Australia Maritime Logistics Market Size, Share, Trends and Forecast by Service Type, Application, Mode of Transport, End-User, and Region, 2025-2033

Australia Maritime Logistics Market Size and Growth :

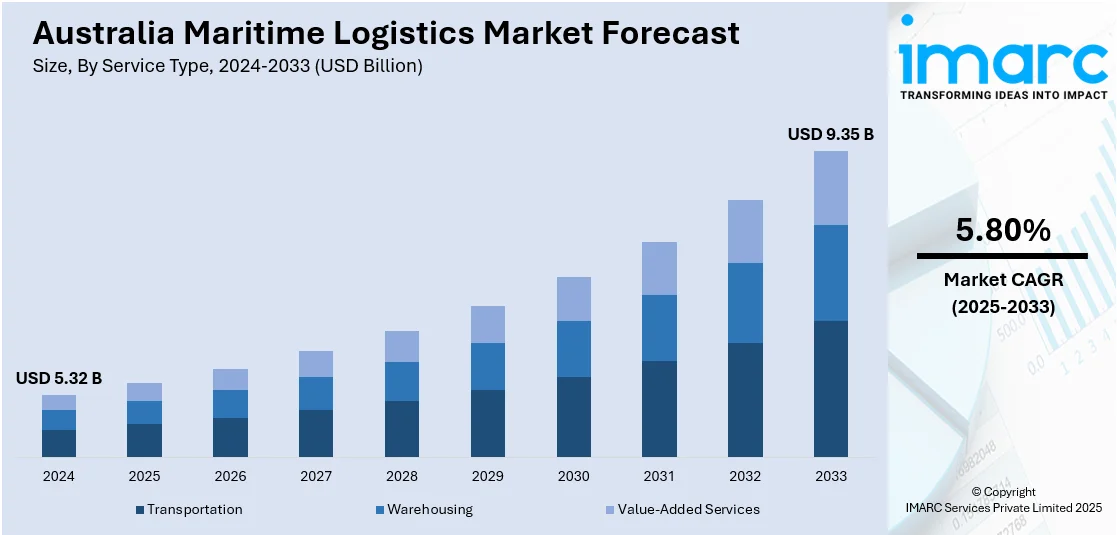

The Australia maritime logistics market size reached USD 5.32 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.35 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. Government funding for workforce training enhances efficiency, ensuring a skilled labor force to support the growing maritime logistics market and global trade needs. Additionally, the rise in e-commerce, which requires faster, reliable shipping solutions, is encouraging investments in port infrastructure and logistics services and contributing to the expansion of the Australia maritime logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.32 Billion |

| Market Forecast in 2033 | USD 9.35 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Maritime Logistics Market Trends:

Growing Popularity of E-Commerce Channels

With an increasing number of individuals opting for online shopping, the demand for efficient sea transportation of goods is on the rise. This shift in user habits is driving the demand for faster, more reliable shipping options, which are essential for meeting the expectations of buyers who now expect faster delivery. The Australian e-commerce market had a valuation of USD 536.0 billion in 2024 and is expected to expand at a compound annual growth rate (CAGR) of 12.70%, arriving at USD 1,568.60 billion by 2033. This rapid increase in e-commerce sales directly influences the maritime logistics industry, encouraging investments in port facilities and shipping services. The growth of online retail is leading to an increase in containerized shipping, as the rising volume of imported products requires more advanced and improved port infrastructure. As a result, maritime logistics firms are adjusting by improving their shipping capabilities and refining supply chain management to meet the growing demand. Additionally, the growth of e-commerce underscores the need for efficient last-mile delivery options, driving the creation of advanced logistics frameworks to facilitate quick distribution networks.

To get more information on this market, Request Sample

Government Investment in Workforce Development

A crucial factor influencing the Australia maritime logistics market growth is the government's funding aimed at addressing workforce shortages in the industry. In 2025, the Australian Government allocated $16.9 million to address this issue, with a focus on specialized training, apprenticeships, and upskilling initiatives for maritime employees. This effort is vital for improving the effectiveness and durability of the maritime supply chain. The governing body aims to enable Australian ports, shipping firms, and logistics operators to effectively address the increasing needs of global trade by providing the workforce with enhanced skills and knowledge. A skilled workforce is essential for managing advanced technologies, maintaining complex logistics systems, and efficiently processing an increasing volume of goods. Additionally, the investment helps mitigate the effects of labor shortages, which can often lead to operational delays and inefficiencies. A more skilled and stronger workforce enables Australian maritime firms to enhance their global competitiveness, embrace new technologies, and provide quicker, more dependable services. Government assistance is crucial in developing a sustainable and effective workforce capable of meeting the growing maritime logistics market's needs, thereby guaranteeing long-term advancement and stability for the industry.

