Australia Mental Health Market Report by Disorder (Schizophrenia, Alcohol Use Disorders, Bipolar Disorder, Depression and Anxiety, Post-traumatic Stress Disorder, Substance Abuse Disorders, Eating Disorders, and Others), Service (Emergency Mental Health Services, Outpatient Counselling, Home-based Treatment Services, Inpatient Hospital Treatment Services, and Others), Age Group (Pediatric, Adult, Geriatric), and Region 2025-2033

Australia Mental Health Market Overview:

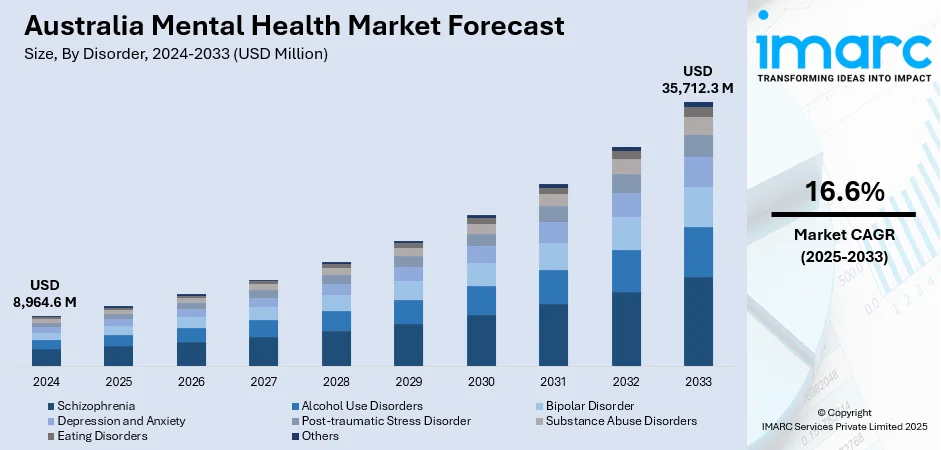

The Australia mental health market size reached USD 8,964.6 Million in 2024. The market is projected to reach USD 35,712.3 Million by 2033, exhibiting a growth rate (CAGR) of 16.6% during 2025-2033. The market is primarily driven by the growing mental healthcare plans, significant government funding on developing new programs and initiatives that address mental health issues, enhanced service quality and accessibility with a focus on innovative treatments and equitable care distribution.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8,964.6 Million |

|

Market Forecast in 2033

|

USD 35,712.3 Million |

| Market Growth Rate 2025-2033 | 16.6% |

Key Trends of Australia Mental Health Market:

Increase in Mental Health Care Plans

According to the Australia Institute of Health and Welfare (AIHW), the utilization of Medicare-subsidized mental health services in Australia has seen a notable increase, with more than 2.7 million patients utilizing nearly 13.2 million mental health services. Moreover, psychologists delivered 49% of these services, while general practitioners (GPs) provided 27%, psychiatrists 20%, and other allied health professionals 5%. Additionally, 13% of female patients accessed these services, compared to 8% of male patients. This upward trend indicates a significant shift toward recognizing and addressing mental health issues within the community. As more individuals seek out such subsidized plans, the demand for professional mental health services increases, expanding the depth and scope of the market in mental health services. Besides, the increase in users under mental health care plans owing to the increased public awareness and destigmatization of mental health issues is influencing the market growth. This would also mean more specialists within the health professions and better mental health facilities. Hence, this fosters a strong expansion in the range of services in the mental health service sector, with the facilities expanding and diversifying their services to meet the growing demand.

To get more information on this market, Request Sample

Increased Government Funding

The Australian government's commitment to mental health is underscored by a significant boost in funding, particularly evident in the 2022-2023 federal budget. According to the Australian Government, Department of Health, the government is dedicated to achieving zero suicides and is allocating $46.7 Million to suicide prevention initiatives and research as part of the second stage of the Mental Health and Suicide Prevention Plan. This funding is an addition to the $2.3 Billion introduced in the initial phase of the plan during the 2021-22 Budget. Besides, the total funding for the plan is approaching $3 Billion, including other mental health and suicide prevention allocations of $648.6 Million in the 2022-2023 budget. Furthermore, since the fiscal year 2012-2013, the government's investment in mental health and suicide prevention through the health portfolio has more than doubled, showing a 106% increase from $3.3 Billion to an anticipated $6.8 Billion in the 2022-2023 Budget. Moreover, the government invests in the improvement of infrastructure to expand outreach and ensure better access to mental health services. Hence, financial support is essential in developing new programs and initiatives that address areas of unmet needs and populations to promote equity in mental health resource distribution.

