Australia Microalgae Based Products Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Australia Microalgae Based Products Market Size & Share Overview:

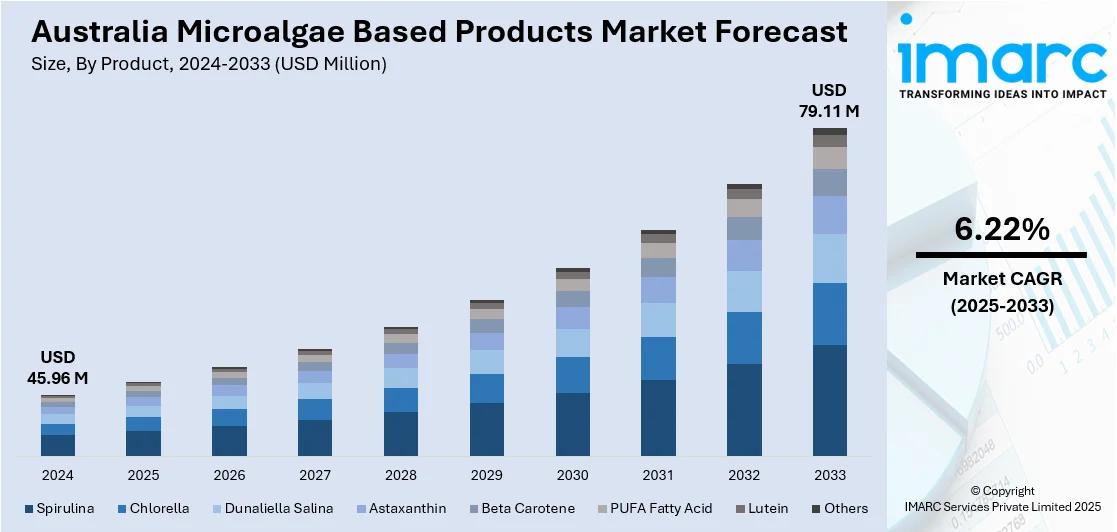

The Australia microalgae based products market size reached USD 45.96 Million in 2024. Looking forward, the market is projected to reach USD 79.11 Million by 2033, exhibiting a growth rate (CAGR) of 6.22% during 2025-2033. The market is driven by rising demand for plant-based nutrition, technological advancements in cultivation and processing, and strong sustainability initiatives. Consumers increasingly seek natural, nutrient-rich alternatives like microalgae for food, health, and wellness. Innovations in bioreactor systems and processing methods are making production more efficient and scalable. At the same time, environmental benefits such as low resource usage and carbon capture support microalgae’s role in circular economy models, aligning with national goals for greener, sustainable industries is impelling the Australia microalgae-based products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 45.96 Million |

| Market Forecast in 2033 | USD 79.11 Million |

| Market Growth Rate 2025-2033 | 6.22% |

Key Trends of Australia Microalgae Based Products Market:

Technological Advancements in Cultivation and Processing

Technological innovation is driving significant growth in Australia’s microalgae sector by boosting cultivation efficiency and reducing costs. Advanced photobioreactors, such as tubular designs, have achieved biomass production rates up to 82.45 tons per hectare annually, enhancing yield and consistency. Optimized nutrient delivery and climate control further improve growth conditions. Improved harvesting, drying, and extraction techniques preserve nutritional quality while streamlining processing, lowering expenses. These advancements enable producers to scale operations and create specialized ingredients for food, pharmaceuticals, cosmetics, and renewable energy. Strong collaborations between universities and biotech companies foster ongoing innovation, ensuring Australia stays competitive in the global market. As these technologies evolve, microalgae products become more accessible and affordable, supporting sustainable development and broadening their application across various industries. This continuous improvement cements microalgae’s role in Australia’s green economy and future food systems.

To get more information on this market, Request Sample

Rising Demand for Plant-Based Nutrition

Another major Australia microalgae-based products market trend is the rising widespread shift toward plant-based lifestyles driven by health, sustainability, and animal welfare concerns. Microalgae like spirulina and chlorella are gaining popularity as clean, plant-based superfoods rich in essential nutrients including proteins, amino acids, antioxidants, and vitamins. Their versatility allows them to be used in everything from smoothies and supplements to energy bars and functional beverages. As consumers increasingly prioritize natural and holistic nutrition, brands are responding by incorporating microalgae into mainstream health products. This trend aligns with broader movements toward vegan and vegetarian diets, clean-label preferences, and holistic wellness. Microalgae’s nutritional value and adaptability to modern formulations make them a go-to ingredient in the evolving food landscape, boosting their commercial appeal and integration into consumer products across Australia.

