Australia Medical Implants Market Size, Share, Trends and Forecast by Product, Material, and Region, 2025-2033

Australia Medical Implants Market Overview:

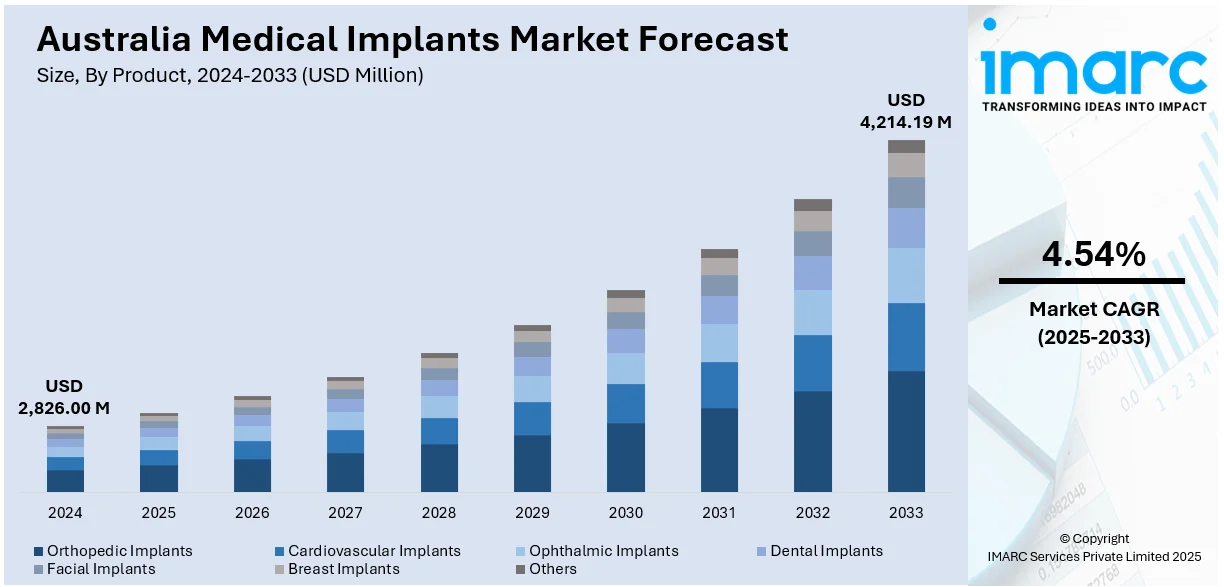

The Australia medical implants market size reached USD 2,826.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,214.19 Million by 2033, exhibiting a growth rate (CAGR) of 4.54% during 2025-2033. The market is expanding steadily, driven by an aging population and a rise in chronic conditions such as cardiovascular and orthopedic disorders. Technological advancements, including 3D printing and biocompatible materials, are enhancing implant performance and patient outcomes. The country's robust healthcare infrastructure and supportive regulatory environment facilitate innovation and accessibility, contributing to the Australia medical implants market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,826.00 Million |

| Market Forecast in 2033 | USD 4,214.19 Million |

| Market Growth Rate 2025-2033 | 4.54% |

Australia Medical Implants Market Trends:

Advancements in Implant Technology

Technological innovation is at the forefront of Australia’s medical implants market. Improvements in 3D printing, the invention of bioengineered materials, and minimally invasive methods have helped make implants fit patients better and work more effectively. Implants have become more long-lasting, less heavy and can be fitted specifically to each person. It allows patients to recover sooner and with fewer problems, which helps their overall satisfaction and makes the treatment more successful. Advancements in robotics, AI, and image-guided surgery are helping with exact placement during surgeries and reducing post-operative problems. Medical research centers in Australia and their relationships with medtech companies internationally help develop advanced products in the medical field. These innovations are making implants safer and more effective, fueling adoption among surgeons and patients and supporting market growth across orthopedic, dental, and cardiovascular segments.

To get more information on this market, Request Sample

Strong Healthcare Infrastructure and Insurance Support

Australia's well-established healthcare infrastructure plays a vital role in supporting the medical implants market. The country offers universal healthcare coverage through Medicare, which subsidizes many implant-related procedures, reducing financial barriers for patients. Additionally, the availability of private health insurance further expands access to advanced implant technologies and elective procedures. Public and private hospitals across Australia are equipped with modern surgical facilities and trained professionals, ensuring quality care and improved clinical outcomes. The government also maintains a strong regulatory framework that encourages innovation while safeguarding patient safety. This combination of access, affordability, and quality care makes Australia an attractive market for both domestic and international medical implant manufacturers, promoting growth and adoption across a wide range of therapeutic areas.

Increasing Preference for Minimally Invasive Procedures

Minimally invasive procedures (MIPs) are gaining popularity in Australia, driven by patient demand for quicker recovery, reduced surgical risks, and shorter hospital stays. This trend is influencing the design and development of medical implants that are smaller, more efficient, and compatible with laparoscopic or robotic-assisted surgeries. Orthopedic, dental, and cardiovascular implants are increasingly being adapted for use in MIPs, which are now common across both public and private healthcare settings. Advances in imaging and surgical tools further support this shift, enabling precise placement and better outcomes. As healthcare professionals embrace less invasive techniques, the demand for implants suitable for these procedures continues to grow. This change in surgical practice aligns with patient-centric care models and significantly boosts the Australia medical implants market growth.