Expansion of Telehealth Services

Telehealth has emerged as a transformative trend in the Australian mental health market, offering greater accessibility to individuals in both urban and remote regions. The growing acceptance of virtual consultations allows patients to connect with psychologists, psychiatrists, and counselors without the need for travel, reducing geographic barriers and wait times. Telehealth is especially beneficial for rural populations where mental health services are scarce or unavailable locally. It also supports privacy and convenience, which can encourage more individuals to seek timely support. The flexibility of scheduling and lower operational costs for providers make telehealth a sustainable service model. As digital literacy and internet connectivity improve across Australia, the continued expansion of telehealth is expected to play a vital role in the sector’s growth.

Growth Drivers of Australia Mental Health Market:

Rising Mental Health Awareness

In Australia, rising awareness of mental health has been an essential catalyst for growth within the sector. Public campaigns, national programs such as R U OK? Day, and social media activism are all playing key roles in de-stigmatizing mental illness. Consequentially, more people are willing to talk about mental health issues and are accessing professional assistance earlier. The normalization of discussing mental health has also caused more people to use services like counseling, therapy, and support groups across different age groups. Schools, workplaces, and communities are also incorporating mental health programs to actively promote well-being. This shift in societal attitudes is significantly contributing to the rising demand for services, thereby positively influencing the Australia mental health market share.

Growing Prevalence of Mental Health Disorders

The increasing rate of mental health diseases like anxiety, depression, bipolar disorder, and PTSD is one of the major drivers of mental health service growth in Australia. Greater awareness, less stigma, and improved diagnostic tools have helped more patients be correctly diagnosed and receive treatment in a timely manner. Contemporary ways of life characterized by work pressures, social isolation, and screen overuse have further accelerated mental health issues, particularly among young adults and working professionals. While more mental health issues are being increasingly acknowledged, increased demand for psychiatrists, psychologists, counseling services, and psychotherapeutic treatments is coming into play. This increased demand is stimulating growth in public and private healthcare facilities, boosting the overall development of the Australia mental health market.

Workplace Mental Health Programs

Australian employers are increasingly focusing on the mental health of their employees, appreciating its direct correlation with productivity, retention, and company culture. Increased levels of stress, burnout, and workplace anxiety have prompted firms to adopt systematic mental health initiatives such as employee assistance programs (EAPs), counseling services, mindfulness sessions, and flexible work arrangements. These efforts are increasingly becoming a part of corporate plans, particularly among large corporations and government agencies. The transition towards mentally healthy workplaces is also being encouraged through regulatory systems and industry standards supporting psychological safety. This growing corporate focus is significantly boosting the need for professional mental health service providers, thereby escalating the Australia mental health market demand across both urban and regional sectors.

Challenges of Australia Mental Health Market:

Limited Access in Rural and Remote Areas

One of the most pressing challenges in Australia’s mental health market is the limited accessibility of services in rural and remote regions. Many communities in these areas face significant barriers due to geographic isolation, poor transportation infrastructure, and a shortage of local healthcare providers. Rural communities often lack access to mental health services because they are often concentrated in large cities. Individuals in remote locations may have to travel long distances or face extended wait times to receive appropriate care, which can deter them from seeking help altogether. Telehealth has emerged as a potential solution, but issues like unreliable internet connectivity and lack of digital literacy further complicate service delivery. This disparity in access continues to affect equitable mental health outcomes nationwide.

Workforce Shortages

Australia’s mental health sector is struggling with a shortage of qualified professionals, including mental health nurses, psychologists, psychiatrists and social workers. This shortfall is contributing to long wait times, overburdened practitioners, and limited availability of specialized care. As demand for mental health services continues to rise, especially in the wake of growing awareness and post-pandemic stressors, the pressure on the existing workforce intensifies. Training and retaining skilled professionals in both urban and regional settings remains a major hurdle. Furthermore, the uneven distribution of professionals, with a concentration in metropolitan areas, exacerbates the problem in rural communities. Addressing workforce shortages is critical for ensuring timely, accessible, and quality mental health care across Australia.

