Australia Milk Alternatives Market Size, Share, Trends and Forecast by Source, Flavor, Packaging, Distribution Channel, and Region, 2025-2033

Australia Milk Alternatives Market Size and Growth:

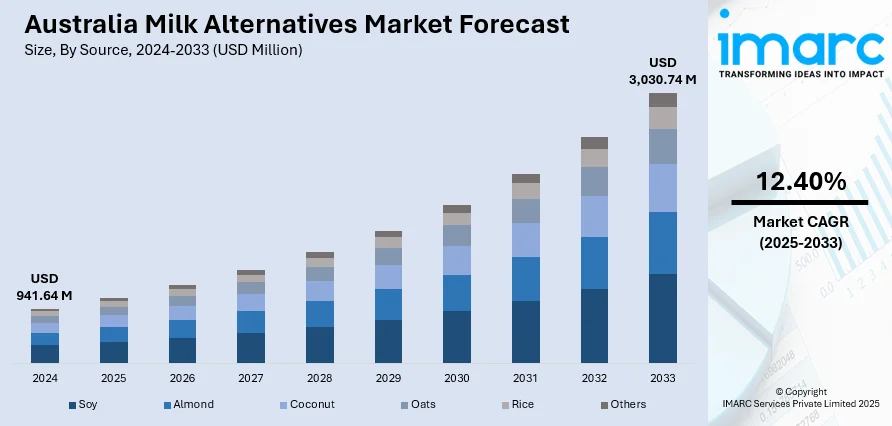

The Australia milk alternatives market size reached USD 941.64 Million in 2024. Looking forward, the market is expected to reach USD 3,030.74 Million by 2033, exhibiting a growth rate (CAGR) of 12.40% during 2025-2033. The market is driven by health-conscious consumers turning to plant-based diets, growing preference for environmentally responsible products, and constant innovations across distribution channels. Ongoing product developments and retail expansions are driving shifts in purchasing behavior across diverse demographics and are expected to play a central role in further augmenting the Australia milk alternatives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 941.64 Million |

| Market Forecast in 2033 | USD 3,030.74 Million |

| Market Growth Rate 2025-2033 | 12.40% |

Key Trends of Australia Milk Alternatives Market:

Shifting Consumer Preferences Toward Plant-Based Diets

In Australia, plant-based consumption has been steadily rising due to a combination of health awareness, ethical considerations, and changing dietary patterns. Consumers are becoming more deliberate in their food choices, often selecting options perceived to be cleaner or more natural. Plant-based milks, derived from almonds, oats, soy, coconut, and other sources, are viewed by many as healthier alternatives to traditional dairy. This preference is not limited to vegan or vegetarian demographics. A broader group of flexitarians, who still consume animal products but in reduced quantities, is fueling steady growth in demand. Concerns related to lactose intolerance and dairy sensitivities are also pushing consumers toward these options. Retailers have responded with expanded shelf space and diverse product offerings, reinforcing consumer confidence in these alternatives. On April 29, 2025, a recent industry report indicated that plant-based milk companies, including Eclipse Foods and Asahi Group, are shifting focus toward replicating the exact taste and texture of dairy milk to better meet consumer expectations. Eclipse Foods launched a Non-Dairy Whole Milk using pea and chickpea proteins to match cow’s milk properties, while Asahi's Like Milk, made from fermented yeast, offers equivalent protein content and allergen-free claims. These innovations respond to the survey data showing that 57% of consumers avoid plant-based milk due to unsatisfactory taste or texture, despite growing interest in non-dairy alternatives. The shift is also evident in cafes and restaurants, wherein plant-based milks are now offered as standard, rather than niche, options. These evolving patterns are setting the stage for sustained Australia milk alternatives market growth.

