Australia MedTech Market Size, Share, Trends and Forecast by Type, Component, Deployment Type, Application, End-User, and Region, 2025-2033

Australia MedTech Market Size and Share:

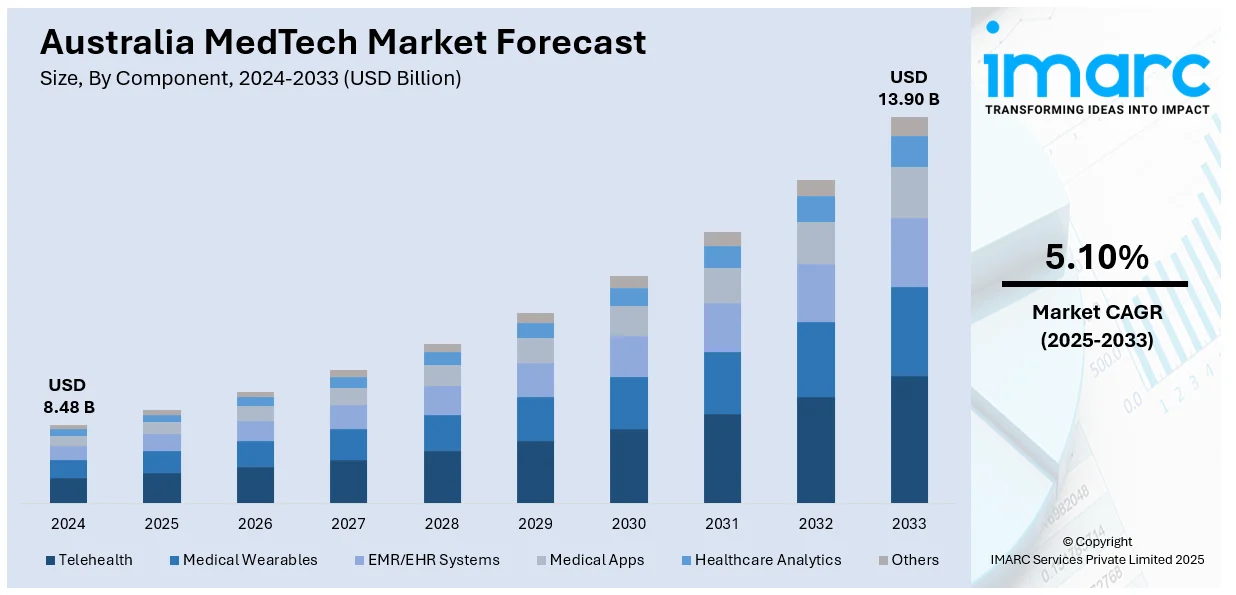

The Australia MedTech market size was valued at USD 8.48 Billion in 2024. Looking forward, the market is projected to reach USD 13.90 Billion by 2033, exhibiting a CAGR of 5.10% from 2025-2033. New South Wales leads the market, driven by robust healthcare infrastructure, extensive research capabilities, government funding, and a thriving innovation ecosystem, fostering advancements in digital health, diagnostics, and medical devices, while supporting a growing startup landscape and responding to the increasing demand for cutting-edge healthcare technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.48 Billion |

|

Market Forecast in 2033

|

USD 13.90 Billion |

| Market Growth Rate (2025-2033) | 5.10% |

The Australia MedTech market growth is fueled by increasing demand for advanced healthcare technologies, driven by an aging population and rising chronic diseases. In addition, increasing government initiatives are funding support innovation, and promoting growth in digital health and telemedicine, which is aiding the market growth. Additionally, the presence of top-tier research institutions and universities promotes collaboration and the advancement of innovative devices, driving market demand. For instance, Monash University partnered with Apollo Hospitals to advance digital health research, fostering innovation in healthcare technology and strengthening international collaborations, highlight Australia's growing influence in shaping global digital health trends. Besides this, the high healthcare standards and well-established regulatory framework in Australia ensure the market trust in MedTech products, providing an impetus to the market. Furthermore, strong private sector investment in health technology boosts advancements and increases the shift toward personalized and minimally invasive treatments, thus impelling the market growth.

