Australia Luxury Furniture Market Size, Share, Trends and Forecast by Raw Material, Application, Distribution Channel, Design, and Region, 2025-2033

Australia Luxury Furniture Market Size and Share:

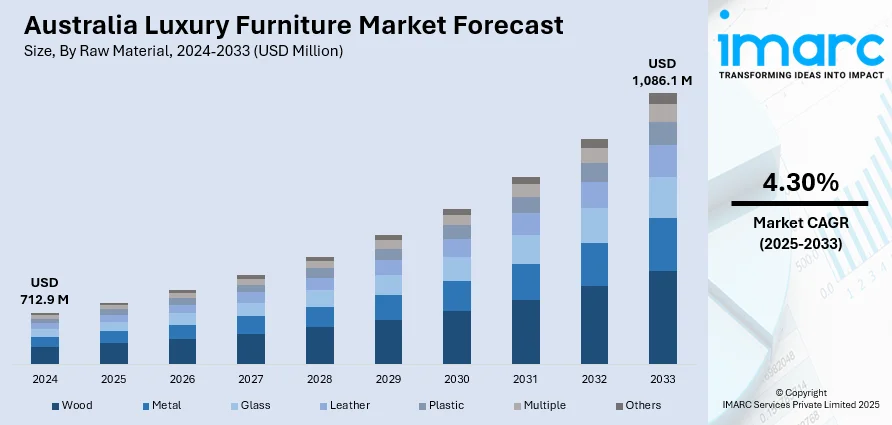

The Australia luxury furniture market size reached USD 712.9 Million in 2024. Looking forward, the market is expected the market to reach USD 1,086.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033. The market is driven by rising disposable incomes, growing demand for premium home aesthetics, and increased interest in sustainable, locally crafted designs. Urbanization and a strong housing market also fuel investment in high-end interiors, while tech integration and customization options further enhance consumer appeal across affluent demographics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 712.9 Million |

| Market Forecast in 2033 | USD 1,086.1 Million |

| Market Growth Rate 2025-2033 | 4.30% |

Key Trends of Australia Luxury Furniture Market:

Rise of Sustainable and Ethical Luxury Designs

Sustainability is becoming an increasingly important consideration for Australian consumers, including those in the luxury furniture segment. According to a 2024 report by the Australian Consumer and Retail Studies (ACRS) at Monash Business School, 46% of Australian shoppers regard sustainability as a significant factor influencing their retail purchasing decisions. This growing environmental awareness is driving demand for transparency in sourcing and production. In response, luxury furniture brands are incorporating eco-friendly materials such as FSC-certified timber, recycled metals, and organic textiles into their offerings. There's a marked shift toward craftsmanship and durability, as consumers seek timeless, long-lasting pieces instead of disposable furniture. Ethical values such as fair labor and reduced carbon footprints have become central to luxury branding. Designers in Australia are blending high-end aesthetics with environmental consciousness, positioning sustainable luxury as both a statement of style and social responsibility, enhancing brand loyalty and market appeal thus strengthening the Australia luxury furniture market growth.

To get more information on this market, Request Sample

Growing Preference for Local Artisanal Craftsmanship

There is a growing shift among Australia luxury furniture buyers toward supporting locally made, artisanal pieces that reflect national heritage and cultural identity. Consumers increasingly prefer handcrafted furniture that values tradition, tells a unique story, and incorporates native materials such as Australian timbers and stone. This movement, intensified post-pandemic, reflects a broader desire to reduce reliance on imports and champion local businesses. Designers integrating Aboriginal art, rural craftsmanship, and sustainable practices are gaining popularity. This trend aligns with the furnishing industry’s significant economic role—employing over 250,000 directly and contributing $27.4 Billion—highlighting its national impact. As a result, boutique workshops and bespoke studios are thriving, offering exclusive, high-quality furniture that blends luxury with authenticity, craftsmanship, and a strong sense of place rooted in Australia’s rich artistic and material legacy.

Integration of Technology in Premium Furniture

The convergence of luxury furniture and smart technology is gaining traction, increasing Australia luxury furniture market share. High-end consumers are seeking convenience, connectivity, and modern functionalities embedded into their living spaces. This includes features such as motorized recliners, embedded wireless chargers, smart lighting integration, and adjustable ergonomic settings. Luxury furniture brands are incorporating sensors, automation, and app-based controls to enhance user experience without compromising on aesthetics. Customization driven by technology also plays a major role, allowing clients to personalize finishes, dimensions, and tech specifications to suit lifestyle preferences. As the smart home concept becomes more mainstream, Australian luxury furniture makers are innovating to blend elegance with functionality, catering to a tech-savvy, design-conscious clientele.

