government Support of Australia Lithium-Ion Battery Market:

National Strategy and Critical Minerals Policy Alignment

The Australian national government has established official policies to promote the lithium-ion battery sector through synergistic strategies, particularly through the National Battery Strategy and the National Critical Minerals Strategy. They seek to take Australia past the simple export of raw materials and toward the capture of more of the value chain locally — refining, processing, component manufacture and even cell-assembly. The government has promised to establish regulatory and financial systems to induce investment, including by setting priority areas, cutting red tape for approvals, and promoting collaborations among state governments, industry and research institutions. Australia is the only jurisdiction with the magnitude of its critical minerals endowment paired with solid governance, so there is more certainty the state can provide long‑lead‑time projects. Alignment of critical minerals policy with emissions and climate objectives ensures lithium‑ion battery support is a part of the country's transformation to clean energy, which also contributes largely to the Australia lithium-ion battery market growth and development.

State‑Level Incentives and WA's Battery Industry Support

At the state government level, Western Australia (WA) has been particularly active, taking advantage of being one of the world's largest producers of lithium and other battery-related minerals. The WA Government has initiated a Future Battery Industry Strategy to bring down‐stream processing and promote value‑adding manufacturing within the state. For instance, the WA support plan has provisions like waiving selected fees (port charges, mining tenement fees), providing low or interest‑free loan facilities to lithium producers, and providing access to infrastructure for enabling facilities capable of refining, processing or producing battery components. This is not common in Australia: a state with such a commanding resource base also vigorously backing downstream industries, instead of depending solely on raw ore export. This state government policy assistance complements federal approaches to ensure investment gets funneled into areas near where the minerals are extracted, minimizing transport and logistics costs and more retaining jobs locally.

Innovation, Skills Development and Recycling Support

For long-term sustainability and competitiveness, the Australian government is also investing in innovation, skills training, and in battery end-of-life management. Programs are established to support research into technologies such as better battery chemistries (greater energy density, safer compositions), silicon anodes, and other next-generation materials. In the same way, grants and funding mechanisms through national agencies assist in bringing pilot plants and demonstration plants into operation, converting academic or early-stage research into commercial battery products. Yet another source of government assistance is skills development: apprenticeships, vocational training in battery manufacture and installation, safety inspection, and recycling. Lastly, since lithium‑ion batteries ultimately are waste, governments are increasingly concerned with regulation and infrastructure for recycling and disposal of batteries. Stricter regulation, better collection systems, and education programs are some things being researched by some states to ensure environmental and safety hazards of used batteries are addressed. This integrated strategy of promoting innovation, skills, and sustainability provides the sector with a better base than supply of resources.

Opportunities of Australia Lithium-Ion Battery Market:

Scaling Grid‑Scale Storage and Grid Stabilization

This need for increasing grid‑scale lithium‑ion battery storage is driven by the need to enable states to transition into renewable energy. With states adopting higher percentages of solar, wind, and offshore renewables, grid operators are challenged by intermittency, voltage variability, and peak demands. Lithium-ion battery systems coupled with wind farms and solar farms are progressively regarded as critical devices for load balancing and frequency management. For instance, plans for big battery energy storage systems in New South Wales are currently underway to store surplus solar production, replace peaking plants, and aid in deferring expensive network upgrades. In areas that have aging transmission infrastructure, battery installations can lower grid stress, lower dependence on costly peaker generation, and increase resilience. Furthermore, Australia's high solar irradiance and strong winds across the majority of states exaggerate the potential benefit of coupling renewables with storage. As renewable penetration increases, the potential for utilities, independent power producers, and investors to construct and operate lithium‑ion systems to provide grid services is significant.

Off‑Grid, Remote, and Mining Industry Electrification

Another opportunity influencing the Australia lithium‑ion battery demand is the supply of battery systems to off‑grid, remote, and mining operations. Much of the mining operations, are now relying mostly on diesel or gas power generation. Battery systems can drastically cut fuel costs, pollution, and operating reliability, especially when paired with solar PV, wind, or hybrid power generation. In Western Australia, remote mines have already started using hybrid systems integrating solar and battery energy storage to minimize the use of diesel. These projects facilitate cost savings and assist in meeting ESG goals and mobilizing investment from stakeholders with interest in sustainable mining. Additionally, remote First Nations settlements and communities offer scope for solar‑battery microgrids to displace or diminish reliance on diesel power, which is a prospect to provide cleaner, more resilient electricity services where traditional grid connection is unfeasible. Modular lithium‑ion systems and mobile energy‑storage units are especially well adapted for remote use, providing scope for design, logistics, and service model innovation in the Australian context.

