Australia Medical Robots Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Australia Medical Robots Market Overview:

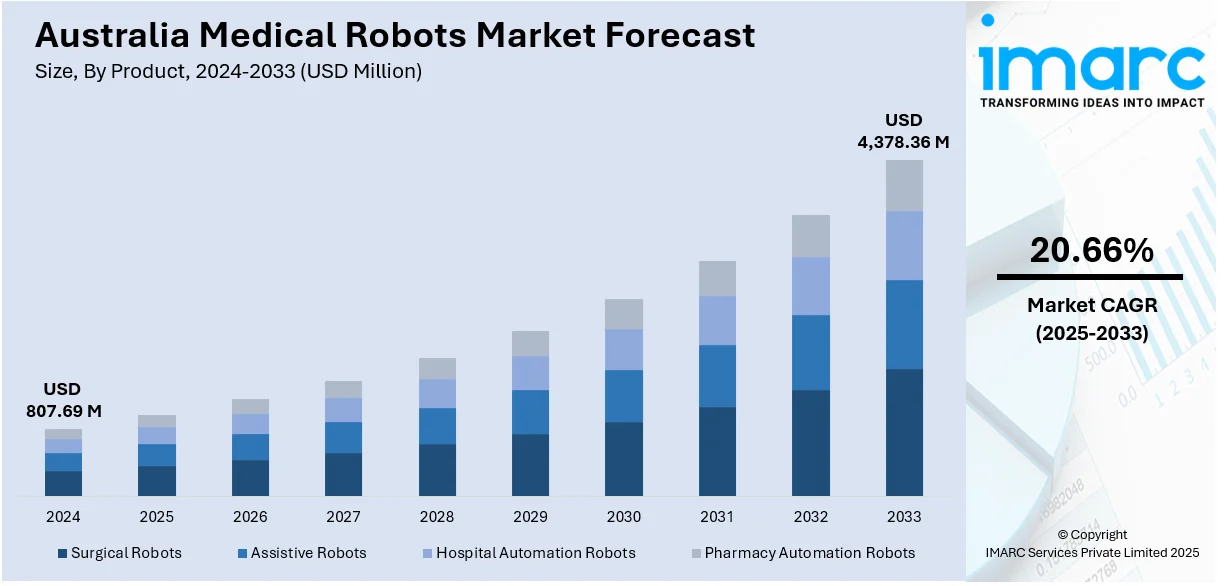

The Australia medical robots market size reached USD 807.69 Million in 2024. Looking forward, the market is expected to reach USD 4,378.36 Million by 2033, exhibiting a growth rate (CAGR) of 20.66% during 2025-2033. The trend is fueled by increasing demand for minimally invasive (MI) procedures, which result in faster recovery and higher accuracy. Technology advances in the form of artificial intelligence (AI) and augmented reality (AR) increase surgical precision and broaden the scope of robotic operations. The development of remote and telepresence surgery also enhances rural and underserved populations' access to healthcare through the ability of specialists to perform surgery remotely. These trends combined enhance the Australia medical robots market share through increased adoption and innovation in medical robotics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 807.69 Million |

| Market Forecast in 2033 | USD 4,378.36 Million |

| Market Growth Rate 2025-2033 | 20.66% |

Key Trends of Australia Medical Robots Market:

Growth of Minimally Invasive Surgeries (MIS):

Minimally invasive procedures are increasingly becoming the preferred method in Australia because they provide advantages like smaller cuts, less pain, faster recovery, and shorter hospitalization. Medical robots significantly improve the accuracy and dexterity of surgeons during procedures, resulting in improved patient outcomes. Since surgeons and hospitals become more and more inclined toward robot-assisted procedures in specialties such as urology, gynecology, and orthopedics, demand for medical robots increases. The movement away from conventional open procedures towards minimally invasive procedures is a significant driver for the market. Medical robots circumvent the frailties of human dexterity and deliver uniform, extremely precise motion, reducing the risk of surgical error and making surgery safer and more productive. This continuing trend in surgical practice continues to drive investment and innovation in robotic systems across Australia's healthcare system.

