Australia Low Voltage Electric Motor Market Size, Share, Trends and Forecast by Efficiency, Application, End-Use Industry, and Region, 2026-2034

Australia Low Voltage Electric Motor Market Summary:

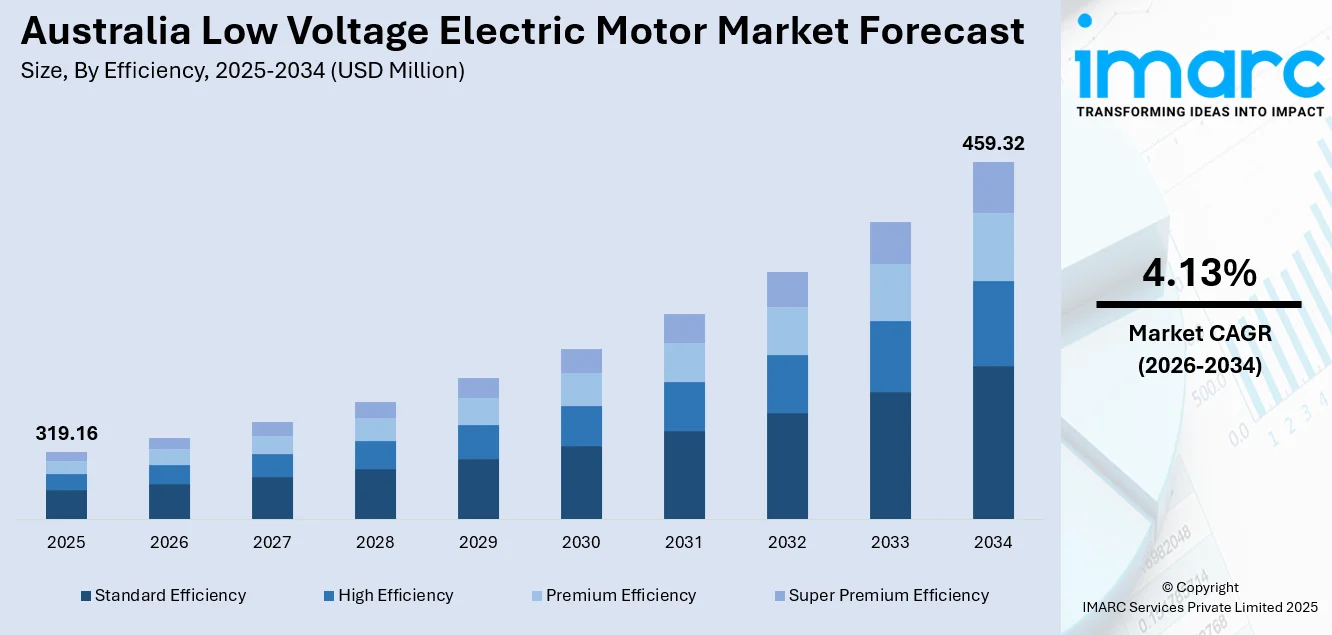

The Australia low voltage electric motor market size was valued at USD 319.16 Million in 2025 and is projected to reach USD 459.32 Million by 2034, growing at a compound annual growth rate of 4.13% from 2026-2034.

The Australia low voltage electric motor market is experiencing sustained momentum driven by robust infrastructure development, expanding commercial construction, and stringent energy efficiency regulations. the growing demand from commercial heating, ventilation and air-conditioning (HVAC) systems, industrial pumping applications, and mining operations continues to fuel adoption of reliable, high-performance motor solutions. The government's commitment to net-zero emissions by 2050 is accelerating the transition toward premium efficiency motors, while digital integration and smart building technologies are reshaping industrial applications, collectively strengthening the Australia low voltage electric motor market share.

Key Takeaways and Insights:

- By Efficiency: Standard efficiency dominates the market with a share of 32% in 2025, driven by widespread adoption across cost-sensitive industrial applications and established infrastructure where immediate efficiency upgrades remain economically constrained.

