Australia Lubrication Systems Market Size, Share, Trends and Forecast by Type, Application, Process, and Region, 2026-2034

Australia Lubrication Systems Market Summary:

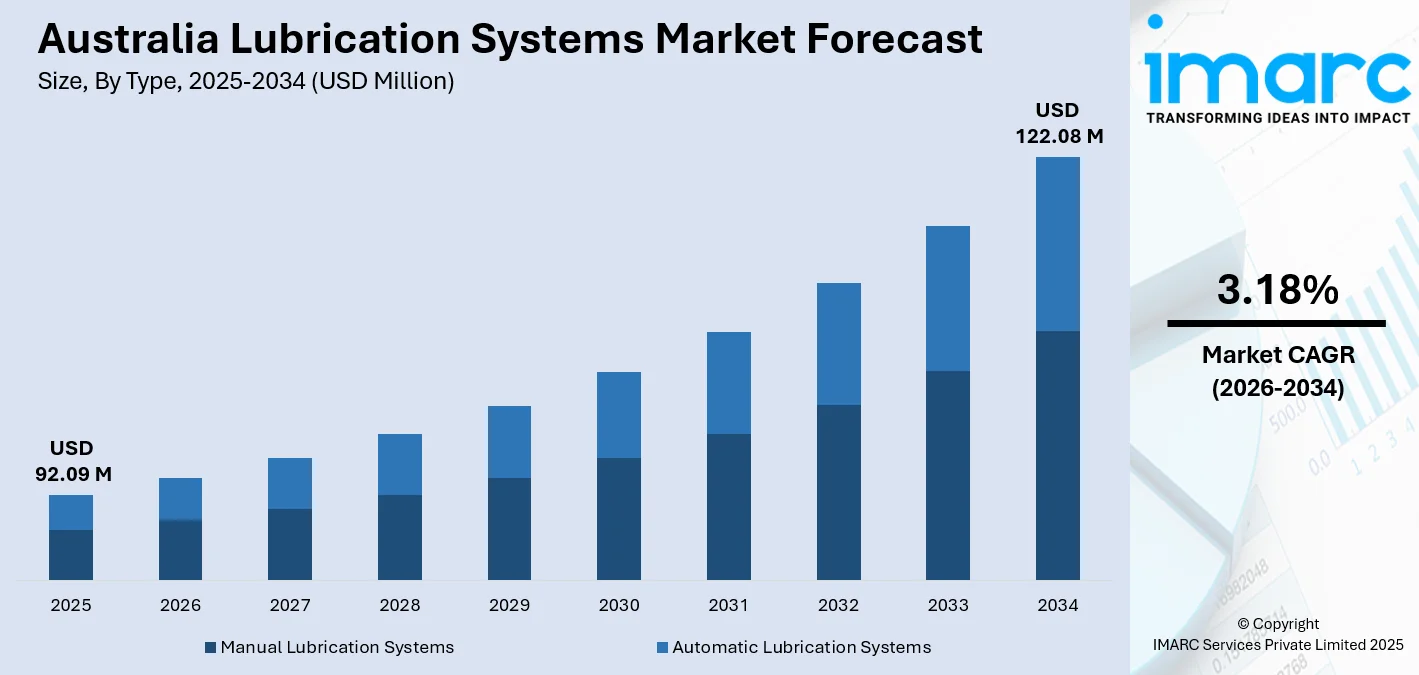

The Australia lubrication systems market size was valued at USD 92.09 Million in 2025 and is projected to reach USD 122.08 Million by 2034, growing at a compound annual growth rate of 3.18% from 2026-2034.

The Australia lubrication systems market is experiencing steady growth, driven by expanding industrial automation and rising demand from the mining and manufacturing sectors. Increasing focus on equipment reliability, preventive maintenance practices, and operational efficiency across heavy industries is accelerating adoption of advanced lubrication systems. Growing infrastructure investments and the transition towards smart, sensor-enabled lubrication technologies are reshaping maintenance strategies and strengthening market share.