To get more information on this market, Request Sample

Technological Advancements and AI Integration:

Technological innovations, particularly the marriage of artificial intelligence (AI) and augmented reality (AR), are greatly propelling expansion in Australia's medical robotics industry. AI improves surgical accuracy by facilitating real-time analysis of data, image identification, and decision-making during procedures, enhancing safety and results. AR augments this by enabling surgeons to visualize internal anatomy more clearly and receive improved, context-sensitive information. Collectively, these technologies increase robotic systems' performance and dependability, rendering them more attractive to hospitals that seek sophisticated, minimally invasive care. Ongoing advancements in software, sensors, and robot hardware are also expanding the scope of procedures robots can perform safely and efficiently. These technologies minimize complications, accelerate recovery times, and enhance patient care. Consequently, robotics convergence with AI and AR is transforming surgical procedures and propelling Australia medical robots market growth.

Expansion of Remote and Telepresence Surgery:

According to the Australia medical robots market analysis, telepresence robots-powered remote surgery is transforming health care delivery in the region by closing access gaps in remote and rural areas. These sophisticated systems allow surgeons to conduct complex procedures from remote locations, beating geographic and logistical constraints. This is especially important for Australia, where enormous distances tend to restrict access to specialist care. Remote surgery decreases patient travel, minimizes delays in treatment, and maximizes the application of surgical talent within facilities. As telecommunication infrastructure and robotics systems become more advanced and reliable, the potential for safe, effective remote operation continues to expand. Encouraged by national plans and professional medical organizations, this technology is in harmony with Australia's overall healthcare objectives enhancing equity, efficiency, and outcomes. Growth of telepresence-enabled surgery is increasingly becoming an important growth driver in Australia medical robots market trends, underscoring the sector’s role in shaping the future of accessible and high-quality care.

Growth Drivers of Australia Medical Robots Market:

Aging Population and Healthcare Workforce Augmentation

The region’s aging population and changing healthcare environment are prime drivers of the expanding Australia medical robots market demand. With demographic changes boosting demand for surgical, rehabilitative, and diagnostic treatments, healthcare providers in cities such as Sydney, Melbourne, and Adelaide are turning to robotic systems to facilitate precision surgery and maximize clinical staff time. Regional hospitals from rural Queensland to remote Western Australia are struggling with workforce shortages and inadequate specialist cover. Medicine robots like telesurgery platforms and distant robotic imaging devices can cover distances, providing specialist care from afar. Robotics in long-term care homes also facilitate mobility aid, physiotherapy and surveillance to preserve quality of life as needs increase. The growing pressure on healthcare providers and increased emphasis on surgical precision, infection prevention, and workflow optimization is compelling adoption of robot technologies across metropolitan and rural regions.

Government Investment in Health Innovation and Research Infrastructure

Australia's strategic investment in health care innovation and research environments is driving medical robotics opportunities at a faster pace. Government programs aligned with hospitals, universities, and research centers, with those located in precincts such as Brisbane's Translational Research Institute and Melbourne's biomedical precincts, are funding robotic platform trials, particularly in orthopedics, neurosurgery, and VR-assisted rehabilitation. Australia's regulatory environment fast-tracks approvals for robotic medical devices under nationally aligned standards, minimizing time to clinical adoption. Grants and public funding facilitate cross-industry collaboration between healthcare providers, medical device companies, and technology startups to design and develop surgical robots, rehabilitation systems, and exoskeletons adapted to local hospital operations. This provides a fertile environment for companies to co‑develop and test products in real-world settings. Regional innovation hubs, particularly in South Australia and New South Wales, stage pilot programs incorporating robotics in aged care, remote clinics, and telehealth services, strengthening the market's momentum nationwide.