Domestic Value‑Chain Development and Exports

There is high potential in Australia to expand its local lithium‑ion battery value chain beyond raw material mining to refining, components manufacture, and even cell assembly. Australia is endowed with abundant lithium and spodumene and other lithium minerals, and strategic mines in the Northern Territory (Finniss) and Western Australia produce battery‑grade feedstocks. Conversion of these into higher-value domestic battery materials can realize greater economic value, generate jobs within regional communities, and minimize transport and import costs. At the same time, demand for locally produced battery systems is growing, fueled by government policy, investment incentive, and supply chain security pressures. Australia is well‑positioned to supply battery components or finished battery systems to neighbouring Asia Pacific markets, especially as nations around it scale up EV adoption and renewable energy deployment. Exports of refined lithium hydroxide, cathode or anode materials, or even complete battery modules could become increasingly profitable as global supply chains seek reliable, high‑quality supply from politically stable jurisdictions.

Challenges of Australia Lithium-Ion Battery Market:

Raw Material Price Volatility and Supply Chain Dependence

Australia, although endowed with lithium, nickel and other key battery metals, is subject to significant threats from price unpredictability of these raw materials. When the world's demand or policy expectations change like the decline of EV sales projections - prices for lithium, nickel and cobalt can plummet, eroding the economics of mines, refineries and battery initiatives. Most Australian lithium producers ship out spodumene or concentrate instead of finished battery chemicals; if global chemical refiners, especially in Asia, shift their buying, it makes uncertainty for Australian upstream operations. Moreover, although Australia produces significant amounts of raw lithium ore, much of the processing remains abroad. Supply chain disruptions, trade barriers, increases in transport costs, or shifts in overseas demand can have a substantial influence on returns. The reliance on worldwide processing capacities and sensitivities in the upstream chain for companies is one of the contributing factors to margin compression. Uncertain access and raw material costs for companies that invest in local refining or cell‑manufacture make it risky to plan.

Energy, Infrastructure and Environmental Constraints

It is costly to operate lithium‑ion battery plants and refineries in Australia in terms of energy and infrastructure. Much of the mining and possible battery component fabrication areas are isolated, in Western Australia, Northern Territory or other remote regions; moving power, water, roads and logistics over long distances incurs overhead. In addition, the cost of electricity and the carbon footprint of energy production in some Australian locations increases the cost and less desirable nature of operating energy‑intensive processes like the conversion of spodumene to lithium hydroxide, or cathode/anode material production. Environmental and community pressures around land disturbance, water use, and habitat effects, particularly in remote or environmentally sensitive areas, also exist. Environmental approvals may take a long time to obtain, with stringent regulation in place. End‑of‑life battery management and recycling infrastructure are underdeveloped, so regulatory responsibility for and management of battery waste can be risky. All of these infrastructure, energy, environmental and regulatory limitations increase capital expenses and diminish competitiveness relative to places with lower‑cost power, more proximate supply chains, or less demanding regulatory requirements.

Competition, Market Uncertainty and Technology Risks

Other challenges arise from market uncertainty, rapidly changing technology, and competition. Internationally, most nations are racing to establish battery supply chains or be part of incentive regimes, thus competing for investment, skilled workforce, and finance. Australia is competing with countries which will potentially provide cheaper labor or energy or more subsidies to attract manufacturing of battery components or cell assembly. Domestically, demand growth is uncertain: how rapidly EV uptake, grid storage purchase, or renewables integration will grow dictates the number of battery systems required. Abrupt policy changes (subsidies, tariffs, trade agreements) can damage the business case. Technological risk is high as well, as new battery chemistries, cell shapes, or other storage technologies (e.g. flow batteries, sodium‑ion) may upend demand for specific lithium‑ion battery types. Firms that are heavily invested in a certain process or chemistry can become stuck if the market transforms. Overall, competition, uncertainty in demand, and changing technology pose risk for Australian firms in the lithium‑ion battery industry.

