Australia Masterbatch Market Size, Share, Trends and Forecast by Type, Polymer Type, Application, and Region, 2026-2034

Australia Masterbatch Market Summary:

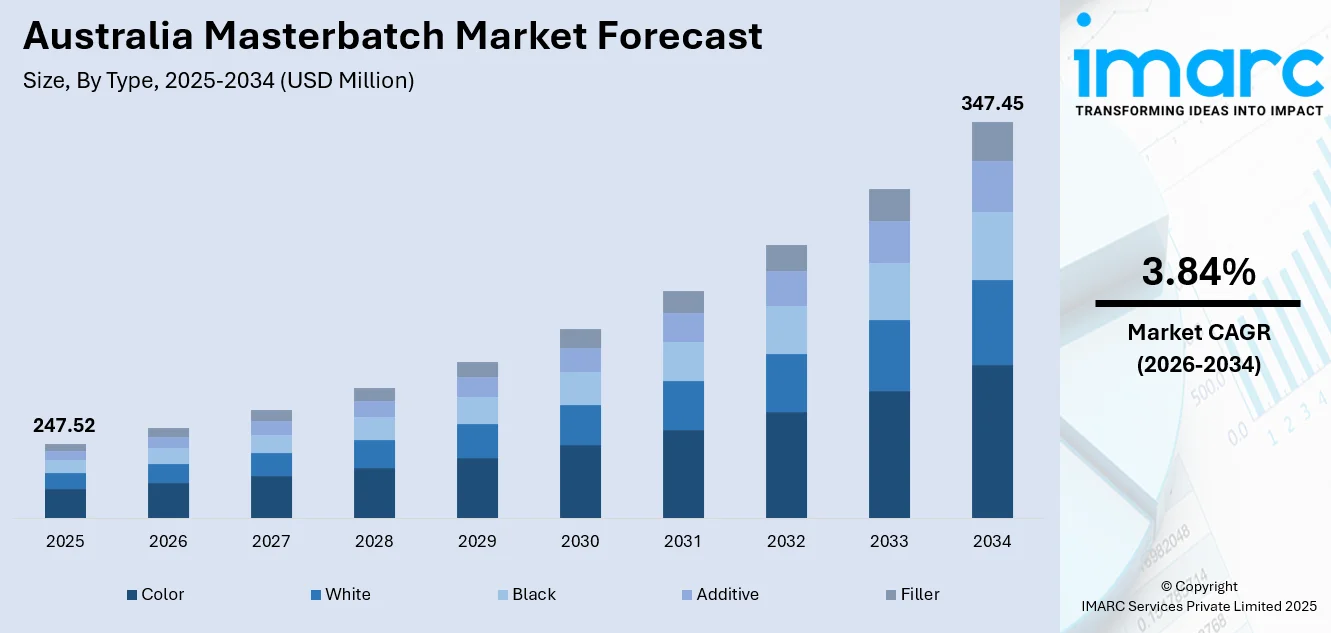

The Australia masterbatch market size was valued at USD 247.52 Million in 2025 and is projected to reach USD 347.45 Million by 2034, growing at a compound annual growth rate of 3.84% from 2026-2034.

The Australia masterbatch market is experiencing steady expansion, driven by the growing demand for high-performance plastics across the packaging, automotive, construction, and consumer goods sectors. Rising emphasis on product aesthetics, functional additives, and sustainable material solutions is reshaping industry dynamics. Advancements in polymer processing technologies and increasing adoption of lightweight, durable materials continue to strengthen market momentum nationwide.

Key Takeaways and Insights:

- By Type: Color dominates the market with a share of 43% in 2025, owing to the widespread demand for visually appealing packaging and consumer products. Rising brand differentiation requirements and customization trends are fueling segment expansion.

- By Polymer Type: PP leads the market with a share of 30% in 2025, driven by its cost-effectiveness, excellent mechanical properties, and widespread applications in packaging, automotive components, and household goods manufacturing.

