Australia Mobile Advertising Market Size, Share, Trends and Forecast by Segment and Region, 2025-2033

Australia Mobile Advertising Market Overview:

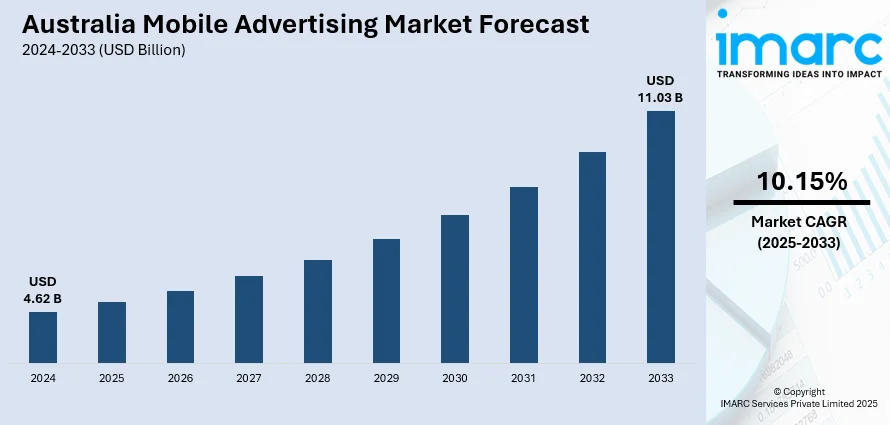

The Australia mobile advertising market size reached USD 4.62 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.03 Billion by 2033, exhibiting a growth rate (CAGR) of 10.15% during 2025-2033. Surging smartphone penetration, growing fifth-generation (5G) coverage, increased mobile internet usage, rising app-based engagement, burgeoning mobile commerce, escalating demand for location-based targeting, data-driven programmatic ads, and mobile-first content strategies are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.62 Billion |

| Market Forecast in 2033 | USD 11.03 Billion |

| Market Growth Rate 2025-2033 | 10.15% |

Australia Mobile Advertising Market Trends:

High Smartphone Penetration Driving Mobile-First Strategies

Australia maintains one of the highest smartphone penetration rates globally, with a significant number of the population using smartphones. For instance, as per IMARC, Australia smartphone market is projected to reach 34.8 million units by 2033. This widespread adoption is a critical driver for the mobile advertising market, as it enables advertisers to reach consumers consistently across various times of the day. With mobile devices becoming the primary access point for internet services, brands are optimizing their content and ad creatives for smaller screens, vertical formats, and mobile browsing behavior. The shift to mobile-first has encouraged investments in responsive design, mobile-optimized landing pages, and seamless app-based experiences. In line with this, advertisers are also leveraging mobile-exclusive features such as push notifications, in-app ads, and SMS-based marketing to engage users, which is another factor boosting the Australia mobile advertising market share. Moreover, the habitual reliance on smartphones for tasks ranging from social interaction to shopping increases the frequency and depth of user engagement, giving marketers a reliable and data-rich platform to execute targeted campaigns with measurable outcomes.

To get more information on this market, Request Sample

5G Network Rollout Enabling Richer Ad Formats

The roll-out of 5G infrastructure in urban and regional Australia is making a dramatic improvement in the abilities of mobile advertising. High-speed data, reduced latency, and enhanced connectivity are facilitating the transmission of high-quality, media-heavy advertisements like interactive video, AR-based campaigns, and dynamic content. This development enables brands to provide more immersive and interactive ad experiences without lags or buffering, which was otherwise hampering user interaction with advanced ad formats. The enhanced bandwidth also enables real-time bidding and quicker data aggregation, enabling marketers to tailor campaigns more accurately and efficaciously. Also, 5G provides high-speed mobile commerce and app performance, so mobile commerce and location-based promotions are more dependable, which is further driving the Australia mobile advertising market growth.

Location-Based Targeting and Geofencing Gaining Adoption

Location-based advertising and geofencing technologies are becoming increasingly prevalent in the mobile advertising ecosystem, particularly across retail, hospitality, and travel sectors, which is creating a positive Australia mobile advertising market outlook. In 2024, Trustifi introduced geofencing capabilities in Australia, enabling businesses to confine email data within national borders. This development aligns with Australia's data privacy regulations, particularly benefiting sectors like healthcare, finance, and legal services. These technologies allow advertisers to deliver hyper-targeted messages based on a user’s real-time geographic location, thereby increasing the relevance and immediacy of ad content. Businesses are using geofencing to trigger promotions, offers, or notifications when a user enters a specific physical zone, such as a store, mall, or event venue. This precision enhances foot traffic and encourages on-the-spot purchasing decisions. Additionally, location data provides valuable insights into consumer movement patterns, helping advertisers optimize campaign timing, content, and targeting parameters. Apart from this, key players are also combining location intelligence with behavioral and demographic data to craft personalized user journeys that extend from mobile ad impressions to offline conversions, which is fueling the market growth.

Australia Mobile Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on the segment.

Segment Insights:

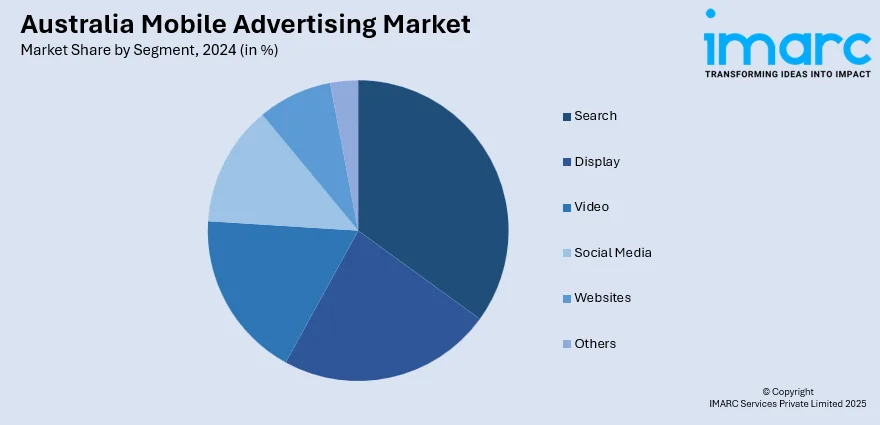

- Search

- Display

- Video

- Social Media

- Websites

- Others

The report has provided a detailed breakup and analysis of the market based on the segment. This includes search, display, video, social media, websites, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Mobile Advertising Market News:

- In 2024, Soup Agency was recognized by Clutch as one of the game-changing social media marketing agencies in Australia. This acknowledgment highlighted their innovative strategies and effective execution in the digital marketing landscape.

Australia Mobile Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Search, Display, Video, Social Media, Websites, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia mobile advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia mobile advertising market on the basis of segment?

- What is the breakup of the Australia mobile advertising market on the basis of region?

- What are the various stages in the value chain of the Australia mobile advertising market?

- What are the key driving factors and challenges in the Australia mobile advertising market?

- What is the structure of the Australia mobile advertising market and who are the key players?

- What is the degree of competition in the Australia mobile advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia mobile advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia mobile advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia mobile advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)