Australia Luxury Car Market Size, Share, Trends and Forecast by Vehicle Type, Fuel Type, Price Range, and Region, 2025-2033

Australia Luxury Car Market Size and Share:

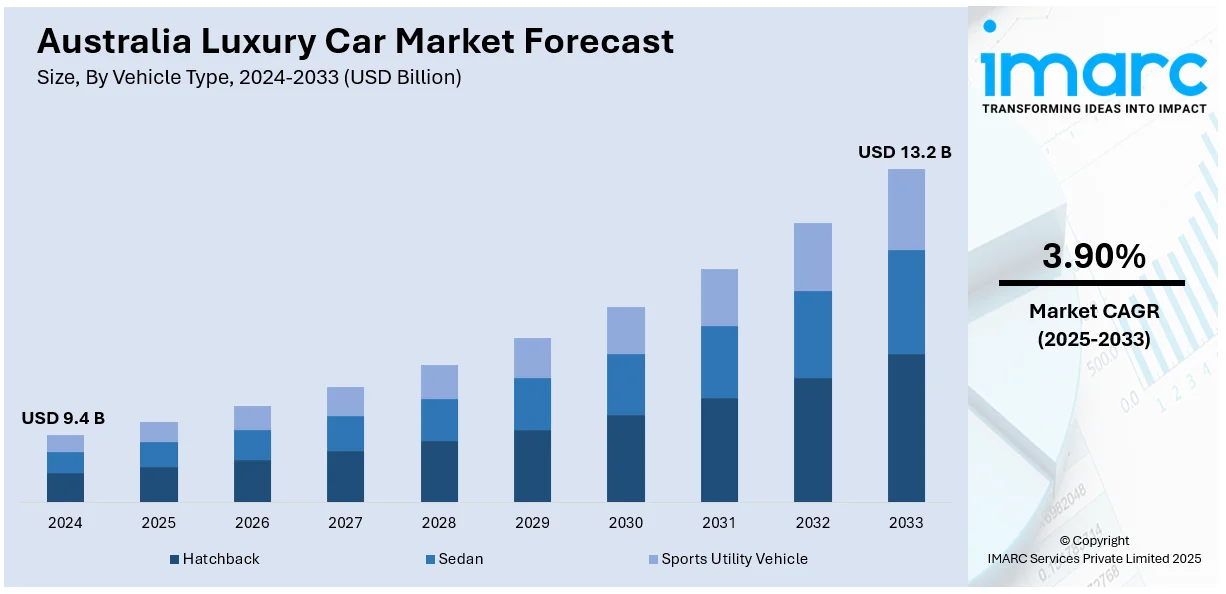

The Australia luxury car market size reached USD 9.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is driven by rising disposable incomes, increasing demand for premium features, technological advancements, and a growing preference for electric and hybrid luxury vehicles. Expanding financing options, strong brand presence, and evolving consumer lifestyles further contribute to the Australia luxury car market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.4 Billion |

| Market Forecast in 2033 | USD 13.2 Billion |

| Market Growth Rate 2025-2033 | 3.90% |

Key Trends of Australia Luxury Car Market:

Rising Disposable Incomes and Wealth Growth

As Australia’s economy strengthens, high-net-worth individuals and affluent consumers have more spending power, driving demand for luxury cars. With rising disposable incomes, consumers are willing to invest in premium vehicles that offer superior comfort, advanced features, and prestige. The growing number of entrepreneurs, executives, and professionals in urban areas contributes to this demand. Luxury car brands cater to this market by offering exclusive models, personalized services, and cutting-edge technology, thereby creating a positive impact on the Australia luxury car market outlook. The increasing financial stability of consumers enables them to afford high-end vehicles, making Australia a key market for luxury car manufacturers. This upward trend in luxury vehicle ownership is also encouraging global automakers to strengthen their presence and brand visibility in Australia through flagship launches and experiential retail spaces. For instance, in February 2025, Genesis marked its dynamic debut in Australia with the opening of its largest retail space in Sydney and the unveiling of the X Gran Berlinetta Concept at Bathurst. The event showcased innovative designs, including the GV60 Magma Concept highlighting the brand's commitment to luxury and performance in a motorsport-rich market.

To get more information on this market, Request Sample

Growing Popularity of Electric and Hybrid Luxury Vehicles

Environmental awareness and government incentives are encouraging the adoption of electric (EV) and hybrid luxury cars, which is further fueling the Australia luxury car market share. Brands like Tesla, BMW, and Mercedes-Benz are expanding their electric vehicle portfolios in Australia, offering high-performance EVs with sustainable technology. Consumers looking for zero-emission vehicles without compromising on luxury and performance are shifting toward premium EVs. Additionally, advancements in battery range, fast-charging infrastructure, and government rebates make electric luxury cars more appealing. This shift aligns with global trends toward sustainable mobility, positioning Australia’s luxury car market for continued growth in the EV and hybrid segment. For instance, in March 2025, Chinese car maker MG Motor Australia announced its plans to introduce its new luxury brand IM to the Australian market later this year. The IM5 sedan and another model will showcase advanced technology and elegant design aiming to redefine luxury electric driving. IM stands for Intelligence in Motion and is backed by SAIC Motor.

