Australia Loaders Market Size, Share, Trends and Forecast by Type, Engine, Fuel, and Region, 2025-2033

Australia Loaders Market Size and Share:

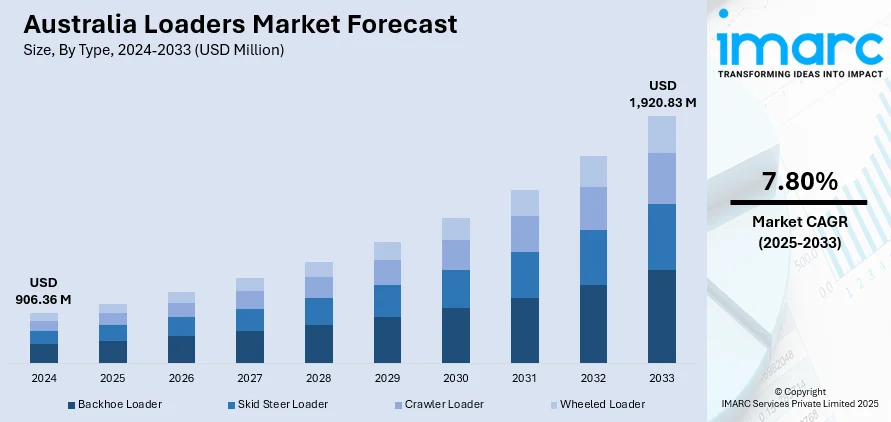

The Australia loaders market size reached USD 906.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,920.83 Million by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. Increased infrastructure development, urbanization, and mining activities are some of the factors contributing to Australia loaders market share. Rising demand for efficient earthmoving equipment, government investments in construction, and technological advancements in machinery also boost market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 906.36 Million |

| Market Forecast in 2033 | USD 1,920.83 Million |

| Market Growth Rate (2025-2033) | 7.80% |

Australia Loaders Market Trends:

Rising Demand for Compact and Efficient Construction Equipment in Urban Projects

In Australia, there is a noticeable shift toward machinery that delivers both power and efficiency within compact designs. This development is driven by increasing construction activity in urban, residential, and roadwork sectors where space constraints are common. Equipment featuring short-radius configurations is gaining attention for its ability to operate effectively in tighter job sites without sacrificing performance. New entrants in the market are emphasizing productivity, fuel efficiency, and operator comfort while aligning with environmental standards like Tier 3 compliance. This reflects a broader push for versatile, cost-effective solutions that can handle complex infrastructure needs in densely built environments, especially as cities expand and construction regulations tighten across the country. These factors are intensifying the Australia loaders market growth. For example, in July 2024, Kobelco introduced two new Tier 3 models to its short radius range in Australia, i.e., the SK225SR-7 and SK235SR-7. These machines are ideal for urban, residential, and roadwork projects, offering compact designs for tighter workspaces. With powerful performance, improved productivity, and lower operational costs, the models maintain the legacy of Kobelco's SR series while offering enhanced comfort.

To get more information on this market, Request Sample

Shift toward High-Performance Tires for Heavy-Duty Machinery

Australia’s construction and mining sectors are increasingly adopting specialized tires designed for extreme conditions and heavy loads. New developments focus on maximizing load-carrying capacity, durability, and efficiency, particularly for large wheel loaders. Enhanced tread depth and cut resistance are becoming key priorities, reflecting the demand for products that can withstand harsh terrain and rigorous use. The move toward higher-rated tires, such as those with three-star designations, signals a commitment to improving operational uptime and safety. As infrastructure and mining projects expand across rugged regions, the market continues to favor tire technologies that boost machine performance while reducing wear and maintenance costs in demanding environments. For instance, in March 2024, Goodyear launched the RL-5K off-the-road tire for large wheel loaders in Australia, designed to enhance load carrying capacity with a three-star designation. Featuring a deep tread for superior cut resistance and traction, the RL-5K is tailored for heavy-duty applications in the Australian construction and mining sectors. This tire promises to optimize performance, durability, and efficiency for large wheel loaders operating in rugged and demanding environments across the country.

Australia Loaders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, engine, and fuel.

Type Insights:

- Backhoe Loader

- Skid Steer Loader

- Crawler Loader

- Wheeled Loader

The report has provided a detailed breakup and analysis of the market based on the type. This includes backhoe loader, skid steer loader, crawler loader, and wheeled loader.

Engine Insights:

- Up to 250 HP

- 250-500 HP

- More than 500 HP

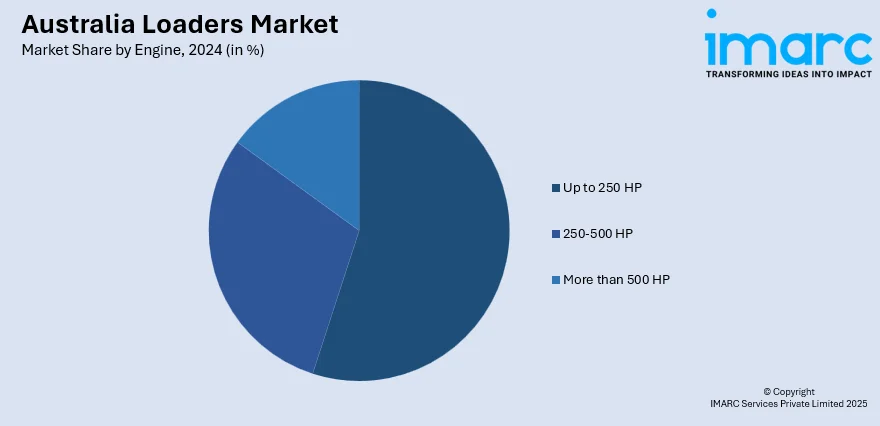

A detailed breakup and analysis of the market based on the engine have also been provided in the report. This includes up to 250 HP, 250-500 HP, and more than 500 HP.

Fuel Insights:

- Electric

- ICE

A detailed breakup and analysis of the market based on the fuel have also been provided in the report. This includes electric and ICE.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Loaders Market News:

- In April 2025, Volvo Construction Equipment launched Volvo Site Operations, a digital service providing real-time, actionable insights for job site management. This brand-agnostic platform consolidates data across mixed-brand fleets, boosting productivity by up to 20%, enhancing safety, and reducing fuel consumption and CO₂ emissions. Initially available in select markets, including Australia, it enables site managers to optimize operations, improve material flow, and streamline administrative tasks, making job sites more efficient and eco-friendlier.

Australia Loaders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Backhoe Loader, Skid Steer Loader, Crawler Loader, Wheeled Loader |

| Engines Covered | Up to 250 HP, 250-500 HP, More than 500 HP |

| Fuels Covered | Electric, ICE |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia loaders market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia loaders market on the basis of type?

- What is the breakup of the Australia loaders market on the basis of engine?

- What is the breakup of the Australia loaders market on the basis of fuel?

- What is the breakup of the Australia loaders market on the basis of region?

- What are the various stages in the value chain of the Australia loaders market?

- What are the key driving factors and challenges in the Australia loaders market?

- What is the structure of the Australia loaders market and who are the key players?

- What is the degree of competition in the Australia loaders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia loaders market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia loaders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia loaders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)