Australia Milk Powder Market Size, Share, Trends and Forecast by Product Type, Function, Application, and Region, 2025-2033

Australia Milk Powder Market Overview:

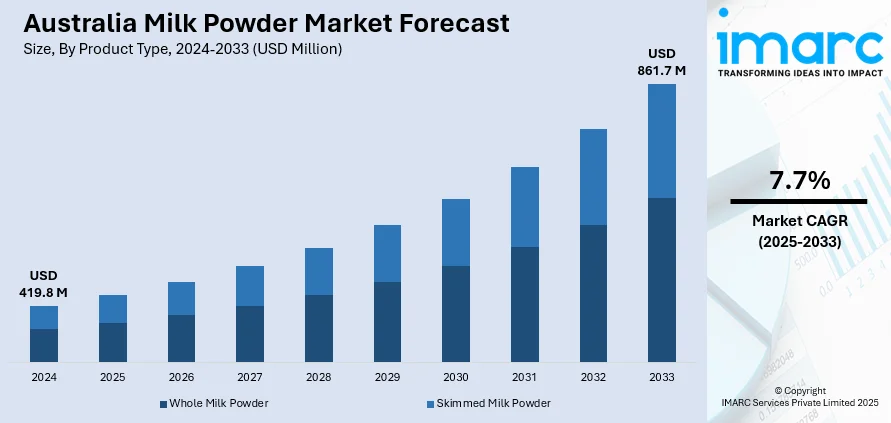

The Australia milk powder market size reached USD 419.8 Million in 2024. Looking forward, the market is expected to reach USD 861.7 Million by 2033, exhibiting a growth rate (CAGR) of 7.7% during 2025-2033. The market is witnessing steady growth, driven by rising demand in food processing, infant nutrition, and dairy-based beverages. Increasing exports, coupled with the popularity of convenient and long-shelf-life dairy products, are further supporting market expansion. Additionally, health-conscious consumers and innovation in formulations are enhancing competitiveness, strengthening the Australia milk powder market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 419.8 Million |

| Market Forecast in 2033 | USD 861.7 Million |

| Market Growth Rate 2025-2033 | 7.7% |

Key Trends of Australia Milk Powder Market:

Expansion of Export Markets

Australia's strategic diversification into new export markets, including India, South America, and ASEAN countries, has significantly bolstered the demand for milk powder. The implementation of Free Trade Agreements (FTAs) has played a pivotal role in this expansion by removing tariffs on key dairy commodities. For instance, as per industry reports, in 2024, Australian dairy exports to China were valued at approximately one billion Australian dollars, making China the top destination for Australian dairy products. It represented around 30% of the total dairy export value, with Japan and Indonesia following as key markets. This surge in exports not only elevates Australia's status in the global dairy market but also stimulates domestic production, thereby enhancing the growth prospects of the milk powder sector.

To get more information on this market, Request Sample

Increasing Health and Wellness Trends

A notable shift towards health and wellness among Australian consumers has led to a heightened demand for nutritious food options, including milk powder. Milk powder's high protein content and essential nutrients align with consumers' health objectives, making it a preferred choice for those seeking convenient and wholesome dietary supplements. This trend is further supported by the growing popularity of protein-enriched products and functional foods. As consumers become more discerning about their nutritional intake, the milk powder market is poised to benefit from this heightened health awareness, driving sustained demand and market expansion. For instance, in October 2024, Australian precision fermentation startup All G announced plans to launch bovine lactoferrin in 2025, followed by human lactoferrin in 2026 and casein proteins thereafter. The company focuses on profitable, high-margin products, aiming to disrupt dairy markets with cost-effective, high-purity proteins. This innovation meets the needs of consumers seeking convenient, health-enhancing foods, supporting sustained market growth.

Growth Drivers of Australia Milk Powder Market:

Rising Infant Nutrition Demand

One of the most powerful drivers in the market is the growing need for infant nutrition products. Milk powder is used extensively in infant formula since it provides excellent nutritional value, safety, and consistency, hence a choice that parents can rely on. The ease of storage and preparation of milk powder-based formula facilitates busy lives while providing infants with the necessary nutrients for development and growth. In Australia, both higher birth rates and heightened awareness of infant health have boosted dependence on milk powder as a reliable replacement for fresh milk. Furthermore, the reputation of the country for producing high-quality, safe dairy products reinforces consumers' faith, thus boosting demand for milk powder in infant food and driving long-term market growth.

Long Shelf-Life and Convenience

Milk powder’s extended shelf-life and ease of transport have made it a staple across households, industries, and export markets in Australia, further driving the Australia milk powder market growth. Unlike liquid milk, powdered milk can be stored for months without refrigeration, making it a reliable option in regions with limited cold storage or irregular fresh milk supply. This durability ensures consistent availability and minimizes wastage, particularly in remote areas. Its lightweight form also reduces logistics costs, supporting large-scale trade and distribution across domestic and international markets. For consumers, it provides a practical and affordable dairy solution for everyday use. For manufacturers, it offers stability in production and supply chains. These attributes make milk powder an essential product, significantly driving its demand in both consumer and industrial applications.