Environmental Sustainability and Circular Economy Initiatives

Environmental sustainability is a key priority for Australia’s policymakers and industries, with microalgae playing a vital role in achieving these goals. Microalgae cultivation requires significantly less land and water than traditional crops and can grow in non-arable areas, minimizing environmental impact. Importantly, microalgae support circular economy models by capturing CO₂ from industrial emissions and effectively treating nutrient-rich wastewater, removing up to 100% of phosphates and 94% of nitrogen compounds. This nutrient recovery reduces pollution and conserves resources, closing ecological loops. As sustainability demands rise, industries increasingly adopt microalgae for biofertilizers, biodegradable materials, and natural food colorants. Their dual ability to address environmental challenges and offer commercial benefits makes them a compelling investment. This synergy between microalgae applications and Australia’s environmental strategies is driving Australia microalgae-based products market growth in the green economy, fostering sustainable and resilient supply chains across multiple sectors.

Growth Drivers of Australia Microalgae Based Products Market:

Nutraceutical and Functional Ingredient Adoption

The Australia microalgae‑based products market demand is experiencing significant growth due to the increasing interest in nutraceuticals and functional foods. Microalgae species such as spirulina, chlorella, and Dunaliella salina are abundant in essential nutrients like omega-3 fatty acids, antioxidants, vitamins, and bioactive peptides. These nutrients are increasingly incorporated into dietary supplements, health beverages, protein powders, and fortified snacks driven by consumer preferences for natural and clean-label options. Additionally, the heightened emphasis on preventive healthcare and immunity-enhancing ingredients is broadening the applications of microalgae in wellness-focused products. As food producers look for sustainable and nutrient-rich ingredients microalgae represent an attractive solution that meets both health and environmental objectives. The integration of these functional components into mainstream nutrition is anticipated to foster long-term growth in this sector.

Renewable Biofuel and Bioproduct Development

Microalgae are being recognized as a valuable feedstock for renewable energy and bioproducts showcasing significant promise for Australia’s clean technology sector. Their high lipid content and rapid growth make them well-suited for biofuel production, including biodiesel and bioethanol. Furthermore, cultivating microalgae requires less land and water compared to conventional crops making it more sustainable. In addition to energy production ongoing research is focused on creating bioplastics, biodegradable packaging, and other eco-friendly materials from algal biomass. These advancements align with Australia’s targets to lower carbon emissions and encourage green industrial practices. As various industries search for alternatives to fossil fuels, microalgae present a low-impact and renewable option. Continued investment in research and development along with supportive policies is likely to speed up commercialization establishing microalgae as a key element in the shift toward a circular bio-based economy.

Cosmetics and Natural Colorants Market Expansion

According to Australia microalgae‑based products market analysis, there is a growing opportunity in the cosmetics and natural colorants segment. Compounds derived from microalgae, such as chlorophyll, astaxanthin, and phycocyanin, are increasingly utilized in skincare, haircare, and beauty products due to their antioxidant, anti-aging, and moisturizing benefits. These natural ingredients are prized for their purity, stability, and multifunctional properties, making them well-suited for clean beauty applications. Additionally, pigments sourced from microalgae are becoming popular as substitutes for synthetic dyes in cosmetics and textiles, addressing the rising consumer demand for sustainable and non-toxic colorants. Australian cosmetic brands, especially those focused on organic and vegan products, are investigating the use of algal extracts to set their offerings apart. As consumers become more aware of the importance of safe and environmentally friendly beauty products, the demand for cosmetic ingredients derived from algae is expected to rise consistently in the future.

Opportunities of Australia Microalgae Based Products Market:

Personalized Nutrition and Wellness

The emergence of tailored health and wellness products represents a significant opportunity for microalgae-based formulations in Australia. There is a growing consumer demand for functional foods, supplements, and beverages that cater to specific health objectives, including immunity enhancement, energy support, and skin health. Microalgae are abundant in omega-3 fatty acids, vitamins, minerals, and antioxidants, making them excellent candidates for customizable nutrition offerings. These bioactive components provide numerous health advantages, such as reducing inflammation and promoting cardiovascular and cognitive health. As data-driven health monitoring and personalized lifestyle tools become more widely available, brands can capitalize on the diverse nutrient profile of microalgae to develop targeted solutions. This trend aligns with the increasing consumer preference for natural, scientifically supported ingredients, positioning microalgae as a premium ingredient in the next generation of personalized wellness products.