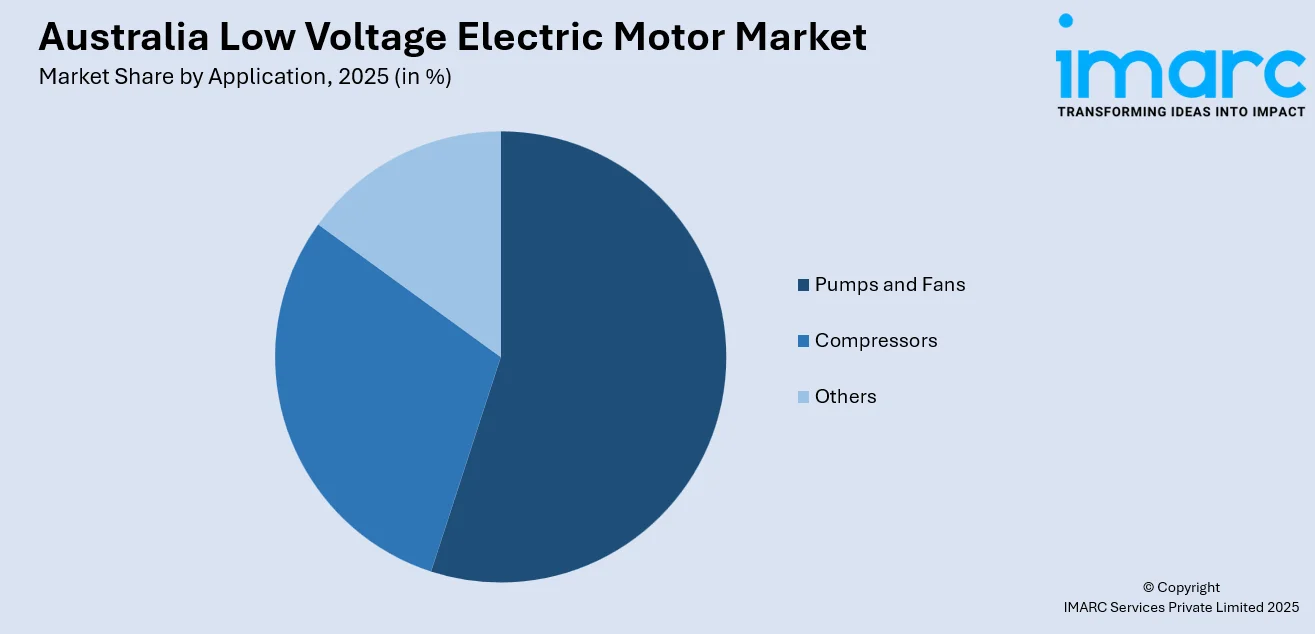

- By Application: Pumps and fans lead the market with a share of 50% in 2025, reflecting the essential role of fluid handling and ventilation systems across mining, HVAC, water treatment, and industrial processing operations.

- By End-Use Industry: Commercial HVAC industry represents the largest segment with a market share of 25% in 2025, supported by expanding office developments, retail complexes, and hospitality projects requiring sophisticated climate control systems.

- By Region: Australia Capital Territory & New South Wales dominate the market with a share of 30% in 2025, owing to concentrated commercial construction activity in Sydney and Canberra metropolitan areas.

- Key Players: The Australia low voltage electric motor market exhibits moderate competitive intensity, with established multinational corporations competing alongside regional distributors across efficiency classes and application segments.

The Australian low voltage electric motor market is experiencing notable growth, driven by increasing demand across industries such as manufacturing, automotive, and renewable energy. These motors are essential for applications requiring lower power levels, offering energy-efficient solutions for machinery and equipment. In manufacturing, low voltage motors power conveyor systems, pumps, and fans, while the automotive sector uses them in electric and hybrid vehicles. For instance, in 2026, Hyundai launched the Elexio, an electric SUV in Australia. This vehicle, designed for Australian roads, features a 546 km range and advanced technology, contributing to the growing automotive demand for efficient motors. Moreover, the rising emphasis on renewable energy, including wind and solar power, is catalyzing the demand for low voltage motors in energy generation and conversion systems. Government sustainability initiatives, including carbon reduction targets, further drive the need for these efficient motors, ensuring continued market growth driven by innovation in automation and smart technologies.