High Cost of Private Services

The high cost of accessing private mental health services is a significant barrier for many individuals in Australia. While public mental health programs exist, they often come with long waiting periods and limited session caps under Medicare. As a result, individuals who require immediate or ongoing support frequently turn to private practitioners, where fees can be substantial. This out-of-pocket expense discourages consistent treatment, particularly for those without private health insurance or with limited financial resources. The financial burden is especially pronounced among low-income groups, students, and part-time workers. Affordability challenges can lead to delayed care or dropped treatment plans, impacting mental health outcomes. According to Australia mental health market analysis, affordability remains a critical factor influencing service accessibility and equity.

Australia Mental Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on disorder, service, and age group.

Disorder Insights:

- Schizophrenia

- Alcohol Use Disorders

- Bipolar Disorder

- Depression and Anxiety

- Post-traumatic Stress Disorder

- Substance Abuse Disorders

- Eating Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the disorder. This includes schizophrenia, alcohol use disorders, bipolar disorder, depression and anxiety, post-traumatic stress disorder, substance abuse disorders, eating disorders, and others.

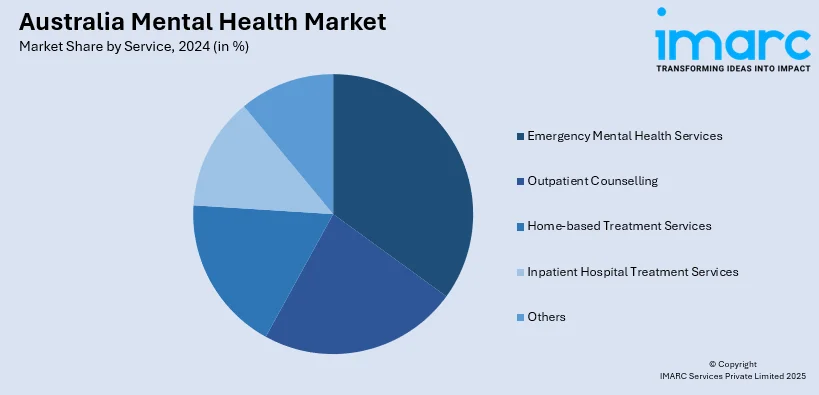

Service Insights:

- Emergency Mental Health Services

- Outpatient Counselling

- Home-based Treatment Services

- Inpatient Hospital Treatment Services

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes emergency mental health services, outpatient counselling, home-based treatment services, inpatient hospital treatment services, and others.

Age Group Insights:

- Pediatric

- Adult

- Geriatric

The report has provided a detailed breakup and analysis of the market based on the age group. This includes pediatric, adult, and geriatric.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Mental Health Market News:

- In June 2023, Australia became the first nation globally to allow the clinical use of Methylenedioxymethamphetamine (MDMA), commonly known as ecstasy and psilocybin, the primary psychoactive component in magic mushrooms, for specific mental health conditions. From July 1, approved psychiatrists will have the authority to prescribe MDMA to treat post-traumatic stress disorder (PTSD) and psilocybin for depression that has not responded to other treatments, as stated in a February news release. These substances remain illegal across the country for other uses.

- May 7, 2024: National Mental Health Commission in Australia is leading a project to develop National Guidelines. These will support states and territories to include mental health and wellbeing in early childhood health checks (for children aged 0-5 years). The introduction National Guidelines supports national consistency. The National Guidelines aim to help children early, and to allow families to get timely support and advice.

Australia Mental Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Disorders Covered | Schizophrenia, Alcohol Use Disorders, Bipolar Disorder, Depression and Anxiety, Post-traumatic Stress Disorder, Substance Abuse Disorders, Eating Disorders, Others |

| Services Covered | Emergency Mental Health Services, Outpatient Counselling, Home-based Treatment Services, Inpatient Hospital Treatment Services, Others |

| Age Groups Covered | Pediatric, Adult, Geriatric |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia mental health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia mental health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia mental health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mental health market in the Australia was valued at USD 8,964.6 Million in 2024.

The Australia mental health market is projected to exhibit a compound annual growth rate (CAGR) of 16.6% during 2025-2033.

The Australia mental health market is expected to reach a value of USD 35,712.3 Million by 2033.

The Australia mental health market is witnessing key trends such as rising telehealth adoption, increased use of mental health apps, greater workplace mental health focus, and growing emphasis on early intervention and youth-centered services. Hybrid care models are also gaining traction for improved accessibility and convenience.

Key growth drivers include increasing mental health awareness, higher diagnosis rates of conditions like anxiety and depression, supportive government policies, and expanded funding. Additionally, the demand for culturally inclusive care and digital mental health solutions is driving market expansion across both urban and regional areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)