Australia Maritime Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, application, mode of transport, and end-user.

Service Type Insights:

- Transportation

- Warehousing

- Value-Added Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, warehousing, and value-added services.

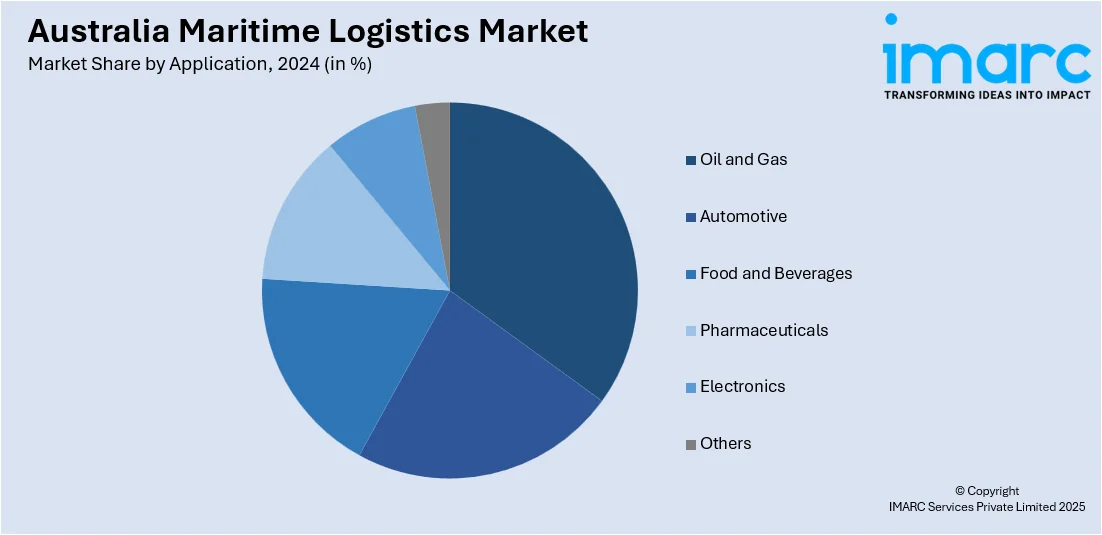

Application Insights:

- Oil and Gas

- Automotive

- Food and Beverages

- Pharmaceuticals

- Electronics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, automotive, food and beverages, pharmaceuticals, electronics, and others.

Mode of Transport Insights:

- Sea

- Inland Waterways

The report has provided a detailed breakup and analysis of the market based on the mode of transport. This includes sea and inland waterways.

End-User Insights:

- Commercial

- Industrial

- Government

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes commercial, industrial, and government.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Maritime Logistics Market News:

- In May 2025, NORDEN signed its first port logistics project in Australia with Kimberley Metals Group (KMG), enhancing their existing partnership. The project involves transshipment operations at the Port of Wyndham, loading iron ore from port to ocean-going vessels. It marks NORDEN’s strategic expansion into integrated logistics services in Australia.

- In February 2025, the Onslow Iron transhipping operation ramp-up by MinRes is revolutionizing Western Australia's iron ore exports through a 35M-tonne offshore system located 40 km from the coast. This innovative method uses high-capacity transhippers and automated logistics to boost efficiency and minimize environmental impact.

Australia Maritime Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Warehousing, Value-Added Services |

| Applications Covered | Oil and Gas, Automotive, Food and Beverages, Pharmaceuticals, Electronics, Others |

| Mode of Transports Covered | Sea, Inland Waterways |

| End-Users Covered | Commercial, Industrial, Government |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia maritime logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia maritime logistics market on the basis of service type?

- What is the breakup of the Australia maritime logistics market on the basis of application?

- What is the breakup of the Australia maritime logistics market on the basis of mode of transport?

- What is the breakup of the Australia maritime logistics market on the basis of end-user?

- What is the breakup of the Australia maritime logistics market on the basis of region?

- What are the various stages in the value chain of the Australia maritime logistics market?

- What are the key driving factors and challenges in the Australia maritime logistics market?

- What is the structure of the Australia maritime logistics market and who are the key players?

- What is the degree of competition in the Australia maritime logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia maritime logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia maritime logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia maritime logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)