Australia Managed Services Market Size, Share, Trends and Forecast by Type, Deployment Mode, Enterprise Size, End Use, and Region, 2026-2034

Australia Managed Services Market Overview:

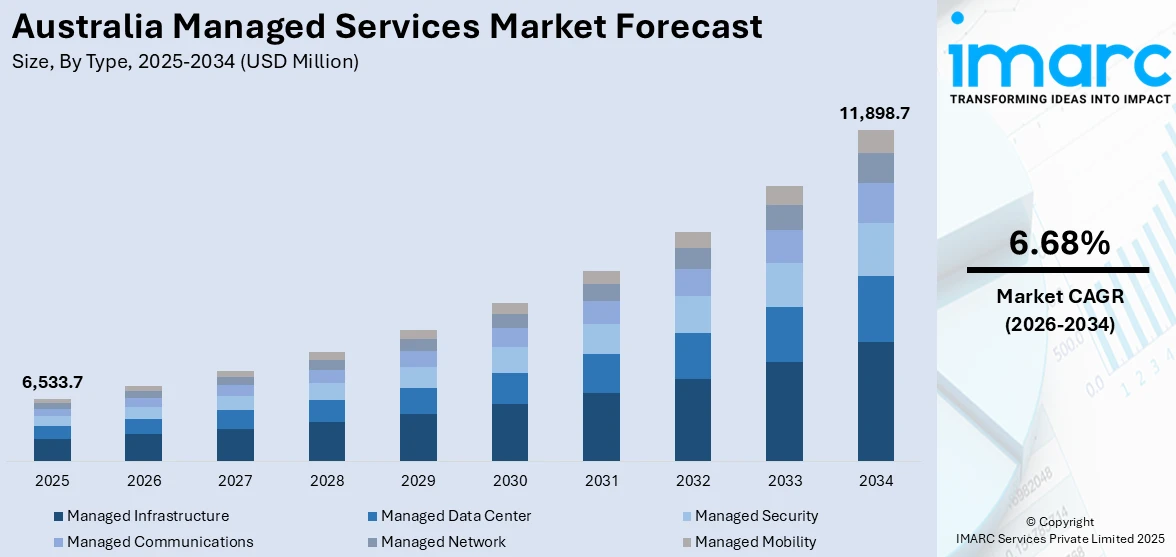

The Australia managed services market size reached USD 6,533.7 Million in 2025. Looking forward, the market is expected to reach USD 11,898.7 Million by 2034, exhibiting a growth rate (CAGR) of 6.68% during 2026-2034. The rising reliance on managed services by firms to monitor cloud performance and ensure compliance with local and international regulations is positively influencing the market. Besides this, the growing role of smartphones in customer service and remote work models is contributing to the expansion of the Australia managed services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6,533.7 Million |

| Market Forecast in 2034 | USD 11,898.7 Million |

| Market Growth Rate 2026-2034 | 6.68% |

Key Trends of Australia Managed Services Market:

Growing Adoption of Cloud Computing

The rising employment of cloud computing is fueling the market growth. As more organizations are transitioning to cloud-based systems, they are experiencing difficulties in managing the intricacies of hybrid environments, safeguarding data, and ensuring service availability. Managed service providers (MSPs) deliver customized solutions that assist businesses in addressing these challenges efficiently. Businesses depend on MSPs to oversee cloud performance, manage resources, and guarantee adherence to local and international regulations. The rising adoption of remote work arrangements is creating the need for cloud-based collaboration tools, which require continuous management and assistance. The increasing use of cloud technology is lowering capital expenses and generating a need for optimization, backups, and compatibility with current systems. MSPs step in to provide scalable and flexible services that align with changing business needs. They also aid in minimizing the burden on internal information technology (IT) teams by offering 24/7 support, disaster recovery, and data analytics. As cloud computing continues to evolve, the role of managed services is becoming more critical in helping businesses stay agile, secure, and competitive. This growing reliance on cloud computing technologies is strengthening the managed services market in Australia, especially across industries like finance, healthcare, education, and retail, where digital transformation is a top priority. According to the IMARC Group, the Australia cloud computing market is set to attain USD 30.24 Billion by 2032, exhibiting a growth rate (CAGR) of 10.60% during 2024-2032.