Growth of Dairy-Based Beverages and Foods

The increasing integration of milk powder in a wide range of processed and ready-to-consume foods is another key factor propelling the Australia milk powder market demand. Milk powder is used in bakery products, confectionery, chocolates, and ice creams, where it enhances texture, taste, and nutritional value. Additionally, the rising popularity of ready-to-drink dairy beverages has boosted demand, as milk powder serves as a critical raw material for production. The foodservice and catering industries also utilize it due to its consistent quality and easy handling in bulk preparations. As consumers increasingly seek convenience-oriented, dairy-enriched products, manufacturers continue to rely on milk powder to meet these expectations. This trend not only strengthens domestic consumption but also supports innovation in product development, solidifying its market position.

Opportunities of Australia Milk Powder Market:

Innovation in Nutritional Fortification

The market is witnessing strong opportunities through advancements in nutritional fortification. Manufacturers are increasingly focusing on developing fortified milk powders enriched with essential vitamins, minerals, proteins, and probiotics to meet the demand for functional and health-enhancing products. Consumers are becoming more conscious about balanced diets and preventive healthcare, driving interest in value-added nutrition. Fortified milk powders address diverse needs, including boosting immunity, supporting bone health, and aiding digestion, making them attractive to families, children, and elderly populations. The rise of lifestyle-related health concerns and the growing preference for wellness-oriented products provide an excellent platform for dairy brands to innovate. This trend not only adds value to traditional offerings but also supports market differentiation in competitive segments.

Growing Demand for Organic Dairy Products

The increasing preference for organic and clean-label food products has created a promising avenue for the Australia milk powder market. Health-conscious consumers are now prioritizing natural, chemical-free, and sustainably produced dairy items, fueling demand for organic milk powders. These products are perceived as safer, healthier, and more environmentally friendly, aligning with evolving dietary lifestyles. Premium segments of the market, particularly urban populations and export-oriented buyers are highly receptive to organic alternatives. According to the Australia milk powder market analysis, this trend is also reinforced by stricter quality standards and transparency in food labeling, which enhance consumer trust. For producers, diversifying into organic milk powders provides an opportunity to capture higher margins while catering to niche but fast-growing demand segments, solidifying their competitive positioning both domestically and internationally.

Increasing Use in Foodservice Sector

The foodservice industry, encompassing hotels, restaurants, cafés, and catering services, represents a significant growth opportunity for the Australia milk powder market. Milk powder’s versatility, long shelf-life, and easy handling make it a preferred ingredient for bulk food preparation and beverage production. It is widely used in baking, desserts, sauces, beverages, and dairy-based dishes, offering consistency in taste and quality. With the expansion of Australia’s foodservice sector and rising dining-out culture, demand for reliable dairy ingredients is increasing. Additionally, milk powder supports efficient supply management for large-scale kitchens, where storage and cost-effectiveness are crucial. As international cuisines and specialty beverages gain popularity, the use of milk powder in diverse foodservice applications is expected to grow substantially, enhancing overall market potential.

Challenges of Australia Milk Powder Market:

Volatility in Raw Milk Prices

One of the most pressing challenges for the Australia milk powder market is the volatility in raw milk prices. Seasonal fluctuations, climatic conditions, and variations in feed costs significantly affect the supply and cost of raw milk, leading to inconsistent production expenses for manufacturers. These instabilities often disrupt long-term planning and make it difficult to maintain stable pricing strategies in domestic and export markets. Rising production costs ultimately squeeze profit margins, particularly for smaller players who lack the financial resilience of larger dairy companies. Additionally, price fluctuations can reduce competitiveness in global markets where stability and cost efficiency are critical. Managing this volatility requires strategic sourcing, supply chain optimization, and risk-mitigation practices, but it remains a significant hurdle for the industry.

Competition from Dairy Alternatives

The growing popularity of plant-based alternatives such as soy, almond, oat, and coconut milk poses a considerable challenge to the Australia milk powder market. Consumers, particularly younger demographics and those with dietary restrictions, are increasingly shifting toward these alternatives due to perceptions of health benefits, lactose intolerance, or ethical concerns regarding animal farming. This shift directly reduces the demand for traditional dairy-based milk powders in both household consumption and foodservice applications. Moreover, aggressive marketing by plant-based beverage brands, coupled with expanding product availability, is reshaping consumer preferences and creating competitive pressure. While milk powder retains strong demand in infant nutrition and industrial applications, the rising adoption of dairy alternatives is steadily carving away at its market share, intensifying competition across segments.

