Australia Metal Casting Market Size, Share, Trends and Forecast by Process, Material Type, End Use, and Region, 2025-2033

Australia Metal Casting Market Size and Share:

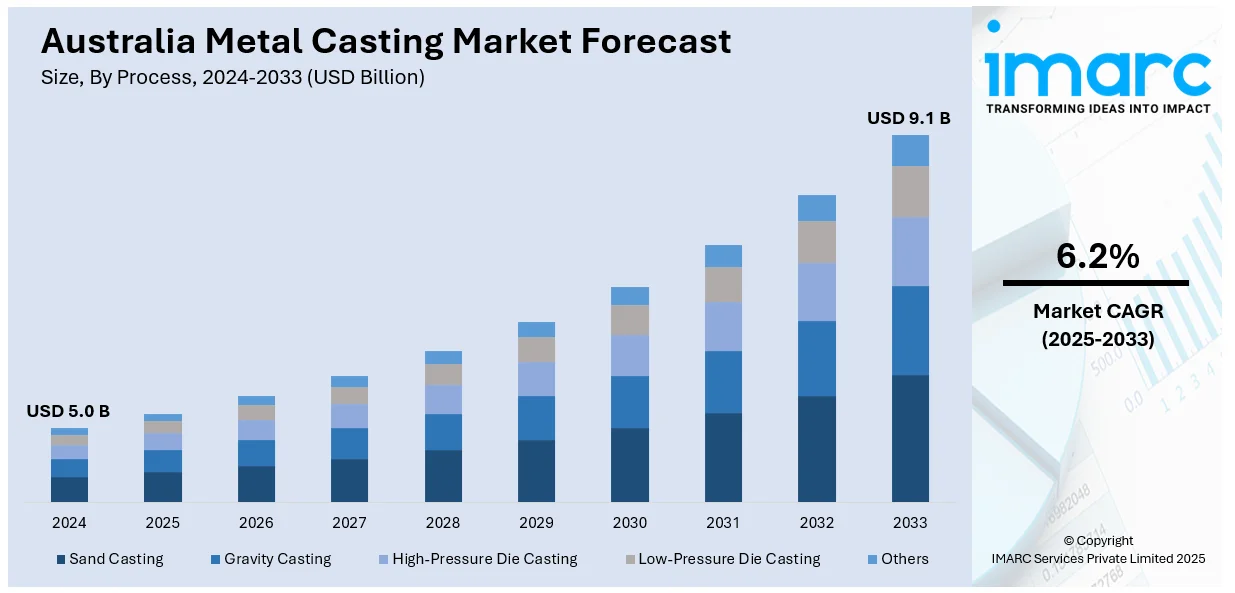

The Australia metal casting market size reached USD 5.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033. The rising industrialization, growing demand for lightweight and durable components in automotive and aerospace sectors, advancements in casting technologies, increasing infrastructure projects, expanding mining activities, stringent environmental regulations promoting sustainable casting methods, and the rising adoption of automation and 3D printing in foundries are some of the major factors augmenting Australia metal casting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.0 Billion |

| Market Forecast in 2033 | USD 9.1 Billion |

| Market Growth Rate 2025-2033 | 6.2% |

Australia Metal Casting Market Trends:

Emphasis on Lightweight Materials in Automotive Manufacturing

The shift towards lightweight materials in the automotive industry is positively impacting the Australia metal casting market outlook. As stricter fuel efficiency and emission standards gain focus, automakers are using more lightweight metal parts to make vehicles perform better. Aluminum and magnesium are in greater demand as they have higher strength-to-weight ratios, making it possible to lower the total vehicle weight while ensuring structural stability. Thus, metal casting manufacturers are embracing more sophisticated methods like high-pressure die casting and precision sand casting. These techniques ensure maximum material usage, minimize costs of production, and enhance the mechanical properties of the cast parts. According to an industry report, Australia has seen a consistent increase in the sales of electric vehicles, with 85,319 sold by the end of September 2024. Also, EVs make up 9.5% of total new car sales, up from 8.4% in 2023. The increasing demand for electric vehicles (EVs) is further accelerating the transition to lightweight materials, as reducing weight enhances battery efficiency and driving range. The continuous development of alloys with improved thermal and mechanical properties further supports this evolution, allowing manufacturers to meet both performance and environmental standards. This industry shift is influencing supply chain dynamics, with a stronger focus on high-quality, lightweight castings tailored to evolving automotive needs.