Key Takeaways and Insights:

- By Type: Automatic lubrication systems dominate the market with a share of 64% in 2025, owing to their ability to deliver precise, continuous lubrication that reduces equipment downtime and maintenance costs. Rising adoption of Industry 4.0 technologies and predictive maintenance practices is driving the segment expansion.

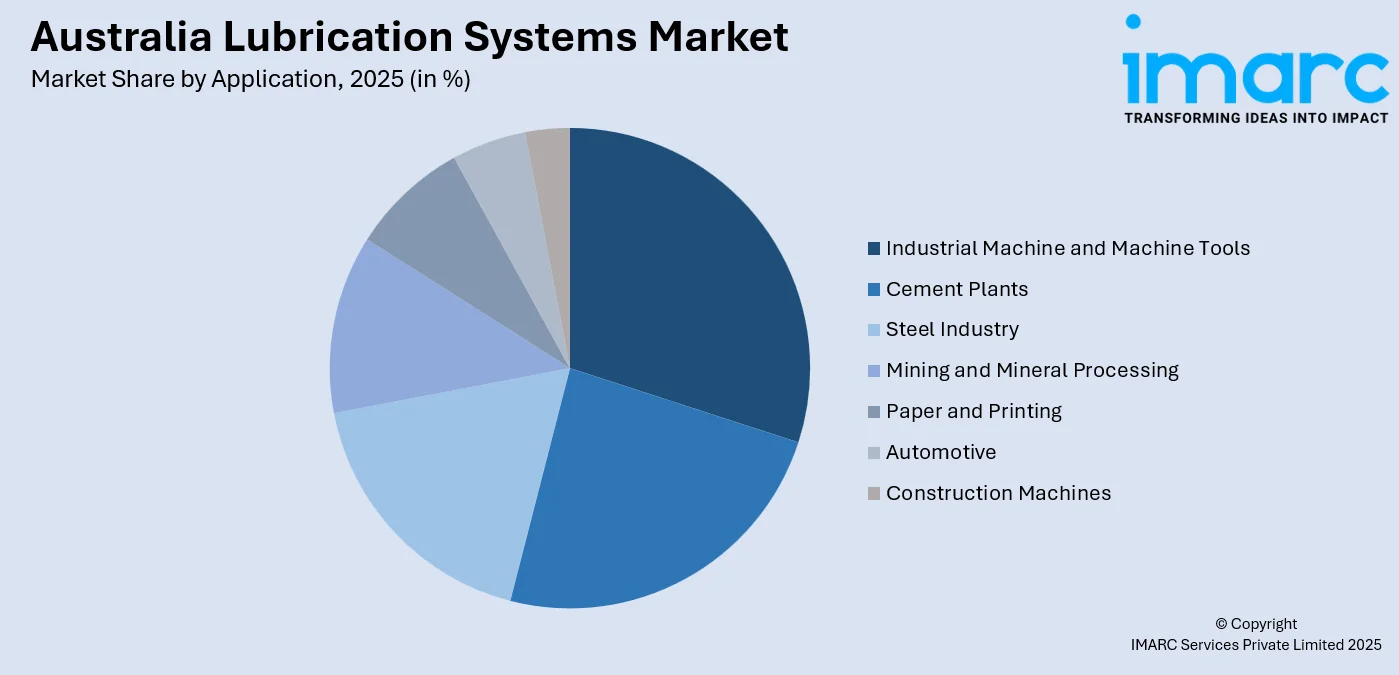

- By Application: Industrial machine and machine tools lead the market with a share of 18% in 2025. This dominance is driven by expanding manufacturing activities, government support for advanced manufacturing initiatives, and growing demand for precision engineering across the automotive, aerospace, and defense sectors.