Australia Medical Implants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and material.

Product Insights:

- Orthopedic Implants

- Hip Orthopedic Device

- Joint Reconstruction

- Knee Orthopedic Devices

- Spine Orthopedic Devices

- Others

- Cardiovascular Implants

- Pacing devices

- Stents

- Structural Cardiac Implants

- Ophthalmic Implants

- Intraocular lens

- Glaucoma Implants

- Dental Implants

- Facial Implants

- Breast Implants

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes orthopedic implants (hip orthopedic device, joint reconstruction, knee orthopedic devices, spine orthopedic devices, and others), cardiovascular implants (pacing devices, stents, and structural cardiac implants), ophthalmic implants (intraocular lens and glaucoma implants), dental implants, facial implants, breast implants, and others.

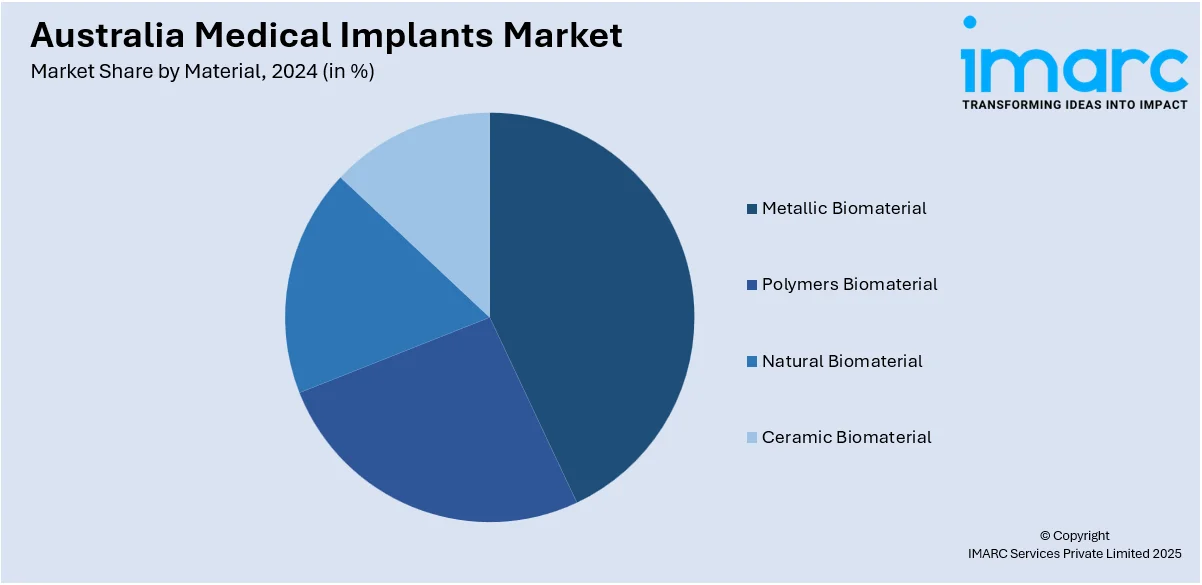

Material Insights:

- Metallic Biomaterial

- Polymers Biomaterial

- Natural Biomaterial

- Ceramic Biomaterial

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metallic biomaterial, polymers biomaterial, natural biomaterial, and ceramic biomaterial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include the Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Medical Implants Market News:

- In March 2025, In Australia, a BiVACOR Total Artificial Heart implant was deemed a complete clinical success, and the patient was the first to be discharged from the hospital worldwide. Dr. Paul Jansz, a renowned cardiothoracic and transplant surgeon from St. Vincent's Hospital in Sydney, supervised the six-hour implant procedure on November 22, 2024.

- In December 2024, the first-in-human clinical trial, called LIBERATE-1TM, began screening and enrolling patients at two Australian centers to examine the safety, tolerability, and complete pharmacokinetic profile of an exenatide implant, according to a statement released by Vivani Medical, Inc., a cutting-edge biopharmaceutical company creating innovative, ultra long-acting drug implants. The company's exclusive NanoPortalTM medication implant technology is being used in this investigation for the first time in a clinical setting.

Australia Medical Implants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered | Metallic Biomaterial, Polymers Biomaterial, Natural Biomaterial, Ceramic Biomaterial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia medical implants market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia medical implants market on the basis of product?

- What is the breakup of the Australia medical implants market on the basis of material?

- What is the breakup of the Australia medical implants market on the basis of region?

- What are the various stages in the value chain of the Australia medical implants market?

- What are the key driving factors and challenges in the Australia medical implants market?

- What is the structure of the Australia medical implants market and who are the key players?

- What is the degree of competition in the Australia medical implants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia medical implants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia medical implants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia medical implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)