To get more information on this market, Request Sample

Advancements in Automation and Digital Casting Technologies

The integration of automation and digital technologies in metal casting is transforming manufacturing processes in Australia. Traditional casting methods are being increasingly supplemented or replaced by computer-aided design (CAD), 3D printing, and simulation software to optimize efficiency, reduce material waste, and enhance precision. For instance, on March 26, 2024, the Innovative Launch Trailblazer (iLAuNCH) initiative commissioned Australia's first multi-metal 3D printer in Melbourne, aiming to enhance affordability and efficiency. Metals will be printed side by side in a single continuous print using the Nikon SLM-280 (Selective Laser Melting) at CSIRO's Lab22 facility. This state-of-the-art printer enables the production of lighter and more robust aerospace components. Automation, especially in mold making and metal pouring, is enhancing productivity as well as reducing human error, hence guaranteeing product quality that is consistent even on a mass scale. Some of the fundamental advances include using robotic automation to increase safety as well as enhance operations by ensuring reduced direct intervention by humans within harmful environments. In addition, intelligent casting technologies, such as real-time monitoring and predictive maintenance, enable manufacturers to detect potential defects early and enhance overall process control. Besides this, the application of digital twins, like virtual models of casting processes, is also increasing, which helps manufacturers simulate and optimize production prior to execution. These technological advancements are driving Australia metal casting market growth by enhancing flexibility, lowering cost, and aligning with improving industry standards.

Australia Metal Casting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on process, material type, and end use.

Process Insights:

- Sand Casting

- Gravity Casting

- High-Pressure Die Casting

- Low-Pressure Die Casting

- Others

The report has provided a detailed breakup and analysis of the market based on the process. This includes sand casting, gravity casting, high-pressure die casting, low-pressure die casting, and others.

Material Type Insights:

- Cast Iron

- Aluminum

- Steel

- Zinc

- Magnesium

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes cast iron, aluminum, steel, zinc, magnesium, and others.

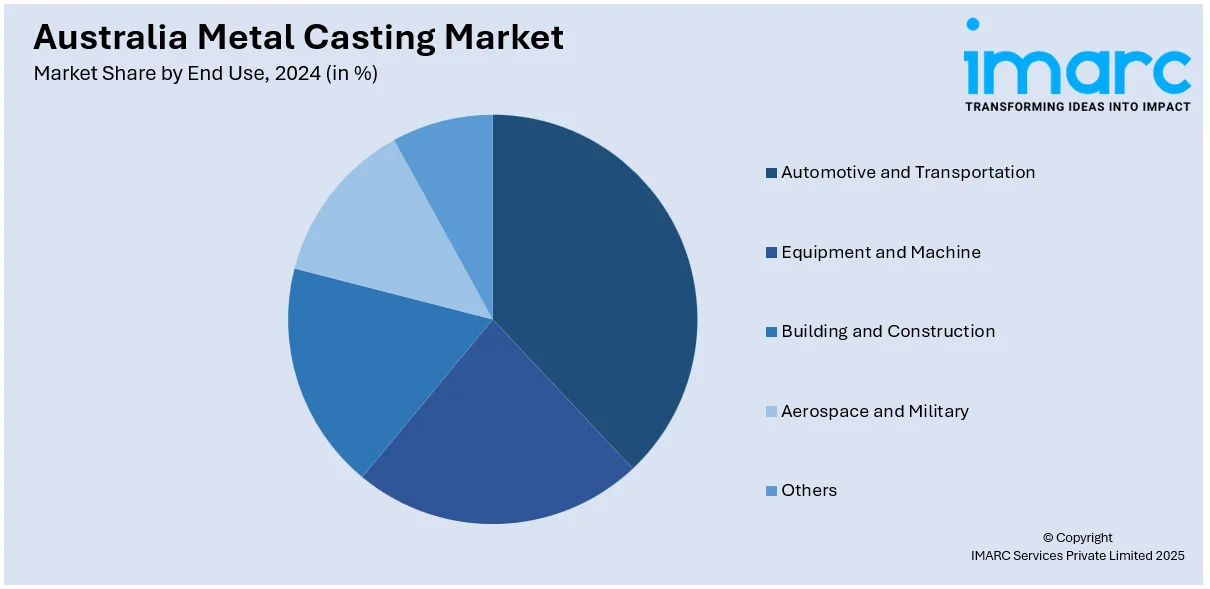

End Use Insights:

- Automotive and Transportation

- Equipment and Machine

- Building and Construction

- Aerospace and Military

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes automotive and transportation, equipment and machine, building and construction, aerospace and military, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Metal Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Sand Casting, Gravity Casting, High-Pressure Die Casting, Low-Pressure Die Casting, Others |

| Material Types Covered | Cast Iron, Aluminum, Steel, Zinc, Magnesium, Others |

| End Uses Covered | Automotive and Transportation, Equipment and Machine, Building and Construction, Aerospace and Military, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia metal casting market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia metal casting market on the basis of process?

- What is the breakup of the Australia metal casting market on the basis of material type?

- What is the breakup of the Australia metal casting market on the basis of end use?

- What is the breakup of the Australia metal casting market on the basis of region?

- What are the various stages in the value chain of the Australia metal casting market?

- What are the key driving factors and challenges in the Australia metal casting market?

- What is the structure of the Australia metal casting market and who are the key players?

- What is the degree of competition in the Australia metal casting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia metal casting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia metal casting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia metal casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)