- By Process: Wet sump lubrication comprises the largest segment with a market share of 57% in 2025, reflecting widespread preference for cost-effective, simple lubrication solutions that require fewer components and offer reliable performance across standard industrial machinery and automotive applications.

- By Region: Australia Capital Territory & New South Wales represents the largest region with 25% share in 2025, driven by concentration of manufacturing facilities, major infrastructure projects, including Sydney Metro developments, and the presence of diverse industries requiring advanced lubrication solutions.

- Key Players: Key players drive the Australia lubrication systems market by expanding product portfolios, investing in sensor-enabled technologies, and forming strategic partnerships. Their focus on Internet of Things (IoT) integration, predictive maintenance solutions, and environmentally sustainable lubricants strengthens market positioning while supporting industrial efficiency improvements.

To get more information on this market Request Sample

The Australia lubrication systems market is advancing, as industries prioritize machinery performance optimization, maintenance cost reduction, and equipment longevity enhancement. Lubrication systems, encompassing automatic, centralized, and manual configurations, play vital roles across the automotive, manufacturing, mining, energy, and construction sectors. The market benefits from Australia's strong mining industry backbone, which demands heavy-duty lubrication solutions for machinery operating under harsh conditions. Growing adoption of predictive maintenance technologies, integration with condition monitoring platforms, and emphasis on digital transformation are reshaping lubrication practices. As per IMARC Group, the Australia predictive maintenance market size reached USD 254.00 Million in 2024. The transition towards synthetic and biodegradable lubricants, aligned with environmental regulations, further supports market evolution. Infrastructure development initiatives, manufacturing modernization programs, and the continued expansion of resource extraction activities position the Australia lubrication systems market for sustained growth throughout the forecast period.

Australia Lubrication Systems Market Trends:

Integration of IoT and Predictive Maintenance Technologies

The integration of digital technologies in lubrication monitoring is transforming industrial maintenance practices across Australia. Sensor-enabled lubrication systems equipped with real-time data analytics and condition monitoring capabilities enable businesses to track lubricant performance and equipment health continuously. These IoT-enabled systems support predictive maintenance by identifying abnormal operating patterns, optimizing lubrication schedules, minimizing unplanned equipment failures, extending asset life, and improving overall maintenance efficiency across numerous complex industrial operations.

Adoption of Environmentally Sustainable Lubrication Solutions

Environmental sustainability is becoming a critical consideration driving lubrication system innovation throughout Australia. Industries are increasingly adopting biodegradable and eco-friendly lubricants to reduce environmental impact while maintaining operational performance. In September 2024, Viva Energy Australia launched Shell Panolin biodegradable lubricants targeting construction and mining industries, meeting global eco-label standards while supporting companies aiming for stricter sustainability and operational efficiency goals. This trend is also prompting manufacturers to redesign lubrication systems for improved leak prevention, extended lubricant life, and compliance with evolving environmental regulations across industrial operations.

Shift Towards Per- and Polyfluoroalkyl Substances (PFAS)-Free Lubrication Technologies

Growing regulatory scrutiny and environmental concerns are accelerating the transition towards PFAS-free lubrication solutions across Australian industries. Manufacturers are developing high-performance alternatives that eliminate synthetic chemicals while maintaining operational effectiveness. Industries, such as mining, food processing, and manufacturing, are prioritizing compliance with stricter environmental and workplace safety standards. PFAS-free lubricants reduce long-term contamination risks and simplify waste disposal and site remediation requirements. This shift also strengthens corporate sustainability commitments and aligns lubrication practices with broader environmental, social, and governance (ESG) objectives.

Market Outlook 2026-2034:

The Australia lubrication systems market outlook remains positive, as industrial automation adoption accelerates and maintenance optimization becomes increasingly critical for operational efficiency. Expanding mining operations, large-scale infrastructure projects, and manufacturing modernization initiatives continue to drive demand for advanced lubrication systems. The market generated a revenue of USD 92.09 Million in 2025 and is projected to reach a revenue of USD 122.08 Million by 2034, growing at a compound annual growth rate of 3.18% from 2026-2034. Government support through manufacturing modernization funds and infrastructure investment programs further strengthens market prospects. The integration of smart technologies, predictive analytics, and sustainable lubrication practices positions the market for continued evolution, as industries prioritize reliability, efficiency, and environmental compliance throughout Australia.