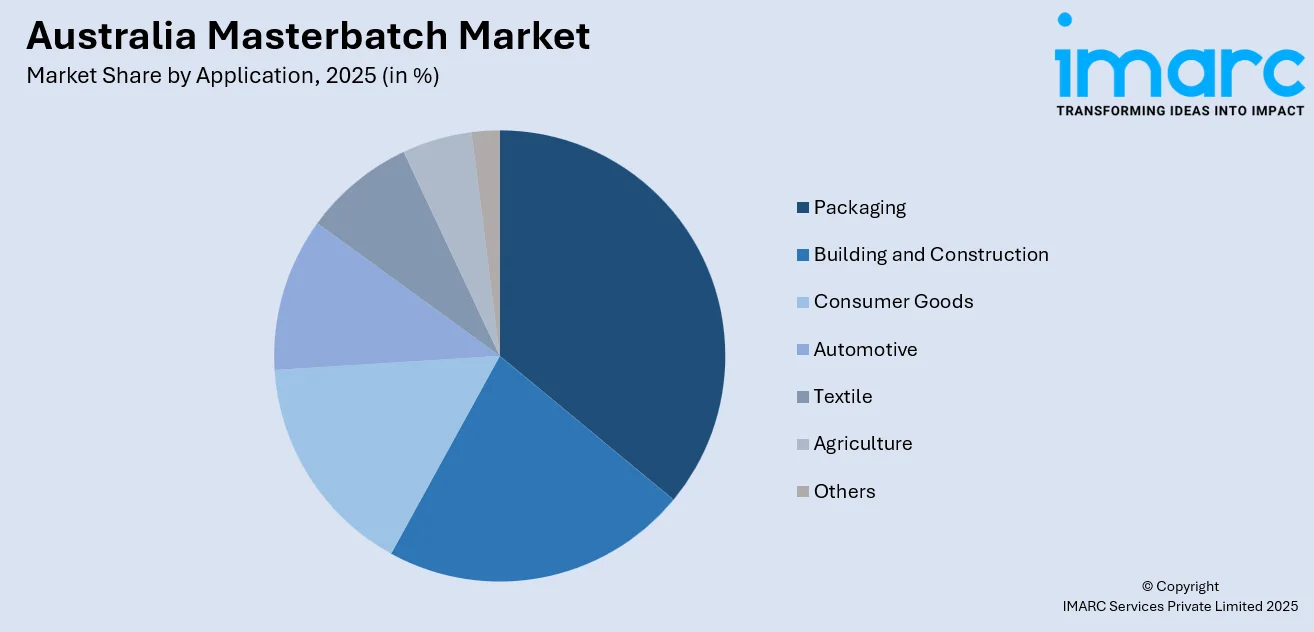

- By Application: Packaging comprises the largest segment with a market share of 35% in 2025, reflecting strong demand for flexible and rigid packaging solutions across the food, beverage, pharmaceutical, and e-commerce industries throughout Australia.

- By Region: Australia Capital Territory & New South Wales represents the largest region with 30% share in 2025, driven by concentrated manufacturing activities, diverse industrial base, and significant urban consumption patterns in Sydney and surrounding areas.

- Key Players: Key players drive the Australia masterbatch market by expanding product portfolios, improving color consistency and additive technologies, and strengthening nationwide distribution. Their investments in sustainable formulations, recycling-compatible solutions, and technical support boost industry adoption.

The Australia masterbatch market is advancing, as manufacturers, converters, and end users embrace enhanced polymer solutions for diverse industrial applications. Growing consumer preferences for visually distinctive packaging and functionally superior plastic products are accelerating demand across key sectors. The construction industry remains a significant contributor, supported by the Australian government’s commitment of USD 16.5 Billion for new and existing infrastructure projects in the 2024-25 Federal Budget, creating robust demand for durable plastic materials in pipes, fittings, and building components. Additionally, the packaging sector continues to evolve with heightened focus on sustainable materials and circular economy principles. Rising automotive lightweighting trends and expanding agricultural film applications further strengthen market prospects. As industries prioritize efficiency, aesthetics, and environmental responsibility, masterbatch solutions delivering color consistency, ultraviolet (UV) protection, and performance enhancement remain essential for achieving competitive advantages across Australia's diverse manufacturing landscape.

Australia Masterbatch Market Trends:

Rising Demand for Sustainable and Recycled-Content Masterbatches

Sustainability expectations are driving manufacturers towards biodegradable plastics, recycled-content materials, and eco-friendly additives. The Australian Packaging Covenant Organisation (APCO) established 2025 targets prescribing that 70% of plastic packaging should be recycled or composted and 50% of new plastic packaging should contain recycled material, driving innovations in masterbatch formulations. Bio-based masterbatches, non-toxic pigments, and recycled polymer-compatible formulations support Australia's circular economy objectives. These sustainability-driven innovations are enabling manufacturers to meet regulatory requirements while appealing to environmentally conscious consumers and brand commitments to greener packaging solutions.