To get more information on this market Request Sample

Increasing Smartphone Penetration

Rising smartphone penetration is impelling the Australia managed services market growth. As per industry reports, Australia's smartphone market made a strong recovery in the first half of 2024, with sales rising 8% compared to 2023, reaching 3.98 Million units. As employees and people are using smartphones for work, communication, and transactions, businesses rely on managed service providers (MSPs) to maintain mobile security, ensure data privacy, and support device integration. Organizations across sectors are adopting mobile-friendly applications and communication platforms, which require constant monitoring and maintenance. MSPs offer solutions that manage mobile access, updates, and user support, ensuring smooth performance and compliance with security policies. With the rise of bring your own device (BYOD) practices, the complexity of managing multiple smartphones in workplace environments is increasing. MSPs help businesses execute security protocols, protect sensitive information, and avoid cyber threats linked to mobile use. They also provide real-time troubleshooting and performance tracking to minimize disruptions. The growing role of smartphones in customer service is further catalyzing the demand for managed mobility services.

Growth Drivers of Australia Managed Services Market:

Growing Digital Transformation Initiatives

Organizations across Australia are accelerating their digital transformation journeys, driving substantial demand for managed services. Firms are moving traditional systems to cloud infrastructure, deploying sophisticated analytics, and embracing artificial intelligence solutions to compete. This transformation requires specialized expertise that many organizations lack internally, creating opportunities for MSPs to provide consulting, implementation, and ongoing management services. The market study indicates that companies are increasingly outsourcing sophisticated IT functions to concentrate on core activities. MSPs provide end-to-end support for digital projects, such as system integration, data migration, and security management, allowing organizations to realize their transformational objectives with reduced risks and decreased operational complexity.

Rising Cybersecurity Threats and Compliance Requirements

The escalating cyber threat landscape and stringent regulatory requirements are significantly propelling the Australia managed services market demand. The organizations are under growing pressure to ensure relevant and sensitive information safety, business continuity, and adherence to the changing regulations, including the Australian Privacy Principles and business-specific regulations. MSPs offer cybersecurity services that are highly specialized, such as threat monitoring, incident response, vulnerability management, and compliance auditing. The services provide affordable access to superior security solutions and highly skilled employees that would otherwise be costly to keep domestically. Additionally, MSPs stay current with emerging threats and regulatory changes, ensuring their clients maintain robust security postures and achieve compliance without significant internal resource investments.

Skills Shortage in IT and Technology Sectors

Australia faces a critical shortage of skilled IT professionals, particularly in specialized areas such as cloud computing, cybersecurity, and data analytics. According to the Australia managed services market analysis, this talent gap is driving organizations to partner with MSPs that possess deep expertise and experienced personnel. MSPs offer access to specialized skills that are difficult and expensive to recruit and retain internally. They provide ongoing training and development for their teams, ensuring clients benefit from the latest industry knowledge and certifications. The market indicates that this skills shortage is particularly acute in regional areas, where MSPs can bridge the gap by providing remote services and on-site support when needed, enabling organizations to access enterprise-level expertise regardless of their location.

Australia Managed Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, deployment mode, enterprise size, and end use.

Type Insights:

- Managed Infrastructure

- Managed Data Center

- Managed Security

- Managed Communications

- Managed Network

- Managed Mobility

The report has provided a detailed breakup and analysis of the market based on the type. This includes managed infrastructure, managed data center, managed security, managed communications, managed network, and managed mobility.