Australia Lubrication Systems Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Automatic Lubrication Systems |

64% |

|

Application |

Industrial Machine and Machine Tools |

18% |

|

Process |

Wet Sump Lubrication |

57% |

|

Region |

Australia Capital Territory & New South Wales |

25% |

Type Insights:

- Manual Lubrication Systems

- Automatic Lubrication Systems

- Single-line Lubrication Systems

- Dual-line Lubrication Systems

- Multi-line Lubrication Systems

- Series Progressive

- Circulating Oil

- Oil and Air

Automatic lubrication systems dominate with a market share of 64% of the total Australia lubrication systems market in 2025.

Automatic lubrication systems are gaining strong traction across Australian industries due to their ability to deliver accurate, continuous lubrication while significantly reducing manual intervention and maintenance effort. By maintaining optimal lubrication cycles, these systems help prevent premature component wear and unexpected equipment failures, improving overall machinery reliability. Industries, such as manufacturing, mining, and heavy engineering, are adopting automated solutions to minimize downtime, enhance workplace safety, and lower long-term operating costs. Ongoing modernization initiatives are further supporting adoption as companies prioritize efficiency-driven maintenance practices.

The integration of Industry 4.0 technologies is further enhancing the capabilities of automatic lubrication systems across Australia. Smart systems equipped with IoT connectivity, sensors, and data analytics enable real-time condition monitoring and proactive maintenance planning. These technologies allow operators to identify lubrication issues early, optimize lubricant usage, and extend equipment lifespan. Cloud-based monitoring and automated refilling features improve asset visibility while supporting predictive maintenance strategies, making advanced lubrication systems an integral part of digitally enabled industrial operations.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Cement Plants

- Steel Industry

- Mining and Mineral Processing

- Paper and Printing

- Automotive

- Industrial Machine and Machine Tools

- Construction Machines

Industrial machine and machine tools lead with a share of 18% of the total Australia lubrication systems market in 2025.

Industrial machine and machine tools drive significant lubrication system demand, as Australian manufacturing continues to modernize production capabilities. Advanced machining solutions require precise lubrication to maintain operational efficiency, reduce wear, and extend equipment lifespan. The Australia machine tools market reached USD 2102.0 Million in 2024 and is expected to grow at 3.96% CAGR during 2025-2033, reflecting strong underlying demand for manufacturing equipment that requires sophisticated lubrication management. Government initiatives, including the Manufacturing Modernization Fund, support domestic manufacturers adopting state-of-the-art machinery while enhancing production capabilities.

The integration of automation, robotics, and digital manufacturing technologies is accelerating lubrication system adoption across Australian industrial machinery applications. National policy initiatives focused on strengthening domestic manufacturing capabilities are encouraging industries to invest in advanced production systems. Automated and digitally enabled equipment supports high-volume, consistent output while reducing reliance on manual labor and improving process reliability. These modern machine tools operate under demanding conditions and therefore require advanced lubrication solutions to ensure precision, thermal stability, and long service life.

Process Insights:

- Dry Sump Lubrication

- Wet Sump Lubrication

Wet sump lubrication exhibits a clear dominance with a 57% share of the total Australia lubrication systems market in 2025.

Wet sump lubrication systems maintain market leadership, due to their simplicity, cost-effectiveness, and reliable performance across standard industrial machinery and automotive applications. These systems store oil directly in a sump at the engine or gearbox bottom, utilizing fewer components without external reservoirs or complex piping. Wet sump lubrication systems are prevalent in automotive engines and smaller industrial machines where straightforward maintenance and lower manufacturing costs provide competitive advantages. The system's widespread adoption reflects strong preference for uncomplicated, dependable lubrication solutions.