Growing Adoption of High-Performance Functional Additives

Industries, including agriculture, construction, electronics, and automotive, require advanced properties, such as UV protection, fire resistance, conductivity, and antimicrobial performance. Additives like flame retardants, anti-static agents, slip additives, UV absorbers, and antioxidant packages are becoming essential in transportation materials, agricultural films, and industrial components. These functional masterbatches enable the market growth in Australia by broadening applications and delivering value-added solutions for demanding environments. Manufacturers increasingly rely on these specialized masterbatches to enhance product durability, safety, and performance, driving innovations and adoption across diverse industrial sectors in Australia.

Expansion of Color Customization and Branding Solutions

Brand differentiation requirements are accelerating demand for customized color masterbatch solutions across the consumer goods and packaging sectors. Manufacturers seek precise color matching, special effects including metallic and pearlescent finishes, and consistent batch-to-batch quality. Advanced color formulation technologies enable producers to deliver tailored solutions meeting specific aesthetic requirements while maintaining processing efficiency and regulatory compliance for food-contact and medical device applications. These capabilities allow brands to strengthen market positioning and create visually distinctive products that resonate with consumer preferences.

Market Outlook 2026-2034:

The Australia masterbatch market demonstrates promising growth prospects, driven by expanding end-use industries and evolving material requirements. Rising construction activities are creating sustained demand for plastic materials, incorporating specialized masterbatch formulations. The packaging sector continues to hold significant market consumption, with flexible and rigid packaging applications benefiting from e-commerce expansion and changing consumer preferences. The market generated a revenue of USD 247.52 Million in 2025 and is projected to reach a revenue of USD 347.45 Million by 2034, growing at a compound annual growth rate of 3.84% from 2026-2034. Automotive lightweighting trends, agricultural sector modernization, and increasing emphasis on sustainable materials position the market for continued expansion throughout the forecast period.

Australia Masterbatch Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Color |

43% |

|

Polymer Type |

PP |

30% |

|

Application |

Packaging |

35% |

|

Region |

Australia Capital Territory & New South Wales |

30% |

Type Insights:

- Color

- White

- Black

- Additive

- Filler

Color dominates with a market share of 43% of the total Australia masterbatch market in 2025.

Color continues to drive the Australia masterbatch market, as industries prioritize product differentiation and visual appeal across consumer goods, packaging, and automotive applications. The segment benefits from rising brand owner requirements for precise color matching, customization capabilities, and consistent batch-to-batch quality. Manufacturers increasingly demand special effects, including metallic, pearlescent, and fluorescent finishes, to enhance product aesthetics and market positioning. This focus on visual appeal also encourages collaboration between masterbatch suppliers and designers to create unique, brand-aligned color palettes that stand out in competitive markets.

Advanced color formulation technologies enable producers to deliver tailored solutions meeting specific requirements while maintaining processing efficiency. The packaging industry represents a significant end use market, where color masterbatches enhance product visibility and shelf appeal. Australian manufacturers are responding to e-commerce growth by developing vibrant, fade-resistant color solutions for diverse packaging formats. These innovations also support sustainable packaging initiatives by integrating recycled polymers without compromising color consistency or quality.

Polymer Type Insights:

- PP

- LDPE/LLDPE

- HDPE

- PVC

- PUR

- PET

- PS

- Others

PP leads with a share of 30% of the total Australia masterbatch market in 2025.

PP maintains market leadership, driven by excellent mechanical properties, cost-effectiveness, and broad application compatibility across packaging, automotive, and consumer goods sectors. The Australia PP market was valued at USD 2.3 Billion in 2024 and is projected to reach USD 3.2 Billion by 2033, indicating sustained demand growth. PP masterbatches offer superior dispersion characteristics, processing flexibility, and compatibility with diverse additive formulations. Automotive manufacturers increasingly adopt PP-based masterbatches for interior components, bumpers, and under-hood applications requiring lightweight, durable materials.