To get more information on this market, Request Sample

Concurrently, the rising number of health-conscious consumers seek better access to personalized care, which is acting as another growth-inducing factor. In line with this, the growing adoption of wearable medical devices and remote monitoring solutions aligns with Australia's push for better chronic disease management, contributing to the market expansion. Additionally, continuous advancements in artificial intelligence (AI) and data analytics, improve diagnostic accuracy and treatment outcomes, strengthening the Australia MedTech market share. Apart from this, the increased focus on mental health and wellness boosts the demand for relevant MedTech solutions, supporting the market growth. For example, the 2024 ResMed Global Sleep Survey examined 17 markets worldwide and it found out that 46% of participants received a diagnosis of obstructive sleep apnea obstructive sleep apnea (OSA) in their past. This highlights the growing awareness of sleep health, further driving demand for diagnostic and therapeutic MedTech solutions. Furthermore, Australia’s position as a hub for MedTech startups fosters innovation and market entry, which is driving the market demand. Also, enhanced funding for clinical trials supports new product development, thereby propelling the market forward.

Key Trends of Australia MedTech Market:

Digital Health Expansion

Digital health is rapidly transforming the Australia MedTech market trends, with an increased focus on telemedicine, wearable devices, and AI-driven health solutions. The utilization of remote monitoring systems especially in chronic disease cases is increasing due to the increasing population, and demand for viable and accessible healthcare services. For instance, OSA is the most common sleep-related breathing disorder, and affects approximately 936 million people worldwide and occurs when throat muscles relax and block the airway, often signaled by snoring, according to reports. This further underscore the critical role of digital health solutions. Besides this, ongoing advancements in health informatics as well as technology in data analytics and effective records in virtual consultations have highly enhanced the delivery of health services, demonstrated high patient care success, and reduced cost, thus impelling the market growth.

Advancements in AI and Robotics

AI and robotics are making a significant impact on Australia MedTech market outlook, particularly in surgery, diagnostics, and patient care. Molecular medicine with the help of AI algorithms is improving the accuracy of the diagnosis which was an issue in the older model diagnostic tools. Moreover, robotics has made minimally invasive surgeries and improved precision along with shorter recovery times. They are also being used for operational functions for practice management, to release the time of health care, and staff for providing care to the patients. For example, a new AI accelerator program has been launched to boost Australia's biomedical sector by providing specialized data and AI services to innovative MedTech companies, further advancing these technologies. As these technologies advance, the educational and delivery system requirements will increase to support these innovations, most especially in large metropolitan areas and specialized hospitals all around Australia, thereby catalyzing the market demand.

Personalized Medicine and Biotechnology

Personalized medicine is gradually becoming popular in Australia, boosted by genomic and biotechnological development. In addition, personalized therapy according to the patient’s genotype is gaining popularity. It is actively being used in oncology and for the treatment of rare diseases. The MedTech market in Australia is witnessing a trend of the emergence of diagnostic and therapeutic tools that are precision solutions to suit various patient requirements. Also, there is a growing synergy between biotech companies, medical research institutions, and healthcare organizations in driving development in this field. Furthermore, with the increasing interest in the concept of genomics, the development of personalized medicine is becoming an important trend, defining the future of the healthcare system in the region, thus enhancing the Australia MedTech market forecast. For example, the Australian government has launched Genomics Australia, a national body with an initial funding of A$30 million over four years, aiming to advance the use of genomics in healthcare.