The dominance of wet sump lubrication reflects practical considerations across Australia's diverse industrial landscape. Most production automobiles and motorcycles utilize wet sump systems due to their straightforward design requiring only a single pump and internal reservoir. In 2024, 1,237,287 new vehicles were sold in Australia representing a 1.7% increase from 2023, supporting sustained demand for wet sump lubrication systems in automotive applications. The system's ease of installation, lower costs, and reduced maintenance requirements make it the preferred choice for everyday vehicles and standard industrial equipment.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represents the leading segment with a 25% share of the total Australia lubrication systems market in 2025.

Australia Capital Territory & New South Wales dominate the regional market, driven by concentration of manufacturing facilities, major infrastructure investments, and diverse industrial activity across metropolitan Sydney and surrounding areas. In the 2024-25 NSW Budget Mid-Year Review, the NSW Government's Infrastructure Pipeline was updated, which included a USD 118.3 Billion commitment over four years, focusing on schools, hospitals, and public transport delivery. Large-scale projects, including Sydney Metro West and Western Sydney Airport developments, generate sustained demand for construction machinery requiring advanced lubrication solutions.

The region also benefits from a well-developed supply chain ecosystem, skilled technical workforce, and proximity to major ports that support efficient equipment sourcing and maintenance services. High adoption of automation, advanced manufacturing practices, and preventive maintenance strategies among industries further accelerates lubrication system deployment. Mining support services, logistics hubs, and utilities infrastructure located across New South Wales additionally contribute to consistent demand, positioning the region as a long-term growth center for industrial lubrication solutions.

Market Dynamics:

Growth Drivers:

Why is the Australia Lubrication Systems Market Growing?

Expansion of Mining Operations and Resource Extraction Activities

Australia's mining industry, contributing over 12% to GDP and representing approximately 70% of export earnings in 2025, serves as a primary growth catalyst for lubrication systems demand. The resource-intensive nature of mining operations requires heavy-duty lubricants and automated lubrication systems for machinery operating under extreme conditions, including high temperatures, dust exposure, and continuous operation cycles. Mining equipment, inculcating haul trucks, drilling rigs, conveyor systems, and processing machinery, demands consistent lubrication to maintain operational efficiency, reduce wear, and prevent costly breakdowns. The increasing focus on predictive maintenance and asset reliability in mining operations further strengthens lubrication system adoption. Automated and centralized lubrication solutions help improve worker safety by minimizing manual intervention in hazardous zones. As mines expand capacity and extend equipment operating hours, efficient lubrication becomes critical for controlling maintenance costs and ensuring uninterrupted production across remote mining locations.

Large-Scale Infrastructure Development and Construction Activities

Substantial infrastructure investments across Australian states are propelling lubrication systems market growth through increased construction machinery deployment. Major metropolitan centers, including Sydney, Melbourne, and Brisbane, are experiencing unprecedented construction activities encompassing roads, bridges, commercial buildings, residential developments, and public transportation projects. The 2024-25 Federal Budget committed USD 16.5 Billion for new and existing infrastructure projects. Major projects, including Sydney Metro West, Western Sydney International Airport, Melbourne Metro Tunnel, and Suburban Rail Loop, require continuous deployment of excavators, cranes, graders, loaders, and concrete equipment operating under high-stress conditions. These developments necessitate sophisticated lubrication management for heavy machinery operating continuously throughout extended project timelines. Equipment reliability requirements drive adoption of automatic lubrication systems that ensure optimal performance while reducing maintenance interventions during critical construction phases.

