Australia Material Handling Equipment Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Australia Material Handling Equipment Market Overview:

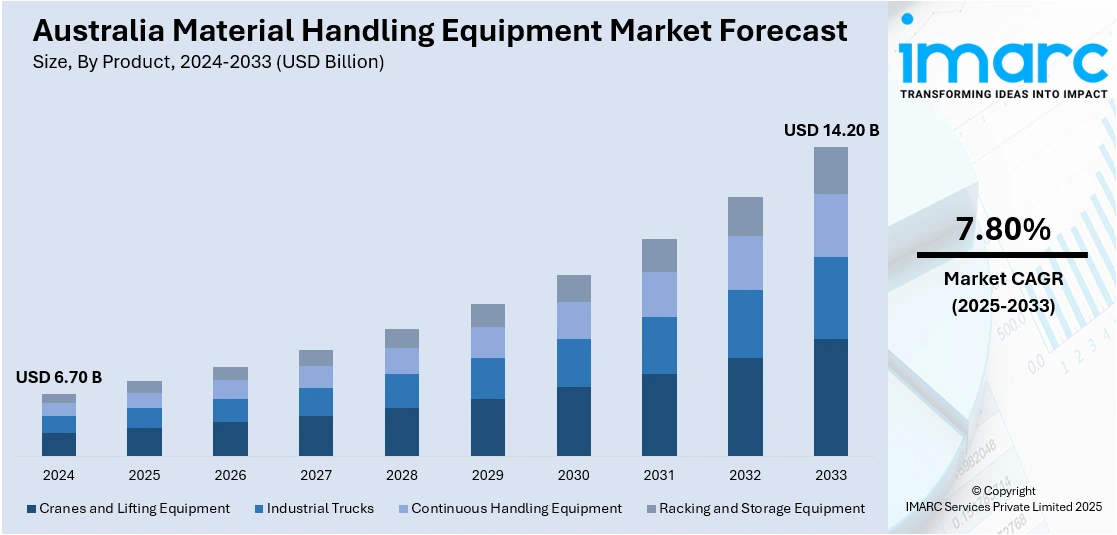

The Australia material handling equipment market size reached USD 6.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.20 Billion by 2033, exhibiting a growth rate (CAGR) of 7.80% during 2025-2033. The market is expanding due to increased demand for innovative, high-performance machinery. Technological advancements in safety and efficiency, along with the expansion of product offerings, continue to support Australia material handling equipment market share, particularly in the construction and logistics sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.70 Billion |

| Market Forecast in 2033 | USD 14.20 Billion |

| Market Growth Rate 2025-2033 | 7.80% |

Australia Material Handling Equipment Market Trends:

Technological Innovation Leading to Market Growth

The material handling equipment industry in Australia is quickly changing with a lot of emphasis on adopting sophisticated technology to enhance efficiency and safety. As businesses expand and need more advanced machinery, innovation becomes significant in keeping up with the demands. In March 2025, Caterpillar introduced the next-generation MH3032 material handler that enhances lifting capability through inbuilt technology like Cat 2D E-fence and Swing Assist. These technologies allow operators to maneuver loads with accuracy and more control in a safe manner, as well as increase productivity through reduced unnecessary motions. The MH3032's cutting-edge design also prioritizes fuel efficiency, which saves operating expenses and contributes to sustainability initiatives. With the increasing emphasis of the market on operational safety and productivity, the launch of such technologically sophisticated material handlers is assisting in molding the future of material handling equipment industry. The introduction of this model is a major leap ahead, catering to the requirements of construction, logistics, and mining industries, where efficiency and safety are the top priorities. With companies heavily investing in advanced machinery, the market for high-performance material handling equipment will continue to grow, hence fueling Australia material handling equipment market growth.

To get more information on this market, Request Sample

Expanding Product Range to Meet Diverse Needs

The market has also experienced strong growth as a result of the increased variety of products on offer to address various customers' requirements. For a competitive market, having a multitude of equipment ensures that firms are able to serve a variety of industries, making it possible for them to provide solutions that are effective and affordable. For instance, in March 2025, Toyota Material Handling Australia (TMHA) took a major step by taking on the national distribution of more than 35 Takeuchi construction machines, such as excavators, track loaders, and dump trucks. This growth of TMHA's product line, with the backing of a large service network, opens up the customer to a wide selection of construction and material handling equipment. Through the provision of machines that can accomplish varied tasks, including earthmoving and lifting, TMHA addresses the increasing needs of both commercial and government clients in different industries. The growth also further positions TMHA as a major player in the material handling sector of Australia, allowing the company to cater to customers in the construction, infrastructure, and manufacturing industries. In addition, these initiatives encourage innovation and increase market prospects.

