Australia Metal Recycling Market Size, Share, Trends and Forecast by Metal, Sector, and Region, 2026-2034

Australia Metal Recycling Market Summary:

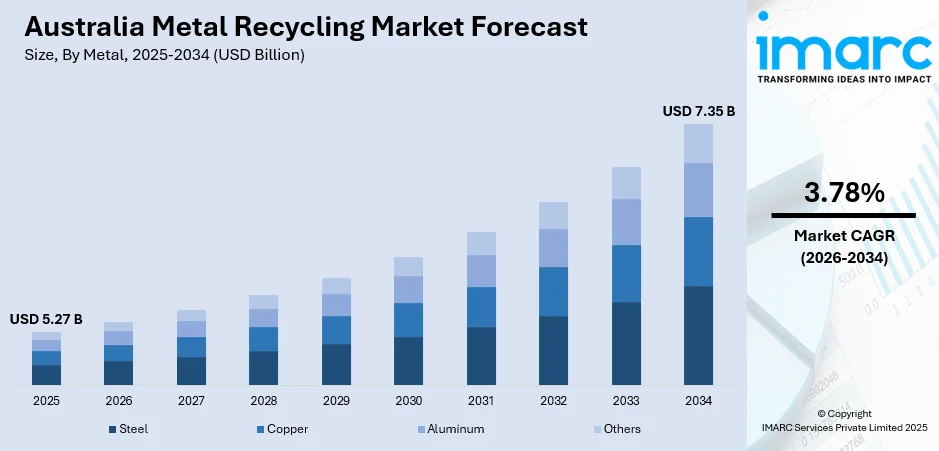

The Australia metal recycling market size was valued at USD 5.27 Billion in 2025 and is projected to reach USD 7.35 Billion by 2034, growing at a compound annual growth rate of 3.78% from 2026-2034.

The Australia metal recycling market is experiencing robust expansion, driven by escalating demand from the construction and infrastructure sectors, tightening environmental regulations promoting circular economy practices, and the growing corporate emphasis on sustainable manufacturing processes. Rising investments in renewable energy projects and the automotive sector are accelerating the need for cost-effective recycled feedstock. Additionally, technological advancements in sorting and processing capabilities are enhancing recovery rates and material quality.

Key Takeaways and Insights:

- By Metal: Steel dominates the market with a share of 48% in 2025, owing to its infinite recyclability, established collection networks, and strong demand from the construction and manufacturing sectors. Recycled steel retains its strength and quality through multiple recycling cycles, making it a preferred sustainable material.

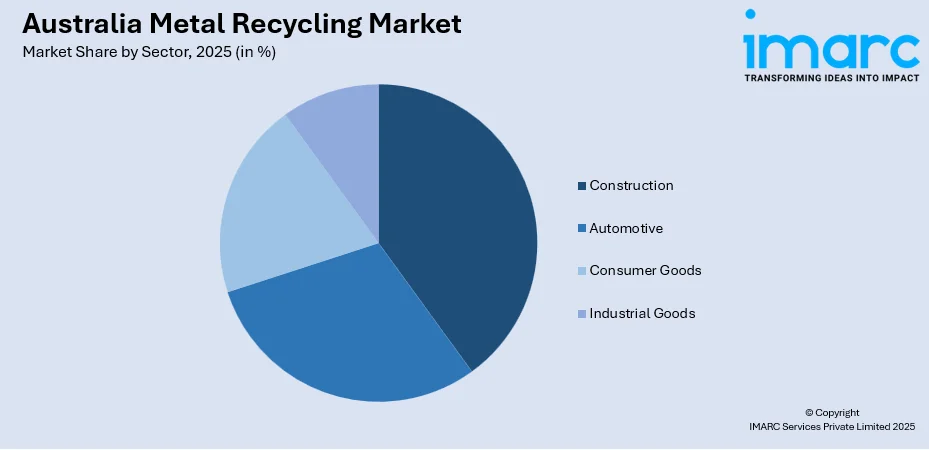

- By Sector: Construction leads the market with a share of 36% in 2025. This dominance is driven by extensive infrastructure development projects, government investment in transportation networks, and rising demand for recycled structural steel and reinforcement bars across residential and commercial building activities.

- Key Players: Key players are driving the market expansion by investing in advanced sorting technologies, expanding processing infrastructure, and establishing closed-loop recycling partnerships. Their focus on sustainability certifications, regional collection networks, and decarbonization initiatives strengthens supply chain resilience and ensures consistent availability of high-quality recycled feedstock across diverse industrial applications.