Growth Drivers of Australia MedTech Market:

Aging Population

Australia’s aging population significantly contributes to the growth of the MedTech market as an increase in life expectancy leads to higher demand for advanced medical technologies. Older adults tend to be more vulnerable to chronic illnesses such as cardiovascular diseases, diabetes, respiratory issues, and mobility limitations necessitating continuous monitoring and specialized care. This need is driving the use of devices such as pacemakers, orthopedic implants, home-based diagnostic kits, and assistive technologies. Furthermore, healthcare systems are increasingly focusing on preventive and personalized treatment strategies to improve the quality of life for seniors. As the proportion of elderly citizens continues to rise the demand for innovative medical solutions that promote independence, reduce hospital admissions, and enable remote care is anticipated to grow substantially.

Rising Healthcare Spending

Increasing healthcare expenditure in Australia is creating substantial opportunities for the adoption of MedTech across both the public and private sectors. Government initiatives aimed at modernizing hospitals, enhancing digital health solutions, and promoting innovative technologies are stimulating market growth. Additionally, private healthcare providers are making significant investments in advanced equipment including imaging systems, surgical robotics, and diagnostic devices to improve patient outcomes and operational efficiency. Furthermore, insurance coverage and policies that support advanced treatments are enhancing access to contemporary medical technologies. According to an analysis of the Australia MedTech market this rising expenditure is fueling the demand for cutting-edge devices while bolstering local manufacturing capabilities and fostering international partnerships thereby creating a strong ecosystem for long-term market growth.

Strong Research and Development Ecosystem

Australia’s MedTech sector reaps considerable benefits from its robust research and development ecosystem, wherein universities, startups, and healthcare providers collaborate to foster innovation. The country boasts a well-established framework for clinical trials, which enables quicker adoption of groundbreaking medical technologies. Partnerships between academic institutions and MedTech companies drive advancements in areas such as imaging, diagnostics, implantable devices, and AI-driven healthcare solutions. Government funding initiatives and innovation grants also support the creation of new products tailored for both domestic and international markets. This ecosystem encourages cross-industry collaboration, particularly among the biotechnology, IT, and MedTech sectors, accelerating the commercialization of products. Consequently, Australia is evolving into a hub for medical technology innovation, enhancing its competitiveness on the global stage.

Opportunities of Australia MedTech Market:

Global Market Access

Australia’s MedTech sector is well-regarded for its high standards of quality, safety, and innovation, which provides a competitive advantage in global markets. Global market access offers substantial potential, particularly in the Asia-Pacific region due to increasing healthcare needs that drive imports of sophisticated medical technologies. Australian firms can take advantage of free trade agreements, stringent regulatory frameworks, and their geographical proximity to rapidly developing economies such as China, India, and Southeast Asia to boost exports. With a growing demand for diagnostic tools, surgical instruments, and digital health technologies in these areas, Australian MedTech companies are in a strong position to enhance global partnerships, diversify their revenue sources, and seize new growth prospects, reinforcing their status as reliable providers of high-quality healthcare solutions on an international scale.

Public-Private Partnerships

PPPs serve as a crucial growth avenue for the Australian MedTech industry, facilitating quicker integration of advanced healthcare technologies. Through collaboration with governmental agencies, hospitals, and private organizations, MedTech companies can expedite clinical trials, expand infrastructure, and roll out cost-effective solutions throughout healthcare networks. These alliances also bridge funding shortfalls, improve innovation pipelines, and ensure that sophisticated technologies such as robotics, AI-based diagnostics, and wearable medical devices reach a wider audience. In addition, engagement from the public sector ensures adherence to healthcare regulations and builds confidence in new technologies. This collaboration further promotes regional development, especially in rural communities, by enhancing healthcare access and creating sustainable models that benefit businesses and local populations.

Sustainability and Green Technologies

The healthcare sector is increasingly prioritizing sustainability, and the Australian MedTech industry is positioned to take the lead in sustainability and green technologies. With growing pressure to minimize environmental footprints, companies are investigating recyclable materials, biodegradable packaging, and energy-saving medical devices. Hospitals and healthcare providers are actively seeking eco-conscious products that can diminish waste and carbon emissions while ensuring patient safety. Australian MedTech firms can capitalize on this trend by creating innovative, sustainable devices that align with global climate objectives. This emphasis on sustainability bolsters their brand image and opens doors to new markets where eco-friendliness is a key purchasing factor. In the long run, commitment to green innovation enhances competitiveness while fulfilling both regulatory and societal expectations for responsible healthcare solutions.