To get more information on this market, Request Sample

Innovations and Product Diversification Across Retail Channels

According to the Australia milk alternatives market analysis, product variety has become a decisive factor in purchasing decisions. In recent years, the range of milk alternatives available in Australia has expanded significantly, both in terms of base ingredients and value-added features. Brands are offering options that cater to specific dietary needs, including calcium-enriched, protein-enhanced, unsweetened, and barista-grade versions. This segmentation allows consumers to find products tailored to taste, nutrition, and usage occasion. Additionally, texture, frothing ability, and flavor customization have become competitive differentiators, especially in foodservice and coffee culture contexts. Retail innovation is also central to this trend. Online grocery platforms, health-focused retailers, and even subscription models are providing easier access to a broader selection of alternative dairy options. According to IMARC Group, Australia online grocery market size reached USD 14,202.0 Million in 2024. The market is further anticipated to reach USD 80,239.7 Million by 2033, projecting a growth rate (CAGR) of 21.22% during 2025-2033. In line with this, online grocery platforms often offer emerging brands a route to market without requiring large-scale distribution. This shift supports experimentation, rapid feedback, and agile product development. In-store experiences, such as sampling and promotions, are further enabling consumer discovery. Meanwhile, partnerships between plant-based producers and cafes or QSR chains are reinforcing the mainstream appeal of these products. The capacity to serve distinct consumer needs through innovation, coupled with efficient retail strategies, is reinforcing demand in a competitive and growing category.

Growth Drivers of Australia Milk Alternatives Market:

Health Awareness and Dietary Diversification

Increasing health consciousness is the major adoption driver for milk alternatives in Australia. Consumers in urban areas like Melbourne and Sydney, as well as more so in suburban and regional markets, are moving toward plant-based drinks to limit lactose consumption or deal with allergies. Milk consumption is commonly associated with digestive unease and cholesterol worries, hence more families are looking toward alternatives including almond, oat, soy, and pea milks. These are particularly favored among younger groups and multicultural families that have traditional histories of non‑dairy drinks, who demand choice in their food shopping. In addition, the growing wellness culture of Australian cities is urging families to include milk alternatives in smoothies, coffee, breakfast cereal, and cooking. As ingredient knowledge increases, with added sugars and preservatives on the rise, consumers increasingly seek brands with simple, natural ingredient declarations. Retailers are responding by increasing shelf space focused on plant milks and recipe-driven marketing campaigns that reinforce their versatility in everyday dietary consumption.

Environmental Concerns and Sustainable Consumption

Environmental sensitivities are an important driver of the expansion of milk alternatives throughout Australia. As the country is often experiencing drought, bushfires, and water shortages, consumers are becoming more conscious of the environmental impact of dairy farming, such as the use of water and methane production. This environmental awareness pushes families to experiment with plant-based milk drinks that are viewed as more sustainable alternatives. Australian manufacturers place focus on domestic crop-based milks like oat milk produced from grains cultivated in Western Australia or pea protein cultivated in Victoria, enhancing a clean, local origin story. Brands promote recyclable packaging and carbon-neutral production to meet wider national ambitions around curbing plastic waste and carbon emissions. As coastal towns and environmental groups from indigenous backgrounds push for more sustainable food chains, most consumers link plant-based milk with good land and resource stewardship. This congruence between consumption behavior and green values serves to further fortify trust and liking of milk alternatives among mindful Australian homes.

Local Product Development and Expansion in Retailing

Australia's dynamic food innovation economy is propelling forces in the milk alternatives space. Local dairy-alternative brands and foodtech startups increasingly test new protein foundations such as macadamia, coconut free of lanolin, and indigenous grains to accommodate local palate profiles and dietary requirements. The adoption of fermentation-based protein and new plant extraction makes products that deliver creaminess and nutritional balance conventionally associated with dairy possible. National innovation precincts' university research centers, including Perth and Brisbane, partner with food producers to push these formulations. Supermarkets and cafes across the nation now have specialty milk alternatives prominently on display, ranging from barista-style oat milk specifically designed for flat whites to fortified ones for kids. Subscription services bring fresh plant milks straight to the doorstep of suburban dwellers, mimicking the wider e-commerce direction within grocery delivery. Collaborations between foodservice companies and alternative milk suppliers facilitate effortless menu integration within coffee chains and fast-casual restaurants, further mainstreaming these items. Hence, these new product variety and retailing innovations drive trial and longer-term adoption by consumers in a wide range of Australian contexts.