Private Sector Adoption and Competitive Healthcare Delivery

Australia's highly established private health system provides a key stimulus for the expansion of medical robots. Specialist clinics and private hospitals are typically more willing to embrace new technologies to remain competitive and attract patients who are looking for cutting-edge care possibilities. Hospitals in large cities like Brisbane, Perth, and Canberra are putting money into advanced robotic operating rooms, becoming leaders in precision care and innovative care provision. These payers focus on quicker recovery periods, reduced risk for complications, and increased patient satisfaction, all of which are areas where medical robotics can excel. Private insurance payers are also slowly catching on to the economic value of robotic surgeries, providing financial incentives for broader use. As private healthcare grows in Australia, hospitals are being pushed to innovate and stand out, which are determinants that make medical robotics a natural investment opportunity. This rivalry between providers is a spur to wider adoption and expansion in the market.

Opportunities of Australia Medical Robots Market:

Rollout of Robotic Surgery to Regional and Remote Communities

The greatest potential in the Australian market for medical robots is in rolling out robotic-assisted health services to regional and remote communities. Australia's geography is so vast that it creates a persistent challenge in the delivery of specialist services to patients outside of major metropolitan cities. Numerous of these areas, such as areas in Northern Queensland, the Northern Territory, and country Western Australia, are disadvantaged by not having access to sophisticated surgical interventions because of a shortage of highly skilled specialists and facilities. Robotic systems have the promise to fill this gap by allowing teleoperated or remote operations, whereby specialists can perform or instruct interventions from metropolitan hospitals. With the assistance of telehealth infrastructure and mobile healthcare units, these technologies have the potential to significantly enhance health outcomes in remote locations. This decentralization of advanced medical care using robotic technology not only promotes healthcare inequality but also helps local hospitals maintain patients who may otherwise travel great distances for their treatment.

Integration of Robotics into Aged Care and Rehabilitation Services

Australia's expanding aged care industry is a prime prospect for medical robots, especially in rehabilitation and assistive living uses. As the country's elderly population continues to grow, there is an ever-greater need for effective, secure, and supportive care facilities. Physical therapy, mobility aid, and cognitive support robot systems can greatly relieve the strain on carers and enhance the autonomy of senior residents. In aged care centers throughout states such as Victoria and South Australia, pilot projects in the early stages are already testing the application of exoskeletons for mobility training and interactive robots for daily support and companionship. These technologies can be adjusted to suit Australian seniors, who, in large numbers, desire to age in place or in care circumstances that are community focused. Additionally, the uptake of medical robots within aged care is in line with the national priority of enhancing quality standards and promoting dignity in aged care services, and this is therefore a timely and socially relevant market opportunity.

Partnership Between Domestic Startups and International Medical Tech Firms

Australia's research-based startup economy and robust research institutions provide an ideal platform for collaboration between domestic robotics businesses and international medical technology companies. These partnerships offer a significant opportunity to co-develop and commercialize next-generation robotic systems that are specific to the requirements of the Australian health system. Domestic companies contribute agility, innovative design, and knowledge of local health challenges, with international players contributing scale, regulatory savvy, and access to overseas markets. Cities like Sydney and Melbourne host med-tech accelerators, university research facilities, and clinical trials centers that drive innovation in robotic surgery, diagnostics, and patient monitoring. When combined, these stakeholders are able to develop solutions tailored to Australian hospitals and clinics, such as compact surgical robots appropriate for smaller operating theatres or AI-assisted rehabilitation devices. As international demand for medical robots continues to rise, such collaborations also create export opportunities, making Australia a consumer and a contributor in the global value chain of medical robotics.