To get more information on this market Request Sample

The Australia metal recycling industry continues to benefit from favorable policy frameworks and substantial government investments aimed at achieving an 80% resource recovery rate by 2030. Government policies promoting waste reduction, greenhouse gas mitigation, and resource efficiency are encouraging companies to adopt advanced metal recovery technologies and higher recycling rates. Increasing construction, manufacturing, and mining operations continue to generate substantial volumes of scrap, ensuring steady raw material availability for recyclers. The shift towards low-carbon production and the rising demand for secondary metals in automotive, infrastructure, and renewable energy sectors further strengthen market momentum. Export opportunities through well-connected ports and improved domestic processing capabilities add to the growth potential. As consumers and industries prioritize responsible material use, the sector is expected to witness greater investments in modern facilities, automation, and environment-friendly recycling processes, reinforcing long-term market expansion.

Australia Metal Recycling Market Trends:

Rising Adoption of Closed-Loop Aluminum Recycling Systems

Australian industry stakeholders are increasingly embracing closed-loop recycling initiatives to strengthen domestic supply chains and reduce carbon footprints. These collaborative arrangements involve processing post-production scrap through specialized facilities before reintroducing recycled content into manufacturing operations. In November 2024, Capral successfully trialed billet, containing 20% recycled content, provided by Rio Tinto at Boyne Smelters Limited (BSL), utilizing 50 to 100 Tons of post-production aluminum scrap from its Bremer Park extrusion facility in Southeast Queensland. This demonstrates the commercial viability of locally sourced recycled aluminum supply chains within Australia's integrated manufacturing ecosystem.

Integration of Advanced Sorting and Processing Technologies

Technological innovations are transforming metal recycling operations across Australia through deployment of artificial intelligence (AI), machine learning (ML) systems, and automated sorting equipment. As per IMARC Group, the Australia AI market size reached USD 2,072.7 Million in 2024. These advancements enable precise identification and segregation of metal alloys, improving recovery rates while minimizing contamination levels. Scrapyard operators throughout the country are investing in intelligent tracking systems, sensor-based separators, and upgraded shredding capabilities to meet rising demand for high-grade recycled ferrous and non-ferrous metals from domestic manufacturers.

Expansion of Electric Arc Furnace (EAF) Steelmaking Capacity

The expansion of EAF steelmaking capacity is driving the market expansion in Australia by increasing the demand for high-quality scrap as a primary feedstock. EAFs rely heavily on recycled metal, making scrap availability essential for efficient, low-emission steel production. As Australia is shifting toward cleaner steelmaking technologies, mills are sourcing more ferrous scrap to reduce energy consumption and carbon emissions. This transition encourages investment in scrap collection, sorting, and processing infrastructure, strengthening the overall metal recycling ecosystem.

Market Outlook 2026-2034:

The Australia metal recycling market demonstrates strong growth potential, supported by favorable regulatory frameworks, expanding infrastructure pipelines, and increasing corporate sustainability commitments. The market generated a revenue of USD 5.27 Billion in 2025 and is projected to reach a revenue of USD 7.35 Billion by 2034, growing at a compound annual growth rate of 3.78% from 2026-2034. Government initiatives targeting circular economy transitions, combined with substantial private sector investments in processing facilities and collection networks, are expected to enhance domestic recycling capabilities significantly throughout the forecast period.

Australia Metal Recycling Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Metal | Steel | 48% |

| Sector | Construction | 36% |

Metal Insights:

- Steel

- Copper

- Aluminum

- Others

Steel dominates with a market share of 48% of the total Australia metal recycling market in 2025.

Steel leads the Australia metal recycling market because it is generated in the highest volumes across construction, automotive, manufacturing, and mining activities. As per IMARC Group, the Australia steel market size reached USD 19.5 Billion in 2024. Its magnetic properties make collection and separation easier, while its inherent recyclability allows it to be processed repeatedly without quality loss. This ensures a steady supply of scrap for domestic steelmakers, especially as industries prioritize cost-efficient and sustainable raw materials.

Strong demand from infrastructure and industrial projects further reinforces steel’s dominant share in recycling streams. Additionally, the increasing adoption of EAF steelmaking boosts the need for recycled steel, strengthening its market leadership. Steel recycling also delivers major environmental benefits, including reduced carbon emissions and lower energy consumption compared to primary production. Australia’s well-established recycling facilities and widespread scrap networks enhance processing efficiency, supporting high recovery rates. These combined economic, industrial, and sustainability advantages ensure steel remains the most recycled metal in the country.