Manufacturing Modernization and Industry 4.0 Adoption

The accelerating adoption of Industry 4.0 technologies across Australian manufacturing is transforming lubrication system requirements and driving market expansion. In 2024, the Australia Industry 4.0 market reached USD 3,294.00 Million and is projected to expand significantly to USD 11,142.25 Million by 2033 at 14.50% CAGR, reflecting strong national commitment to smart manufacturing advancement. Government initiatives support domestic manufacturers embracing advanced machinery requiring sophisticated lubrication solutions. The integration of IoT sensors, robotics, and digital twin technologies into production lines demands high-performance machine tools with precise lubrication management capabilities. These smart manufacturing environments rely on real-time lubrication monitoring to optimize equipment performance and reduce unplanned downtime. Connected lubrication systems enable data-driven maintenance decisions that align with predictive and condition-based maintenance strategies. As factories pursue higher automation levels, lubrication systems are increasingly designed to integrate seamlessly with centralized digital control platforms.

Market Restraints:

What Challenges the Australia Lubrication Systems Market is Facing?

Shortage of Skilled Lubrication Technicians

A key challenge is the limited availability of skilled technicians capable of installing, configuring, and maintaining modern lubrication systems. As systems become more automated and digitally integrated, traditional maintenance skills are often insufficient. Inadequate training leads to improper installation, inefficient operation, and higher failure risks. This skills gap slows adoption of advanced lubrication technologies, as end users remain cautious about investing in systems they cannot confidently operate or maintain.

High Costs of Legacy Equipment Retrofitting

Retrofitting advanced lubrication systems onto older machinery remains complex and expensive, particularly for small and mid-sized operators. Legacy equipment often lacks compatibility with automated or sensor-enabled lubrication solutions, requiring customization and extended downtime. These challenges discourage upgrades, as businesses across Australia prioritize uninterrupted operations and cost control. As a result, many operators continue to use manual or outdated lubrication methods, limiting broader market penetration despite clear efficiency and reliability benefits.

Fluctuating Raw Material and Component Prices

Instability in the prices of base oils, additives, and specialized components creates uncertainty for lubrication system manufacturers and end users. Cost fluctuations complicate long-term pricing strategies and procurement planning, especially for high-performance and synthetic lubricant solutions. Manufacturers must balance quality, availability, and affordability, while customers may delay purchasing decisions due to unpredictable costs, slowing adoption and affecting overall market growth momentum.

Competitive Landscape:

The Australia lubrication systems market is characterized by the presence of established global manufacturers alongside specialized regional distributors, competing through product innovations, service capabilities, and technological integration. Companies focus on expanding product portfolios encompassing automatic, centralized, and manual lubrication solutions while investing in IoT-enabled systems supporting predictive maintenance applications. Competition intensifies around sensor-enabled technologies, environmental compliance offerings, and comprehensive service packages that combine equipment supply with maintenance support and technical training. Manufacturers emphasize partnerships with end users across the mining, manufacturing, and construction sectors to develop customized solutions addressing specific operational requirements while building long-term customer relationships.

Australia Lubrication Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Cement Plants, Steel Industry, Mining and Mineral Processing, Paper and Printing, Automotive, Industrial Machine and Machine Tools, Construction Machines |

| Processes Covered | Dry Sump Lubrication, Wet Sump Lubrication |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia lubrication systems market size was valued at USD 92.09 Million in 2025.

The Australia lubrication systems market is expected to grow at a compound annual growth rate of 3.18% from 2026-2034 to reach USD 122.08 Million by 2034.

Automatic lubrication systems dominated the market with a share of 64%, driven by their ability to deliver precise, continuous lubrication that reduces equipment downtime, maintenance costs, and premature bearing failures across Australian industries.

Key factors driving the Australia lubrication systems market include expansion of mining operations, large-scale infrastructure development, manufacturing modernization, Industry 4.0 adoption, growing focus on predictive maintenance, and increasing demand for equipment reliability.

Major challenges include shortage of skilled lubrication technicians, high costs associated with legacy equipment retrofitting, fluctuating raw material prices, compatibility issues with diverse machinery, and limited awareness about advanced lubrication solutions among smaller operators.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)