Australia Metal Fabrication Market Size, Share, Trends and Forecast by Material Type, Service Type, End-Use Industry, and Region, 2025-2033

Australia Metal Fabrication Market Overview:

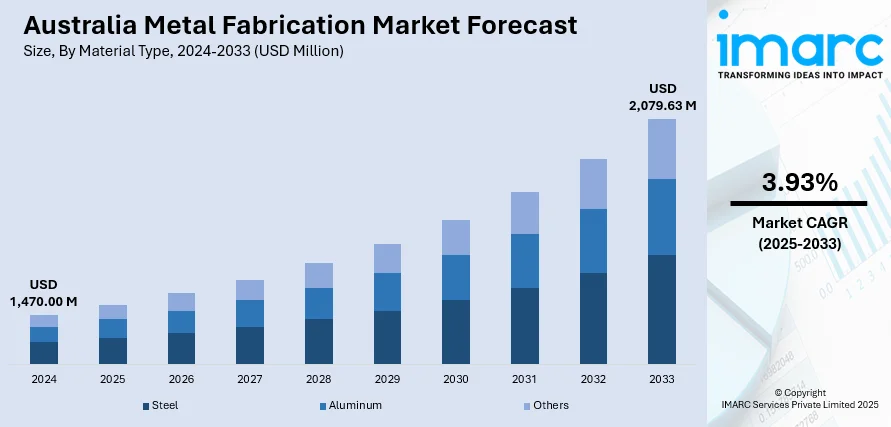

The Australia metal fabrication market size reached USD 1,470.00 Million in 2024. Looking forward, the market is expected to reach USD 2,079.63 Million by 2033, exhibiting a growth rate (CAGR) of 3.93% during 2025-2033. The industry is spurred by growth in infrastructure development, use of new manufacturing technologies, growing demand in defense and renewable energy industries, and high emphasis on sustainability. These trends combined improve production capacity and competitiveness, leading to the consistent growth in Australia metal fabrication market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,470.00 Million |

| Market Forecast in 2033 | USD 2,079.63 Million |

| Market Growth Rate 2025-2033 | 3.93% |

Key Trends of Australia Metal Fabrication Market:

Adoption of Industry 4.0 Technologies

Australian metal fabrication is rapidly adopting Industry 4.0 technologies to improve the efficiency and accuracy of production. The integration of Artificial Intelligence (AI), Internet of Things (IoT), and analytics enables real-time monitoring and optimization of the manufacturing process. Moreover, the deployment of sophisticated robotics and automation systems simplifies repetitive tasks, enhancing consistency as well as minimizing human error. This technological transformation not only enhances productivity but also positions Australian manufacturers to satisfy the growing demand for high-quality, custom metal products, thus driving the growth of the Australia metal fabrication market. For instance, in March 2025, the Australian Government committed $750 Million through the $1.7 Billion Future Made in Australia Innovation Fund to modernize the metals sector with low-emissions technologies. This includes funding for pilot projects, plant upgrades, and green metals production using renewables, enhancing productivity and aligning with Industry 4.0, which further contributes to the growth of Australia metal fabrication market demand.

To get more information on this market, Request Sample

Sustainability Initiatives and Green Manufacturing

Sustainability has become a central focus in the Australia metal fabrication market growth, driven by both regulatory pressures and market demand for environmentally responsible practices. Fabricators are adopting energy-efficient technologies and sourcing recycled materials to minimize their carbon footprint. For example, the Australian government has launched a $636 Million fund to support the production and supply chains of green iron, aiming to reduce emissions in steel manufacturing. Firms are also adopting waste reduction methods, including the recycling of scrap metal and minimizing material usage to reduce waste output. The eco-friendly practices not only ensure environmental conservation but also help make Australian manufacturers more competitive in the global market, in accordance with the increased focus on environmentally friendly manufacturing practices.

Growth Drivers of Australia Metal Fabrication Market:

Infrastructure Development and Government Investment

One of the major drivers of growth in the metal fabrication industry in Australia is the nation's sustained investment in infrastructure development driven by both federal and state-level investment programs. Large-scale public infrastructure projects such as transport systems, bridges, tunnels, and energy plants demand huge amounts of fabricated metal products like beams, pipes, and structural members. The Australian government's focus on massive-scale infrastructure improvements to facilitate urban growth, economic recovery, and regional integration has generated a consistent demand for metal fabrication services. Australia's sheer size and increasing population also continue to drive investment in both country and urban infrastructure. The demand for durable, corrosion-resistant materials that can handle Australia's varied climates has further fostered local innovations in fabrication materials and methods. This dynamic, facilitated by long-term government planning and funding streams, places the infrastructure sector as an important growth driver for metal fabricators, specifically those that provide high-performance, durable, and customizable solutions.