Government Support of Australia MedTech Market:

Regulatory Framework and Standards

The Australian government is crucial in fostering the MedTech sector through a strong regulatory framework that guarantees product safety, efficacy, and adherence to global standards. Well-defined guidelines for the registration and approval of medical devices allow companies to bring innovative technologies to market with greater confidence. Efficient processes, such as expedited approval pathways for breakthrough products, motivate both startups and established companies to invest in research and product development. By upholding stringent quality and safety standards, the regulatory system protects patients and enhances the international reputation of Australian MedTech products. This clarity in regulations boosts industry competitiveness and enables companies to concentrate on innovation, minimizing delays and uncertainties in the commercialization journey.

Funding and Grants

Government funding and grant initiatives significantly contribute to the growth of Australia’s MedTech industry. Targeted financial assistance allows early-stage startups, research institutions, and established manufacturers to access essential resources for innovation, product testing, and market growth. Grants often finance R&D, clinical trials, commercialization efforts, and advanced manufacturing projects, mitigating financial risks linked to innovation. This funding also facilitates stronger collaboration within the ecosystem by bridging the gap between academic research and industrial application. By providing subsidies and co-investment opportunities, the government helps MedTech companies maintain global competitiveness while expanding operations. This financial support cultivates an environment conducive to disruptive technologies, ultimately enhancing healthcare outcomes and driving economic growth.

Healthcare Infrastructure Investments

Continuous investments by the Australian government in healthcare infrastructure generate strong demand for MedTech products and services. The expansion and modernization of hospitals, diagnostic centers, and aged-care facilities necessitate advanced medical devices, diagnostic systems, and digital health platforms. Government-led digital health initiatives further promote the integration of telehealth, electronic health records, and AI-powered diagnostic tools. These investments improve patient care and create opportunities for MedTech firms to implement and showcase innovative solutions on a larger scale. By aligning infrastructure progress with technological advancements, the government ensures that healthcare systems are prepared for the future. This ongoing commitment offers MedTech companies a stable and expanding market, reinforcing Australia’s role as a center for advanced medical technologies.

Challenges of Australia MedTech Market:

High Regulatory Compliance Costs

In Australia, the MedTech industry functions within strict regulatory guidelines designed to guarantee the safety, effectiveness, and quality of medical devices and technologies. Although these regulations are crucial for upholding patient confidence and the standard of healthcare, they frequently present significant financial and administrative hurdles for businesses, particularly for smaller companies and startups. The expenses involved in preparing technical documentation, conducting clinical trials, and fulfilling compliance requirements can be quite significant, resulting in delays in product development timelines. Additionally, adapting to changing international standards for global expansion adds another layer of complexity. Although larger corporations may find these challenges manageable, they can stifle competitiveness among smaller players, hinder innovation, and impede their ability to rapidly launch groundbreaking technologies in the market.

Limited Access to Capital for Startups

One of the primary hurdles for early-stage MedTech companies in Australia is securing funding. Creating new medical technologies necessitates considerable investment in areas such as research, prototyping, clinical testing, and regulatory approvals, all of which are resource-intensive processes. In contrast to industries that offer quicker returns, MedTech innovations typically require long development cycles prior to reaching commercialization, leading to investor reluctance. Compared to global hubs like the U.S. or Europe, opportunities for venture capital and private equity funding are limited, which leaves many startups reliant on grants or partnerships. This financing shortfall often hampers growth, restricts scaling, and limits potential for global expansion. Without adequate capital flow, even the most innovative solutions can struggle to transition from research environments to widespread clinical application, ultimately affecting the industry's competitiveness.