The packaging industry represents a dominant consumer of PP masterbatches, utilizing these formulations for food containers, bottle caps, and flexible packaging applications. PP's chemical resistance, recyclability, and moisture barrier properties enhance its appeal for demanding packaging requirements. Australian manufacturers benefit from PP's versatility in injection molding, blow molding, and film extrusion processes, enabling efficient production of diverse finished products across multiple industries. Ongoing innovations in PP formulations, including impact-modified and high-clarity grades, are further expanding its adoption across premium packaging and specialized automotive applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging

- Building and Construction

- Consumer Goods

- Automotive

- Textile

- Agriculture

- Others

Packaging exhibits a clear dominance with a 35% share of the total Australia masterbatch market in 2025.

Packaging drives the Australia masterbatch market, consuming substantial volumes of color, additive, and white masterbatch formulations across the food, beverage, pharmaceutical, and e-commerce sectors. The Recycling Modernization Fund initiative aims to increase Australia's recycling capacity by more than 1 Million Tons annually while creating over 3,000 jobs, supporting circular economy transitions in packaging. Flexible packaging formats, including pouches, wraps, and films, benefit from masterbatch solutions delivering barrier properties, UV protection, and aesthetic appeal. Rigid packaging applications utilize masterbatches for consistent coloration and performance enhancement.

Rising e-commerce penetration accelerates demand for durable, visually appealing packaging solutions incorporating advanced masterbatch technologies. Australian brand owners increasingly specify sustainable masterbatch formulations compatible with recycling streams and containing recycled content. Innovations in biodegradable and compostable masterbatches are supporting the shift towards eco-friendly packaging solutions. Specialty masterbatches with anti-microbial and anti-fog properties are gaining traction in food and pharmaceutical packaging. Additionally, manufacturers are investing in high-performance UV-stable and impact-resistant masterbatches to ensure product integrity during transportation and storage.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represents the leading segment with a 30% share of the total Australia masterbatch market in 2025.

Australia Capital Territory & New South Wales dominates the masterbatch market, owing to diversified industrial base and substantial urban consumption patterns centered around Sydney metropolitan area. The region hosts major manufacturing facilities across the automotive, packaging, consumer goods, and electronics sectors, which rely heavily on masterbatch formulations for color, additives, and performance enhancement. Advanced industrial clusters in and around Sydney benefit from proximity to ports and logistics hubs, ensuring efficient supply chain operations for raw materials and finished products.

The presence of research institutions and polymer technology centers supports innovations in specialty and sustainable masterbatches, enabling local manufacturers to meet evolving industry requirements. Strong urban demand, coupled with adoption of modern production technologies, continues to reinforce Australia Capital Territory & New South Wales as the primary regional hub for masterbatch consumption and technological advancement in Australia. Collaborations between industry players and government initiatives further strengthen the region’s position, fostering skill development, sustainable practices, and enhanced competitiveness in the masterbatch sector.

Market Dynamics:

Growth Drivers:

Why is the Australia Masterbatch Market Growing?

Expanding Packaging Industry and E-Commerce Growth

The packaging sector remains the primary growth driver for the Australia masterbatch market, with rising demand from the food, beverage, pharmaceutical, and e-commerce industries. Masterbatch solutions enhance packaging functionality through color consistency, UV protection, barrier properties, and aesthetic appeal. Growing e-commerce penetration accelerates demand for durable, visually distinctive packaging solutions. As per IMARC Group, the Australia e-commerce market size was valued at USD 604.1 Billion in 2025. Flexible packaging formats, including stand-up pouches, laminated films, and shrink wraps, increasingly incorporate specialized masterbatch formulations. Brand differentiation requirements drive adoption of custom color matching and special effect masterbatches across consumer goods packaging applications. Sustainability considerations are further boosting demand for recyclable and bio-based masterbatch solutions, aligning with Australia’s circular economy initiatives. Manufacturers are developing formulations compatible with recycled plastics and optimized for energy-efficient processing.

Infrastructure Development and Construction Activities

Infrastructure development and construction activities are driving significant growth of the Australia masterbatch market, as these projects require large volumes of durable, high-performance polymers for applications, such as piping, insulation, roofing, and interior and exterior components. Masterbatches enhance the functionality of construction plastics by providing UV stability, color consistency, flame retardancy, and weather resistance, ensuring long-term performance in demanding environments. The growth of residential, commercial, and public infrastructure projects, supported by government spending and private investment, is expanding demand for flexible and rigid polymer materials. Prefabricated construction elements, modular building solutions, and innovative building designs increasingly rely on tailored masterbatch formulations to meet aesthetic and functional requirements. Rising urbanization, smart city initiatives, and renewable energy infrastructure projects further accelerate the need for specialty masterbatches, making the construction and infrastructure sector a key driver of the market growth.