Increasing Focus on Advanced In-Car Technology and Connectivity

One major trend escalating the Australia luxury car market demand is the rising consumer demand for advanced in-car technology and connectivity features. Today’s luxury car buyers expect a seamless digital experience, including AI-powered infotainment systems, intuitive user interfaces, real-time navigation, voice control, over-the-air updates, and smartphone integration. Manufacturers are heavily investing in innovations such as augmented reality head-up displays, adaptive cruise control, and autonomous driving capabilities to differentiate their offerings. This trend is driven by a tech-savvy customer base that values not just performance and comfort, but also digital sophistication. As a result, tech innovation has become a central aspect of brand identity and a key factor influencing purchase decisions in the market.

Key Drivers of Australia Luxury Car Market:

Strong Brand Aspirations and Lifestyle Alignment

Australian buyers increasingly link luxury cars with success, status, and lifestyle upgrades. Luxury car brands are not just a means of transportation but also a symbol of their social status. Global players such as BMW, Mercedes-Benz, and Audi bank on this emotion through luxury features, rarity, and heritage. Such aspirational behavior, particularly among younger wealthy individuals and professionals, is driving consistent demand. Marketing campaigns targeting lifestyle alignment, rather than just performance, are resonating well, making brand perception a powerful demand driver in the Australian luxury car space.

Urbanization and Infrastructure Development

With growing urban centers and improved road infrastructure in major cities like Sydney, Melbourne, and Brisbane, luxury car owners are now able to fully utilize high-performance features and enjoy comfortable commuting. Well-developed road networks and increasing availability of premium parking solutions support the usability and convenience of luxury vehicles in urban areas. Additionally, luxury car makers are introducing models tailored for city driving with advanced navigation, real-time traffic support, and autonomous features. These improvements enhance the appeal of luxury vehicles as both a practical and prestigious mode of transport for urban dwellers in Australia.

Expansion of Finance and Leasing Options

Luxury vehicles are becoming more accessible through flexible financing models, subscription plans, and tailored leasing options. Leading automotive brands and dealerships in Australia now offer low-interest loans, guaranteed buyback schemes, and extended warranty plans, which reduce the financial burden on buyers. These offerings appeal particularly to younger consumers and business professionals who desire luxury vehicles without long-term ownership commitments. The shift from outright purchases to usage-based models is democratizing access to premium brands, expanding the consumer base, and fueling consistent growth in luxury vehicle sales.

Opportunities of Australia Luxury Car Market:

Expansion of Electric Luxury Car Segment

With a national push toward sustainability and decarbonization, the electric luxury car segment presents a major opportunity. Premium EVs from brands like Tesla, BMW, and Porsche are gaining traction as infrastructure improves, and consumer awareness about environmental impact grows. Government incentives and growing charging station networks further support this shift. As battery technology improves and range of anxiety declines, more luxury buyers are expected to transition to electric models. This shift opens the door for traditional and emerging brands to offer new electric lineups, capitalize on the green mobility trend, and reshape the future of luxury automotive experiences in Australia.

Rising Demand in Regional and Suburban Markets

Historically concentrated in major urban centers, luxury car demand in Australia is expanding into suburban and regional areas. According to the Australia luxury car market analysis, this opportunity is fueled by increased remote work, lifestyle changes, and rising affluence beyond capital cities. A common reason for buying luxury cars among suburban people is their comfort, dependability, and role in showing status, due to the growing number of long commutes and trips to other cities. Companies and stores in the car industry have the option to reach these rising sectors by adding more service spots, promoting products that fit their needs, and featuring rural-friendly options such as all-wheel or off-road drive in high-end SUVs. This geographic expansion can significantly boost market share.

Digitalization and Direct-to-Consumer Sales Models

The shift toward digital retailing offers luxury car brands a new frontier for growth in Australia. With consumers increasingly researching and purchasing vehicles online, automakers are investing in immersive virtual showrooms, online configuration tools, and remote consultation services. Direct-to-consumer (DTC) models allow brands to control the customer experience, enhance personalization, and reduce dealership dependency. Additionally, digital channels provide data-driven insights for targeted marketing and product development. This evolution not only caters to tech-savvy buyers but also enhances efficiency and transparency in the purchasing process. Embracing digital transformation positions brands to attract younger luxury consumers and stay competitive in a rapidly evolving retail landscape.