Market Fragmentation

The Australian MedTech market is marked by notable fragmentation, driven by differences in healthcare systems, patient demographics, and varying adoption rates across states and territories. Hospitals, private clinics, and public healthcare providers often utilize distinct procurement processes, resulting in inconsistent demand for new technologies. Furthermore, healthcare facilities in rural and regional areas may lack the necessary resources or infrastructure to incorporate advanced medical technologies, exacerbating the gap in market penetration. This fragmented environment poses challenges for MedTech companies aiming to achieve economies of scale or establish consistent distribution channels. The absence of centralized purchasing power complicates pricing strategies and technology integration, necessitating tailored approaches for different segments, which in turn increases costs and slows the broader adoption of innovative solutions.

Australia MedTech Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia MedTech market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, component, deployment type, application, and end user.

Analysis by Type:

- Telehealth

- Medical Wearables

- EMR/EHR Systems

- Medical Apps

- Healthcare Analytics

- Others

The telehealth sector leads the Australia MedTech market, as people seek easier healthcare options especially when they live far from medical facilities. The rising number of older patients with chronic diseases makes it necessary to monitor them from a distance and offer virtual medical consultations. Moreover, healthcare delivery methods that connect doctors and patients online help patients reach medical services faster and easier. Furthermore, government funding programs and helpful rules help speed up the use of telehealth services. As a result, patients want easier ways to access personalized healthcare services, telehealth is significantly contributing to the market expansion in the region.

Analysis by Component:

- Software

- Hardware

- Service

Software is the largest component in the Australia MedTech market, driven by the growing need for innovative digital health solutions. The healthcare industry uses electronic health records (HER) more often and depends on health management apps and AI systems to boost software requirements throughout medical systems. The software system also helps doctors provide better care by processing patient data instantly while predicting health risks and delivering telemedicine services to be prepared. Apart from this, government funding of digital health systems and efforts to share data between healthcare providers drives the market expansion. The Australia medical sector uses advanced software faster because patients want custom healthcare treatment and doctors are moving toward preventive care through remote monitoring. As a result, the market growth of healthcare depends mainly on software advancements.

Analysis by Deployment Type:

- On-Premises

- Cloud-Based

On-premises deployment in the Australia MedTech market offers greater control over data security and system customization, particularly for large healthcare institutions. It is preferred by providers with established IT infrastructure seeking to comply with stringent data privacy regulations. Although initial setup costs are higher, on-premises solutions ensure full ownership and offline operability, appealing to highly regulated environments.

Cloud-based deployment is rapidly gaining traction in Australia’s MedTech sector due to its scalability, remote accessibility, and cost-effectiveness. It supports seamless integration with digital health tools like telemedicine, wearables, and AI analytics. This model enables real-time patient monitoring, faster software updates, and secure data sharing across systems, aligning with Australia’s push for digital transformation in healthcare delivery.