Opportunities of Australia Milk Alternatives Market:

Regional and Rural Market Expansion

Although Australia's milk alternatives market has been strongest in urban cities like Sydney, Melbourne, and Brisbane in the past, there are several opportunities in regional and rural communities. Historically, the regions have been slower to adopt due to low product availability and consumer visibility. Nevertheless, health consciousness and environmental sustainability are progressively altering consumption trends outside urban cities. Regional center retailers are starting to carry greater types of plant milk alternatives, such as oat, almond, and soy, as demand increases. Local community events and farmers markets also offer outlets for lesser brands to launch distinctive milk substitutes made from native Australian ingredients. The development in these under-served markets is also in line with local economic development objectives, stimulating investment in supply chains and dairy innovation in local agriculture. Building trust among regional consumers is possible by highlighting the environmental and health advantages of milk substitutes, facilitated by community education and customized marketing initiatives resonating with rural lifestyles, which will further contribute toward the growth of Australia milk alternatives market demand.

Partnership with Indigenous Communities and Utilization of Native Ingredients

Australia's vibrant Indigenous culture presents a compelling value proposition for the milk alternatives market through the use of indigenous ingredients and partnering with Aboriginal communities. Ingredients like wattle seed, macadamia nuts, and quandong are significant culturally and nutritionally, and are appealing components in new dairy-free drinks. The indigenous botanicals create a point of differentiation within a crowded market that is rapidly being driven by authenticity and geographical provenance. Partnerships between milk alternative producers and Indigenous enterprises not only foster economic inclusion but also support cultural preservation and sustainable harvesting practices. There is growing consumer interest in products that tell a story about Australia’s landscape and heritage, especially among ethically minded shoppers. This possibility permits businesses to develop premium, niche product lines appealing domestically and in international markets where Australian indigenous foods are emerging as unique and healthful, offering a competitive advantage based on the natural biodiversity of the country.

Emerging Demand from Foodservice and Hospitality Markets

Australia's dynamic foodservice and hospitality markets represent an exciting opportunity for the milk alternatives market, fueled by changing consumer trends and menu innovation. Hotels, restaurants, and cafes now offer plant milk alternatives as part of their growing response to the increasing number of customers demanding vegan, lactose-free, or lower-carbon-footprint drinks. Melbourne and Sydney, among others, which are cities with world-renowned coffee culture, have been introducing barista-quality oat and almond milks to go with specialty coffee beverages like flat whites and lattes. This trend carries over to catering operations and events where dietary inclusivity is becoming business as usual. On top of that, foodservice operators are experimenting with milk alternatives for cooking and baking uses, providing new opportunities for product development specific to commercial purposes. The partnership between milk alternative brands and groups of hospitality companies provides opportunities for co-branding, bulk supply contracts, and innovation in packaging to suit industry requirements. This industry's need for stable quality and supply leads producers to increase volumes and invest in R&D, further fueling market growth.

Challenges of Australia Milk Alternatives Market:

Consumer Perceptions and Taste Preferences

A major challenge confronting the Australia milk alternatives market is consumer perception, particularly taste and texture. Australian consumers have historically consumed traditional dairy milk over a long period of time, and many have stuck to the well-known flavor and feel of the milk. In spite of the increasing popularity of plant-based beverages like oat, almond, and soy milk, there remain some customers who find the alternatives less satiating or unsuitable for specific uses in cooking. Such reluctance is typically greater among the elderly segments or rural communities in which customary eating patterns are more entrenched. Furthermore, misperceptions about nutritional values, e.g., protein content or added sugars in certain milk alternatives, can discourage consumers from making a change. Natural, minimally processed products are what Australian consumers increasingly demand, and those milk alternatives failing to deliver this may find it difficult to gain mass appeal. Breaking down these perception barriers involves continued education, product development to enhance sensory characteristics, and marketing specifically addressing regional and demographic differences.

Supply Chain and Ingredient Sourcing Hurdles

Australia's distinct farming conditions present supply chain hurdles for the milk alternatives industry, including sourcing reliable, high-quality ingredients locally. Although native crops macadamias and wattle seed present exciting prospects, their seasonal nature and lack of large-scale cultivation can hold back production. Moreover, the nation's dependence on foreign-brought raw materials such as overseas-bought almonds and soybeans, subjects manufacturers to global market fluctuations, trade disruption, and logistics setbacks. This reliance can cause increased costs and supply unpredictability, influencing pricing and product availability. Additionally, local droughts and climate fluctuations affect local crop volumes, such that it becomes challenging for plant milk manufacturers to ensure stable supply chains using Australian-grown ingredients. Geographic distances of agricultural production also increase transportation expenses and carbon emissions, making attempts to promote milk alternatives as both local and sustainable challenging. Redressing these supply-side problems requires investment in local crop diversification, enhanced storage and processing facilities, and increased cooperation between growers and processors.

