Australia Microwave Oven Market Size, Share, Trends and Forecast by Type, Capacity, Distribution Channel, End User, and Region, 2025-2033

Australia Microwave Oven Market Size and Growth:

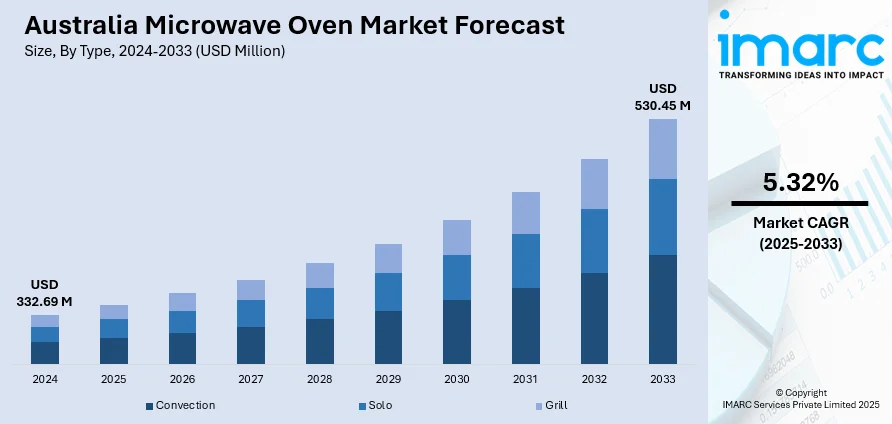

The Australia Microwave Oven Market size reached USD 332.69 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 530.45 Million by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The market is spurred by changing consumer lifestyles, growing need for time-efficient kitchen appliances, and rising popularity of multi-functional cooking solutions. As more Australians spend longer hours working, they opt for microwave ovens that provide an easy and effective method for cooking meals. Growing interest in healthy eating is also escalates the demand for models that support functionalities such as steam cooking and inverter technology. The increasing trend toward intelligent kitchens and integrated appliances in new-age homes further fuels the Australia microwave oven market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 332.69 Million |

| Market Forecast in 2033 | USD 530.45 Million |

| Market Growth Rate 2025-2033 | 5.32% |

Australia Microwave Oven Market Trends:

Adoption of Multifunctional and Built-In Microwave Ovens

In Australia, there is a noticeable shift toward multifunctional and built-in microwave ovens as modern households increasingly seek compact and integrated kitchen appliances. Australian homes, especially in urban centers like Sydney and Melbourne, are being designed with open-plan kitchens where space optimization and sleek aesthetics are critical. As a result, consumers are gravitating toward built-in models that combine traditional microwave functionality with convection, grill, and air fry features. These models offer greater versatility and complement the minimalistic design preferences prevalent across many contemporary Australian kitchens. Additionally, built-in units help reduce clutter, which is especially appealing to apartment dwellers and those embracing smaller, sustainable living environments. This reflects a broader demand for appliances that align with both form and function, where convenience is not sacrificed for style. Retailers and brands are increasingly highlighting this dual benefit, promoting microwave ovens as central, integrated components of the modern Australian kitchen.

To get more information on this market, Request Sample

Health and Eco-Conscious Consumer Behavior

Australian consumers are highly influenced by health and sustainability considerations, and this mindset is shaping the local microwave oven market. There is growing interest in microwave ovens that support healthier cooking methods, such as steam cooking, oil-free air frying, and nutrient-retaining reheating options. This is reflective of the wider wellness trend in the country, where organic food consumption and active lifestyles influence appliance preferences. Additionally, energy efficiency is becoming a strong selling point, as Australians are mindful of reducing household energy usage amid rising utility costs and growing environmental awareness. Microwave ovens with inverter technology, which allows for more precise and efficient heating, are gaining popularity for their performance and eco-friendly profile. Brands that prioritize environmentally friendly packaging, sustainable manufacturing, and long-lasting product lifespans are also more likely to win consumer trust. These preferences illustrate a uniquely Australian approach, where technology is expected to align with ethical and sustainable living values, further propelling the Australia microwave oven market growth.