Challenges of Australia Medical Robots Market:

High Capital Investment and Restricted Budgets in Public Healthcare

Among the most pressing challenges for the use of medical robots in Australia is the high capital outlay needed for procurement, maintenance, and training of staff. Although private hospitals tend to be faster in adopting advanced technologies, public hospitals, particularly regional or rural hospitals, are often unable to bear the added cost. Australia's public health system functions under strict budgetary controls, and the deployment of large sums on robotic systems could be viewed as taking away from more immediate needs like staff recruitment, casualty services, or the upgrading of infrastructure. Even in the presence of funding, the expense of continuous support, such as software maintenance, robotic instrument renewal, and specialist technician training, can discourage long-term investment. Smaller regional hospitals in regions such as inland New South Wales or regional Tasmania might struggle to deliver the quantity of procedures needed to offset the cost of these technologies. Consequently, access to robotic care can be uneven throughout the nation, constraining overall market development.

Skill Gap and Training Needs for Robotic Systems

The second major challenge facing the Australian medical robots industry is a skill gap currently existing amongst healthcare professionals. To implement systems of skillfully coordinated robots, there are specific sets of technical skills needed, from coordinating surgical teams to programming and equipment calibration. To date, most Australian medical schools and training facilities are just starting to incorporate robotic procedures into their curricula. Surgeons and nurses would frequently have to travel to cities or abroad for further training, sometimes slowing down implementation in smaller or remote hospitals. In addition, the learning curve of robotic equipment can sometimes lead to longer surgical durations and inefficiencies, deterring uptake from already stretched hospital personnel. The absence of special training facilities in places like the Northern Territory or Far North Queensland further increases the accessibility gap. To overcome this challenge involves coordinated investment in education, simulation training facilities, and on-site mentoring to guarantee that Australia's workforce is trained to use medical robotics effectively in different clinical applications.

Hospital System Regulatory and Integration Challenges

Navigating regulatory complexities and integrating robotic systems within hospital systems is another major challenge in Australia. Although the nation boasts a highly respected medical regulatory system, the process of approval for new robotic systems is slow and demands meticulous compliance with safety, performance, and software standards. Hospitals also must go through stringent internal assessments before the implementation of new technologies, especially in public hospitals where procurement policy is tight. Aside from approvals, incorporating robotic systems into hospitals creates logistical challenges, including rearranging operating rooms, modifying staff schedules, and rewriting electronic health records to interface with robotics software. Such changes are disruptive to operations and involve long planning horizons. Further, issues of data security, patient confidentiality, and system reliability remain paramount as the use of robotics becomes more networked within hospital networks. These regulatory and infrastructural challenges delay adoption and could keep smaller institutions from being able to fully take advantage of medical robotic technology.

Australia Medical Robots Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Surgical Robots

- Assistive Robots

- Hospital Automation Robots

- Pharmacy Automation Robots

The report has provided a detailed breakup and analysis of the market based on the product. This includes surgical robots, assistive robots, hospital automation robots, and pharmacy automation robots.