Growth Drivers of Australia Luxury Furniture Market:

Expanding Affluent Consumer Base

Australia’s steadily growing base of high-net-worth individuals is significantly influencing the luxury furniture market. These consumers seek more than just functionality; they desire unique pieces that reflect status, personal style, and superior craftsmanship. With increasing disposable incomes, there is a clear shift toward premium furnishings that emphasize custom design, exclusive materials, and attention to detail. Buyers are willing to invest in high-end furniture that enhances the aesthetic and cultural value of their homes. As luxury lifestyles evolve, the demand for curated and personalized living spaces continues to rise, positioning luxury furniture as a central element in showcasing wealth, taste, and identity within Australia’s affluent residential communities.

Growth in High-End Residential Developments

The boom in Australia luxury housing market demand, including architecturally designed homes, high-end apartments, and large-scale residential renovations, is fueling demand for sophisticated furniture solutions. Homeowners are increasingly focusing on creating harmonious and elegant interiors that reflect their lifestyle and elevate their living experience. This trend drives preference for custom-made furniture that complements architectural elements and integrates seamlessly with interior aesthetics. Interior designers and developers are also partnering with premium furniture brands to outfit upscale properties, enhancing market exposure. As the line between architecture and interior design blurs, furniture is seen not only as a functional necessity but as a statement of luxury, contributing significantly to property value and visual appeal.

Globalization of Aesthetic Preferences

The Australia luxury furniture market growth is being reshaped by consumers’ growing exposure to international design influences. Through global travel, digital media, design blogs, and social platforms, consumers are increasingly drawn to European elegance, Japanese minimalism, and contemporary global styles. This trend has expanded demand for both imported furniture and locally crafted pieces inspired by global aesthetics. As modern consumers seek furnishings that blend functionality with refined design, preferences have shifted toward clean lines, artisanal finishes, and sophisticated material combinations. Luxury buyers are no longer limited to traditional styles; instead, they are curating eclectic spaces influenced by global culture, architecture, and fashion, contributing to a more diverse and dynamic luxury furniture landscape in Australia.

Opportunities of Australia Luxury Furniture Market:

Digitalization and Online Premium Retailing

The digital transformation of the luxury furniture industry in Australia is creating new growth opportunities. High-end e-commerce platforms are now equipped with advanced tools such as virtual showrooms, 3D product visualization, and AI-driven personalization to replicate the in-store experience online. These technologies allow customers to explore premium collections in detail, customize features, and visualize how pieces will fit into their spaces. The convenience of online access is particularly appealing to time-conscious, digitally savvy consumers who value both quality and experience. As a result, digital retail is not only increasing accessibility to luxury furniture but also reshaping how brands interact with customers, offering immersive, tailored journeys that enhance satisfaction and drive online custom orders.

Demand from Luxury Hospitality and Corporate Spaces

The expansion of Australia’s luxury hospitality and corporate real estate sectors is generating significant opportunities for premium furniture suppliers. High-end hotels, boutique resorts, and executive office spaces are increasingly investing in designer furnishings to elevate aesthetics and comfort for guests and clients. Developers and interior designers are seeking furniture that combines durability with elegance, making high-quality materials and timeless design essential. These commercial buyers often prefer bespoke or semi-custom solutions that align with specific brand identities and functional needs. As hospitality and office environments prioritize both luxury and practicality, demand for stylish, long-lasting furniture continues to grow, opening new channels for luxury brands beyond the traditional residential segment.

Strategic Designer Collaborations and Pop-Up Experiences

Strategic collaborations between luxury furniture brands and renowned architects or interior designers are becoming vital marketing and sales drivers in Australia. These partnerships enable brands to participate in prestigious residential and commercial projects, gaining visibility among high-end clientele. Additionally, curated pop-up showrooms and immersive retail installations allow brands to showcase their craftsmanship and design narratives in engaging, experiential settings. These temporary spaces foster direct interaction with consumers, generate media attention, and strengthen brand image. By blending artistry with exclusivity, such initiatives help luxury furniture labels stand out in a crowded market and build deeper relationships with design-conscious buyers looking for distinctive, story-rich pieces.

Challenges of Australia Luxury Furniture Market:

Import Dependency and Rising Operational Costs

Australia’s luxury furniture market remains heavily dependent on imported goods and components, making it vulnerable to global supply chain issues. High international shipping rates, customs duties, and lengthy transit times add substantial costs to operations. Additionally, fluctuating exchange rates and rising fuel prices further compress profit margins and create unpredictability in pricing and delivery schedules. These financial pressures can deter some consumers or delay projects requiring time-sensitive deliveries. Retailers and designers often face challenges in managing stock levels and ensuring the consistent availability of premium products. As operational costs escalate, luxury furniture brands may be forced to raise prices or explore alternative sourcing strategies to maintain profitability and meet rising customer expectations for quality and timeliness.