Rise of Smart Kitchen Technology and E-Commerce

The rise of smart home technology is influencing the Australian microwave oven market, as consumers increasingly demand connected appliances that integrate with broader digital ecosystems. According to the IMARC Group, the Australia smart homes market size reached USD 3.8 Billion in 2024 and is further expected to reach USD 11.5 Billion by 2033, exhibiting a growth rate (CAGR) of 11.60% during 2025-2033. Smart microwaves that offer app control, voice assistance compatibility, and personalized cooking presets are being adopted in both new homes and kitchen renovations. Australians, who are generally early adopters of smart home tech, appreciate the convenience these features bring to daily routines. Moreover, the growing prevalence of e-commerce in Australia has made it easier for consumers to research, compare, and purchase microwave ovens online, with detailed product descriptions and user reviews influencing buying behavior. Retailers often bundle smart kitchen appliances with other connected devices, enhancing perceived value. The digital-savvy consumer base is helping to push innovation forward, with brands investing more in connected product development and localized tech support.

Australia Microwave Oven Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, capacity, distribution channel, and end user.

Type Insights:

- Convection

- Solo

- Grill

The report has provided a detailed breakup and analysis of the market based on the type. This includes convection, solo, and grill.

Capacity Insights:

- Below 25 Liters

- 25-30 Liters

- Above 30 Liters

A detailed breakup and analysis of the market based on the capacity has also been provided in the report. This includes below 25 liters, 25-30 liters, and above 30 liters.

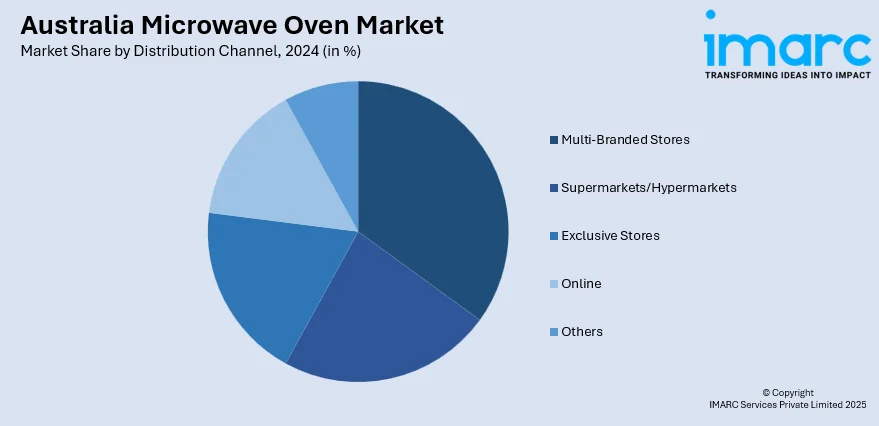

Distribution Channel Insights:

- Multi-Branded Stores

- Supermarkets/Hypermarkets

- Exclusive Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes multi-branded stores, supermarkets/hypermarkets, exclusive stores, online, and others.

End User Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Microwave Oven Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Convection, Solo, Grill |

| Capacities Covered | Below 25 Liters, 25-30 Liters, Above 30 Liters |

| Distribution Channels Covered | Multi-Branded Stores, Supermarkets/Hypermarkets, Exclusive Stores, Online, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia microwave oven market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia microwave oven market on the basis of type?

- What is the breakup of the Australia microwave oven market on the basis of capacity?

- What is the breakup of the Australia microwave oven market on the basis of distribution channel?

- What is the breakup of the Australia microwave oven market on the basis of end user?

- What is the breakup of the Australia microwave oven market on the basis of region?

- What are the various stages in the value chain of the Australia microwave oven market?

- What are the key driving factors and challenges in the Australia microwave oven market?

- What is the structure of the Australia microwave oven market and who are the key players?

- What is the degree of competition in the Australia microwave oven market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia microwave oven market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia microwave oven market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia microwave oven industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)