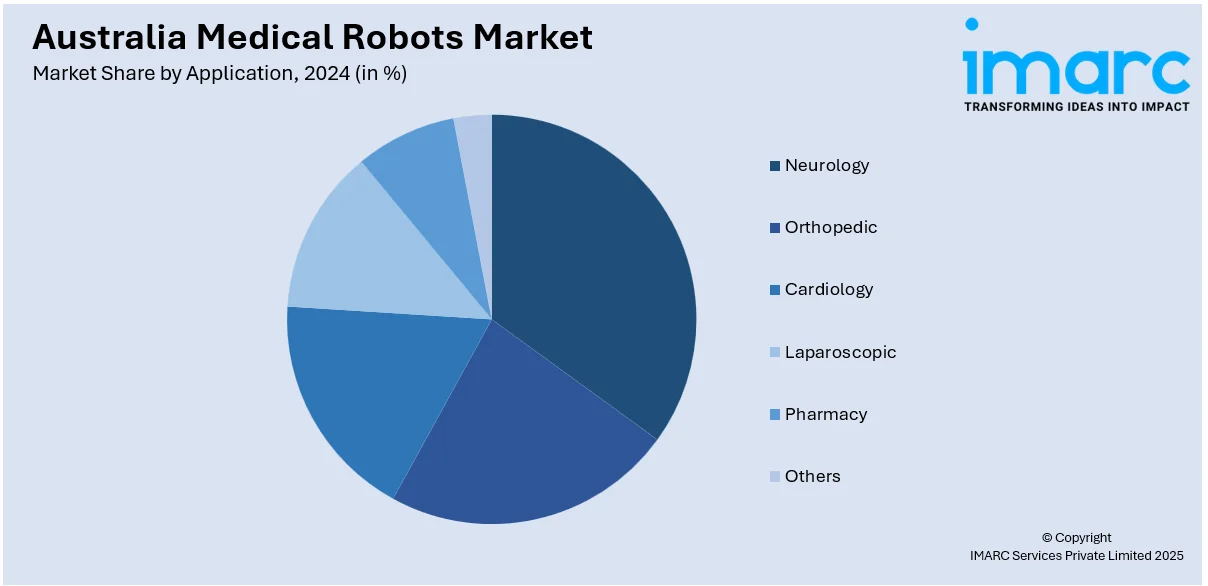

Application Insights:

- Neurology

- Orthopedic

- Cardiology

- Laparoscopic

- Pharmacy

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes neurology, orthopedic, cardiology, laparoscopic, pharmacy, and others.

End User Insights:

- Hospitals

- Ambulatory Surgery Centers

- Rehabilitation Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, ambulatory surgery centers, rehabilitation centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Medical Robots Market News:

- In May 2025, Enlil is accelerating medical device innovation by offering an integrated solution tailored for early to mid-stage medical device developers and contract manufacturers. Combining QMS and PLM capabilities, Enlil supports product scaling and regulatory approval processes. Their specialized SaaS platform empowers MedTech innovators to bring life-changing products to market faster with strong regulatory confidence, focusing on startups and small teams developing pre-clinical, Class 2, and Class 3 medical devices.

- In May 2025, The Australian government is investing $3.05 million to introduce a surgical robot at Launceston General Hospital in Tasmania. The robot will be used for urological, gynecological, and other precision procedures, including helping patients with endometriosis. Health Minister Jacquie Petrusma highlighted that the technology will improve clinical outcomes, shorten recovery times, reduce hospital stays, and enhance bed availability and patient flow, ultimately cutting surgical wait times.

- In December 2024, St Vincent's Hospital Melbourne now has the Symani System, which is robotic microsurery technology mimicking hand and wrist movement on a much smaller scale. It will allow surgeons to work on vessels as small as one millimetre. It will initially be applied in breast reconstruction, sarcoma surgery, head and neck cancer reconstruction, and digit replantation. Proposals are also in place to include using it for lymphoedema and chronic wound management.

Australia Medical Robots Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Surgical Robots, Assistive Robots, Hospital Automation Robots, Pharmacy Automation Robots |

| Applications Covered | Neurology, Orthopedic, Cardiology, Laparoscopic, Pharmacy, Others |

| End Users Covered | Hospitals, Ambulatory Surgery Centers, Rehabilitation Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia medical robots market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia medical robots market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia medical robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia medical robots market was valued at USD 807.69 Million in 2024.

The Australia medical robots market is projected to exhibit a CAGR of 20.66% during 2025-2033.

The Australia medical robots market is expected to reach a value of USD 4,378.36 Million by 2033.

The Australia medical robots market trends include rising adoption of telesurgery platforms connecting urban hospitals to remote clinics, the emergence of robotic rehabilitation tools in aged care, and integration of AI-powered diagnostic systems. Hospitals are incorporating compact surgical robots for precision operations, while local startups collaborate with global firms to bring tailored innovations to national healthcare.

The Australia medical robots market is driven by an aging population, increased demand for precision healthcare, and a shortage of skilled medical professionals in regional areas. Government investment in health innovation and growing private sector interest further accelerate adoption, positioning robotics as a solution for efficiency, accuracy, and improved patient outcomes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)