Australia Low Voltage Electric Motor Market Trends:

Advancements in Automation and Robotics

The adoption of automation and robotics across various industries is a significant driver of the low-voltage electric motor market in Australia. As industries modernize their production systems, the need for efficient and precise motors is increasing. Low voltage motors play a crucial role in enabling the seamless operation of automated machinery, robotics, and conveyor systems, supporting faster production cycles and reducing maintenance costs. A notable example of this trend is the opening of the Australian Automation and Robotics Precinct (AARP) in Perth in 2024, a $28 million facility dedicated to autonomous systems and zero-emissions technologies. This development highlights the increasing importance of automation and further accelerates the adoption of low voltage motors in various sectors, including manufacturing and logistics.

Shift Toward Renewable Energy Sources

Australia's transition toward renewable energy sources, such as wind and solar power, is driving the growing demand for low-voltage electric motors, which play a critical role in energy generation, conversion, and supporting sustainable infrastructure. These motors are used in wind turbines and solar tracking systems to improve efficiency and reduce operational costs. For example, in 2025, Neoen inaugurated the 412 MW Goyder South Wind Farm, the largest in South Australia, which is expected to increase the state’s wind generation by over 20%. This development aligns with Australia’s renewable energy targets and offers significant growth opportunities for low-voltage motor manufacturers as the nation advances toward a cleaner, more sustainable energy future.

Rising Preference for Electric Vehicles

The growing adoption of electric vehicles (EVs) in Australia is catalyzing the demand for low-voltage electric motors. As the automotive industry shifts towards electrification, low-voltage motors are crucial for EV drive systems, particularly in small vehicles and auxiliary applications. Government policies, including subsidies and tax incentives, are further accelerating this transition. In 2025, Australia’s electric vehicle market saw a 38% rise in annual sales, with December achieving a record monthly share, according to the Electric Vehicle Council (EVC). This growth in EV adoption, driven by efforts to reduce emissions and carbon footprints, which continues to drive the demand for efficient low voltage motors in the automotive sector.

Market Outlook 2026-2034:

The Australia low voltage electric motor market demonstrates robust growth potential over the forecast period, supported by strong demand from industrial automation, energy efficiency initiatives, and infrastructure development. Regulatory policies promoting efficient motor systems and reduced energy usage are accelerating replacement of older equipment. Expanding manufacturing activity, rise in mining operations, and increasing use of automation across commercial facilities further support market growth. The market generated a revenue of USD 319.16 Million in 2025 and is projected to reach a revenue of USD 459.32 Million by 2034, growing at a compound annual growth rate of 4.13% from 2026-2034.

Australia Low Voltage Electric Motor Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Efficiency |

Standard Efficiency |

32% |

|

Application |

Pumps and Fans |

50% |

|

End-Use Industry |

Commercial HVAC Industry |

25% |

|

Region |

Australia Capital Territory & New South Wales |

30% |

Efficiency Insights:

- Standard Efficiency

- High Efficiency

- Premium Efficiency

- Super Premium Efficiency

Standard efficiency dominates with a market share of 32% of the total Australia low voltage electric motor market in 2025.

Standard efficiency leads the market due to its strong balance of reliability, affordability, and operational suitability across a wide range of applications. This motor delivers dependable performance for general-purpose industrial, commercial, and utility operations, making it a preferred choice for manufacturing, water management, mining services, and building systems. Its widespread availability, proven design, and ease of installation support quick deployment and consistent operation, helping end users maintain productivity while managing capital expenditure efficiently.

The large installed base of standard efficiency motor further reinforces its dominance by supporting seamless replacement and maintenance practices. This motor integrates smoothly with existing infrastructure, minimizing downtime and avoiding costly system modifications. For many applications with stable operating conditions, standard efficiency motors provide sufficient energy performance and long service life. Its cost effectiveness, operational familiarity, and reliable output continue to make it an attractive solution for a broad range of users.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Pumps and Fans

- Compressors

- Others

Pumps and fans lead with a market share of 50% of the total Australia low voltage electric motor market in 2025.

Pumps and fans hold the biggest market share owing to their extensive use across water management, HVAC systems, industrial processing, and infrastructure operations. These applications require continuous and reliable motor performance to ensure efficient fluid movement and air circulation. Low voltage motors used in pumps and fans offer consistent operation, energy reliability, and adaptability across diverse operating conditions, making them essential for municipal utilities, commercial buildings, and industrial facilities nationwide.

