Australia Metal Sheets Market Size, Share, Trends and Forecast by Material Type, Thickness, Application, and Region, 2026-2034

Australia Metal Sheets Market Summary:

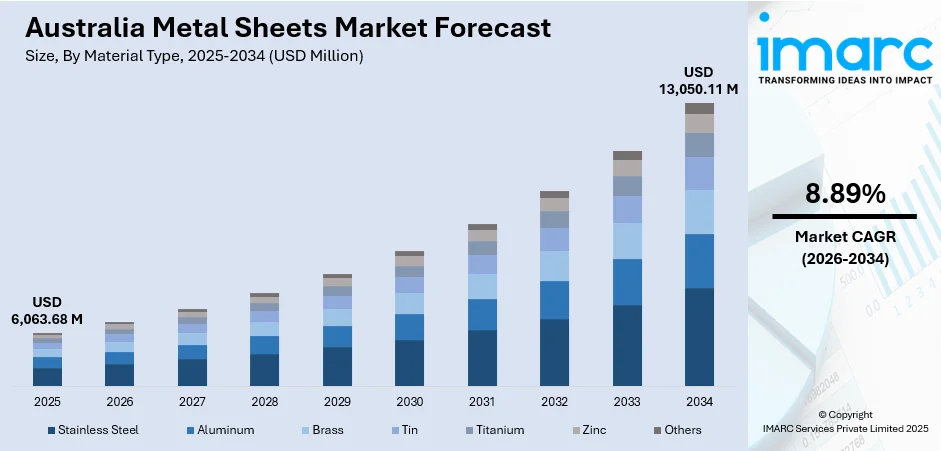

The Australia metal sheets market size was valued at USD 6,063.68 Million in 2025 and is projected to reach USD 13,050.11 Million by 2034, growing at a compound annual growth rate of 8.89% from 2026-2034.

The Australia metal sheets market is experiencing robust expansion, fueled by substantial infrastructure development programs, urbanization trends in major metropolitan areas, and the growing adoption across renewable energy applications. Rising demand for lightweight, corrosion-resistant materials in construction facades, modular building systems, and transport equipment manufacturing continues to strengthen market momentum. Government initiatives supporting domestic manufacturing capacity and green steel production further bolster the Australia metal sheets market share.

Key Takeaways and Insights:

-

By Material Type: Stainless steel dominates the market with a share of 30% in 2025, owing to its superior corrosion resistance, durability, and aesthetic appeal that make it essential for architectural applications, food processing equipment, and marine environments across coastal regions.

-

By Thickness: 1–6 mm leads the market with a share of 55% in 2025, reflecting strong demand from construction and general fabrication sectors requiring medium-gauge sheets for structural components, roofing materials, and industrial enclosures.

-

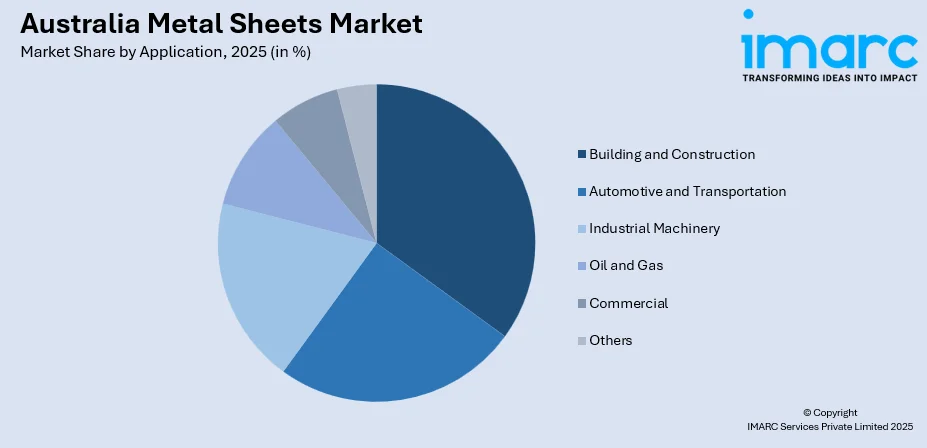

By Application: Building and construction represents the largest segment with a market share of 32% in 2025, driven by extensive residential development programs, commercial real estate expansion, and large-scale public infrastructure projects throughout Australia's major urban centers.

