Australia Luxury Cosmetics Market Size, Share, Trends and Forecast by Product Type, Type, Distribution Channel, End User, and Region, 2025-2033

Australia Luxury Cosmetics Market Overview:

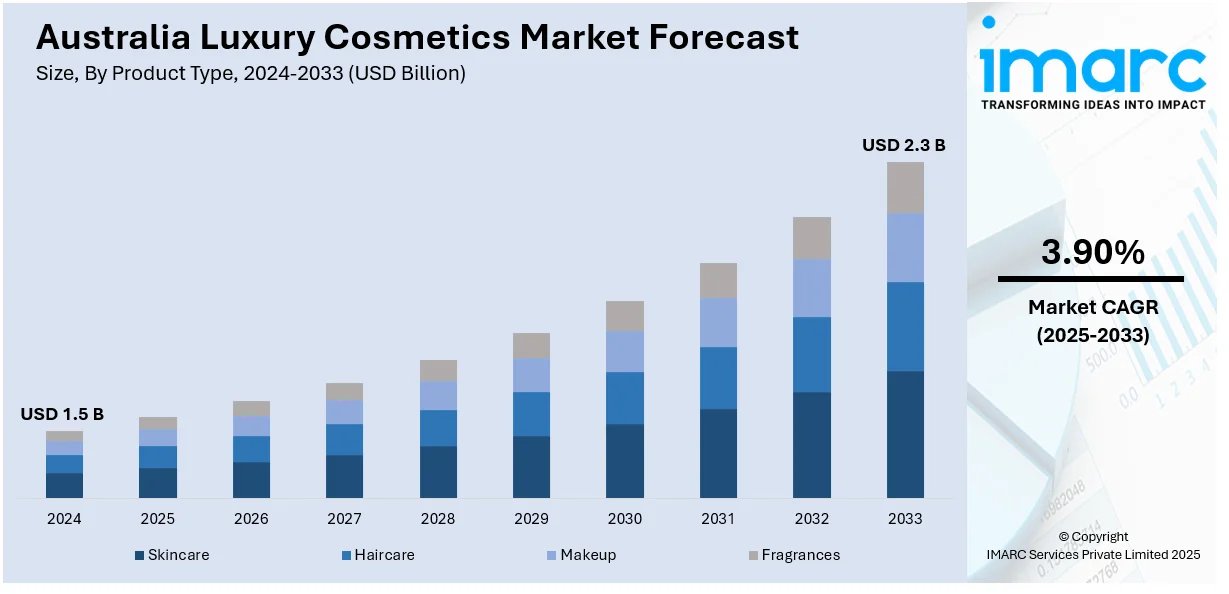

The Australia luxury cosmetics market size reached USD 1.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is driven by rising disposable incomes, increasing demand for premium skincare and beauty products, growing consumer preference for natural and sustainable ingredients, and digital marketing influence. Expanding e-commerce, celebrity endorsements, and innovation in product formulations further boost the Australia luxury cosmetics market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Market Growth Rate 2025-2033 | 3.90% |

Australia Luxury Cosmetics Market Trends:

Rising Disposable Incomes and Affluent Consumer Base

As Australia's economy strengthens, high-income consumers are increasingly investing in luxury cosmetics. People who want effective luxury beauty products choose premium skincare together with premium makeup, premium fragrances for their needs. The increasing number of Australians who can manage the cost of luxury brands now drive demand for Chanel, Dior, and La Mer products. Elite beauty products obtain prestige status while promoting self-care practices, which attracts consumers from upper income groups. Additionally, the rise of spa culture and personalized skincare solutions has further fueled demand, with consumers prioritizing high-performance products that deliver visible results, thereby creating a positive impact on the Australia luxury cosmetics market outlook. This surge in demand is also encouraging international luxury skincare brands to enter the Australian market through strategic partnerships and targeted distribution. For instance, in March 2025, Hydrinity announced its plans to launch in Australia through a partnership with Device Consulting, which will distribute the skincare line via medical professionals. This expansion is driven by an increasing demand for premium skincare among health-conscious consumers, potentially doubling the market size over the next 5 to 7 years.

To get more information on this market, Request Sample

Expansion of E-Commerce and Omnichannel Retailing

The luxury cosmetics market in Australia is thriving online, with premium brands expanding their direct-to-consumer (DTC) channels, luxury department stores, and exclusive online boutiques. E-commerce platforms like Sephora, MECCA, and brand-owned websites make high-end beauty products more accessible, which is further fueling the Australia luxury cosmetics market share. Features such as AI-driven skin care analysis, personalized recommendations, and same-day delivery services enhance the luxury shopping experience. Additionally, brands are integrating physical retail experiences with digital innovations, such as in-store virtual consultations and interactive beauty kiosks, ensuring a seamless omnichannel presence. For instance, in January 2025, Wesfarmers Health, Australia's leading beauty, health and wellness company, launched a pilot for a new beauty and wellness concept store named Atomica, intending to expand it to major cities this year. The initial store is situated in the Castle Towers shopping centre in Sydney, in an area that was previously home to a Priceline shop. Wesfarmers Health collaborated with Houston Group to create the branding and teamed up with YourStudio for the design of the first Atomica store. Atomica stores will carry various global brands, such as Bubble Skincare, Innisfree, The Ordinary, Milani, and ELF.