The dominance of pumps and fans is further supported by steady demand from construction, mining services, agriculture, and building services sectors. Expansion of water treatment facilities, irrigation systems, and energy-efficient ventilation solutions is increasing motor deployment. Pumps and fans also benefit from routine replacement cycles and long operating hours, supporting sustained demand. Their critical role in essential services and infrastructure ensures ongoing investment and stable growth within the market.

End-Use Industry Insights:

- Commercial HVAC Industry

- Food, Beverage and Tobacco Industry

- Mining Industry

- Utilities

- Others

Commercial HVAC industry exhibits a clear dominance with a 25% share of the total total Australia low voltage electric motor market in 2025.

The commercial HVAC industry represents the largest segment, attributed to its consistent demand for reliable, efficient, and durable motor solutions. Commercial buildings, including offices, retail complexes, hospitals, and hotels, rely heavily on HVAC systems to maintain indoor comfort and air quality. Low voltage electric motors play a vital role in driving fans, pumps, and compressors, supporting uninterrupted system performance across diverse operating environments.

Growth in commercial construction, urban redevelopment, and building upgrades continues to strengthen this dominance. Increasing focus on indoor air quality, climate control, and occupant comfort is encouraging sustained investment in HVAC systems. Adoption of modern ventilation and cooling solutions in commercial spaces supports long operating cycles for motors. These factors ensure steady demand and reinforce the commercial HVAC sector as a key end-use industry in the market.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales dominate with a market share of 30% of the total Australia low voltage electric motor market in 2025.

Australian Capital Territory and New South Wales lead the market due to strong economic activity, advanced infrastructure, and high concentration of commercial and industrial facilities. These regions host major urban centers, data facilities, public infrastructure, and manufacturing hubs that require reliable motor-driven systems. In 2025, the NSW Government announced the commencement of major construction on 60 new Build-to-Rent homes in Bomaderry, further driving demand for low-voltage motors in HVAC, water management, and industrial applications.

The presence of modern commercial developments, government facilities, and large service-sector operations further reinforces regional dominance. Ongoing upgrades to public buildings, healthcare facilities, and transport systems sustain motor replacement and installation activity. Strong focus on operational efficiency and system reliability encourages adoption of dependable motor solutions.

Market Dynamics:

Growth Drivers:

Why is the Australia Low Voltage Electric Motor Market Growing?

Increasing Popularity of Smart Grids and Energy Storage Solutions

The rise of smart grids and energy storage solutions in Australia is creating new opportunities for low-voltage electric motors, as these systems require efficient and reliable motors to drive components such as pumps, compressors, and fans within energy storage facilities and grid infrastructure. In 2025, Wärtsilä announced its tenth Australian project, a 100 MW / 223 MWh battery energy storage system (BESS) for Flow Power, located in Victoria. The Bennetts Creek BESS will enhance grid stability, provide ancillary services, and support Australia’s renewable energy transition. As energy management becomes a central focus, the demand for low-voltage motors grows, driving their essential role in advanced energy systems.

Growing Demand in Construction and Building Sector

As large-scale infrastructure projects increase, the demand for low-voltage motors is growing, particularly in building systems like elevators, escalators, HVAC units, and lighting control systems. These motors are essential to modern building automation, enhancing energy efficiency, reliability, and user comfort. In 2025, Marubeni Corporation partnered with AsheMorgan, Haseko Corporation, and Mizuho Leasing on the District Living Project in Melbourne’s Docklands area. This Build-to-Rent (BTR) development featured 626 residential units and aim for net-zero carbon emissions, reflecting the growing emphasis on sustainability in construction. As a result, the adoption of low-voltage motors in both residential and commercial buildings is rising, further strengthening the market growth.

Rise in Smart Home and Home Automation Technologies

The increasing popularity of smart home and automation technologies in Australia is driving the demand for low voltage electric motors. These motors are essential in devices, such as automated window shades, robotic vacuum cleaners, and smart HVAC systems. As per the IMARC Group, the Australian smart homes market is projected to reach USD 11.54 Billion by 2034, reflecting the growing user adoption of smart technologies for enhanced convenience, energy efficiency, and security. As homeowners seek more energy-saving and reliable products, the demand for small, efficient electric motors continues to rise, further supporting the growth of low voltage motors in residential applications.