-

Key Players: Key players drive the Australia metal sheets market by investing in advanced coating technologies, expanding domestic fabrication capacity, strengthening distribution networks, and developing sustainable production methods. Their focus on product innovation, quality assurance, and strategic partnerships enables them to meet evolving customer specifications across the construction, automotive, and industrial sectors.

To get more information on this market Request Sample

The Australia metal sheets market demonstrates resilient growth, supported by diversified end use applications spanning the construction, transportation, renewable energy, and advanced manufacturing sectors. In 2023, the Australia construction industry contributed USD 162 Billion annually to the economy, accounting for nearly ten percent of the nation's GDP, which sustains consistent demand for metal sheet products. The market is transitioning toward higher-value, specification-driven products, including pre-coated, precision-cut, and alloyed metal sheets that meet stringent performance requirements for durability, sustainability, and aesthetic standards. Digital fabrication technologies and advanced surface coatings are increasingly adopted by manufacturers to enhance product quality and operational efficiency across supply chains. Moreover, rising investments in renewable energy projects, particularly solar and wind, are driving demand for corrosion-resistant and lightweight metal sheets. Additionally, the growing focus on smart infrastructure is encouraging innovations and adoption of advanced metal sheet solutions across Australia.

Australia Metal Sheets Market Trends:

Accelerated Adoption of Green Steel and Low-Emission Production Technologies

Australian manufacturers and policymakers are prioritizing decarbonization through investments in green steel production technologies. In February 2024, Rio Tinto, BHP, and BlueScope partnered to develop Australia's first electric smelting furnace (ESF) pilot plant aimed at producing near-zero emission iron using direct reduced iron (DRI) technology and renewable energy. This initiative represents a fundamental shift towards sustainable metal sheet production, with potential to reduce greenhouse gas emissions while strengthening domestic supply chain capabilities.

Rising Demand for Advanced Surface Coatings and Pre-Finished Products

The market is witnessing increasing preference for value-added metal sheet products, featuring advanced coatings that enhance weatherability, ultraviolet (UV) resistance, and aesthetic appeal. Manufacturers are investing in fluoropolymer, ceramic, and powder coating technologies to address performance requirements for coastal environments, commercial facades, and modular building systems demanding superior durability. The growing adoption of pre-finished metal solutions in residential and commercial projects is also boosting market growth across urban and regional construction sectors.

Digital Transformation and Smart Manufacturing Integration

Industry 4.0 technologies, including artificial intelligence (AI), Internet of Things (IoT) connectivity, and advanced analytics are reshaping metal sheet fabrication operations. In March 2025, the Australian Government declared that USD 750 Million of the USD 1.7 Billion Future Made in Australia Innovation Fund will aid groundbreaking green metal initiatives. Funding for innovation, commercialization, pilot, and demonstration initiatives will aid the initial development of Australia’s green iron, steel, alumina, and aluminum industries. This digital transformation enables real-time monitoring, predictive maintenance, and optimized production workflows that enhance efficiency, reduce waste, and improve product quality across the supply chain.

Market Outlook 2026-2034:

The Australia metal sheets market outlook remains strongly positive, supported by sustained infrastructure investment, expanding renewable energy installations, and growing automotive sector requirements. The market generated a revenue of USD 6,063.68 Million in 2025 and is projected to reach a revenue of USD 13,050.11 Million by 2034, growing at a compound annual growth rate of 8.89% from 2026-2034. Government commitments to major transportation projects, housing development programs, and green steel initiatives will continue to drive the demand for diverse metal sheet grades and specifications throughout the forecast period.

Australia Metal Sheets Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material Type |

Stainless Steel |

30% |

|

Thickness |

1–6 mm |

55% |

|

Application |

Building and Construction |

32% |

Material Type Insights:

- Stainless Steel

- Aluminum

- Brass

- Tin

- Titanium

- Zinc

- Others

Stainless steel dominates with a market share of 30% of the total Australia metal sheets market in 2025.

Stainless steel leads the Australia metal sheets market due to its exceptional corrosion resistance, strength, and durability, making it ideal for diverse applications across construction, automotive, and industrial sectors. Its ability to withstand harsh environmental conditions and maintain aesthetic appeal over time drives preference among manufacturers and architects, especially in urban infrastructure and high-rise building projects where longevity and low maintenance are critical. These properties make stainless steel a reliable choice for long-term investments.

