Australia Medium Density Fiberboard Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2025-2033

Australia Medium Density Fiberboard Market Overview:

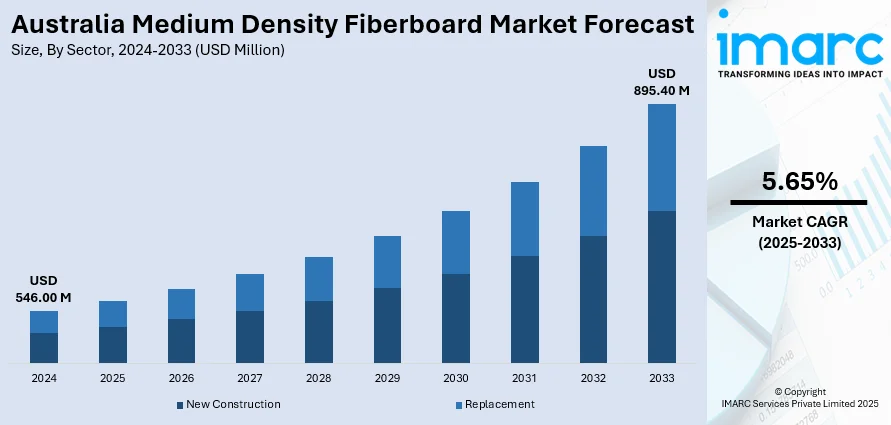

The Australia Medium Density Fiberboard Market size reached USD 546.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 895.40 Million by 2033, exhibiting a growth rate (CAGR) of 5.65% during 2025-2033. The market is expanding due to urbanization and increased construction activities in residential and commercial sectors. Increasing focus on sustainable as well as eco-friendly materials has promoted manufacturers to produce MDF with lower formaldehyde emissions as well as from recycled wood fibers. Technological advancements in manufacturing processes have also improved the quality and durability of MDF products, making them more appealing to businesses and consumers, further expanding the Australia medium density fiberboard market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 546.00 Million |

| Market Forecast in 2033 | USD 895.40 Million |

| Market Growth Rate 2025-2033 | 5.65% |

Australia Medium Density Fiberboard Market Trends:

Emphasis on Sustainable and Eco-Friendly Materials

In Australia, the medium-density fiberboard (MDF) sector is putting greater emphasis on sustainable and eco-friendly materials. MDF producers are now utilizing more recycled wood fibers and low-emission adhesives in their bid to produce MDF products that attain green building requirements. This comes in response to consumer demand for sustainable products and government regulations promoting environmental sustainability. In addition to lessening the environmental effect of MDF production, these methods satisfy growing consumer demand for environmentally friendly building and interior design materials. Manufacturers will be compelled to innovate and go green as the demand for green MDF products rises in tandem with environmental awareness.

To get more information on this market, Request Sample

Use of Fire-Resistant MDF in Construction

The application of fire-retardant medium-density fiberboard (MDF) is becoming a leading trend in Australia's construction industry. With safety and compliance to building codes increasingly assuming greater significance, fire-resistant MDF products are gaining broader acceptance in residential, commercial, and institutional buildings. Fire-rated MDF panels offer enhanced resistance to fire hazards and can be used for interior applications such as wall paneling, ceilings, and doors. Manufacturers are responding to this demand by producing MDF products that meet rigorous fire safety standards, thereby expanding their application in numerous building projects. This reflects a broader dedication to safety and compliance within the Australian construction sector, which further contributes to the Australia medium density fireboard market growth.

Technological Advancement in MDF Production

Technological innovation is significantly influencing the Australian medium-density fiberboard (MDF) industry. Technology changes in the manufacturing process, such as the production of moisture-resistant and fire-retardant MDF, are enhancing the performance and versatility of MDF products. This kind of innovation enables MDF to meet the specific requirements of specific applications, including cabinetry, flooring, and wall paneling. Also, the application of digital technologies allows for better inventory management, supply chain management, and customer service. As the industry is poised to embrace further technological advancements, the market for MDF will probably witness increased competitiveness, product diversification, and the ability to cater to specific consumer needs more effectively.

Australia Medium Density Fiberboard Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and sector.

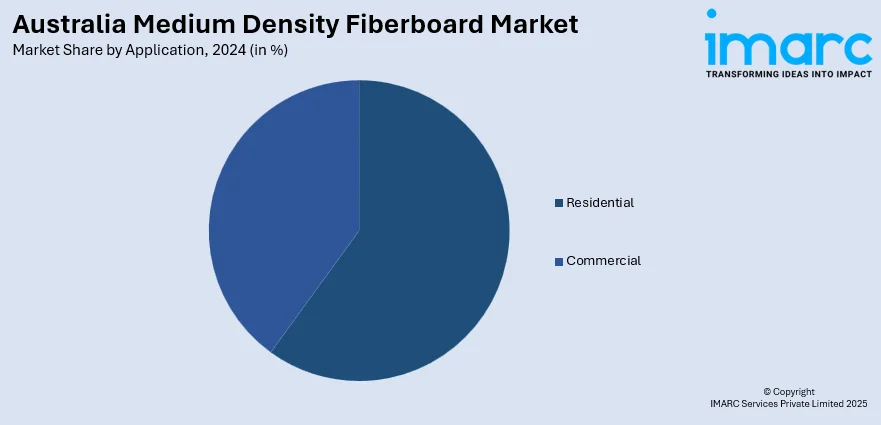

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Sector Insights:

- New Construction

- Replacement

A detailed breakup and analysis of the market based on the sector has also been provided in the report. This includes new construction and replacement.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Medium Density Fiberboard Market News:

- In February 2024, the new MDF facility for Australian Panels became the most extensive ever built by Siempelkamp. The wood-based panel manufacturer from Australia requested the facility from its German collaborator for its site in Mount Gambier. This new MDF facility is the sixth Siempelkamp plant for Australian Panels. In August 2023, the customer selected a Siempelkamp particleboard facility, set to be the largest in Australia with a yearly capacity exceeding 650,000 m³. It will also be constructed at the Mount Gambier location.

Australia Medium Density Fiberboard Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia medium density fiberboard market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia medium density fiberboard market on the basis of application?

- What is the breakup of the Australia medium density fiberboard market on the basis of sector?

- What is the breakup of the Australia medium density fiberboard market on the basis of region?

- What are the various stages in the value chain of the Australia medium density fiberboard market?

- What are the key driving factors and challenges in the Australia medium density fiberboard market?

- What is the structure of the Australia medium density fiberboard market and who are the key players?

- What is the degree of competition in the Australia medium density fiberboard market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia medium density fiberboard market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia medium density fiberboard market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia medium density fiberboard industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)