Australia Maritime Freight Market Size, Share, Trends and Forecast by Transport Type, Application, and Region, 2025-2033

Australia Maritime Freight Market Overview:

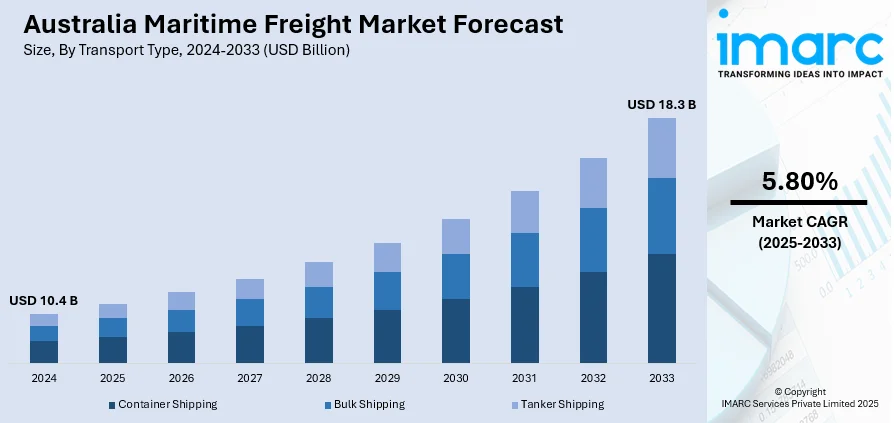

The Australia maritime freight market size reached USD 10.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is driven by increasing trade volumes, technological advancements, and infrastructure improvements. A growing demand for efficient transportation of goods, along with investments in green technologies, is boosting the market. The expansion of Australia’s ports and logistics services contributes to its strong Australia maritime freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.4 Billion |

|

Market Forecast in 2033

|

USD 18.3 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Maritime Freight Market Trends:

Growing Demand for Sustainable Shipping

As environmental problems grow, there is immense pressure in reducing carbon emissions in shipping. Australia's shipping industry is focusing on greener sources of energy, such as LNG-powered ships, to meet global environmental standards. The sector is witnessing greener means of shipping, such as developing energy-efficient ships and using renewable sources of energy at terminals. In addition, emission-cutting policies and regulations are also compelling companies to adopt green practices and technology. This is in sync with world sustainability objectives, making Australia a pioneer in sustainable maritime freight transport, boosting the Australia maritime freight market growth. For instance, in March 2024, Australia and Singapore formally agreed to collaborate on creating a green and digital shipping corridor between the two nations. The memorandum of understanding (MoU) was signed by the federal transport ministries of both countries during the ninth Australia-Singapore Annual Leaders' Meeting. The MoU outlines plans to explore the development of zero or near-zero GHG emission fuel supply chains for the maritime sector.

To get more information on this market, Request Sample

Expansion of Ports and Infrastructure Investments

Australia's maritime freight market is benefiting from significant investments in port infrastructure. For instance, in May 2024, Western Australia revealed plans to allocate $246 million from its 2024-2025 budget for enhancing port infrastructure. Major Australian ports like Port of Melbourne and Port Botany are in expansion and upgrading processes to support expanded vessels and boost throughput capacity. These upgrades are increasing the capacity of the country to manage increasing international trade. In addition, infrastructure projects like improved rail and road links to ports are making inland transportation of cargo smoother, resulting in an integrated logistics system. Consequently, the Australia maritime freight market will continue to grow, with improved port efficiency and greater access to global shipping routes supporting its growing share of the market.

Australia Maritime Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on transport type and application.

Transport Type Insights:

- Container Shipping

- Bulk Shipping

- Tanker Shipping

The report has provided a detailed breakup and analysis of the market based on the transport type. This includes container shipping, bulk shipping, and tanker shipping.

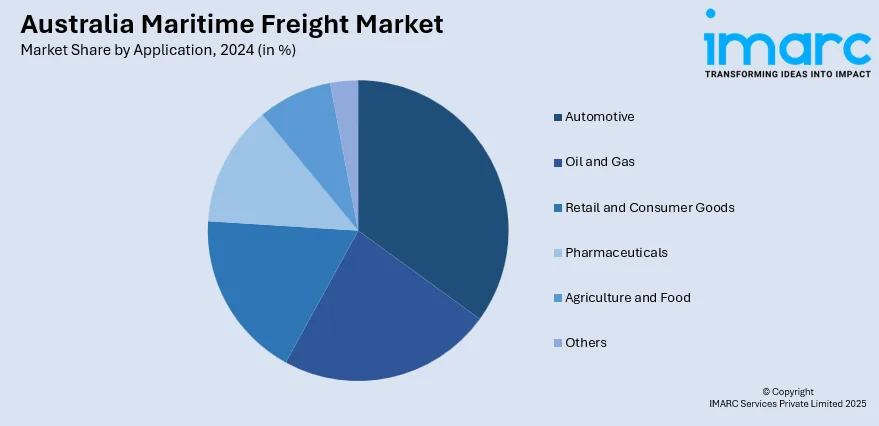

Application Insights:

- Automotive

- Oil and Gas

- Retail and Consumer Goods

- Pharmaceuticals

- Agriculture and Food

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, oil and gas, retail and consumer goods, pharmaceuticals, agriculture and food, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Maritime Freight Market News:

- In June 2025, the Global Ro-Ro Community, under Smart Freight Centre, developed guidelines to calculate GHG emission intensity for car carriers and similar vessels. This standard method helps measure Scope 3 emissions and promotes decarbonization in shipping. The guidelines align with ISO 14083 and GLEC frameworks, advancing environmental transparency.

- In January 2025, Svitzer and Höegh Autoliners partnered to introduce Australia’s first-ever low-carbon towage service, using Svitzer’s EcoTow solution. This service supports the largest and most eco-friendly car-carrier vessel, the Höegh Aurora, and aims to significantly reduce CO2 emissions in maritime operations. The partnership highlights progress in maritime decarbonization efforts.

Australia Maritime Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transport Types Covered | Container Shipping, Bulk Shipping, Tanker Shipping |

| Applications Covered | Automotive, Oil and Gas, Retail and Consumer Goods, Pharmaceuticals, Agriculture and Food, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia maritime freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia maritime freight market on the basis of transport type?

- What is the breakup of the Australia maritime freight market on the basis of application?

- What is the breakup of the Australia maritime freight market on the basis of region?

- What are the various stages in the value chain of the Australia maritime freight market?

- What are the key driving factors and challenges in the Australia maritime freight market?

- What is the structure of the Australia maritime freight market and who are the key players?

- What is the degree of competition in the Australia maritime freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia maritime freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia maritime freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia maritime freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)