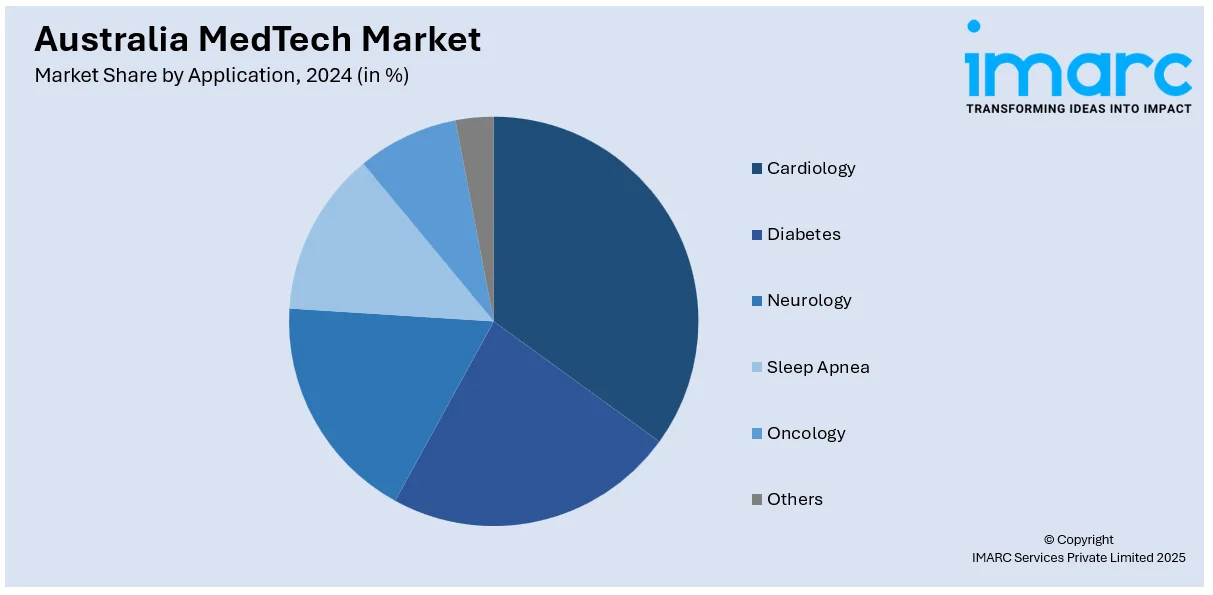

Analysis by Application:

- Cardiology

- Diabetes

- Neurology

- Sleep Apnea

- Oncology

- Others

Cardiology holds the biggest share in the Australia MedTech market due to the constantly increasing rate of cardiovascular diseases (CVDs) and the need for better diagnostic and therapeutic tools. As people get older and new lifestyle factors are causing heart disease rates to rise, new cardiology devices are needed. Besides this, emerging technologies in diagnostics including imaging, wearable electrocardiogram (ECG), and implantable devices including pacemakers and defibrillators among others are significantly driving the adoption of MedTech in cardiology. The availability of grants for heart disease, coupled with the existence of a strong healthcare infrastructure, allows for the advancement of new cardiology solutions. Also, growing patient knowledge and requests for individual, less invasive care also contribute to the growth of cardiology in the Australia MedTech market, making it an ideal area for future expansion.

Analysis by End User:

- Healthcare Providers

- Healthcare Payers

- Pharmaceutical Companies

Healthcare providers is the largest and the fastest growing in the Australia MedTech market due to continuous innovations in medical technologies and focus on patient care. Medical centers and healthcare organizations are adopting new technologies and appliances in diagnosing, treating, and monitoring patients. The population density of elder citizens and the prevalence of chronic diseases define the need for qualitative medical instruments, diagnostic and surgical tools as well as wearables. The healthcare segment further is driven by increased government funding, capital investment by healthcare facilities, and the use of such solutions as telemedicine and home monitoring. Apart from this, the efforts to increase the performance and the level of patient satisfaction in healthcare organizations guarantee the constant improvement of the popularity of MedTech products among hospitals, clinics, and specialized care centers, thereby by propelling the market forward.

Regional Analysis:

- Western Australia

- New South Wales

- Queensland

- Victoria

- Rest of Australia

New South Wales (NSW) dominates Australia MedTech market, driven by its strong healthcare infrastructure, research excellence, and innovation hubs. The state is home to leading universities, hospitals, and private-sector collaborations that foster the development of cutting-edge medical technologies. Additionally, rising government support, including funding for research and development (R&D), is another key driver propelling growth in NSW. Furthermore, the growing demand for advanced medical devices, in the region, particularly in digital health, diagnostics, and personalized care, boosts the market expansion. Concurrently, NSW’s thriving startup ecosystem attracts both local and international investments, fueling the development of new solutions. For instance, Victoria allocated an additional $14M for EMR implementation, while public health services in South Australia and Melbourne announced plans to adopt a digital patient flow management platform to enhance healthcare efficiency. Also, the large, diverse population, along with a high rate of chronic disease, creates a continual demand for advanced MedTech solutions, ensuring NSW remains a central player in Australia MedTech market growth.