Sector Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Automotive

- Consumer Goods

- Industrial Goods

Construction leads with a share of 36% of the total Australia metal recycling market in 2025.

The construction sector's dominance in recycled metal consumption reflects the industry's extensive use of structural steel, reinforcement bars, and metal components across residential, commercial, and infrastructure projects. Growing emphasis on sustainable building practices and green building certifications is driving demand for recycled-content materials.

Government infrastructure investments are accelerating the demand for recycled construction steel across major development projects. The Australian Government is dedicated to funding the appropriate infrastructure initiatives that bolster Australia’s expanding cities and areas. In the 2024-25 Budget, the Australian Government allocated USD 16.5 Billion for ongoing and new initiatives, significantly boosting demand for steel reinforcement and structural materials. Major initiatives, including transport network expansions, renewable energy infrastructure, and urban development projects, are creating sustained demand for high-quality recycled steel products throughout the construction value chain.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

In Australia Capital Territory & New South Wales, the market is driven by strong urbanization, high construction activity, and extensive industrial operations that generate large volumes of scrap metal. The region benefits from advanced recycling infrastructure, strong policy support, and high consumer participation in waste recovery programs. Growing automotive, manufacturing, and commercial sectors contribute significantly to scrap generation, while increasing sustainability commitments strengthen demand for efficient metal recovery and reprocessing solutions.

Victoria & Tasmania hold a strong position in the metal recycling market due to their established manufacturing bases, robust construction activity, and well-developed waste management systems. Victoria’s dense population and industrial clusters generate substantial ferrous and non-ferrous scrap, while Tasmania contributes through mining, automotive dismantling, and regional collection programs.

Queensland’s metal recycling market is shaped by its strong mining, construction, and agricultural activities, all of which generate large quantities of metal waste. The state’s expanding infrastructure projects and coastal industrial hubs contribute to consistent scrap availability. Ports and logistics centers also support export-oriented recycling operations.

In Northern Territory & South Australia, the market is supported by their significant mining, defense, and heavy industrial sectors, which produce steady volumes of metal scrap. South Australia’s strong manufacturing and renewable energy industries further boost demand for recycled materials. Regional policies promoting waste diversion and circular resource use encourage investments in modern recycling facilities.

Western Australia leads in metal recycling due to its extensive mining operations, large-scale industrial activities, and strong export capabilities through major ports. High production of ferrous and non-ferrous scrap from mining equipment, construction projects, and manufacturing plants supports a vibrant recycling ecosystem. The region’s focus on sustainability, resource efficiency, and waste minimization drives adoption of advanced processing technologies.

Market Dynamics:

Growth Drivers:

Why is the Australia Metal Recycling Market Growing?

Rising Industrial, Construction, and Mining Scrap Generation

Australia’s expanding construction, mining, and industrial activities are major drivers of the metal recycling market, generating large volumes of ferrous and non-ferrous scrap. During 2023-24, in Australia, over half a billion dollars in voluntary mining sector grants, sponsorships, and donations aided over 5,800 community organizations, services, and initiatives. Infrastructure upgrades, equipment replacement cycles, and continuous project development create steady scrap availability. Mining operations produce substantial metal waste from machinery, structural components, and decommissioned assets, while construction sites contribute steel beams, rebar, and fabrication offcuts. Manufacturing clusters further add production scrap and end-of-life metal products. This abundant raw material supply lowers sourcing costs for recyclers and supports higher processing volumes. As Australia intensifies investments in commercial buildings, transport networks, and industrial modernization, scrap generation will continue to rise, strengthening demand for efficient recycling systems. Improved collection networks and stricter disposal regulations also ensure more material enters the recycling stream rather than landfills, reinforcing long-term market growth.

Strong Push Towards Sustainability and Circular Economy Goals

Australia’s accelerating transition towards a circular economy is significantly boosting the metal recycling market. Governments, industries, and consumers are emphasizing reduced landfill waste, resource conservation, and lower carbon footprints. Recycling metals requires far less energy than producing virgin materials, making it a key strategy for achieving climate targets and supporting low-emission manufacturing. Businesses increasingly incorporate recycled metals into supply chains to meet environmental, social, and governance (ESG) commitments and sustainability certifications. National and state-level waste policies encourage higher recovery rates, efficient material sorting, and improved recycling infrastructure. Public awareness about resource scarcity and environmental protection also supports stronger participation in scrap collection programs. With circular economy roadmaps gaining momentum, metal recycling is becoming central to Australia’s industrial sustainability framework. This shift ensures continuous investments in advanced recycling technologies, automation, and greener processing methods, driving long-term market expansion.