Regulatory and Labelling Challenges

The Australian regulatory climate poses significant challenges for the milk alternatives industry, particularly regarding product labelling and claims. The labelling of plant-based beverages as "milk" is still a contentious issue for the dairy industry and regulators. Certain stakeholders contend that "milk" must only refer to products from animals, possibly resulting in limitation or misunderstanding in the way products are labelled. Such ambiguity makes it more difficult to market and can influence consumer comprehension. Moreover, strict regulations on food safety and nutritional labelling necessitate a delicate balance between openness and attractive packaging from the manufacturers. With an increasingly health-aware marketplace, it is essential that there be transparent communication of ingredient origin, allergens, and nutritional value. Yet, it is costly to navigate the changing regulatory environments, especially for startups and smaller businesses that control the milk alternatives market. Compliance and competitive differentiation require constant legal knowledge and interaction with policy makers to influence standards that balance consumer demands and industry innovation in Australia.

Australia Milk Alternatives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, flavor, packaging, and distribution channel.

Source Insights:

- Soy

- Almond

- Coconut

- Oats

- Rice

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes soy, almond, coconut, oats, rice, and others.

Flavor Insights:

- Flavored

- Unflavored

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes flavored and unflavored.

Packaging Insights:

- Cartons

- Glass bottles

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes cartons, glass bottles, and others.

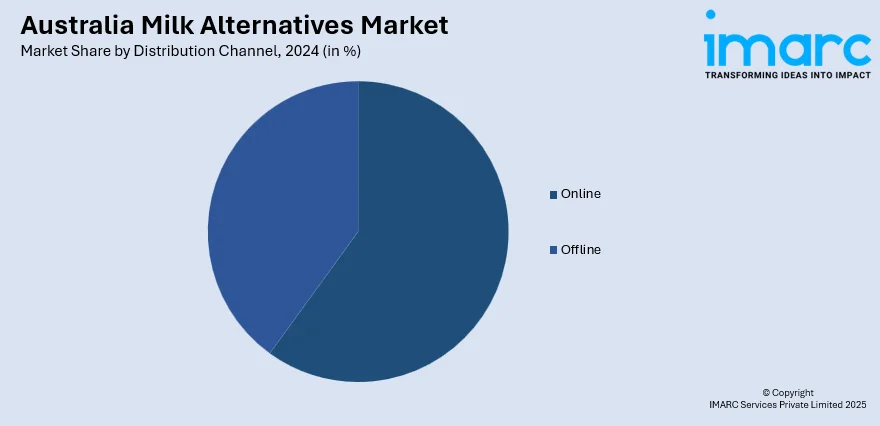

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Milk Alternatives Market News:

- On October 3, 2023, Breakthrough Victoria announced an investment of up to USD 3.9 Million (AUD 6 Million) in Eden Brew, an Australian company developing animal-free dairy through precision fermentation. The funding forms part of a USD 15.9 Million (AUD 24.4 Million) Series A round, which includes investors such as Main Sequence Ventures, Orkla, and Digitalis Ventures. Eden Brew will use the funds to pursue regulatory approvals, expand production of its animal-free milk and ice cream, and establish its headquarters and manufacturing operations in Melbourne.

Australia Milk Alternatives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Soy, Almond, Coconut, Oats, Rice, Others |

| Flavors Covered | Flavored, Unflavored |

| Packagings Covered | Cartons, Glass bottles, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia milk alternatives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia milk alternatives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia milk alternatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia milk alternatives market was valued at USD 941.64 Million in 2024.

The Australia milk alternatives market is projected to exhibit a CAGR of 12.40% during 2025-2033.

The Australia milk alternatives market is expected to reach a value of USD 3,030.74 Million by 2033.

The Australia milk alternatives market trends include rising demand for oat and almond milk, increased product innovation, and growing acceptance in cafes and households. Sustainability and health consciousness drive growth, while online retail expands accessibility, supporting wider adoption across urban and regional areas.

The Australia milk alternatives market is driven by increasing health awareness, lactose intolerance prevalence, and environmental concerns. Growing vegan and flexitarian lifestyles, along with government support for sustainable agriculture, further boost demand for dairy-free beverages.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)