Australia Luxury Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, type, distribution channel, and end user.

Product Type Insights:

- Skincare

- Haircare

- Makeup

- Fragrances

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skincare, haircare, makeup, and fragrances.

Type Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes organic and conventional.

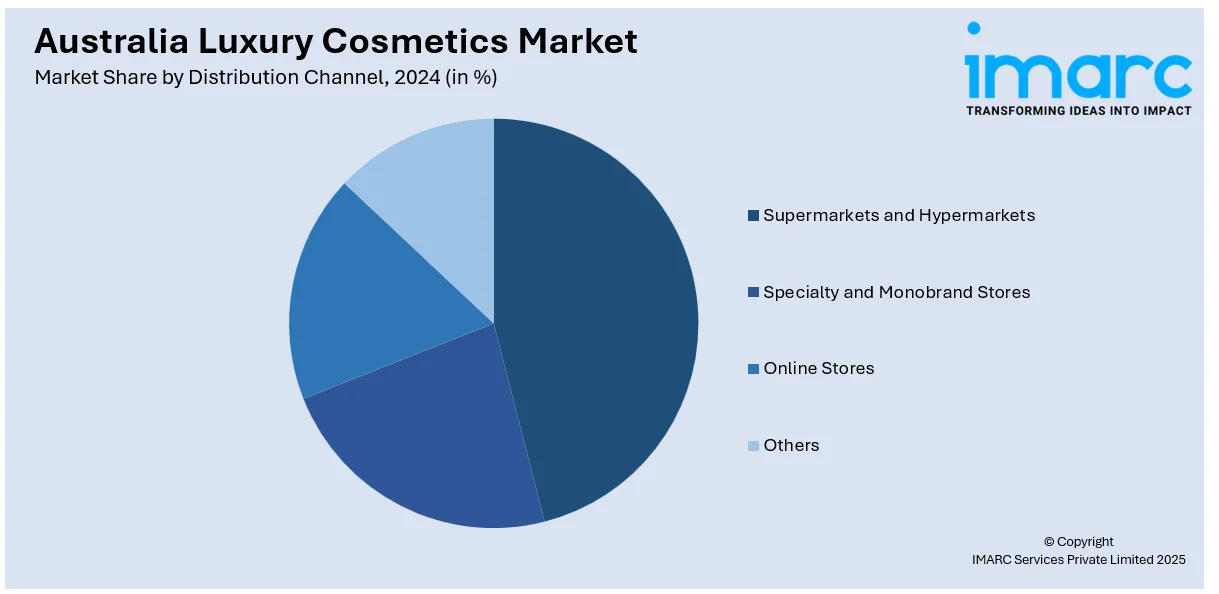

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty and Monobrand Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty and monobrand stores, online stores, and others.

End User Insights:

- Male

- Female

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes male and female.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Luxury Cosmetics Market News:

- In April 2024, The Kroger Co. announced that MCoBeauty, the fastest-growing beauty brand in Australia, will exclusively launch in the United States at Kroger Family of Stores. More than 250 skincare and cosmetic products are currently available in stores.

- In February 2025, popular Australian beauty e-tailer Adore Beauty announced its partnership with technology company Tutch on an "omnichannel" in-store integration, following the opening of its first physical store in Melbourne. The company also plans to open 25 retail locations nationwide over the next three years.

Australia Luxury Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skincare, Haircare, Makeup, Fragrances |

| Types Covered | Organic, Conventional |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty and Monobrand Stores, Online Stores, Others |

| End Users Covered | Male, Female |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia luxury cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia luxury cosmetics market on the basis of product type?

- What is the breakup of the Australia luxury cosmetics market on the basis of type?

- What is the breakup of the Australia luxury cosmetics market on the basis of distribution channel?

- What is the breakup of the Australia luxury cosmetics market on the basis of end user?

- What is the breakup of the Australia luxury cosmetics market on the basis of region?

- What are the various stages in the value chain of the Australia luxury cosmetics market?

- What are the key driving factors and challenges in the Australia luxury cosmetics market?

- What is the structure of the Australia luxury cosmetics market and who are the key players?

- What is the degree of competition in the Australia luxury cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia luxury cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia luxury cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia luxury cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)