Australia Medical Tubing Market Size, Share, Trends and Forecast by Product, Structure, Application, End User, and Region, 2025-2033

Australia Medical Tubing Market Overview:

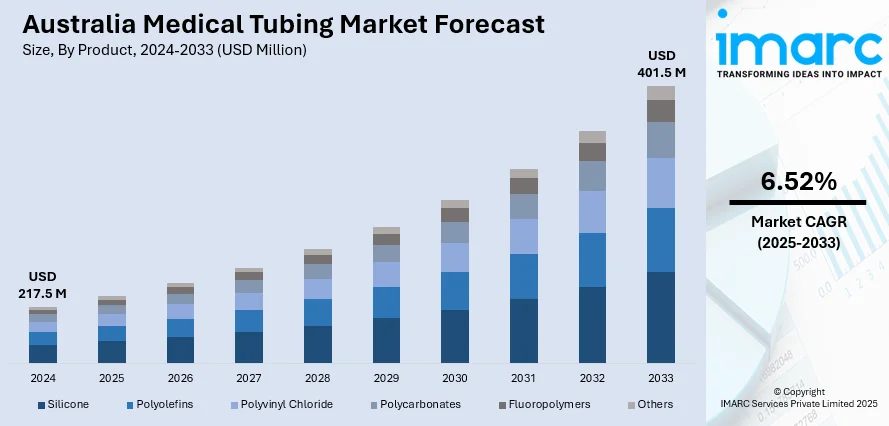

The Australia medical tubing market size reached USD 217.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 401.5 Million by 2033, exhibiting a growth rate (CAGR) of 6.52% during 2025-2033. The market is witnessing steady growth, driven by rising healthcare needs, expanding medical infrastructure, and increasing demand for advanced medical devices. The increasing aging population, growing demand for minimally invasive procedures and a wide range of applications, including drug delivery, fluid management, and diagnostics are some pf the other growth-inducing factors contributing to the Australia medical tubing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 217.5 Million |

| Market Forecast in 2033 | USD 401.5 Million |

| Market Growth Rate 2025-2033 | 6.52% |

Australia Medical Tubing Market Trends:

Increase in Aging Population and Chronic Illnesses

With an increasingly aging population in Australia, there is a rising demand for medical devices that facilitate long-term care such as catheters, dialysis tubing, and feeding tubes. This demographic shift is significantly influencing Australia medical tubing market growth as the healthcare sector adapts to the increasing need for medical tubing in treatments for chronic conditions such as diabetes and cardiovascular diseases. According to data published by the Heart Foundation, cardiovascular disease (CVD) affects one in six Australians which amounts to over 4.5 million people. It is responsible for one in four deaths averaging about 120 deaths each day. Hospitalizations due to CVD occur every minute, totaling around 1,500 per day, and the annual cost is about $5 billion. With the aging population on the rise, especially in aged care facilities and home healthcare environments, the need for tailored, biocompatible, and user-friendly medical tubing is on the rise. All these are contributing to the increasing growth of the market. The market is poised to rise as healthcare professionals continue to favor the treatment and management of patients with chronic diseases.

To get more information on this market, Request Sample

Growth in Minimally Invasive Procedures

The growing growing demand for minimally invasive procedures is strongly influencing the demand for medical tubing in Australia. These procedures such as laparoscopic procedures, endoscopic tests, and catheter-based procedures need flexible and long-lasting tubing to move through small and complex parts of the body. Medical tubing is essential in administering fluids, gases, or drugs during these procedures as well as in the removal of waste or body fluids. As patients increasingly turn to less invasive procedures because they have quicker recovery times, cause less pain and are less likely to experience complications the demand for specialized tubing continues to expand. Furthermore, advances in medical technology and materials science have enabled the manufacture of tubing that is not only more flexible and biocompatible but also resistant to kinking and damage in complicated surgeries. For instance, in December 2024, Terumo Interventional Systems released the R2P™ NaviCross® peripheral support catheter, which is 200 cm in length for improved performance in radial-to-peripheral procedures. With superior trackability and torque control, the catheter allows physicians to safely and effectively treat complex lesions while meeting the increasing need for peripheral artery disease treatment, which is creating a positive market outlook.

Australia Medical Tubing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, structure, application, and end user.

Product Insights:

- Silicone

- Polyolefins

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes silicone, polyolefins, polyvinyl chloride, polycarbonates, fluoropolymers, and others.

Structure Insights:

- Single-Lumen

- Co-Extruded

- Multi-Lumen

- Tapered or Bump Tubing

- Braided Tubing

A detailed breakup and analysis of the market based on the structure have also been provided in the report. This includes single-lumen, co-extruded, multi-lumen, tapered or bump tubing, and braided tubing.

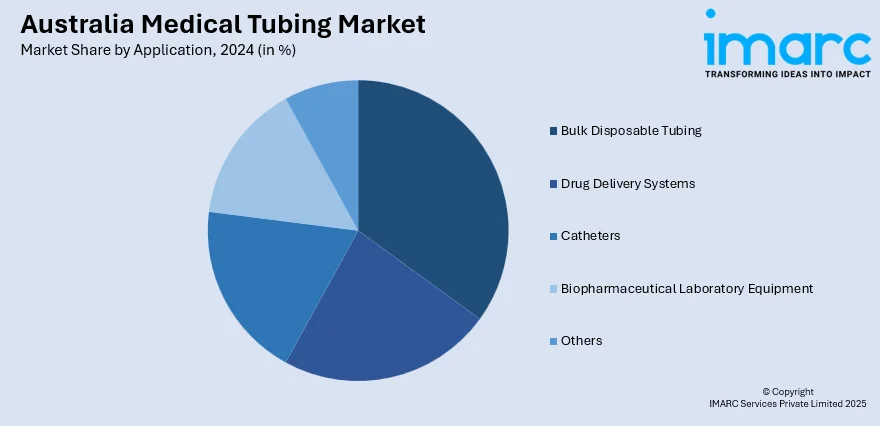

Application Insights:

- Bulk Disposable Tubing

- Drug Delivery Systems

- Catheters

- Biopharmaceutical Laboratory Equipment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bulk disposable tubing, drug delivery systems, catheters, biopharmaceutical laboratory equipment, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Medical Labs

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, medical labs, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Medical Tubing Market News:

- In July 2024, MedSource Labs and Sydney-based Medilogic formed an exclusive partnership to launch Logiflow Exactus and Exactus Shield safety IV catheters in Australia. These innovative catheters feature blood control technology, enhancing safety, precision, and usability for healthcare workers, aiming to improve patient care across the Australian healthcare system.

Australia Medical Tubing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Silicone, Polyolefins, Polyvinyl Chloride, Polycarbonates, Fluoropolymers, Others |

| Structures Covered | Single-Lumen, Co-Extruded, Multi-Lumen, Tapered or Bump Tubing, Braided Tubing |

| Applications Covered | Bulk Disposable Tubing, Drug Delivery Systems, Catheters, Biopharmaceutical Laboratory Equipment, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Medical Labs, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia medical tubing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia medical tubing market on the basis of product?

- What is the breakup of the Australia medical tubing market on the basis of structure?

- What is the breakup of the Australia medical tubing market on the basis of application?

- What is the breakup of the Australia medical tubing market on the basis of end user?

- What is the breakup of the Australia medical tubing market on the basis of region?

- What are the various stages in the value chain of the Australia medical tubing market?

- What are the key driving factors and challenges in the Australia medical tubing market?

- What is the structure of the Australia medical tubing market and who are the key players?

- What is the degree of competition in the Australia medical tubing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia medical tubing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia medical tubing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia medical tubing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)