Automotive Lightweighting and Sustainable Material Trends

The automotive industry increasingly adopts plastics to replace metals, reducing vehicle weight while improving fuel efficiency and reducing emissions. PP masterbatches find extensive application in interior components, bumpers, dashboards, and under-hood parts. Electric vehicle (EV) adoption accelerates demand for specialty masterbatches in battery casings, electrical components, and lightweight structural parts. In 2025, EVs made up over 13% of the total car sales in Australia for the first time. Manufacturers prioritize masterbatch formulations compatible with recycled polymers to meet sustainability objectives. Regulatory pressures and consumer preferences for environmentally responsible products drive innovations in biodegradable and recyclable masterbatch solutions. Advanced aesthetic and functional requirements in automotive components, such as scratch resistance, UV stability, and heat tolerance, further boost demand for specialized masterbatches. Additionally, partnerships between automotive original equipment manufacturers (OEMs) and masterbatch suppliers are fostering tailored solutions that optimize performance and sustainability across vehicle platforms.

Market Restraints:

What Challenges the Australia Masterbatch Market is Facing?

Raw Material Price Volatility and Supply Chain Dependencies

In Australia, the masterbatch industry faces challenges from fluctuating raw material costs, particularly petrochemical-derived polymers and specialty pigments. Import dependency exposes manufacturers to currency fluctuations and international supply chain disruptions. Price volatility affects production economics and margin stability. Australia's reliance on imported plastic resins creates vulnerabilities, complicating cost management for masterbatch producers.

Regulatory Pressures and Environmental Compliance Requirements

Stringent environmental regulations regarding plastic usage, single-use plastics bans, and extended producer responsibility schemes create compliance challenges. Manufacturers must continuously adapt formulations to meet evolving regulatory standards while maintaining product performance. Investment requirements for sustainable alternatives, recyclability improvements, and carbon footprint reduction add operational complexity. Navigating diverse state-level regulations across Australian jurisdictions demands significant resources for compliance management.

Limited Domestic Manufacturing Capacity and Technical Expertise

The Australia masterbatch market faces constraints from limited domestic manufacturing capacity compared to larger markets. Access to specialized technical expertise and advanced formulation capabilities remains challenging for smaller manufacturers. Competition from imports, particularly from Asia-Pacific producers with cost advantages, pressures local manufacturers. Developing sufficient scale and technical capabilities to serve diverse customer requirements across multiple end-use industries requires substantial capital investment and workforce development.

Competitive Landscape:

The Australia masterbatch market features a mix of global and regional players competing across color, additive, and specialty segments. Competition centers on product quality, color consistency, technical support, and sustainable formulations. Global manufacturers leverage advanced research and development (R&D) capabilities and broad product portfolios while local players emphasize customer service, customization, and rapid delivery. Strategic partnerships between masterbatch producers and polymer converters strengthen market positions. Companies invest in sustainable solutions, recycled-content formulations, and application-specific innovations to differentiate offerings and capture market share across packaging, automotive, and construction applications.

Australia Masterbatch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Color, White, Black, Additive, Filler |

| Polymer Types Covered | PP, LDPE/LLDPE, HDPE, PVC, PUR, PET, PS, Others |

| Applications Covered | Packaging, Building and Construction, Consumer Goods, Automotive, Textile, Agriculture, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia masterbatch market size was valued at USD 247.52 Million in 2025.

The Australia masterbatch market is expected to grow at a compound annual growth rate of 3.84% from 2026-2034 to reach USD 347.45 Million by 2034.

Color dominated the market with a share of 43%, driven by rising demand for product differentiation, brand aesthetics, and customized color solutions across packaging, consumer goods, and automotive applications throughout Australia.

Key factors driving the Australia masterbatch market include expanding packaging industry, infrastructure development activities, automotive lightweighting trends, growing emphasis on sustainable materials, and increasing demand for functional additives.

Major challenges include significant raw material price volatility, complex supply chain dependencies, regulatory compliance requirements, limited domestic manufacturing capacity, competition from imports, and investment needs for sustainable formulation development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)