Market Restraints:

What Challenges the Australia Low Voltage Electric Motor Market is Facing?

Higher Upfront Costs of Premium Efficiency Motors

The initial purchase price of high-efficiency and premium efficiency motors remains substantially higher than standard alternatives, creating adoption barriers particularly for cost-sensitive small and medium enterprises. While lifecycle cost analysis typically demonstrates favorable returns through energy savings, the upfront capital requirement can delay procurement decisions where operating budgets are constrained or where short-term financial metrics take precedence over long-term operational efficiency considerations.

Supply Chain Constraints and Import Dependencies

Australia's reliance on imported motors and components creates vulnerability to global supply chain disruptions, shipping delays, and currency fluctuations that can impact product availability and pricing stability. Limited domestic manufacturing capacity for specialized motor variants means end-users face extended lead times for custom specifications, potentially constraining project timelines and creating operational planning challenges across industrial and commercial sectors.

Technical Skills Shortage in Motor System Integration

The increasing sophistication of motor systems incorporating digital controls, variable speed drives, and smart monitoring capabilities requires specialized technical expertise that remains scarce across Australia's industrial workforce. Facilities managers and maintenance personnel require updated skills to effectively commission, operate, and maintain advanced motor-drive combinations, creating potential implementation barriers that can slow adoption of newer technologies despite their operational advantages.

Competitive Landscape:

The Australia low voltage electric motor market exhibits moderate competitive intensity characterized by the presence of established multinational manufacturers alongside regional distributors and specialized service providers competing across efficiency classes and application segments. Market dynamics reflect strategic positioning, ranging from comprehensive product portfolios emphasizing advanced efficiency ratings and digital integration capabilities to value-oriented offerings targeting cost-conscious industrial segments. Competition is increasingly shaped by service capabilities, including technical support, maintenance programs, and system integration expertise as end-users prioritize total cost of ownership considerations alongside initial equipment pricing. Sustainability credentials, energy efficiency certifications, and demonstrated compliance with Australian regulatory standards have emerged as critical differentiators influencing procurement decisions across commercial and industrial user segments.

Recent Developments:

- May 2024: IPD announced its partnership with ABB Australia to become the official Low Voltage Motors Master Distributor, effective June 1, 2024. This agreement enhanced local stock availability, logistics, and customer service across Australia.

- January 2024: A1 Electric Motors became the newest ABB Motors Australia Authorised Value Provider (AVP). This partnership enables A1 Electric Motors to supply, install, and maintain ABB’s low-voltage motors, including SynRM motors, enhancing their support for customers across Australia. With over 17 years of experience, A1 provided energy-efficient motor solutions to reduce operational costs and carbon emissions.

Australia Low Voltage Electric Motor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Efficiencies Covered | Standard Efficiency, High Efficiency, Premium Efficiency, Super Premium Efficiency |

| Applications Covered | Pumps and Fans, Compressors, Others |

| End-Use Industries Covered | Commercial HVAC Industry, Food, Beverage and Tobacco Industry, Mining Industry, Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia low voltage electric motor market size was valued at USD 319.16 Million in 2025.

The Australia low voltage electric motor market is expected to grow at a compound annual growth rate of 4.13% from 2026-2034 to reach USD 459.32 Million by 2034.

Pumps and fans dominated the market with a 50% revenue share in 2025, driven by essential requirements across HVAC, water treatment, mining, and industrial processing applications that depend fundamentally on reliable fluid handling and ventilation systems.

Key factors driving the Australia low voltage electric motor market include the growing shift toward renewable energy, including wind and solar, which requires low voltage electric motors for energy generation and conversion. In 2025, Neoen launched the 412 MW Goyder South Wind Farm, boosting South Australia’s wind generation by 20%, aligning with renewable targets and catalyzing the demand for these motors.

Major challenges include higher upfront costs of premium efficiency motors limiting adoption among cost-sensitive enterprises, supply chain constraints and import dependencies creating availability concerns, technical skills shortages constraining advanced system integration, and economic uncertainties affecting capital investment decisions across industrial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)