Technological Advancements in Sorting, Shredding, and Processing Systems

Innovations in metal recycling technologies are significantly driving the market growth in Australia. Modern systems, such as advanced magnetic separators, optical sorters, eddy current separators, and high-capacity shredders, allow recyclers to process complex scrap streams with higher accuracy and lower contamination levels. Automation and AI-based sorting enhance operational efficiency, reduce labor intensity, and improve recovery rates of valuable metals like aluminum, copper, and stainless steel. Upgraded foundry and smelting technologies enable production of high-quality secondary metals that meet industry specifications. Energy-efficient furnaces, low-emission processing lines, and digital monitoring systems also support cleaner operations. These advancements make recycling more cost-effective, reliable, and environment-friendly. As investments in technologically advanced facilities are increasing nationwide, Australia’s metal recycling industry is becoming more competitive, capable of meeting rising domestic and export demand with consistent quality and improved sustainability performance.

Market Restraints:

What Challenges is the Australia Metal Recycling Market Facing?

Limited Domestic Remelting and Reprocessing Capacity

Australia faces significant constraints in domestic metal reprocessing capabilities, with a major portion of scrap aluminum being exported for recycling to international markets, including South Korea and Indonesia. The closure of domestic rolling mills and car manufacturing operations has eliminated critical remelting infrastructure, forcing processors to rely on export channels rather than local value addition.

Material Contamination and Quality Control Challenges

Mixed materials, foreign substances, and inadequate sorting present ongoing challenges for recycling operations seeking to produce high-quality feedstock meeting manufacturer specifications. Contamination reduces recovery rates, increases processing costs, and potentially compromises the properties of recycled metal products.

Raw Material Price Volatility and Market Fluctuations

Global commodity price movements create uncertainty for recycling operators balancing feedstock acquisition costs against processed material revenues. Fluctuations in steel, aluminum, and copper prices driven by international demand patterns and geopolitical factors impact profitability throughout the recycling value chain.

Competitive Landscape:

The Australia metal recycling market features a competitive landscape comprising major integrated operators, regional processors, and specialized recyclers serving diverse industry segments. Leading companies are investing substantially in sorting technologies, processing capabilities, and collection infrastructure to enhance operational efficiency and capture market opportunities. Strategic partnerships between primary producers and recycling specialists are emerging to establish closed-loop systems maximizing domestic value retention. Industry consolidation trends reflect ongoing efforts to achieve scale economies while expanding geographic coverage across metropolitan and regional markets.

Recent Developments:

- In July 2025, Sims Limited, the prominent firm in metal recycling, announced a non-binding memorandum of understanding with Equest Steel Pty Ltd to create a scrap supply and services agreement, supporting Alter’s intended EAF planned for Pinkenba, Queensland in 2028. Sims would solely provide up to 550,000 Tons of ferrous scrap each year and handle Alter Steel’s scrap inventory on a just-in-time schedule. Both firms would convert local scrap into premium steel, reduce emissions, and maintain manufacturing domestically.

Australia Metal Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Metals Covered | Steel, Copper, Aluminum, Others |

| Sectors Covered | Construction, Automotive, Consumer Goods, Industrial Goods |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia metal recycling market size was valued at USD 5.27 Billion in 2025.

The Australia metal recycling market is expected to grow at a compound annual growth rate of 3.78% from 2026-2034 to reach USD 7.35 Billion by 2034.

Steel dominated the market with a share of 48%, driven by its infinite recyclability, established collection networks, and strong demand from construction and manufacturing sectors requiring high-quality recycled steel products.

Key factors driving the Australia metal recycling market include expanding construction and infrastructure investment programs, strengthening circular economy policies and regulatory frameworks, decarbonization imperatives across manufacturing sectors, and technological advancements in sorting and processing capabilities.

Major challenges include limited domestic remelting and reprocessing capacity, material contamination and quality control issues, raw material price volatility, inadequate collection infrastructure in regional areas, and competition from low-cost imported materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)