Australia Material Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Cranes and Lifting Equipment

- Industrial Trucks

- Continuous Handling Equipment

- Racking and Storage Equipment

The report has provided a detailed breakup and analysis of the market based on the product. This includes cranes and lifting equipment, industrial trucks, continuous handling equipment, racking and storage equipment.

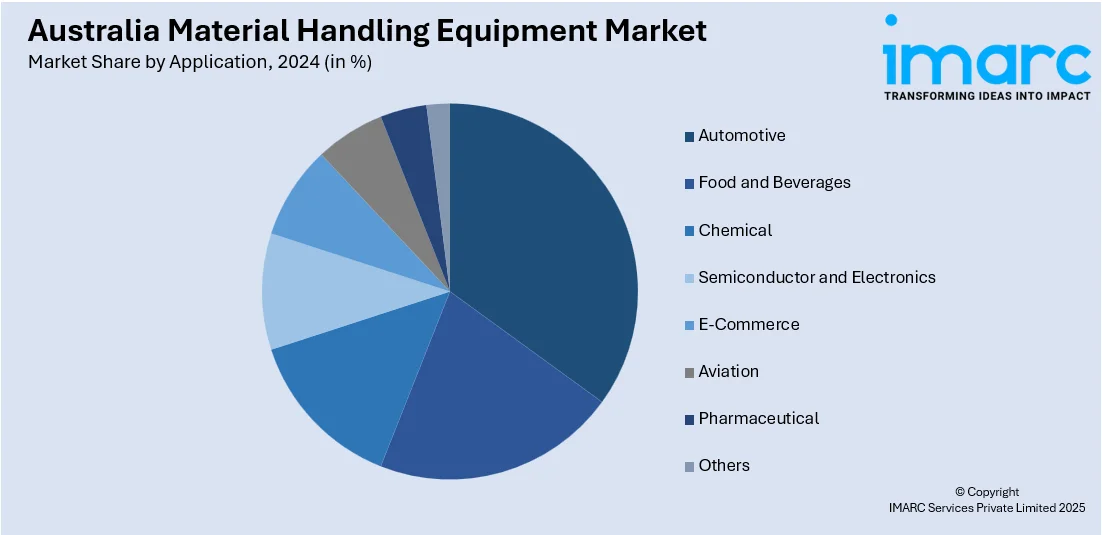

Application Insights:

- Automotive

- Food and Beverages

- Chemical

- Semiconductor and Electronics

- E-Commerce

- Aviation

- Pharmaceutical

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, food and beverages, chemical, semiconductor and electronics, e-commerce, aviation, pharmaceutical, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Material Handling Equipment Market News:

- May 2025: LGH Australia expanded its operations by opening a new location in Somersby, New South Wales. The company introduced a wide range of material handling equipment, including hoists, clamps, and hydraulic cylinders, boosting the Australian market's growth and reinforcing industry demand for quality rental solutions.

- May 2025: Mobicon Systems launched its first battery-powered container handler, the 2HLe, in response to customer demand for zero-emission, low-cost solutions. The 2HLe offers enhanced safety, reduced noise, and lower running costs, driving the growth of sustainable material handling equipment in Australia’s logistics sector.

Australia Material Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cranes and Lifting Equipment, Industrial Trucks, Continuous Handling Equipment, Racking and Storage Equipment |

| Applications Covered | Automotive, Food and Beverages, Chemical, Semiconductors and Electronics, E-Commerce, Aviation, Pharmaceutical, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia material handling equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia material handling equipment market on the basis of product?

- What is the breakup of the Australia material handling equipment market on the basis of application?

- What is the breakup of the Australia material handling equipment market on the basis of region?

- What are the various stages in the value chain of the Australia material handling equipment market?

- What are the key driving factors and challenges in the Australia material handling equipment market?

- What is the structure of the Australia material handling equipment market and who are the key players?

- What is the degree of competition in the Australia material handling equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia material handling equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia material handling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia material handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)