Stringent Regulatory Standards

Strict regulatory standards present another critical challenge for the Australia milk powder market. Government agencies enforce rigorous requirements concerning product safety, nutritional quality, labeling accuracy, and manufacturing practices to ensure consumer protection and maintain international trade credibility. While such standards help in building trust, they demand substantial investments in testing, certification, and compliance infrastructure. For small and medium-sized producers, meeting these requirements can be financially and operationally burdensome, limiting their competitiveness. Non-compliance risks include penalties, product recalls, and damage to brand reputation, which can be devastating for market players. Furthermore, international export markets often impose additional regulations, making it even more challenging to expand globally. Thus, the high compliance burden remains a significant barrier to efficient operations and growth.

Australia Milk Powder Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, function, and application.

Product Type Insights:

- Whole Milk Powder

- Skimmed Milk Powder

The report has provided a detailed breakup and analysis of the market based on the product type. This includes whole milk powder and skimmed milk powder.

Function Insights:

- Emulsification

- Foaming

- Flavoring

- Thickening

The report has provided a detailed breakup and analysis of the market based on the function. This includes emulsification, foaming, flavoring, and thickening.

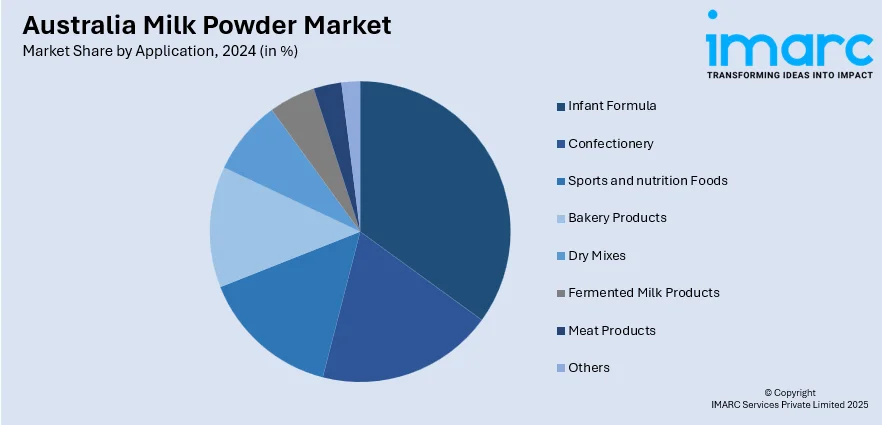

Application Insights:

- Infant Formula

- Confectionery

- Sports and nutrition Foods

- Bakery Products

- Dry Mixes

- Fermented Milk Products

- Meat Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes infant formula, confectionery, sports and nutrition foods, bakery products, dry mixes, fermented milk products, meat products, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Australia Dairy Park

- Bega Cheese Limited

- Blue Lake Dairy Group Pty Ltd

- Burra Foods Australia

- Nature One Dairy Pty Ltd

- Saputo Dairy Australia Pty Ltd.

- Tatura Milk Industries Pty. Ltd.

Australia Milk Powder Market News:

- In June 2024, Saputo Inc. completed the sale of two fresh milk processing facilities in Laverton North, Victoria, and Erskine Park, New South Wales, to Coles Group Limited for approximately AUD 105 Million. This transaction is part of Saputo’s global strategic plan to optimize its manufacturing network.

- In November 2024, NOVUS International expanded its nutritional feed solutions to Australia and New Zealand, offering products designed to enhance milk yield, optimize reproductive performance, and improve animal welfare. Key products include MFP Feed Supplement, MINTREX Bis-Chelated Trace Minerals, and ZORIEN SeY 3000 Prilled Yeast Additive. These improvements directly impact the quality and quantity of milk produced and higher quality milk with optimized fat and protein content is essential for producing superior milk powder.

Australia Milk Powder Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Whole Milk Powder, Skimmed Milk Powder |

| Functions Covered | Emulsification, Foaming, Flavoring, Thickening |

| Applications Covered | Infant Formula, Confectionery, Sports and Nutrition Foods, Bakery Products, Dry Mixes, Fermented Milk Products, Meat Products, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Australia Dairy Park, Bega Cheese Limited, Blue Lake Dairy Group Pty Ltd, Burra Foods Australia, Nature One Dairy Pty Ltd, Saputo Dairy Australia Pty Ltd., Tatura Milk Industries Pty. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia milk powder market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia milk powder market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia milk powder industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The milk powder market in Australia was valued at USD 419.8 Million in 2024.

The Australia milk powder market is projected to exhibit a CAGR of 7.7% during 2025-2033.

The Australia milk powder market is projected to reach a value of USD 861.7 Million by 2033.

The Australia milk powder market is shaped by rising demand for infant formula, growing exports to Asian markets, and increasing consumer preference for convenient, long-shelf-life dairy products. Trends such as health-focused formulations, organic variants, and fortified nutritional offerings are further enhancing product innovation and driving steady market expansion.

The growth of the Australia milk powder market is driven by rising demand in infant nutrition, strong export opportunities, and the convenience of long-shelf-life dairy products. Increasing health awareness, along with innovations in fortified and organic formulations, further supports market expansion across domestic and international segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)