Mining and Resource Sector Growth

Australia's mineral-rich environment has placed the region at the forefront of the global mining industry, and this continues to facilitate strong growth in the metal fabrication industry. Mining operations involve heavy equipment, equipment enclosures, conveyors, platforms, and parts for repairing, nearly all of which are manufactured by metal fabrication. With continuous demand for goods like iron ore, coal, lithium, and rare earth minerals, mining firms are investing in ground expansion, upgrades, and modernization of technology. Metal fabricators directly gain from this demand by providing precision-made components that satisfy the industry's stringent standards for strength, safety, and performance. In addition, the distant locations of most of Australia's mines require site-specific, custom-built fabrication solutions and frequently involve intimate collaboration between fabricators and engineering teams. In places such as Western Australia and Queensland, where mining activity is particularly concentrated, the metal fabrication sector benefits from the constant flow of resource industry projects to create an even more stable pillar of industrial support.

Expansion in Advanced Manufacturing and Export Prospects

According to the Australia metal fabrication market analysis, the industry is also being driven by the expanding focus on cutting-edge manufacturing and rising export prospects. As the nation shifts to diversify its manufacturing sector and decrease dependence on imports, the metal fabrication industry is experiencing greater investment in automaton, robotics, and precision machine work. These technologies allow local producers to improve productivity, minimize operating expenditures, and make intricate, high-quality components which are appropriate for worldwide use. Australia's healthy trade ties, especially with Asia-Pacific countries, present fabricators with chances to supply fabricated metal components utilized in industries including automotive, construction, aerospace, and defense. Moreover, local efforts to build sovereign industrial capabilities, most notably in defense and renewable energy, are incentivizing the utilization of locally fabricated metal solutions. With increasing global interest in Australian engineering skills and quality, metal fabrication firms are expanding operations to satisfy both domestic and foreign demand. This focus toward innovation and export preparedness is a long-term market growth driver.

Opportunities of Australia Metal Fabrication Market:

Green Infrastructure and Renewable Energy Projects

The swift growth of Australia's renewable energy industry provides a great opportunity for the metal fabrication industry. As there is national momentum in becoming net-zero emissions, there is growing investment in solar farms, wind installations, and green hydrogen infrastructure, needing bespoke metal parts. Wind turbines, solar panel supports, structural frames, and supporting systems need to be manufactured to resist Australia's varied and sometimes extreme environmental conditions, so high-quality local manufacture is crucial. Offshore wind farm development, especially in Victoria and New South Wales coastal areas, is creating new opportunity for corrosion-proof, marine-quality metal structures. In addition, the development of energy storage facilities and transmission networks enables additional opportunity for metal fabricators to provide custom-engineered components. As green energy becomes the foundation of Australia's energy strategy for the future, metal fabrication businesses that can target sustainability objectives and create components designed specifically for renewable uses can reap high-value, long-term projects throughout the nation.

Defense and Aerospace Sector Development

Australia's growing emphasis on enhancing its sovereign defense capabilities is building significant opportunity in the metal fabrication sector. Defense initiatives driven by governments, such as naval shipbuilding, military vehicle manufacturing, and aerospace technology development, depend on precision-fabricated, highly specialized metal components. These industries require items that are subject to strict standards of safety, durability, and performance, which stimulates innovation and technical development in metalworking. Increased investment in local manufacturing of defense decreases dependence on foreign suppliers and focuses on collaborations with local fabricators. Parts of South Australia, which host naval shipbuilding projects and aerospace plants already, are being targeted for next-generation fabrication. Also, Australian participation in global defense collaborations demands more components that are globally compliant, paving the way for exports. Metal fabrication companies that are able to navigate the intricate demands of the defense and aerospace sectors like welding specifications, traceability, and intense testing, are positioned to become major suppliers in a high-growth, government-supported segment of the market.

Technological Improvements and Automation Incorporation

The increased use of advanced smart manufacturing technologies in Australia presents a revolutionary chance for the metal fabrication industry. As industry-wide adoption of Industry 4.0 practices such as robotics, computer-aided design (CAD), CNC machining, and real-time production monitoring accelerates, fabricators can enhance efficiency as well as product accuracy. This change is especially beneficial to small and medium-sized enterprises (SMEs), which are a dominant proportion of the manufacturing sector in Australia and are consequently eager to find means of sharpening competitiveness. With automation, these companies can cut the dependency on labor, minimize production faults, and ensure consistent quality, which is paramount when it comes to winning contracts in highly regulated sectors. Additionally, the country's high emphasis on upskilling labor and enhancing digital skills through government-backed programs offers a conducive environment for tech-led growth. As demand grows for bespoke and intricate metal parts across sectors, from construction through to mining and transportation, those fabricators that embrace and implement new technologies will realize new efficiencies, access high-margin markets, and make themselves future-proof.