Competitive Landscape:

The competitive landscape of Australia’s MedTech market is marked by a mix of established global players and innovative local startups. Major international companies dominate key segments, particularly in diagnostics, imaging, and cardiology, leveraging advanced technologies and extensive distribution networks. Meanwhile, local startups focus on niche markets, often driving innovation in digital health, AI, and wearable devices. Government support, along with partnerships between research institutions and the private sector, creates a dynamic environment that drives growth. However, competition is intensifying as new entrants and disruptive technologies emerge, compelling companies to innovate continuously while adhering to stringent regulatory standards.

The report provides a comprehensive analysis of the competitive landscape in the Australia MedTech market with detailed profiles of all major companies, including:

- Alcidion Group Limited

- Anatomics Pty Ltd

- Artrya

- AusBiotech

- Avanade Australia (Accenture)

- Cochlear Limited

- Ellex

- ResMed Inc.

- Schott AG

- Sirtex Medical Limited

Latest News and Developments:

- In November 2024, Alcidion secured a contract with Peninsula Health to implement its Miya Precision platform, enhancing digital maturity and supporting clinicians in delivering high-quality, safe patient care.

- In November 2024, Alcidion announced a contract with Northern Adelaide Local Health Network (NALHN) for the use of its Miya Precision and mobile clinical task management solutions, aiming to improve patient flow and operational efficiency.

- In April 2024, Artrya signed its first commercial agreement in Australia with The Cardiac Centre NSW and The Cardiac CT Centre NSW. Under this 12-month agreement, Artrya's Salix Coronary Anatomy platform will be used across four specialist centers in New South Wales to detect vulnerable plaque in patients, aiming to improve coronary artery disease diagnosis and care.

- In April 2024, Cochlear received FDA clearance to lower the age indication for its Osia® System to 5 years old. This approval allows younger patients with conductive or mixed hearing loss to benefit from the bone conduction implant system, expanding treatment options for pediatric patients.

- In March 2024, Avanade expanded its digital consultancy and design capabilities to Australia with the launch of Avanade X. This initiative aims to deliver innovative digital products and experiences, leveraging Microsoft's technologies to assist organizations in building differentiated and scalable customer and employee experiences.

Australia MedTech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Telehealth, Medical Wearables, EMR/HER Systems, Medical Apps, Healthcare Analytics, Others |

| Components Covered | Software, Hardware, Service |

| Deployment Types Covered | On-Premises, Cloud-Based |

| Applications Covered | Cardiology, Diabetes, Neurology, Sleep Apnea, Oncology, Others |

| End Users Covered | Healthcare Providers, Healthcare Payers, Pharmaceuticals Companies |

| Regions Covered | Western Australia, New South Wales, Queensland, Victoria, Rest of Australia |

| Companies Covered | Alcidion Group Limited, Anatomics Pty Ltd, Artrya, AusBiotech, Avanade Australia (Accenture), Cochlear Limited, Ellex, ResMed Inc., Schott AG, Sirtex Medical Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia MedTech market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia MedTech market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia MedTech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia MedTech market was valued at USD 8.48 Billion in 2024.

Key factors driving the growth of the Australia MedTech market include an aging population, rising chronic disease rates, strong government support, advances in digital health and AI technologies, increased healthcare infrastructure investment, and a growing demand for personalized and minimally invasive treatments, alongside a thriving innovation ecosystem.

IMARC estimates the Australia MedTech market to exhibit a CAGR of 5.10% during 2025-2033, reaching a value of USD 13.90 Billion by 2033.

Based on type, telehealth accounts for the largest Australia MedTech market, due to its ability to improve healthcare accessibility, particularly in remote areas. The growing demand for remote consultations, chronic disease management, and government support for digital health adoption are driving the market forward.

Some of the major players in the Australia MedTech market include Alcidion Group Limited, Anatomics Pty Ltd, Artrya, AusBiotech, Avanade Australia (Accenture), Cochlear Limited, Ellex, ResMed Inc., Schott AG, and Sirtex Medical Limited.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)