Intense Competitive Landscape

The Australian luxury furniture sector is facing intensified competition due to the entry of well-established international brands and the emergence of innovative local players. According to the Australia luxury furniture market analysis, this crowded market environment challenges businesses to distinguish themselves through more than just product quality. Factors like design originality, sustainability practices, craftsmanship, and brand storytelling have become essential for differentiation. Consumers are increasingly drawn to brands that offer authentic narratives, bespoke design solutions, or eco-conscious production methods. As choices multiply, building brand loyalty requires deeper customer engagement and consistent value delivery. To stay competitive, luxury furniture companies must continually innovate in design, refine their marketing strategies, and strengthen their unique brand identities in an oversaturated marketplace.

Shortage of Skilled Artisans and Local Expertise

Australia’s luxury furniture market is constrained by a declining number of skilled artisans capable of crafting detailed, high-end pieces. Traditional craftsmanship, which forms the backbone of many luxury offerings, is being lost due to an aging workforce and insufficient training pipelines for new talent. This shortage impacts local production capacity and limits the ability of brands to meet growing demand for custom and handmade furniture. Consequently, many businesses are increasingly dependent on international sourcing to fill this gap, which may reduce local identity and increase costs. Addressing this challenge requires renewed investment in vocational education, apprenticeship programs, and industry-led initiatives that preserve artisanal skills and encourage the next generation of expert furniture makers.

Australia Luxury Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on raw material, application, distribution channel, and design.

Raw Material Insights:

- Wood

- Metal

- Glass

- Leather

- Plastic

- Multiple

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes wood, metal, glass, leather, plastic, multiple, and others.

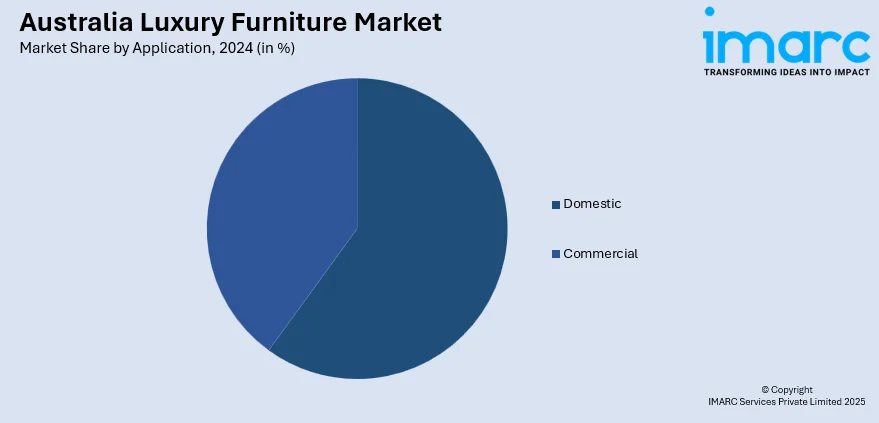

Application Insights:

- Domestic

- Living Room and Bedroom

- Kitchen

- Bathroom

- Outdoor

- Lighting

- Commercial

- Office

- Hospitality

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes domestic (living room and bedroom, kitchen, bathroom, outdoor, and lighting), and commercial (office, hospitality, and others).

Distribution Channel Insights:

- Conventional Furniture Stores

- Specialty Stores

- Online Retailers

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes conventional furniture stores, specialty stores, online retailers, and others.

Design Insights:

- Modern

- Contemporary

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes modern and contemporary.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Luxury Furniture Market News:

- In January 2025, Luxury bedmaker Vispring launched its flagship showroom in Melbourne’s upscale Armadale district, marking its official entry into the Australian market. Known for handcrafted beds made in Plymouth, Devon, Vispring blends traditional techniques with premium natural materials. The new showroom features the brand’s full sleep collection, reflecting its commitment to quality and comfort. Managing Director Martin Gill emphasized the brand’s mission to redefine sleep and enhance wellbeing through bespoke craftsmanship.

Australia Luxury Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Wood, Metal, Glass, Leather, Plastic, Multiple, Others |

| Applications Covered |

|

| Distribution Channels Covered | Conventional Furniture Stores, Specialty Stores, Online Retailers, Others |

| Designs Covered | Modern, Contemporary |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia luxury furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia luxury furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia luxury furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury furniture market in Australia was valued at USD 712.9 Million in 2024.

The Australia luxury furniture market is projected to exhibit a CAGR of 4.30% during 2025-2033.

The Australia luxury furniture market is projected to reach a value of USD 1,086.1 Million by 2033.

Key growth drivers include a rising affluent population, booming high-end residential developments, and increasing demand for bespoke interiors. Expanding luxury hospitality and corporate sectors, coupled with digital innovation and evolving lifestyle preferences, are fueling consumer appetite for premium, customized furniture solutions across Australia’s evolving home and commercial environments.

Australia's luxury furniture market is seeing a rise in personalized design, digital showroom experiences, and designer collaborations. Consumers are drawn to global aesthetics, limited-edition collections, and immersive retail. There's also a growing emphasis on sustainability, craftsmanship, and hybrid spaces blending functionality with high-end style in both residential and commercial interiors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)