Government Initiatives for Australia Metal Fabrication Market:

National Manufacturing Priorities and Strategic Funding Programs

The Australian government has announced several national programs to enhance the country's domestic manufacturing industry, with metal fabrication being a key focus area. By targeting advanced manufacturing, critical infrastructure, and sovereign capabilities, the government is directly assisting fabricators looking to modernize and expand their operations. Funding programs are focused on upgrading equipment, embracing digital technologies, and improving workforce capabilities. The Modern Manufacturing Strategy, for instance, encompasses priority sectors such as clean energy, defense, and resource technology, all of which depend extensively on fabricated metal parts. These national priorities provide uniform demand for precision-fabricated structures and influence manufacturers towards pursuing innovation in processes and product design. The government is also promoting higher levels of collaboration among manufacturers, research institutions, and technology providers to instill innovation and establish globally competitive supply chains. These strategic efforts highlight the government's involvement in turning metal fabrication into a pillar of a more diversified and future-proofed industrial base.

State-Level Assistance and Regional Economic Development

State governments in Australia have also been critical in helping the metal fabrication industry expand through investments, training, and infrastructure development. These countries like South Australia, Victoria, and Queensland have incorporated regional manufacturing plans aimed at developing industry in their areas. For instance, South Australia's focus on advanced manufacturing and defense shipbuilding resulted in heavy investment in fabrication plant and skills development. Regional development grants frequently cover provisions to assist small and medium-sized fabrication companies in extending their capacity, acquiring new machines, and training their personnel. These initiatives enhance local employment and assist in decentralizing industrial capacity away from large cities. Emphasis on regional development is particularly crucial in regions near mining or defense centers, where there is strong demand for fabricated metal structures and equipment. Through matching industry needs with available local capabilities, state governments are establishing sustainable prospects for fabricators throughout Australia.

Skills Development and Industry-Academic Partnerships

Identifying the need for a competent workforce to perpetuate the metal fabricating sector, the Australian government has put significant investment into numerous training and education programs aimed at filling the skill gap. Special courses in welding, machining, CAD drawing, and other skill areas concerning metal fabrication are made available by TAFE schools and vocational training operators nationwide. The initiatives are supported by the federal and state governments with subsidies, apprenticeships, and employment services connecting graduates with local manufacturers. Moreover, collaborations between universities and fabrication firms are being stimulated to promote research in material science, automation, and manufacturing innovation. These collaborations are intended to take academic research and turn it into usable solutions that improve productivity and product quality in metal fabrication. These government-sponsored initiatives, apart from providing a steady stream of quality technicians and engineers, also promote a culture of lifelong learning and technological innovation. By investing in talent and technology, the Australian government is building a solid foundation for the long-term growth of the metal fabrication industry.

Challenges of Australia Metal Fabrication Market:

Increasing Operating Expenses and Supply Chain Volatility

The high level of volatility in supply chains combined with the ever-increasing operational expenses, especially in terms of raw materials, energy, and logistics, is one of the significant challenges that the metal fabrication industry in Australia has been experiencing. The metal fabricators tend to source both locally and overseas metals like steel, aluminum, and special alloys. Global supply chain disruptions, together with currency fluctuations and trade uncertainties, have resulted in it becoming more challenging to obtain materials at reliable prices. Moreover, the geographical location of Australia creates logistical difficulties, as long transport routes and high shipping prices prevail, particularly when supplying remote mining or construction locations. Energy prices, which are a key component of fabrication processes involving cutting, welding, and forming, remain volatile and put pressure on profit margins. For most small to medium-sized fabricators, such expenses can become a constraint on their capacity to invest in new equipment or open additional services. Consequently, the balancing act between cost control and quality expectation continues to be a critical challenge in competitiveness in the local and global markets.

Labor Shortages and Skills Mismatch

The Australian metal fabrication sector is also facing a chronic shortage of skilled labor, which is now acting as a key restraint on growth and productivity. Although the nation has attempted to encourage vocational training and apprenticeships, the supply of qualified fabricators, welders, and CNC operators to the workforce has failed to keep up with industry demand. A surging workforce and a limited flow of younger professionals into the profession have compounded this issue, particularly in rural areas where industrial activities tend to congregate. In addition, the industry is in the process of digitalization, with growing uses of automation, robotics, and precision manufacturing technologies. This transition calls for a different skill set that combines traditional fabrication knowledge with technological skills in programming, software, and data analysis. Too many training programs have not yet fully evolved to address these shifting needs, and there is still a skills mismatch compared to contemporary fabrication demands. Managing this talent shortage is paramount to maintaining long-term competitiveness in the industry.