Expansion in Aquaculture and Animal Feed

Microalgae serve as a sustainable and nutrient-rich alternative to traditional feed sources within Australia's aquaculture and livestock industries. High in protein, essential fatty acids, and trace minerals, microalgae can improve the nutritional quality of feed for fish, poultry, and cattle while diminishing the dependence on environmentally taxing inputs such as fishmeal and soy. Their natural bioactive components can also enhance gut health, immunity, and growth rates in animals. With mounting pressure to implement sustainable agricultural practices and address increasing protein demands, microalgae-based feed solutions offer both ecological and economic benefits. The scalability of algae cultivation, paired with its minimal land and water requirements, makes it particularly well-suited for circular and low-impact farming systems. This potential supports Australia’s goals of enhancing food security and promoting agricultural sustainability.

Agri-biotech and Biofertilizers

Microalgae-derived biofertilizers are gaining traction as an environmentally friendly alternative to synthetic fertilizers in Australia’s agricultural landscape. These algae-based inputs boost soil vitality by supplying essential nutrients, fostering microbial activity, and enhancing moisture retention. They also include natural growth enhancers that support plant growth and resilience against pests and diseases. Unlike chemical fertilizers, which can contribute to soil depletion and water pollution, microalgae-based products provide a sustainable approach to increasing crop yields without harming the environment. Their use is particularly beneficial in organic and regenerative farming practices, where the preference is for clean, natural inputs. As Australian farmers encounter heightened regulatory and environmental challenges, the adoption of microalgae-derived biofertilizers offers a feasible solution for enhancing productivity while advancing soil health and sustainability objectives.

Challenges of Australia Microalgae Based Products Market:

Limited Commercial-Scale Infrastructure

A significant challenge facing the microalgae-based products market in Australia is the insufficient infrastructure for large-scale production. Most existing facilities operate at pilot or small commercial scales, limiting the ability to consistently meet increasing market demand. The lack of mature processing units, standardized cultivation systems, and extensive downstream processing capabilities makes scalability a critical issue. Moreover, the absence of integrated supply chains from cultivation to final product packaging results in inefficiencies and elevates operational expenses. These factors impede mass production, prolong time-to-market, and lessen the competitiveness of Australian producers against global competitors. To unlock the full commercial potential of this market, it is vital to enhance industrial infrastructure, promote private investment, and foster collaborative networks among research institutions and manufacturers.

Technical Barriers in Strain Optimization

Choosing and optimizing strains is a key challenge in the creation of high-value microalgae-based products. Every strain exhibits varying growth rates, nutrient profiles, and environmental tolerances, complicating the selection process. Achieving optimal yield, consistency, and extractability of essential compounds such as proteins, pigments, or fatty acids necessitates significant research and development along with trial-and-error testing. Additionally, cultivation conditions such as light intensity, temperature, and CO₂ levels can significantly affect performance, adding to the technical complexity. Insufficient understanding of how to enhance output without sacrificing quality leads to inefficiencies and constrains commercial viability. Tackling this issue requires ongoing investment in biotechnology, genomic tools, and pilot-scale testing to identify and optimize suitable microalgae strains for Australia’s varied climatic and industrial contexts.

Regulatory and Approval Complexities

The commercialization of microalgae-based products in Australia is often hindered by intricate and prolonged regulatory approval processes. Whether intended for human consumption, animal feed, cosmetics, or pharmaceuticals, each product category must adhere to stringent safety, labeling, and quality standards set by regulatory authorities. Novel food regulations, biosecurity guidelines, and ingredient approval processes demand comprehensive documentation, toxicological evaluations, and sometimes clinical validation. These requirements can prolong the path to market, particularly for smaller companies that may lack regulatory expertise or the financial resources for compliance. Furthermore, the inconsistent classification of microalgae as food, supplements, or agricultural inputs can further complicate the approval process. For a quicker market entry, it is essential to establish clearer regulatory frameworks, streamline processes, and enhance collaboration between regulators and innovators, ensuring product safety while fostering innovation.

Australia Microalgae Based Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Spirulina

- Chlorella

- Dunaliella Salina

- Astaxanthin

- Beta Carotene

- PUFA Fatty Acid

- Lutein

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes spirulina, chlorella, dunaliella salina, astaxanthin, beta carotene, PUFA fatty acid, lutein, and others.