Deployment Mode Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

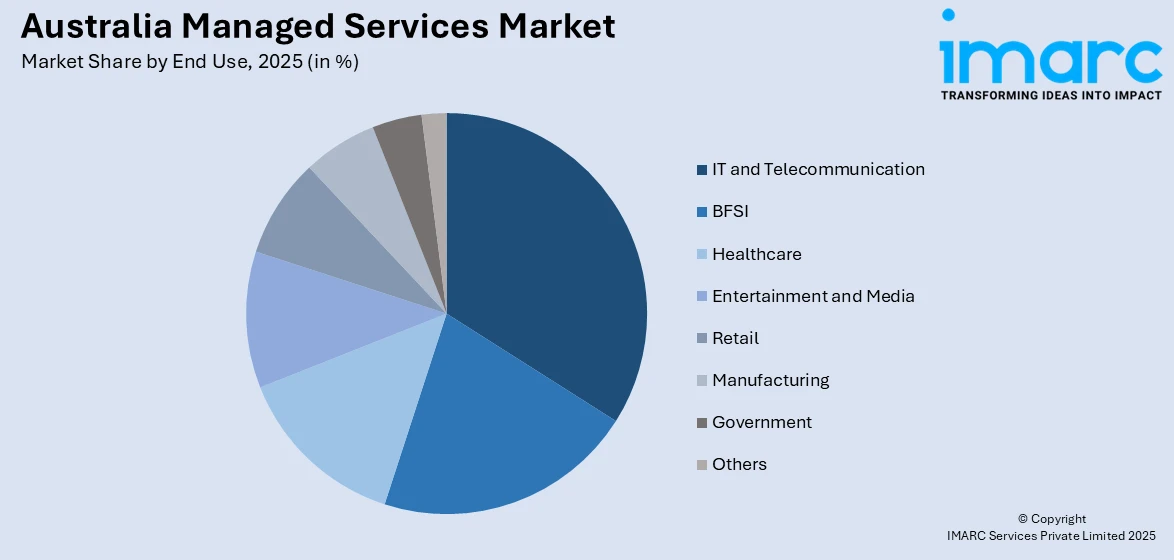

End Use Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecommunication

- BFSI

- Healthcare

- Entertainment and Media

- Retail

- Manufacturing

- Government

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes IT and telecommunication, BFSI, healthcare, entertainment and media, retail, manufacturing, government, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Managed Services Market News:

- In November 2024, Consilio, a prominent leader in legal tech solutions and enterprise legal services, revealed the launch of two new data centers in Sydney and Melbourne, finalizing the expansion of its top-tier eDiscovery services to the Australian market. The company supported worldwide law firms and corporations with cutting-edge software, affordable managed services, and extensive legal and regulatory industry knowledge. It aimed to broaden its complete range of services in the country.

- In March 2024, AUCloud, the well-known Australian sovereign cloud provider, introduced various MSP security services to assist customers in navigating a quickly changing regulatory landscape. The three managed services offerings included- ‘Microsoft 365 Protection & Backup, Fundamental Cyber Security Protection, and Advanced Cyber Security Protection’.

Australia Managed Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Managed Infrastructure, Managed Data Center, Managed Security, Managed Communications, Managed Network, Managed Mobility |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Uses Covered | IT and Telecommunication, BFSI, Healthcare, Entertainment and Media, Retail, Manufacturing, Government, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia managed services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia managed services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia managed services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The managed services market in Australia was valued at USD 6,533.7 Million in 2025.

The Australia managed services market is projected to exhibit a CAGR of 6.68% during 2026-2034.

The Australia managed services market is projected to reach a value of USD 11,898.7 Million by 2034.

The market is driven by growing cloud computing adoption, increasing smartphone penetration for business applications, rising cybersecurity requirements, and digital transformation initiatives across industries. Enhanced demand for compliance management and 24/7 monitoring services further accelerates growth across diverse sectors.

The Australia managed services market is driven by escalating cybersecurity threats requiring specialized protection, critical IT skills shortages, and increasing regulatory compliance demands. Cloud migration needs and cost optimization pressures further propel demand for comprehensive managed services solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)