Australia Luxury Car Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on vehicle type, fuel type, and price range.

Vehicle Type Insights:

- Hatchback

- Sedan

- Sports Utility Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchback, sedan, and sports utility vehicle.

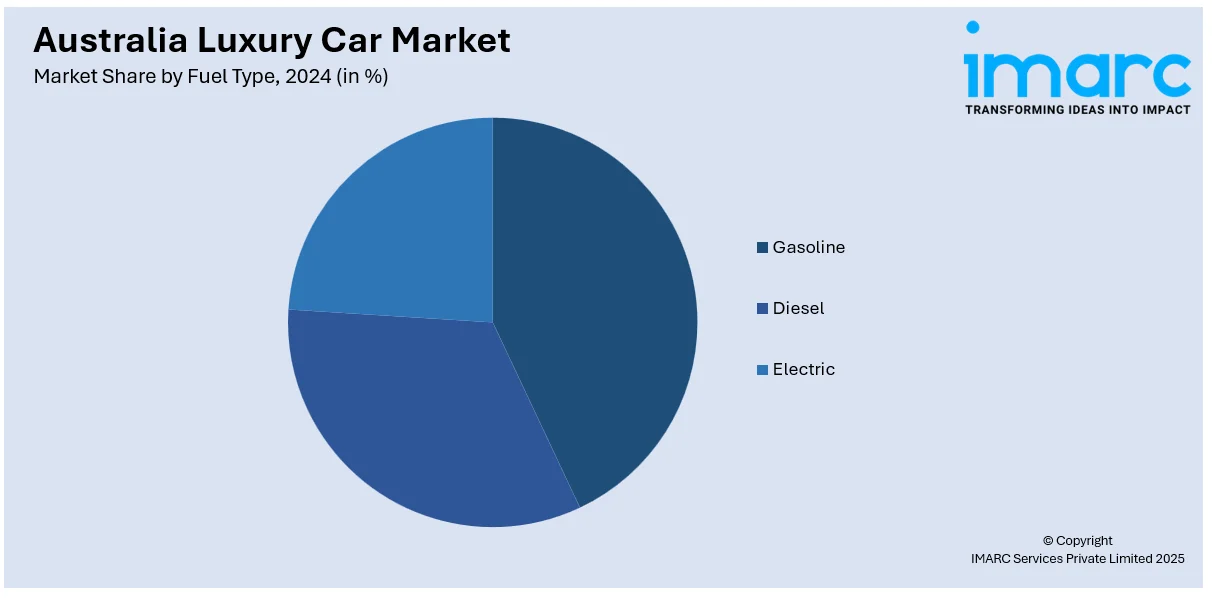

Fuel Type Insights:

- Gasoline

- Diesel

- Electric

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes gasoline, diesel, and electric.

Price Range Insights:

- Entry-Level

- Mid-Level

- High-End

- Ultra

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes entry-level, mid-level, high-end, and ultra.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Luxury Car Market News:

- In March 2025, Cadillac announced its plans to launch three luxury electric SUVs in Australia by 2026, including the Optiq and Vistiq alongside the Lyriq. Built-in North America these models feature dual-motor all-wheel drive with the Optiq offering an estimated range of 486 km and the Vistiq at 483 km.

- In October 2024, Porsche Cars Australia announced its partnership with Penske Automotive Australia to enhance the luxury automotive experience in Melbourne. Penske will take over Porsche Centre Melbourne following successful acquisitions of other dealerships. The collaboration aims to elevate customer service and innovate retail formats while preserving Porsche's legacy.

Australia Luxury Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, Sports Utility Vehicle |

| Fuel Types Covered | Gasoline, Diesel, Electric |

| Price Ranges Covered | Entry-Level, Mid-Level, High-End, Ultra |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia luxury car market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia luxury car market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia luxury car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury car market in Australia was valued at USD 9.4 Billion in 2024.

The Australia luxury car market is projected to exhibit a CAGR of 3.90% during 2025-2033.

The Australia luxury car market is projected to reach a value of USD 13.2 Billion by 2033.

The Australian luxury car market is trending toward electric and hybrid models, driven by environmental awareness and tech-savvy consumers. Sedans dominate due to performance and comfort. Personalized services, digital showrooms, and experiential retail spaces are enhancing brand engagement, while premium EVs gain traction among affluent buyers.

The growth drivers fueling the Australia luxury car market are the rising disposable incomes, expanding urban affluence, and demand for premium features. Technological innovation, government EV incentives, and flexible financing options also contribute to market growth. Strong brand presence and lifestyle shifts toward luxury and sustainability further accelerate market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)