Australia Lithium-Ion Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, power capacity, and application.

Product Type Insights:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, and others.

Power Capacity Insights:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

A detailed breakup and analysis of the market based on the power capacity have also been provided in the report. This includes 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and more than 60000mAh.

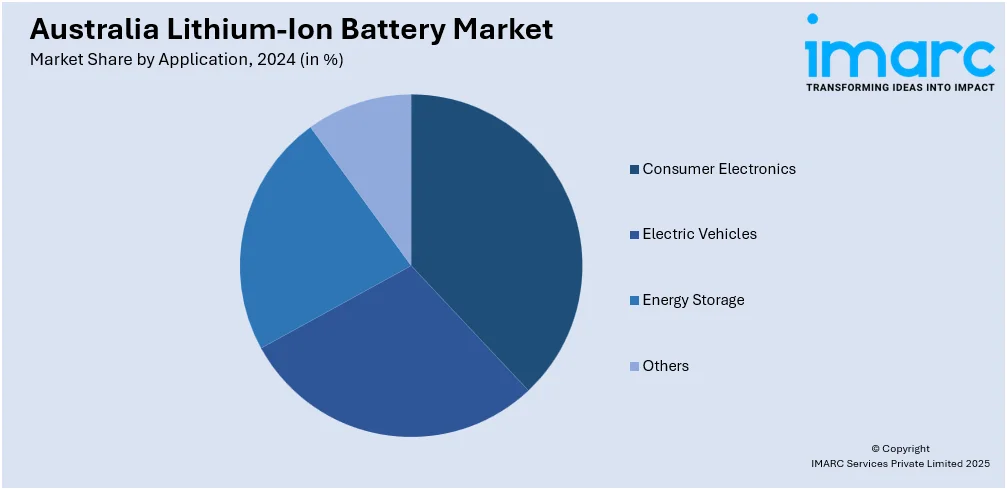

Application Insights:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, electric vehicles, energy storage, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Lithium-Ion Battery Market News:

- In August 2025, the Australian government officially introduced its eagerly awaited AU$500 million (USD 323 Million) Battery Breakthrough Initiative (BBI), with the goal of establishing the country as a significant competitor in the global battery manufacturing industry. The initiative, currently open for applications via the Australian Renewable Energy Agency (ARENA), signifies one of the largest federal investments in battery production capacity thus far. Revealed in the May 2024 Federal Budget and crafted through industry consultations, the program provides Australian companies with access to capital grants and production incentives aimed at bridging essential gaps in local manufacturing capability and scale.

- On August 13, 2025, an ASIC notice revealed that Energy Renaissance, a manufacturer of lithium-ion batteries, had appointed administrators. Energy Renaissance marked its 10-year anniversary in June and outlined its plans to expand its Tomago factory to gigawatt capacity to produce 5GWh of energy storage each year. Although the company has not issued a public statement regarding its management, managing director Brian Craighead provided some information in a recent update on the company's website.

- In June 2024, the National Battery Strategy outlined Australia's strategies and funding efforts to expand its battery sector. Australia’s inaugural National Battery Strategy outlined the nation’s plan to develop and maintain a robust battery sector. The plan details how Australia can assist in diversifying global battery supply chains through collaboration with important trading partners. It additionally explained how the government and industry will collaborate to enhance battery production.

Australia Lithium-Ion Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia lithium-ion battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia lithium-ion battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia lithium-ion battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia lithium-ion battery market was valued at USD 1,080.0 Million in 2024.

The Australia lithium-ion battery market is projected to exhibit a CAGR of 16.22% during 2025-2033.

The Australia lithium-ion battery market is expected to reach a value of USD 4,179.1 Million by 2033.

Key trends in the Australia lithium-ion battery market include expanding grid-scale storage projects, increased focus on local battery material processing, and rising adoption of residential solar-battery systems. There is also growing interest in safer chemistries like LFP, development of battery recycling infrastructure, and integration of lithium-ion storage with off-grid and remote energy systems.

The Australia lithium-ion battery market is driven by abundant mineral resources, growing renewable energy adoption, and increasing demand for energy storage solutions. Government policies supporting critical minerals and battery manufacturing, alongside rising electric vehicle interest and industrial decarbonization goals, further accelerate domestic production, infrastructure investment, and downstream development opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)