Additionally, stainless steel’s versatility supports specialized applications in the thriving food processing, healthcare, and advanced manufacturing industries in Australia. As per IMARC Group, the Australia food processing market size reached USD 112.95 Billion in 2024. The compatibility of stainless steel with precision fabrication, forming, and coating technologies allows manufacturers to produce high-quality, specification-driven sheets that meet strict performance and safety standards. Rising awareness about sustainability and recyclability further strengthens stainless steel’s position, as it aligns with Australia’s environmental and efficiency-focused construction practices.

Thickness Insights:

- < 1 mm

- 1–6 mm

- >6 mm

1–6 mm leads with a share of 55% of the total Australia metal sheets market in 2025.

Medium-gauge metal sheets in the 1–6 mm thickness range represent the dominant segment, owing to their optimal balance of structural strength, formability, and cost-effectiveness for diverse construction and fabrication applications. Australia's major infrastructure pipeline totaling AUD 242 Billion over five years through 2028-29 generates substantial demand for medium-thickness sheets used in structural frameworks, roofing panels, cladding systems, and industrial equipment manufacturing.

The 1–6 mm thickness category serves essential requirements across commercial building construction, transportation vehicle bodies, agricultural equipment, and general manufacturing applications. Fabricators prefer medium-gauge sheets for their excellent workability in cutting, bending, and welding operations while maintaining adequate strength for load-bearing and protective functions in demanding operational environments.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive and Transportation

- Building and Construction

- Industrial Machinery

- Oil and Gas

- Commercial

- Others

Building and construction exhibits a clear dominance with a 32% share of the total Australia metal sheets market in 2025.

Building and construction leads the Australia metal sheets market because the sector consistently demands durable, versatile, and weather-resistant materials suitable for roofing, cladding, structural framing, and façade systems. Metal sheets offer long service life, fire resistance, and compatibility with Australia’s varied climate conditions, making them a preferred choice for residential, commercial, and industrial projects. Their ease of installation and design flexibility further support widespread adoption across new builds and renovations.

Moreover, Australia’s strong infrastructure pipeline, growing urban development, and emphasis on energy-efficient buildings are driving the use of advanced metal sheet solutions. The rise of modular construction, prefabricated housing, and sustainable building practices also increases demand for high-performance coated and lightweight metal sheets. As per IMARC Group, the Australia modular construction market size reached USD 11.3 Billion in 2024. With government-driven construction initiatives and ongoing population growth, the building and construction segment remains the dominant consumer of metal sheets in the country.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represents a significant regional market, driven by Sydney's extensive metro rail projects, commercial development activities, and residential construction programs. The region benefits from major infrastructure investments and substantial renewable energy installations requiring metal sheet components for mounting structures and equipment enclosures.

Victoria & Tasmania demonstrates strong market presence supported by Melbourne's urban renewal initiatives and expanding manufacturing sector. The region's construction industry benefits from government infrastructure spending on transportation networks, healthcare facilities, and commercial developments that generate consistent metal sheet demand.

Queensland experiences robust market growth fueled by renewable energy zone development and expanding mining sector activities. The region's infrastructure pipeline includes significant transportation upgrades, commercial construction projects, and resource industry investments, driving metal sheet consumption.

Northern Territory & Southern Australia presents emerging opportunities supported by mining sector expansion, renewable energy projects, and government initiatives to develop regional infrastructure. South Australia's Green Iron and Steel Strategy positions the region as a potential hub for sustainable metal production.

Western Australia benefits from extensive mining operations, resource industry investments, and growing renewable energy installations. The region's strong export infrastructure and abundant iron ore resources support both consumption and potential domestic production expansion for metal sheet products.

Market Dynamics:

Growth Drivers:

Why is the Australia Metal Sheets Market Growing?

Extensive Infrastructure Development and Government Investment Programs

Extensive infrastructure development and government investment programs are significantly driving the market growth by creating sustained demand across transportation, utilities, public buildings, and urban expansion projects. Large-scale investments in water infrastructure require durable, high-strength metal sheets for structural components, safety barriers, cladding, drainage systems, and prefabricated units. Government-backed initiatives, such as regional infrastructure upgrades, social housing programs, and resilience-focused construction, further expand opportunities for coated, corrosion-resistant, and custom-fabricated sheet products. As procurement frameworks increasingly favor long-lasting and low-maintenance materials, metal sheets remain essential for achieving reliability and lifecycle efficiency in public works. The shift towards modular construction, rapid project timelines, and standardized components reinforces the use of precision-cut metal sheets, enabling faster assembly and cost-effective delivery.