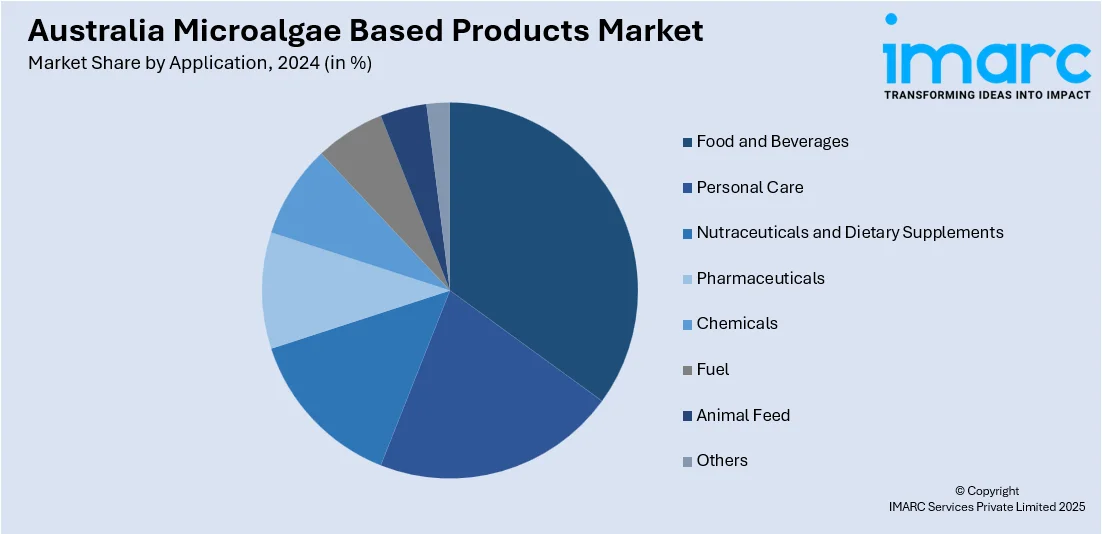

Application Insights:

- Food and Beverages

- Personal Care

- Nutraceuticals and Dietary Supplements

- Pharmaceuticals

- Chemicals

- Fuel

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, personal care, nutraceuticals and dietary supplements, pharmaceuticals, chemicals, fuel, animal feed, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Microalgae Based Products Market News:

- In September 2024, Algenie, a biotech startup from the University of Technology Sydney, developed a breakthrough helix-shaped photobioreactor to boost algae growth for sustainable plastics and fuels. This innovative technology significantly improves efficiency and scalability, potentially reducing production costs tenfold. Algenie aims to replace fossil fuels with algae-based products, helping tackle climate change by capturing CO₂. The company is collaborating with UTS to optimize algae strains and accelerate commercial production.

- In July 2024, New Zealand biotech Nutrition from Water (NXW) is scaling up production of its microalgae-based Marine Whey 50 protein for an overseas launch targeting markets in India, China, Southeast Asia, and Africa. Produced in Portugal, the product is being tested in various food applications like coffee creamers and baked goods. NXW is partnering with global nutrition companies and backed by investors including IndieBio and SOSV to accelerate growth in affordable, specialized nutrition.

Australia Microalgae Based Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Spirulina, Chlorella, Dunaliella Salina, Astaxanthin, Beta Carotene, PUFA Fatty Acid, Lutein, Others |

| Applications Covered | Food and Beverages, Personal Care, Nutraceuticals and Dietary Supplements, Pharmaceuticals, Chemicals, Fuel, Animal Feed, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia microalgae based products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia microalgae based products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia microalgae based products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The microalgae based products market in Australia was valued at USD 45.96 Million in 2024.

The Australia microalgae based products market is projected to exhibit a compound annual growth rate (CAGR) of 6.22% during 2025-2033.

The Australia microalgae based products market is expected to reach a value of USD 79.11 Million by 2033.

Key trends include the integration of microalgae into personalized nutrition and clean-label supplements, growing use in animal and aquaculture feed, and the emergence of algae-based cosmetics and natural colorants. Sustainability and biotechnological innovation are also shaping product development across food, health, and industrial sectors.

The market is fueled by the rising demand for plant-based protein options, greater consumer awareness about natural health components, and government backing for sustainable agriculture and biotechnology. Expanding applications in functional foods, cosmetics, and environmental solutions are further accelerating interest in scalable microalgae production and product innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)