Regulatory Pressures and Compliance Complexity

Another ongoing challenge for the metal fabrication industry is an awareness of Australia's intricate regulation matrix. Manufacturers must meet a wide variety of standards and regulations governing workplace safety, environmental responsibility, and product quality. These regulations differ from state to state and territory to territory, adding extra administrative loads for businesses that operate in multiple areas. Environmental compliance is especially onerous, with the push for lower emissions, proper disposal of waste, and eco-friendly sourcing of materials. Though these practices are vital to long-term environmental well-being, they can be costly to implement in the form of new machinery, monitoring systems, and process redesign. Compliance expenses can be especially onerous for smaller companies with fewer resources or compliance staff to devote to them. Furthermore, changing building codes and industry certifications, particularly in industries such as construction and defense, mandate fabricators remain in a state of perpetual catch-up or face the loss of project eligibility. Regulatory complexity and profitability are a challenge to manage for most in Australia's metal fabricating industry.

Australia Metal Fabrication Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on material type, service type, and end-use industry.

Material Type Insights:

- Steel

- Aluminum

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes steel, aluminum, and others.

Service Type Insights:

- Casting

- Forging

- Machining

- Welding and Tubing

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes casting, forging, machining, welding and tubing, and others.

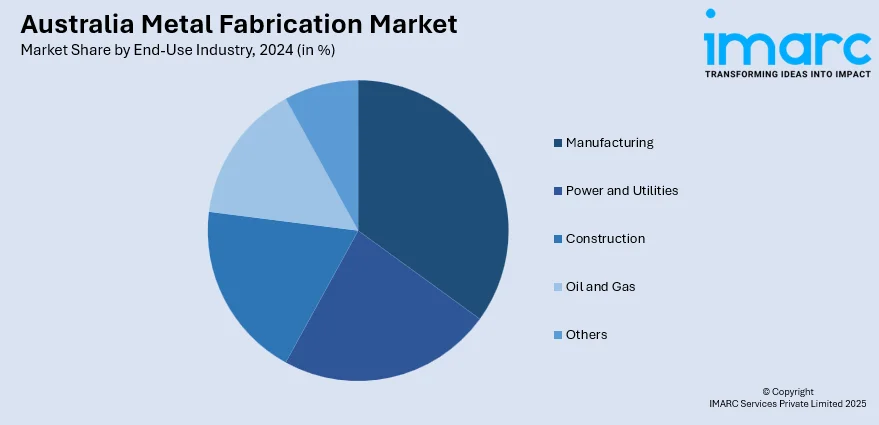

End-Use Industry Insights:

- Manufacturing

- Power and Utilities

- Construction

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes manufacturing, power and utilities, construction, oil and gas, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Metal Fabrication Market News:

- In February 2025, Metal Powder Works merged with K-Tig Advanced Welding Systems in a A$10 Million deal, combining their patented technologies in metal powder production and automated welding. The merger enhances their advanced manufacturing solutions, targeting defense and industrial markets. Both companies bring complementary expertise, expanding metal alloy offerings and automation capabilities to improve productivity, cost-efficiency, and global competitiveness in metal fabrication.

- In February 2024, Australia’s top iron ore producers, Rio Tinto and BHP, partnered with BlueScope to explore the development of the nation’s first Electric Smelting Furnace (ESF) pilot plant. The initiative aims to decarbonise steelmaking by using Direct Reduced Iron (DRI) and renewable energy, potentially reducing emissions by over 80%.

Australia Metal Fabrication Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Steel, Aluminum, Others |

| Service Types Covered | Casting, Forging, Machining, Welding and Tubing, Others |

| End-Use Industries Covered | Manufacturing, Power and Utilities, Construction, Oil and Gas, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia metal fabrication market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia metal fabrication market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia metal fabrication industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia metal fabrication market was valued at USD 1,470.00 Million in 2024.

The Australia metal fabrication market is projected to exhibit a CAGR of 3.93% during 2025-2033.

The Australia metal fabrication market is expected to reach a value of USD 2,079.63 Million by 2033.

Key trends in the Australia metal fabrication market include rising adoption of automation and smart manufacturing, increased demand from renewable energy and defense sectors, and a shift toward sustainable fabrication practices. Integration of digital design technologies are also gaining traction across both urban and regional industrial hubs.

The Australia metal fabrication market is driven by expanding infrastructure projects, and a robust mining sector. Government support for advanced manufacturing and technological adoption further boosts growth, while regional demand for custom fabrication solutions sustains momentum across key industrial and construction sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)