Increasing focus on sustainability

The growing emphasis on sustainability is significantly fueling the market expansion, as industries shift towards low-carbon materials, recyclable products, and energy-efficient building solutions. Metal sheets, especially those manufactured using renewable energy or recycled inputs, align well with green construction requirements and environmental certifications. Manufacturers are increasingly adopting eco-friendly coatings, solar-reflective finishes, and waste-minimizing fabrication technologies to meet evolving regulatory expectations. In April 2025, Greensteel Australia announced a USD 1.6 Billion investment to construct a new ultra-low-carbon steel manufacturing facility, featuring electric arc furnaces and rolling mills for structural steel and rebar production. The facility aims to strengthen Australia's sovereign steelmaking capability with expected delivery by late 2026. This broader industry push towards cleaner production enhances supply reliability, reduces embodied carbon, and encourages greater adoption of sustainable metal sheet solutions across construction, infrastructure, and industrial sectors.

Automotive and Transportation Sector Modernization

Automotive and transportation sector modernization is accelerating the demand for metal sheets in Australia, as manufacturers move toward lightweighting, improved fuel efficiency, and electrification. In January 2025, the Australian Government allocated USD 7.2 Billion to repair the Bruce Highway in Queensland, aiming to achieve at least a three-star safety rating. Metal sheets, particularly high-strength steel and aluminum, are essential for producing vehicle bodies, chassis components, trailers, and rail infrastructure. As electric vehicle (EV) manufacturing, fleet upgrades, and public transport projects expand, the need for corrosion-resistant, formable, and precision-engineered metal sheet products grows substantially. Modern transport designs emphasize safety, durability, and reduced environmental impact, which further increases reliance on advanced sheet materials. Additionally, logistics and freight industries are upgrading truck bodies, storage units, and cargo solutions, supporting higher consumption of metal sheets. The shift towards smarter, energy-efficient mobility solutions is reinforcing the metal sheet industry’s role in supporting Australia’s evolving transportation landscape.

Market Restraints:

What Challenges the Australia Metal Sheets Market is Facing?

Raw Material Price Volatility and Supply Chain Disruptions

Fluctuations in global metal prices and supply chain constraints create challenges for manufacturers and end users managing procurement costs and project budgets. Import dependence for certain metal sheet grades exposes the market to international trade dynamics, shipping delays, and currency fluctuations that impact pricing stability and availability.

Skilled Labor Shortages and Productivity Constraints

Australia faces significant skilled labor shortages in the construction and manufacturing sectors, with projected workforce gaps reaching 300,000 workers by 2027. Labor constraints limit fabrication capacity, extend project timelines, and increase operational costs for metal sheet processing and installation activities.

Competition from Low-Cost Imports and Quality Concerns

Australian metal sheet producers face competitive pressure from lower-cost imports, particularly from Asian manufacturing centers. Quality concerns over imported products and inconsistent enforcement of Australian Standards create challenges for maintaining market integrity and safety compliance.

Competitive Landscape:

The Australia metal sheets market features a competitive landscape comprising domestic producers, international manufacturers, and specialized fabricators serving diverse end use segments. Market participants compete on product quality, technical specifications, delivery reliability, and value-added processing capabilities. Companies invest in advanced coating technologies, digital fabrication systems, and sustainable production methods to differentiate offerings and capture market share. Strategic partnerships between steel producers, fabricators, and construction companies strengthen supply chain integration and project delivery capabilities. The domestic steel fabrication sector plays a critical role in processing and distributing metal sheet products.

Australia Metal Sheets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Stainless Steel, Aluminum, Brass, Tin, Titanium, Zinc, Others |

| Thicknesses Covered | < 1 mm, 1-6 mm, > 6mm |

| Applications Covered | Automotive and Transportation, Building and Construction, Industrial Machinery, Oil and Gas, Commercial, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia metal sheets market size was valued at USD 6,063.68 Million in 2025.

The Australia metal sheets market is expected to grow at a compound annual growth rate of 8.89% from 2026-2034 to reach USD 13,050.11 Million by 2034.

Stainless steel dominated the market with a share of 30%, owing to its exceptional corrosion resistance, durability, and versatility across construction, food processing, and marine applications.

Key factors driving the Australia metal sheets market include extensive government infrastructure investments, renewable energy expansion, growing construction sector activity, and increasing demand for lightweight materials in automotive applications.

Major challenges include raw material price volatility, skilled labor shortages in fabrication sectors, competition from low-cost imports, supply chain disruptions, and the need for significant investment in domestic production capacity to reduce import dependence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)