Australia Machine Tools Market Size, Share, Trends and Forecast by Tool Type, Technology Type, End Use Industry, and Region, 2025-2033

Australia Machine Tools Market Overview:

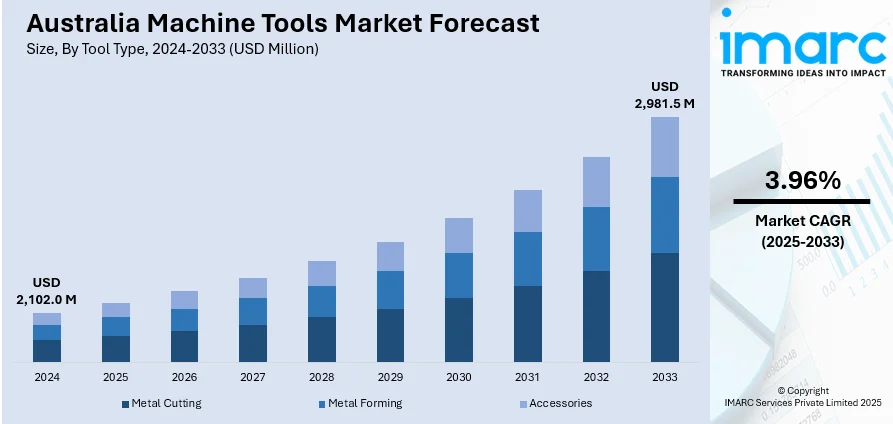

The Australia machine tools market size reached USD 2,102.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,981.5 Million by 2033, exhibiting a growth rate (CAGR) of 3.96% during 2025-2033. The market share is expanding, driven by the heightened use of industrial automation and sophisticated manufacturing technologies, strong infrastructure building and consistent investment in construction activities, and implementation of supportive government policies and fiscal incentives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,102.0 Million |

| Market Forecast in 2033 | USD 2,981.5 Million |

| Market Growth Rate 2025-2033 | 3.96% |

Australia Machine Tools Market Trends:

Industrial Automation and Advanced Manufacturing

The rising use of industrial automation and sophisticated manufacturing technologies is impelling the market growth in Australia. With local industries seeking to increase productivity, minimize operational expenses, and maintain precision in manufacturing processes, the demand for computer numerical control (CNC) and other automated machine tools is on a rise. These technologies facilitate effective mass production with less human intervention, which overcomes the issues of high labor costs and a dwindling skilled workforce. Additionally, Industry 4.0 initiatives are promoting Australian manufacturers to incorporate smart systems, sensors, and robotics into their production lines. Incorporating these technologies requires the utilization of high-performance machine tools that can effectively cater to complex and customized production demands. This trend is particularly evident in industries like automotive, chemicals, aerospace, medical devices, and defense, which are highly dependent on precision engineering and high-quality output. For instance, in 2024, Australia's national science agency, CSIRO, and Standards Australia released a new tool, HyStandards, to assist the hydrogen industry and identify the appropriate Australian and global standards for their hydrogen projects.

To get more information on this market, Request Sample

Growth in Infrastructure and Construction Projects

Australia's strong infrastructure building and consistent investment in construction activities significantly contribute to the increasing demand for machine tools. Government initiatives like the Infrastructure Investment Program have initiated massive developments in transport, energy, and public utilities. All these projects need significant applications of metal fabrication, heavy equipment servicing, and component production, all of which are reliant on sophisticated machine tools such as milling machines, lathes, and grinding systems. The mining industry, an anchor of the Australian economy, also catalyzes the demand through its never-ending requirement for equipment repair and production of substitute parts. Machine tools are of paramount importance to forming, cutting, and fitting parts necessary in construction equipment, mining equipment, and structural applications. The rising level and technological intensity of infrastructure investments also generate pressure for greater accuracy and customizations, inducing spending on high-technology machine tools. As per the data provided by the IMARC Group, the Australia construction market size will reach USD 588 Billion by 2033.

Supportive Government Policies and Incentives

Supportive government policies and fiscal incentives are driving the Australian machine tools market. Initiatives such as the Modern Manufacturing Strategy and Manufacturing Modernization Fund (MMF) are supporting domestic manufacturers that are focusing on embracing the state-of-the-art machinery and consequently enhancing their production efficiencies. Such initiatives are not just granting money and subsidies but also promoting partnerships among academia, technology providers, and manufacturers to strengthen Australia's manufacturing prowess. In addition, tax breaks like the instant asset write-off enable companies to claim a deduction for the price of qualifying machinery and equipment outright, boosting investment in new machine tools at an earlier date. These measures have been particularly useful for small and medium-sized firms (SMEs). Moreover, in 2024, prime minister Anthony Albanese revealed the government's intention to implement the Future Made in Australia Act, aimed at enhancing Australia's manufacturing industry and strengthening economic growth.

Australia Machine Tools Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on tool type, technology type, and end use industry.

Tool Type Insights:

- Metal Cutting

- Metal Forming

- Accessories

The report has provided a detailed breakup and analysis of the market based on the tool type This includes metal cutting, metal forming, and accessories.

Technology Type Insights:

- Conventional

- Computerized Numerical Control (CNC)

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes conventional and computerized numerical control (CNC).

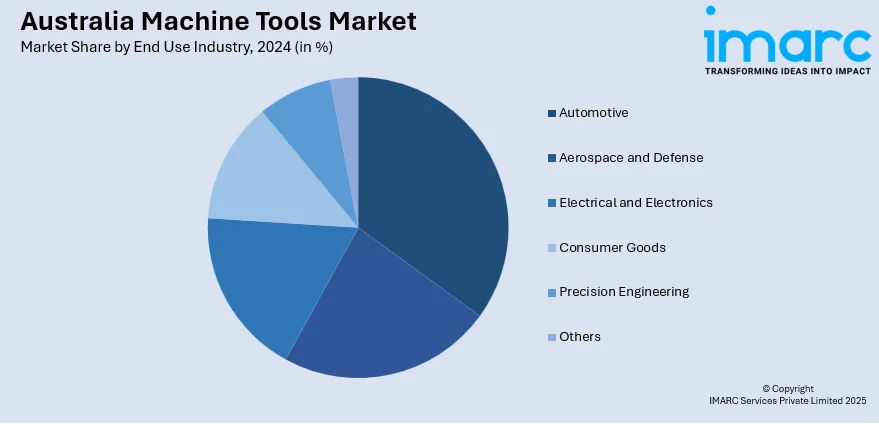

End Use Industry Insights:

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- Consumer Goods

- Precision Engineering

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, aerospace and defense, electrical and electronics, consumer goods, precision engineering, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Machine Tools Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tool Types Covered | Metal Cutting, Metal Forming, Accessories |

| Technology Types Covered | Conventional, Computerized Numerical Control (CNC) |

| End Use Industries Covered | Automotive, Aerospace and Defense, Electrical and Electronics, Consumer Goods, Precision Engineering, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia machine tools market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia machine tools market on the basis of tool type?

- What is the breakup of the Australia machine tools market on the basis of technology type?

- What is the breakup of the Australia machine tools market on the basis of end use industry?

- What is the breakup of the Australia machine tools market on the basis of region?

- What are the various stages in the value chain of the Australia machine tools market?

- What are the key driving factors and challenges in the Australia machine tools?

- What is the structure of the Australia machine tools market and who are the key players?

- What is the degree of competition in the Australia machine tools market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia machine tools market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia machine tools market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia machine tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)